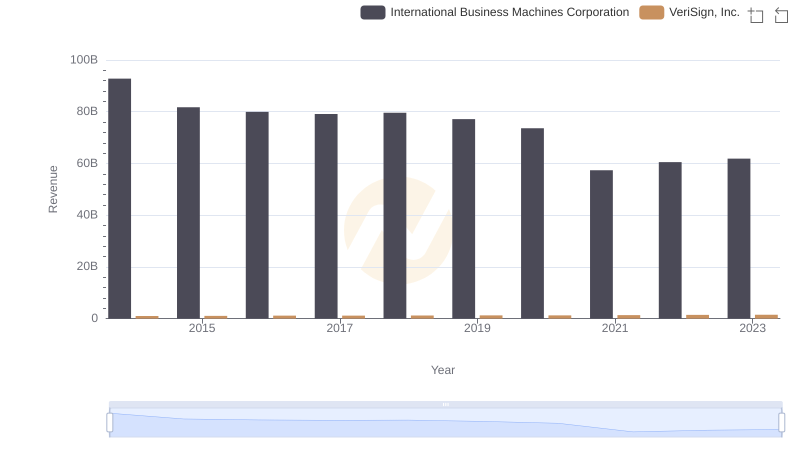

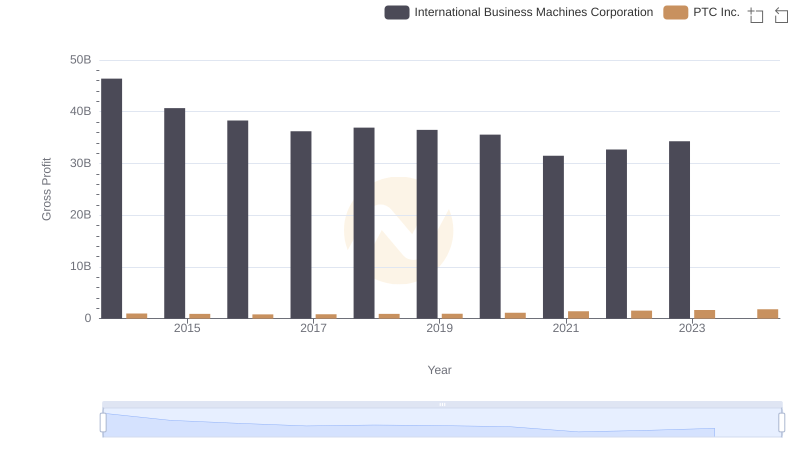

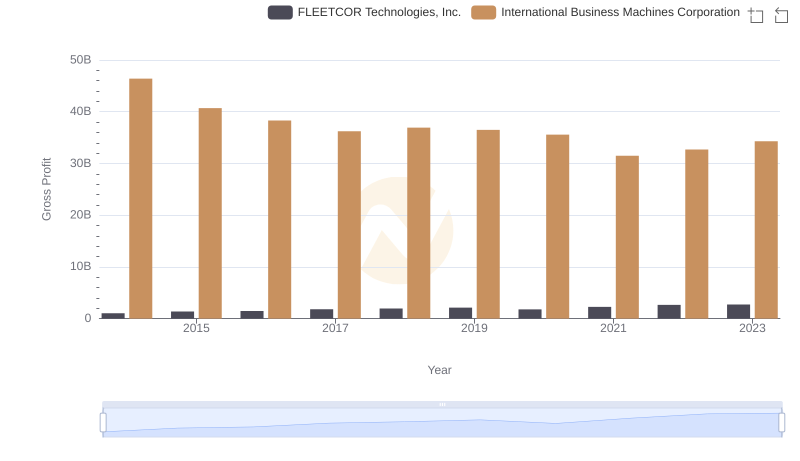

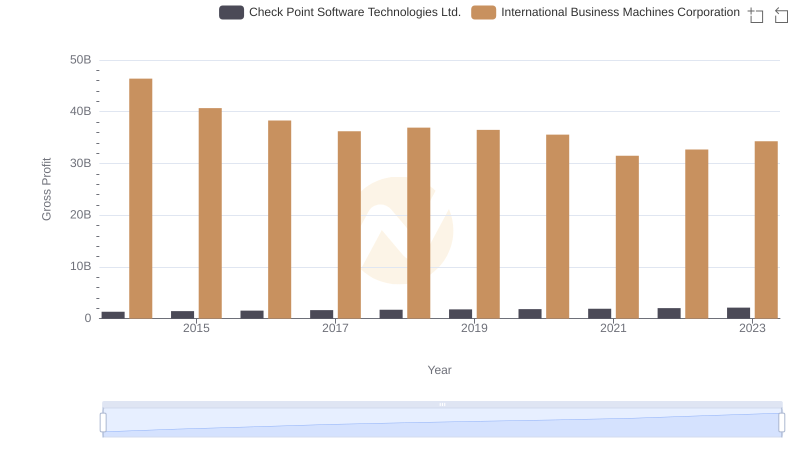

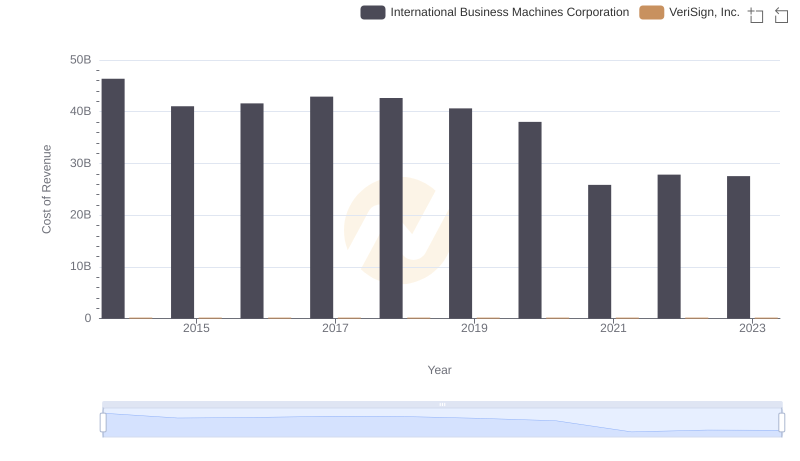

| __timestamp | International Business Machines Corporation | VeriSign, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 46407000000 | 821692000 |

| Thursday, January 1, 2015 | 40684000000 | 866578000 |

| Friday, January 1, 2016 | 38516000000 | 943925000 |

| Sunday, January 1, 2017 | 36943000000 | 971769000 |

| Monday, January 1, 2018 | 36936000000 | 1022835000 |

| Tuesday, January 1, 2019 | 31533000000 | 1051194000 |

| Wednesday, January 1, 2020 | 30865000000 | 1084875000 |

| Friday, January 1, 2021 | 31486000000 | 1135643000 |

| Saturday, January 1, 2022 | 32687000000 | 1224200000 |

| Sunday, January 1, 2023 | 34300000000 | 1295800000 |

| Monday, January 1, 2024 | 35551000000 | 1366000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of technology, understanding financial health is crucial. This analysis delves into the gross profit trends of two industry giants: International Business Machines Corporation (IBM) and VeriSign, Inc., from 2014 to 2023. IBM, a stalwart in the tech industry, saw its gross profit peak in 2014, with a gradual decline of approximately 24% by 2021. However, a recovery trend is evident, with a 9% increase from 2021 to 2023. In contrast, VeriSign, a leader in domain name registry services, demonstrated consistent growth, with its gross profit rising by nearly 58% over the same period. Notably, 2024 data for VeriSign is missing, leaving room for speculation on its future trajectory. This comparative analysis highlights the resilience and adaptability of these companies in a competitive market, offering valuable insights for investors and industry enthusiasts alike.

Who Generates More Revenue? International Business Machines Corporation or VeriSign, Inc.

Gross Profit Analysis: Comparing International Business Machines Corporation and PTC Inc.

Gross Profit Comparison: International Business Machines Corporation and FLEETCOR Technologies, Inc. Trends

Key Insights on Gross Profit: International Business Machines Corporation vs Check Point Software Technologies Ltd.

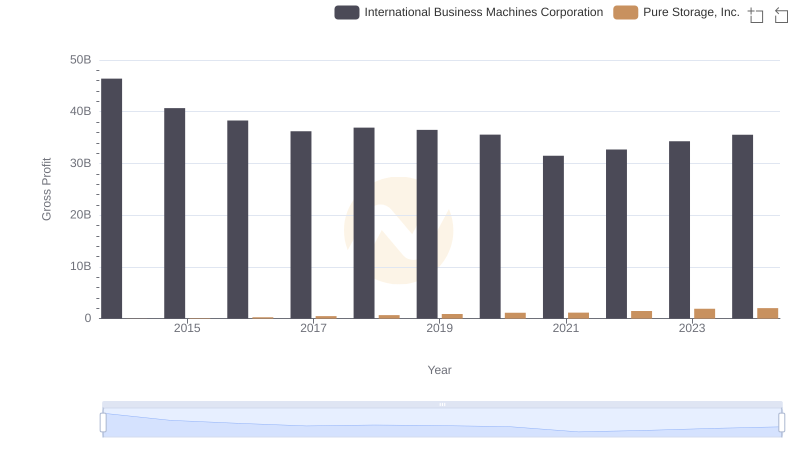

Gross Profit Trends Compared: International Business Machines Corporation vs Pure Storage, Inc.

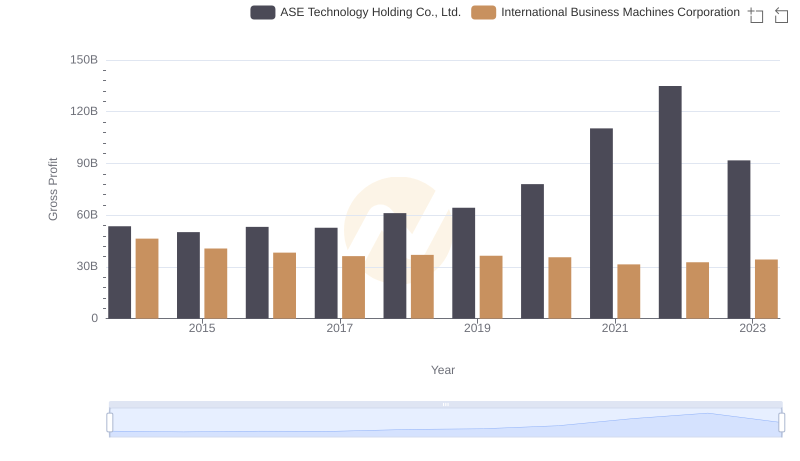

International Business Machines Corporation vs ASE Technology Holding Co., Ltd.: A Gross Profit Performance Breakdown

Cost of Revenue: Key Insights for International Business Machines Corporation and VeriSign, Inc.

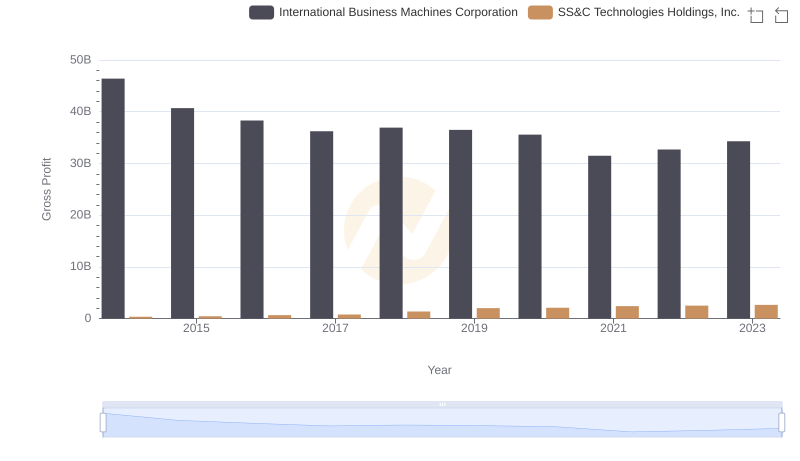

Who Generates Higher Gross Profit? International Business Machines Corporation or SS&C Technologies Holdings, Inc.

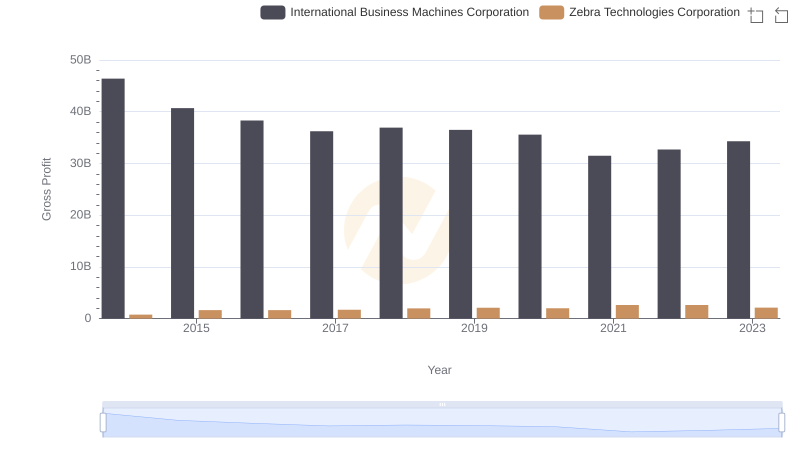

Gross Profit Trends Compared: International Business Machines Corporation vs Zebra Technologies Corporation

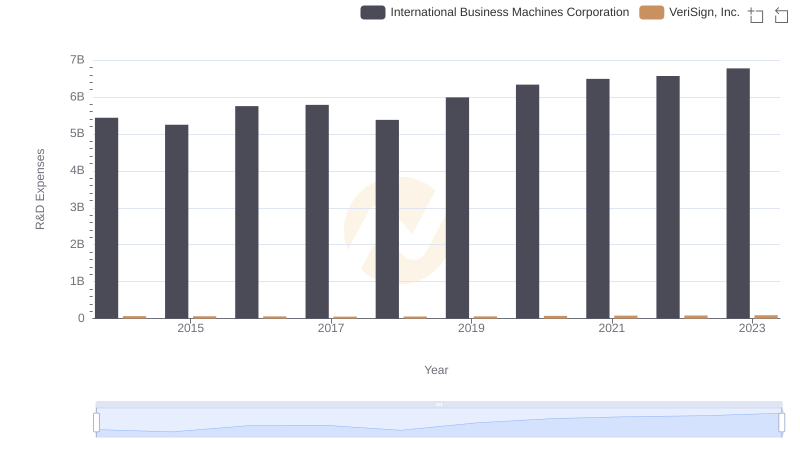

International Business Machines Corporation vs VeriSign, Inc.: Strategic Focus on R&D Spending

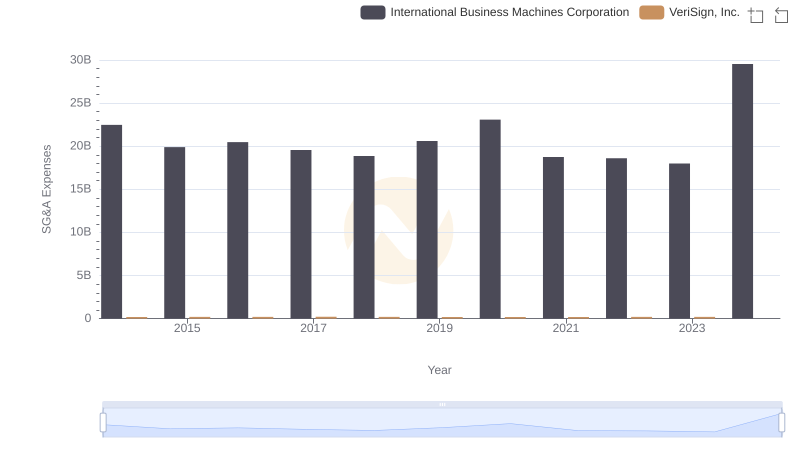

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and VeriSign, Inc.

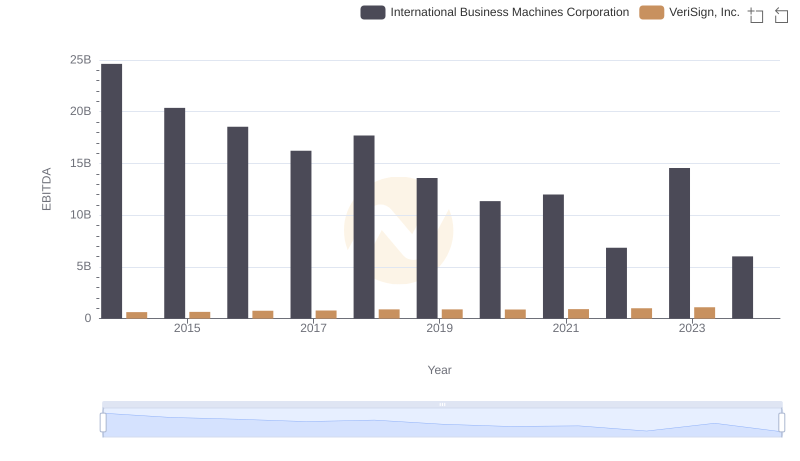

International Business Machines Corporation and VeriSign, Inc.: A Detailed Examination of EBITDA Performance