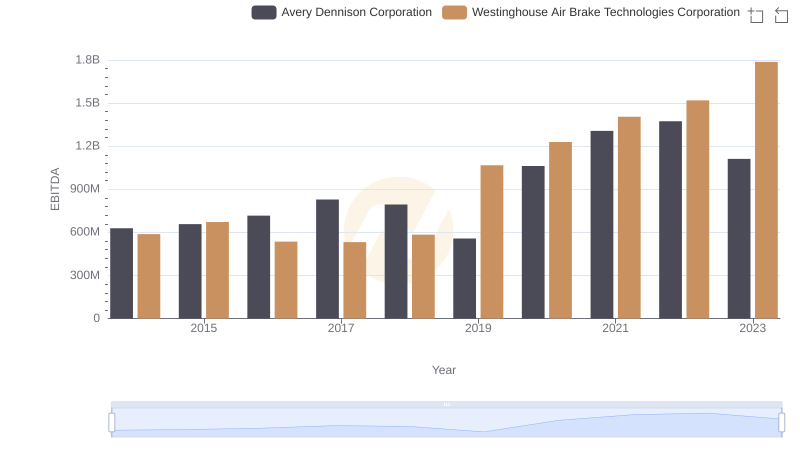

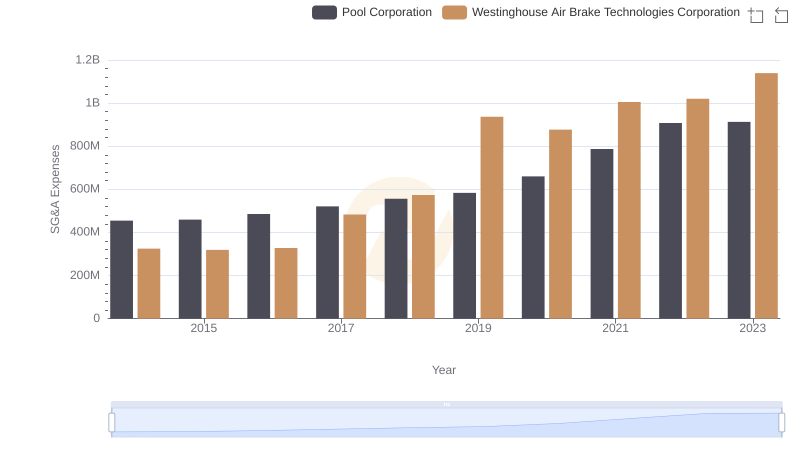

| __timestamp | Pool Corporation | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 204752000 | 588370000 |

| Thursday, January 1, 2015 | 233610000 | 672301000 |

| Friday, January 1, 2016 | 277836000 | 535893000 |

| Sunday, January 1, 2017 | 310096000 | 532795000 |

| Monday, January 1, 2018 | 341804000 | 584199000 |

| Tuesday, January 1, 2019 | 370520000 | 1067300000 |

| Wednesday, January 1, 2020 | 493425000 | 1229400000 |

| Friday, January 1, 2021 | 862810000 | 1405000000 |

| Saturday, January 1, 2022 | 1064808000 | 1519000000 |

| Sunday, January 1, 2023 | 786707000 | 1787000000 |

| Monday, January 1, 2024 | 1609000000 |

Unleashing the power of data

In the world of industrial giants, Westinghouse Air Brake Technologies Corporation and Pool Corporation have carved out significant niches. Over the past decade, Westinghouse has consistently outperformed Pool in EBITDA, showcasing a robust growth trajectory. From 2014 to 2023, Westinghouse's EBITDA surged by approximately 204%, peaking at nearly 1.8 billion in 2023. In contrast, Pool Corporation, while experiencing a commendable rise of around 284%, reached its zenith in 2022 with an EBITDA of just over 1 billion.

This comparison highlights Westinghouse's steady dominance, particularly from 2019 onwards, where it maintained a lead of over 50% in EBITDA each year. The data underscores the resilience and strategic prowess of Westinghouse in navigating market challenges, while Pool Corporation's growth reflects its adaptability and market expansion efforts.

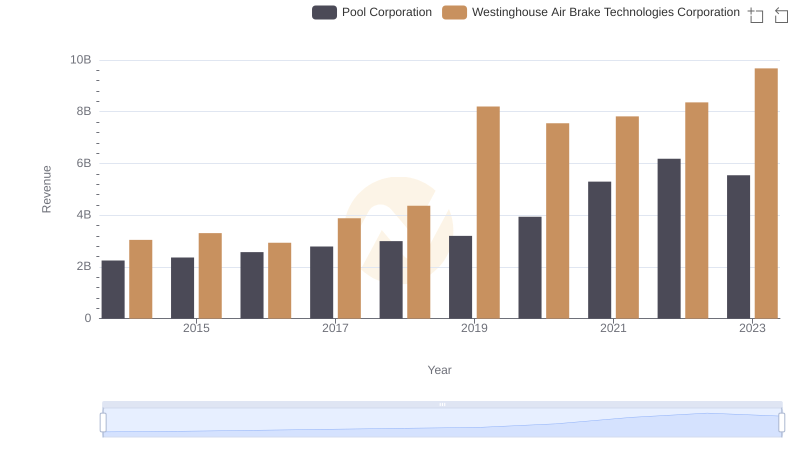

Westinghouse Air Brake Technologies Corporation and Pool Corporation: A Comprehensive Revenue Analysis

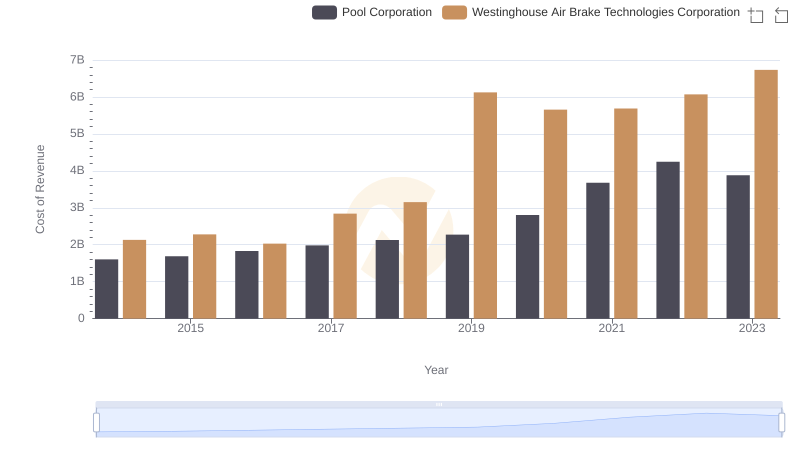

Cost of Revenue Comparison: Westinghouse Air Brake Technologies Corporation vs Pool Corporation

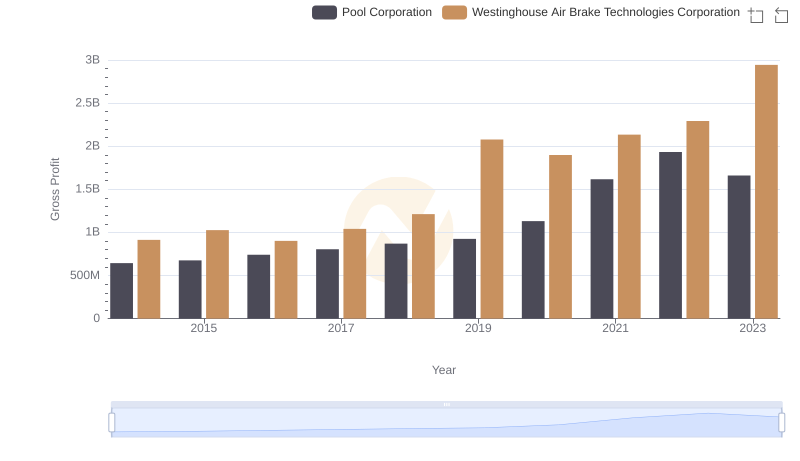

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and Pool Corporation Trends

EBITDA Performance Review: Westinghouse Air Brake Technologies Corporation vs Avery Dennison Corporation

Westinghouse Air Brake Technologies Corporation vs Pool Corporation: SG&A Expense Trends

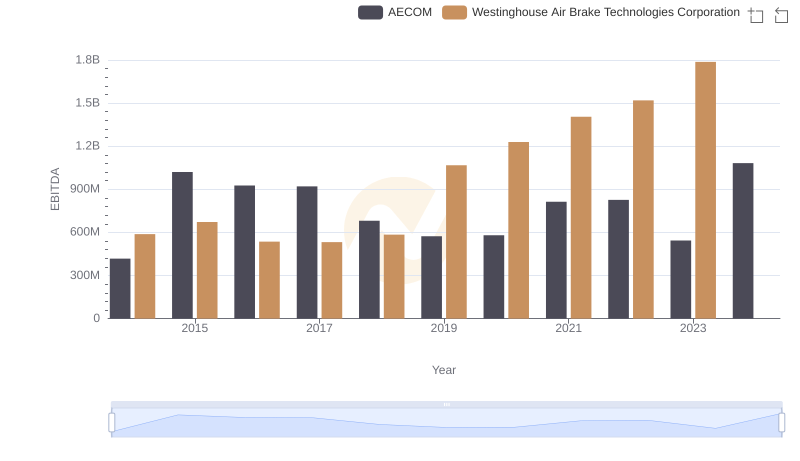

EBITDA Performance Review: Westinghouse Air Brake Technologies Corporation vs AECOM

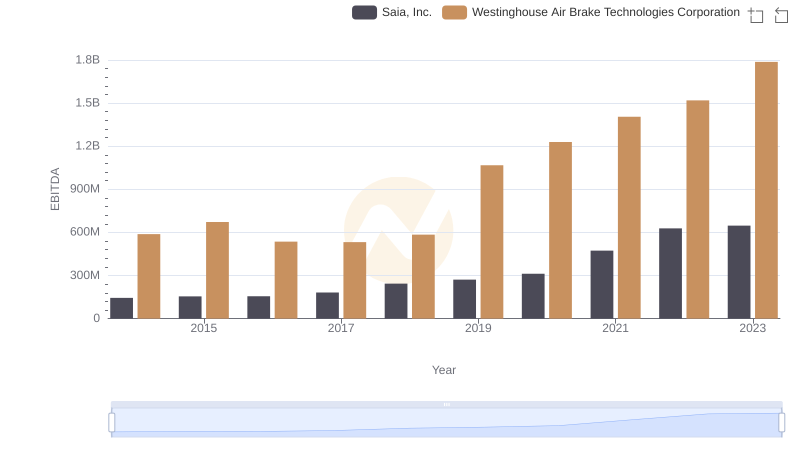

Professional EBITDA Benchmarking: Westinghouse Air Brake Technologies Corporation vs Saia, Inc.

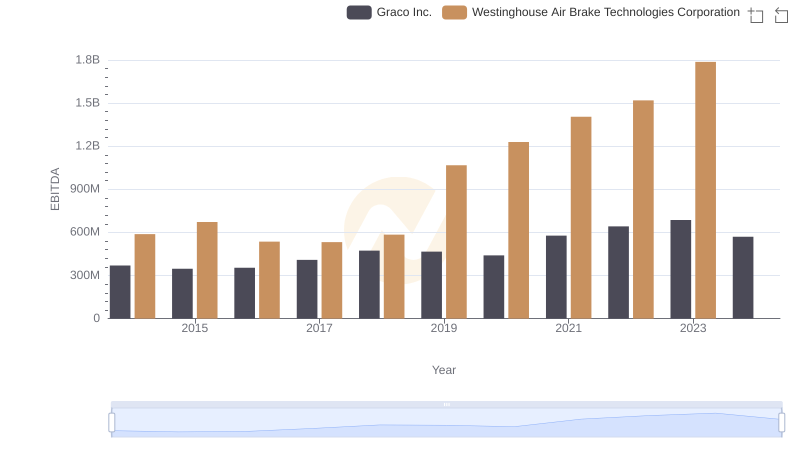

Westinghouse Air Brake Technologies Corporation and Graco Inc.: A Detailed Examination of EBITDA Performance

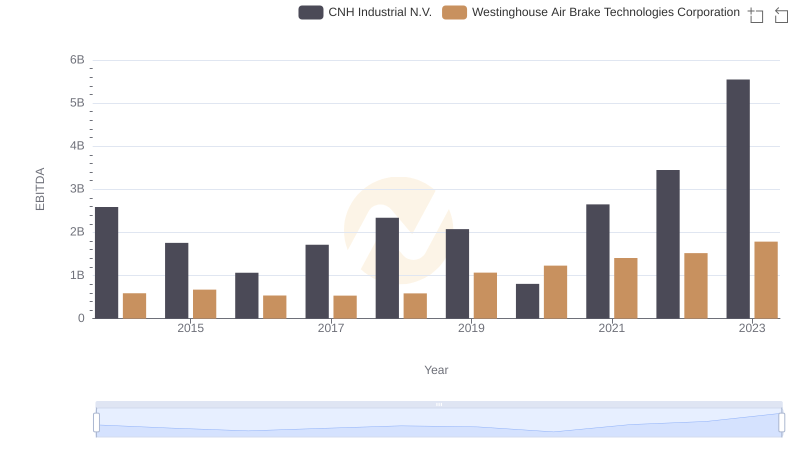

Westinghouse Air Brake Technologies Corporation and CNH Industrial N.V.: A Detailed Examination of EBITDA Performance

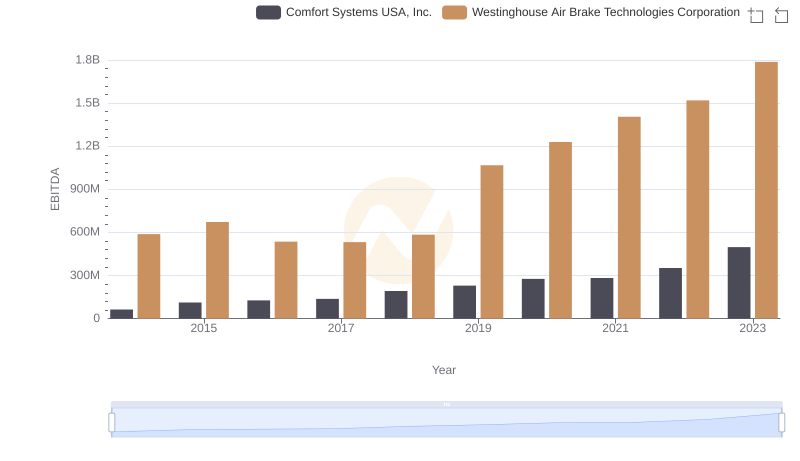

Westinghouse Air Brake Technologies Corporation vs Comfort Systems USA, Inc.: In-Depth EBITDA Performance Comparison

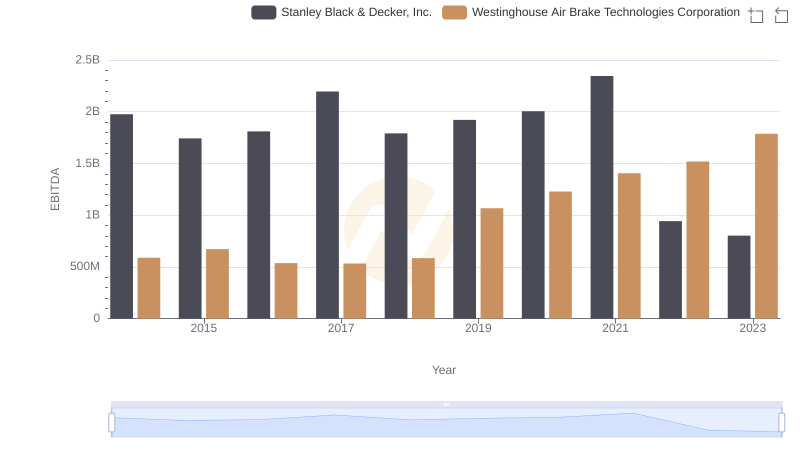

Westinghouse Air Brake Technologies Corporation and Stanley Black & Decker, Inc.: A Detailed Examination of EBITDA Performance

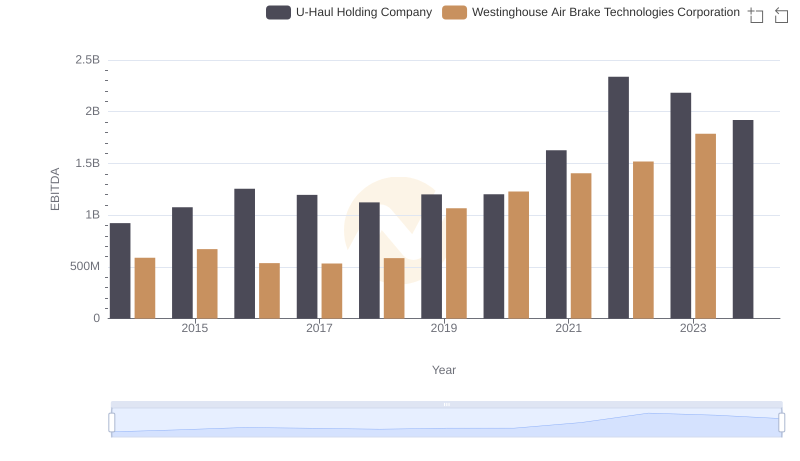

A Side-by-Side Analysis of EBITDA: Westinghouse Air Brake Technologies Corporation and U-Haul Holding Company