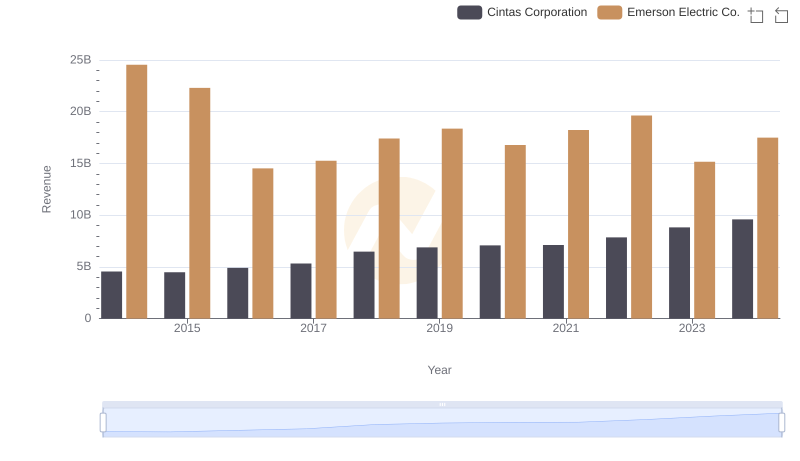

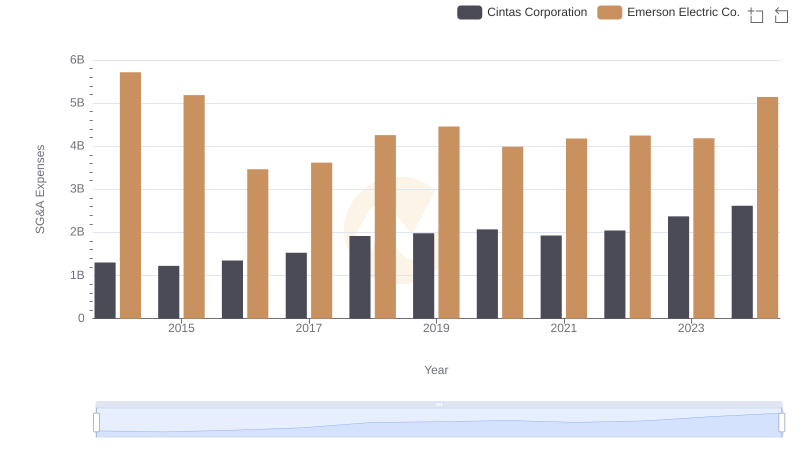

| __timestamp | Cintas Corporation | Emerson Electric Co. |

|---|---|---|

| Wednesday, January 1, 2014 | 1914386000 | 10158000000 |

| Thursday, January 1, 2015 | 1921337000 | 9048000000 |

| Friday, January 1, 2016 | 2129870000 | 6262000000 |

| Sunday, January 1, 2017 | 2380295000 | 6404000000 |

| Monday, January 1, 2018 | 2908523000 | 7460000000 |

| Tuesday, January 1, 2019 | 3128588000 | 7815000000 |

| Wednesday, January 1, 2020 | 3233748000 | 7009000000 |

| Friday, January 1, 2021 | 3314651000 | 7563000000 |

| Saturday, January 1, 2022 | 3632246000 | 8188000000 |

| Sunday, January 1, 2023 | 4173368000 | 7427000000 |

| Monday, January 1, 2024 | 4686416000 | 7808000000 |

Unleashing the power of data

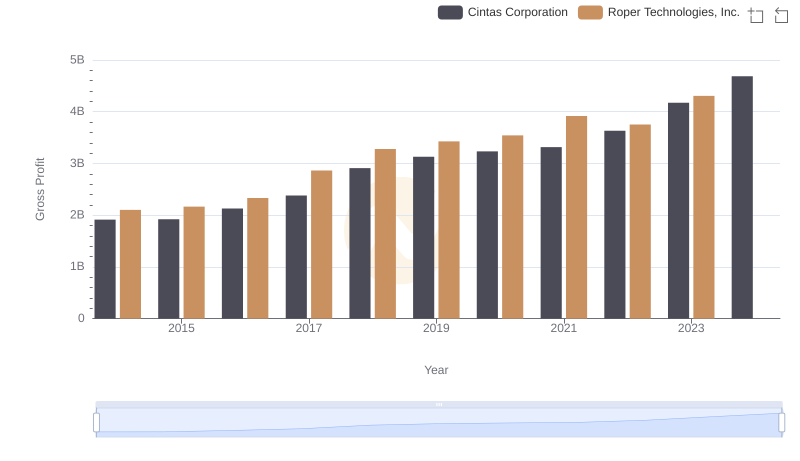

In the competitive landscape of American industry, Cintas Corporation and Emerson Electric Co. have long been titans in their respective fields. Over the past decade, from 2014 to 2024, these companies have showcased their prowess in generating gross profit. Emerson Electric Co. consistently outperformed Cintas Corporation, with an average gross profit nearly 2.5 times higher. However, Cintas has shown remarkable growth, increasing its gross profit by over 145% during this period. In 2023, Cintas achieved a significant milestone, reaching a gross profit of approximately $4.17 billion, a 30% increase from 2022. Meanwhile, Emerson Electric Co. experienced fluctuations, peaking in 2014 and 2015, but showing a decline in recent years. This dynamic shift highlights Cintas's strategic growth and adaptability, positioning it as a formidable competitor in the industrial sector.

Revenue Showdown: Cintas Corporation vs Emerson Electric Co.

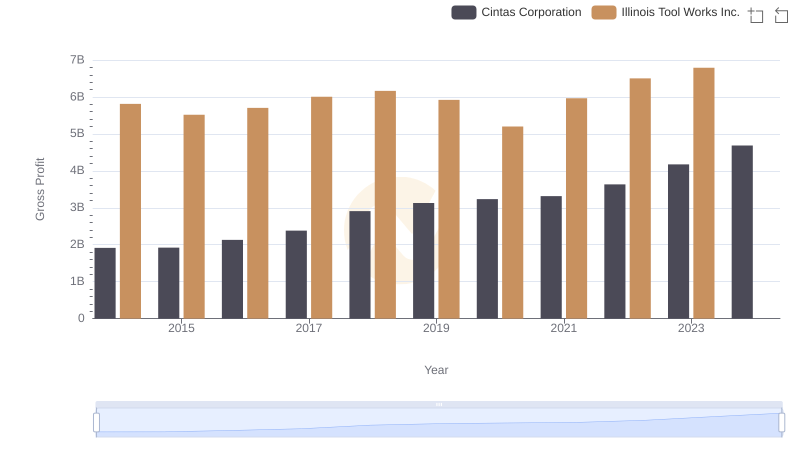

Key Insights on Gross Profit: Cintas Corporation vs Illinois Tool Works Inc.

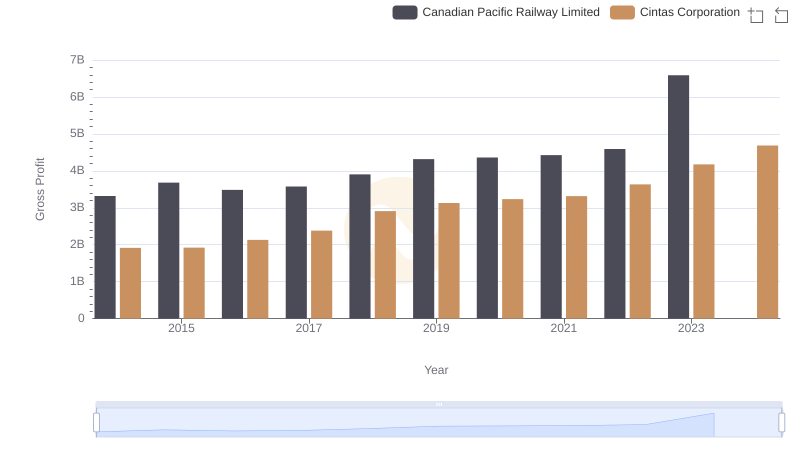

Gross Profit Comparison: Cintas Corporation and Canadian Pacific Railway Limited Trends

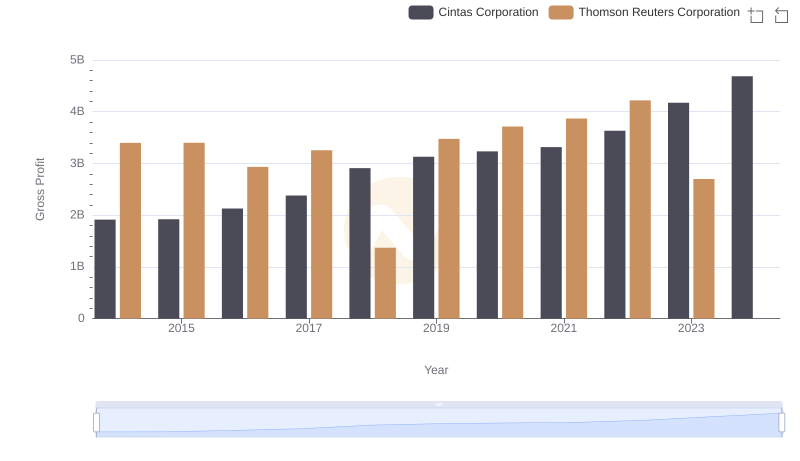

Cintas Corporation and Thomson Reuters Corporation: A Detailed Gross Profit Analysis

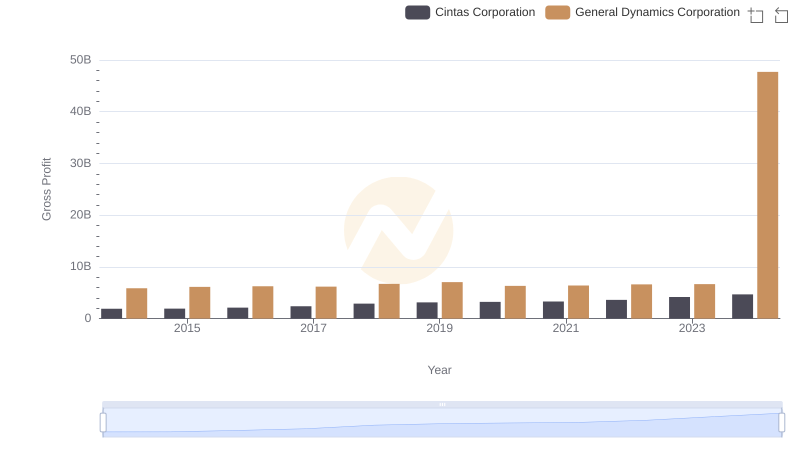

Gross Profit Trends Compared: Cintas Corporation vs General Dynamics Corporation

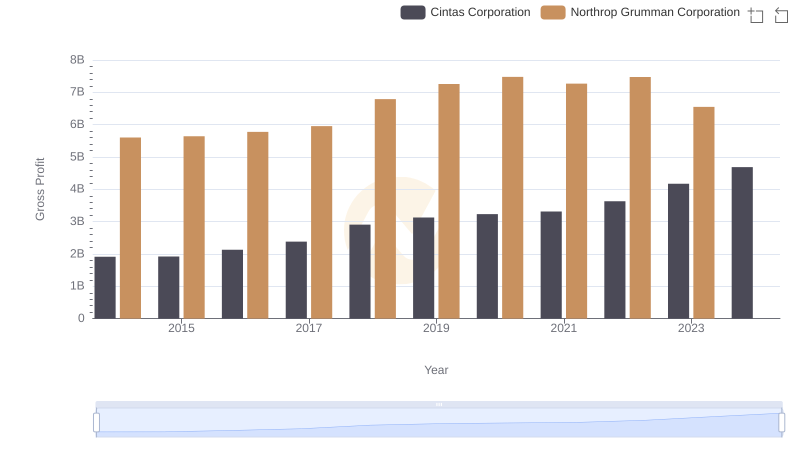

Cintas Corporation and Northrop Grumman Corporation: A Detailed Gross Profit Analysis

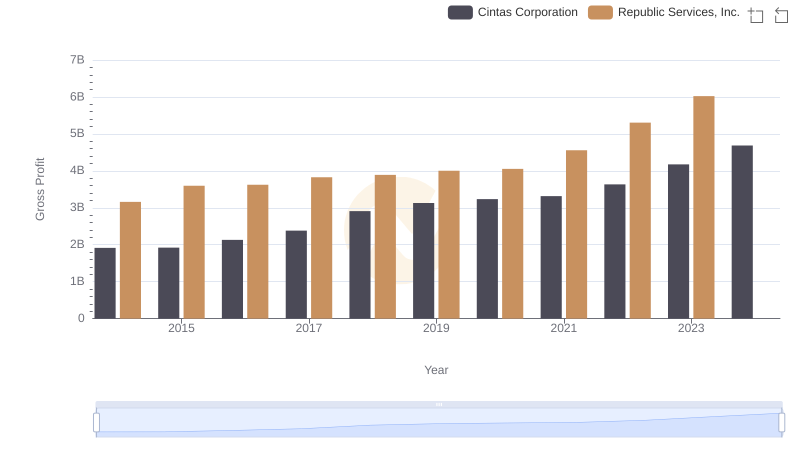

Cintas Corporation vs Republic Services, Inc.: A Gross Profit Performance Breakdown

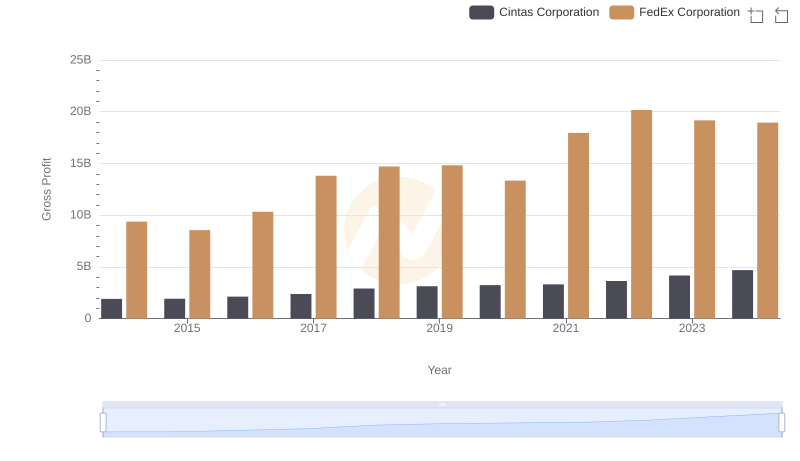

Gross Profit Comparison: Cintas Corporation and FedEx Corporation Trends

Cintas Corporation vs Emerson Electric Co.: SG&A Expense Trends

Key Insights on Gross Profit: Cintas Corporation vs Roper Technologies, Inc.

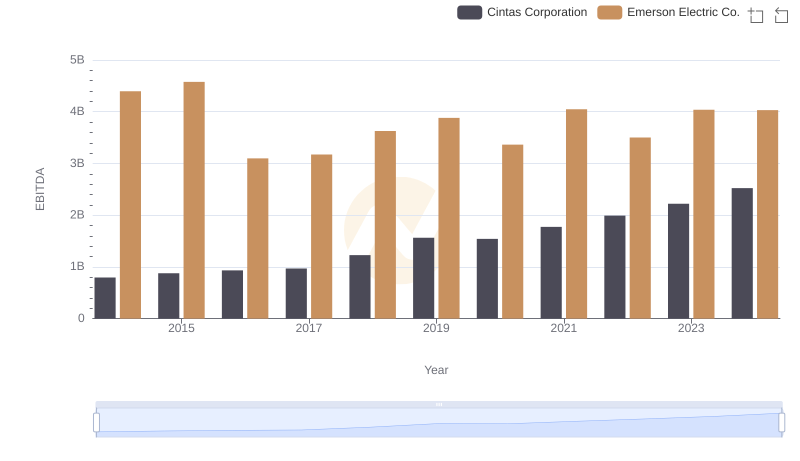

Comparative EBITDA Analysis: Cintas Corporation vs Emerson Electric Co.