| __timestamp | Cintas Corporation | Emerson Electric Co. |

|---|---|---|

| Wednesday, January 1, 2014 | 4551812000 | 24537000000 |

| Thursday, January 1, 2015 | 4476886000 | 22304000000 |

| Friday, January 1, 2016 | 4905458000 | 14522000000 |

| Sunday, January 1, 2017 | 5323381000 | 15264000000 |

| Monday, January 1, 2018 | 6476632000 | 17408000000 |

| Tuesday, January 1, 2019 | 6892303000 | 18372000000 |

| Wednesday, January 1, 2020 | 7085120000 | 16785000000 |

| Friday, January 1, 2021 | 7116340000 | 18236000000 |

| Saturday, January 1, 2022 | 7854459000 | 19629000000 |

| Sunday, January 1, 2023 | 8815769000 | 15165000000 |

| Monday, January 1, 2024 | 9596615000 | 17492000000 |

Data in motion

In the ever-evolving landscape of industrial giants, Cintas Corporation and Emerson Electric Co. have been pivotal players. Over the past decade, from 2014 to 2024, these companies have showcased contrasting revenue trajectories. Cintas Corporation, a leader in corporate identity uniforms, has seen its revenue grow by approximately 111%, from $4.6 billion in 2014 to an impressive $9.6 billion in 2024. This growth reflects a robust annual increase, highlighting Cintas's strategic market expansions and operational efficiencies.

Conversely, Emerson Electric Co., a stalwart in the engineering and technology sector, experienced a more fluctuating revenue pattern. Starting at $24.5 billion in 2014, Emerson's revenue saw a decline, reaching $17.5 billion in 2024. This 29% decrease underscores the challenges faced by Emerson amidst global economic shifts and industry-specific hurdles.

This revenue showdown not only highlights the dynamic nature of these industries but also offers insights into strategic business adaptations over time.

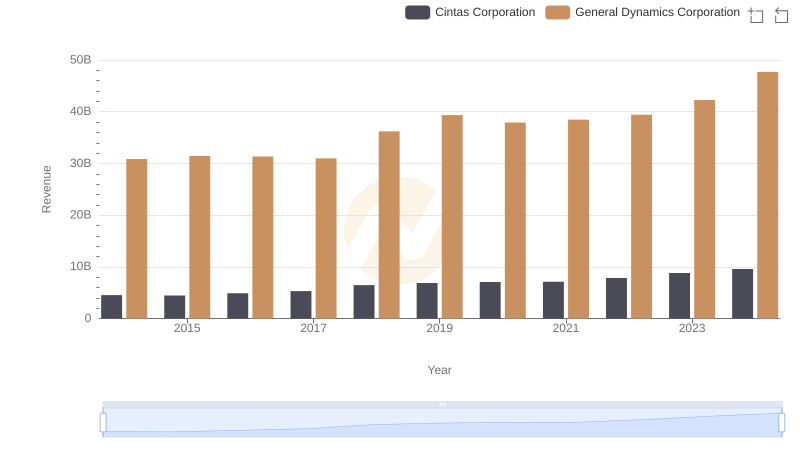

Comparing Revenue Performance: Cintas Corporation or General Dynamics Corporation?

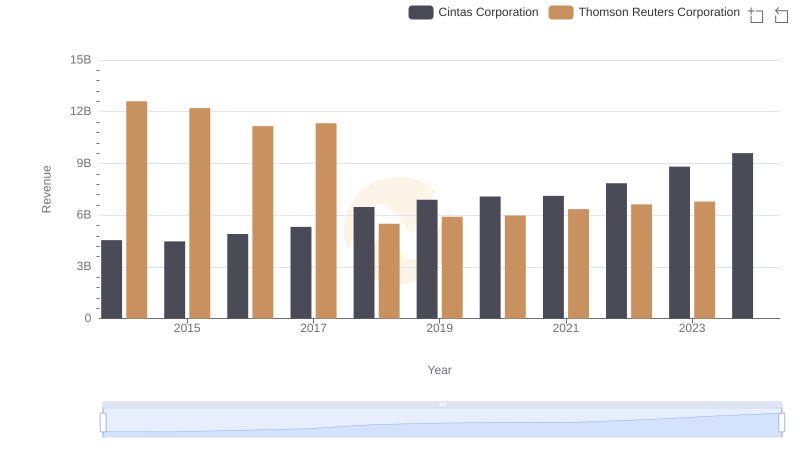

Breaking Down Revenue Trends: Cintas Corporation vs Thomson Reuters Corporation

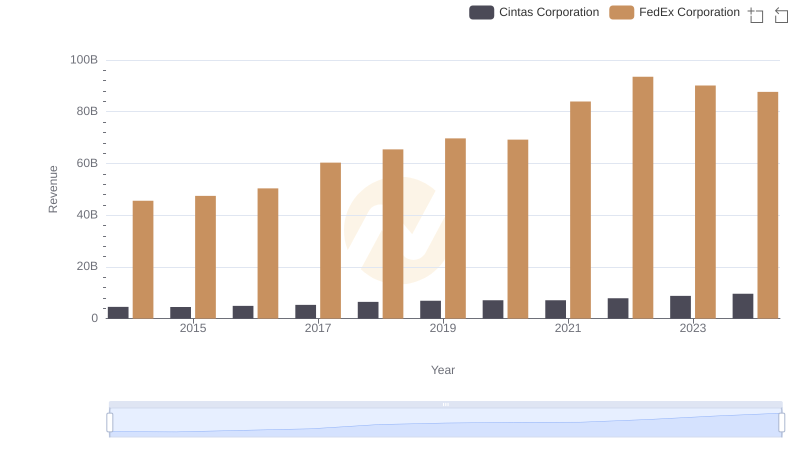

Cintas Corporation vs FedEx Corporation: Annual Revenue Growth Compared

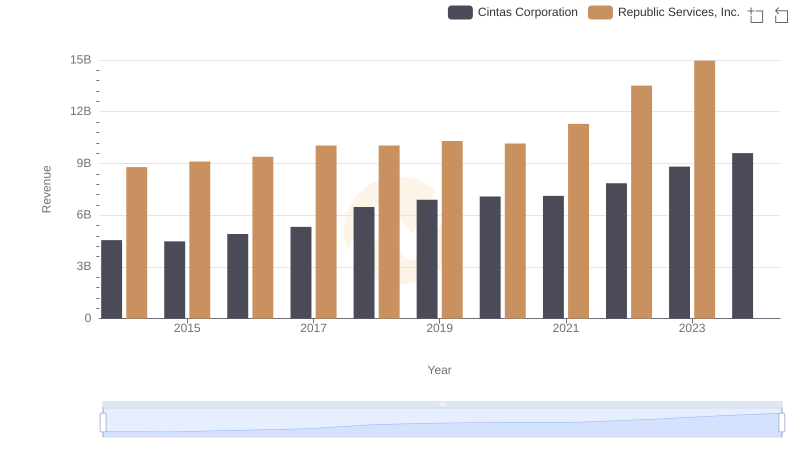

Cintas Corporation or Republic Services, Inc.: Who Leads in Yearly Revenue?

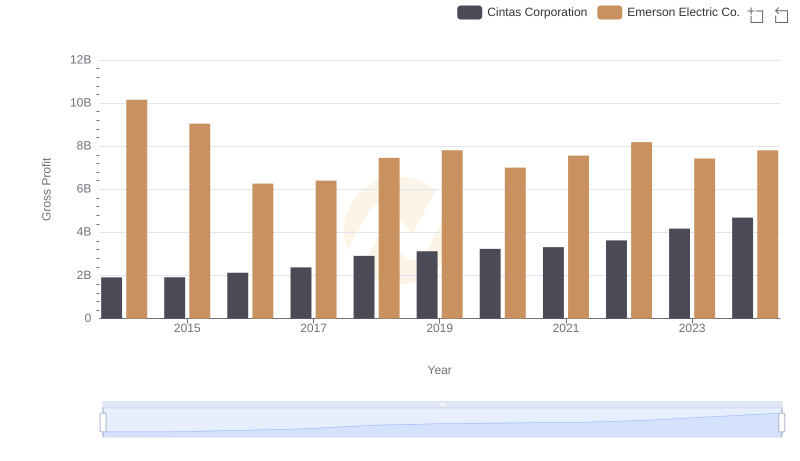

Who Generates Higher Gross Profit? Cintas Corporation or Emerson Electric Co.

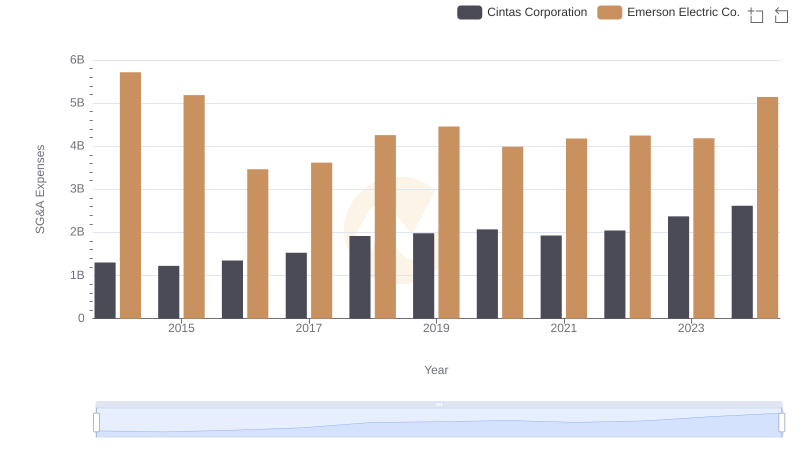

Cintas Corporation vs Emerson Electric Co.: SG&A Expense Trends

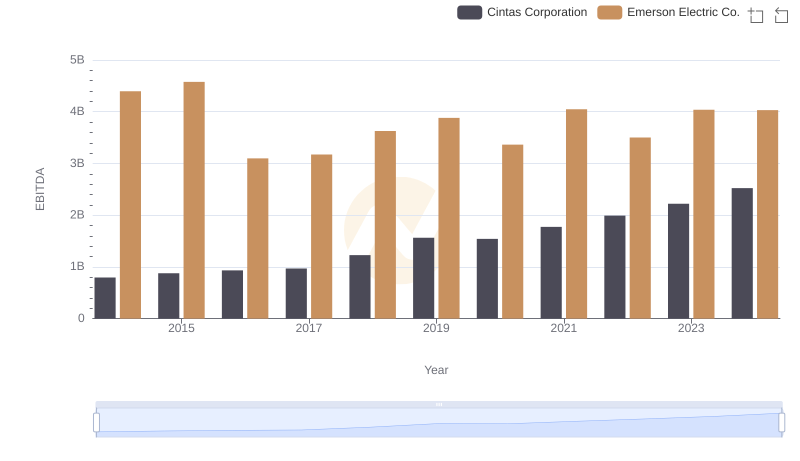

Comparative EBITDA Analysis: Cintas Corporation vs Emerson Electric Co.