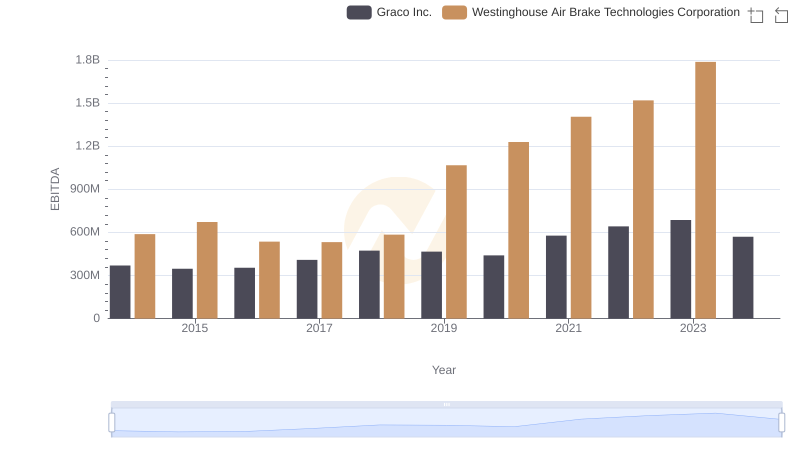

| __timestamp | U-Haul Holding Company | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 923383000 | 588370000 |

| Thursday, January 1, 2015 | 1076520000 | 672301000 |

| Friday, January 1, 2016 | 1255474000 | 535893000 |

| Sunday, January 1, 2017 | 1195593000 | 532795000 |

| Monday, January 1, 2018 | 1123974000 | 584199000 |

| Tuesday, January 1, 2019 | 1200955000 | 1067300000 |

| Wednesday, January 1, 2020 | 1202436000 | 1229400000 |

| Friday, January 1, 2021 | 1627442000 | 1405000000 |

| Saturday, January 1, 2022 | 2337788000 | 1519000000 |

| Sunday, January 1, 2023 | 2183839000 | 1787000000 |

| Monday, January 1, 2024 | 1919656000 | 1609000000 |

In pursuit of knowledge

In the ever-evolving landscape of American industry, U-Haul Holding Company and Westinghouse Air Brake Technologies Corporation (WAB) stand as titans in their respective fields. Over the past decade, these companies have showcased remarkable financial resilience, as evidenced by their EBITDA performance from 2014 to 2023.

U-Haul, a leader in the moving and storage sector, has seen its EBITDA grow by approximately 135% from 2014 to 2023, peaking in 2022. This growth underscores its adaptability and strategic expansion in a competitive market. Meanwhile, WAB, a key player in the transportation sector, has demonstrated a steady upward trajectory, with a notable 204% increase in EBITDA from 2014 to 2023.

While U-Haul's EBITDA took a slight dip in 2023, WAB continued its ascent, highlighting the dynamic nature of these industries. Missing data for 2024 suggests potential shifts on the horizon, inviting investors to stay tuned for future developments.

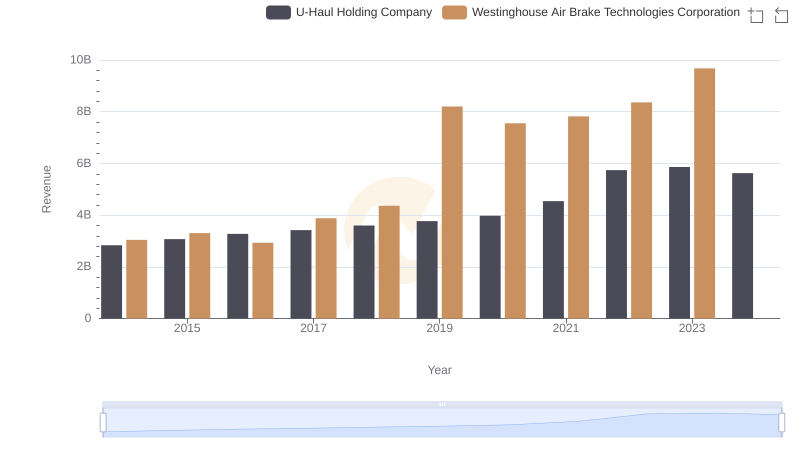

Westinghouse Air Brake Technologies Corporation vs U-Haul Holding Company: Annual Revenue Growth Compared

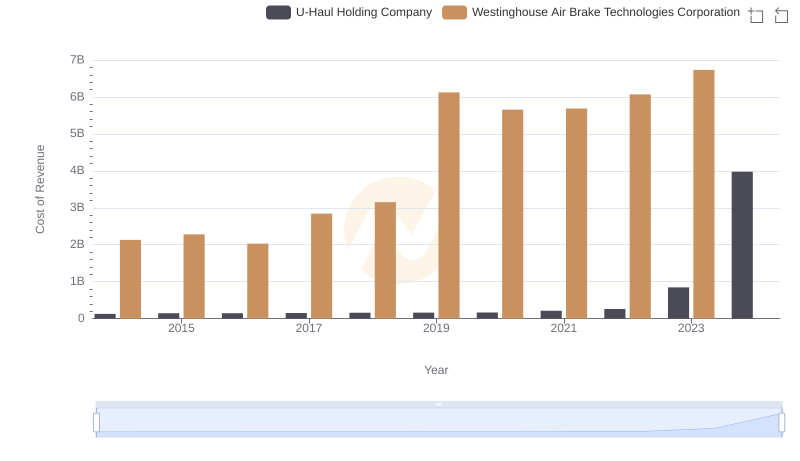

Cost Insights: Breaking Down Westinghouse Air Brake Technologies Corporation and U-Haul Holding Company's Expenses

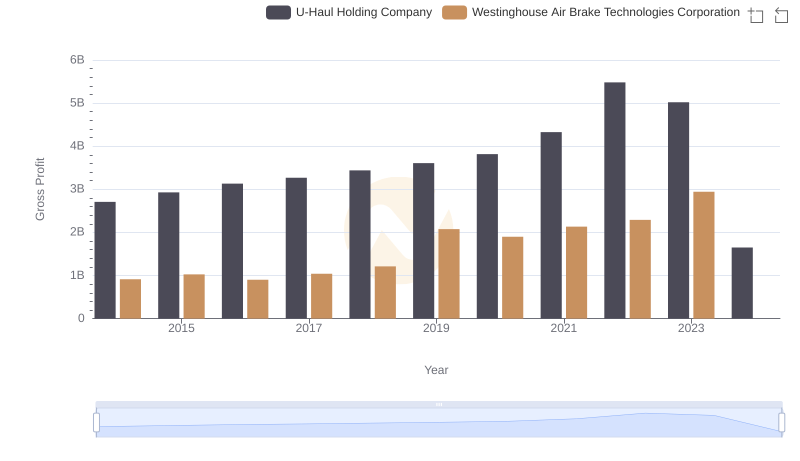

Gross Profit Analysis: Comparing Westinghouse Air Brake Technologies Corporation and U-Haul Holding Company

Westinghouse Air Brake Technologies Corporation and Graco Inc.: A Detailed Examination of EBITDA Performance

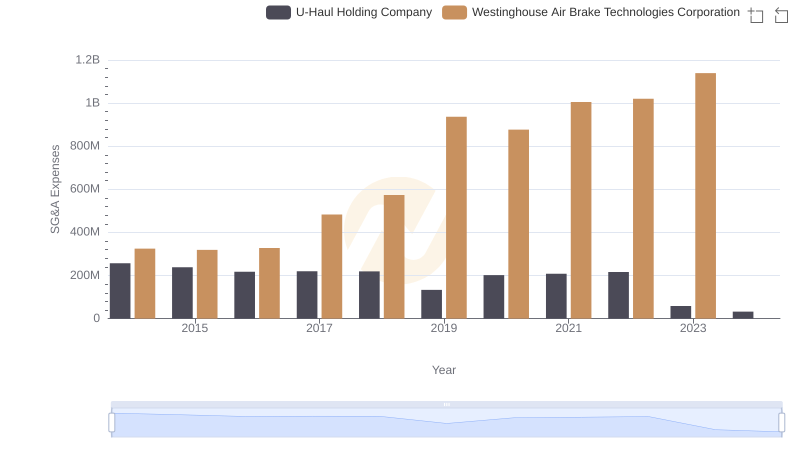

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs U-Haul Holding Company

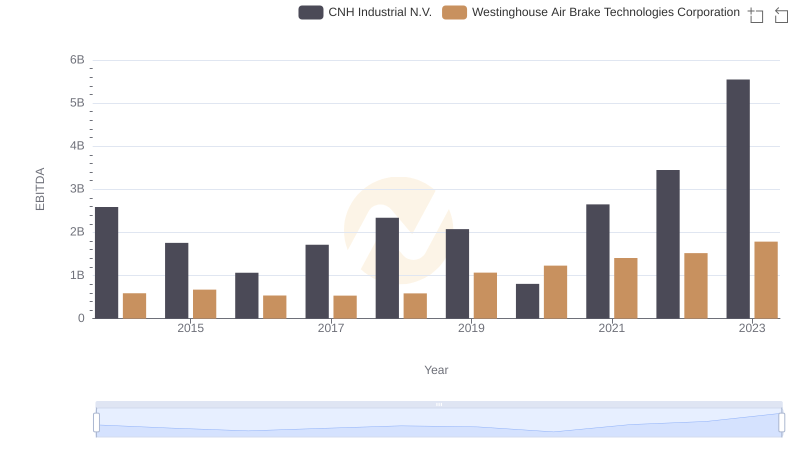

Westinghouse Air Brake Technologies Corporation and CNH Industrial N.V.: A Detailed Examination of EBITDA Performance

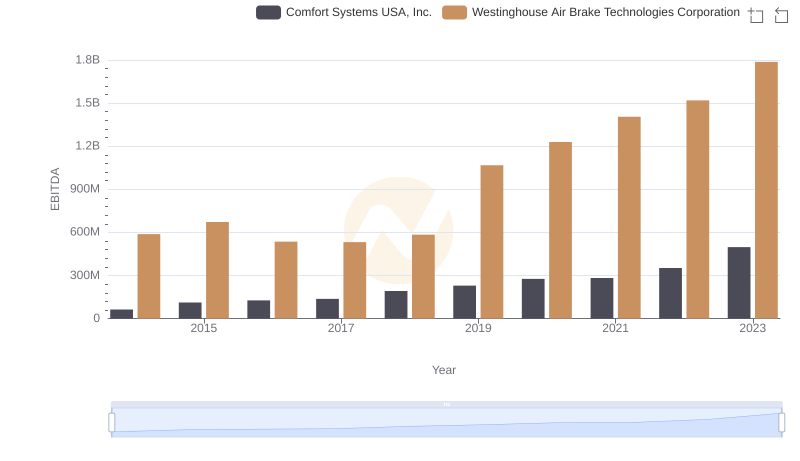

Westinghouse Air Brake Technologies Corporation vs Comfort Systems USA, Inc.: In-Depth EBITDA Performance Comparison

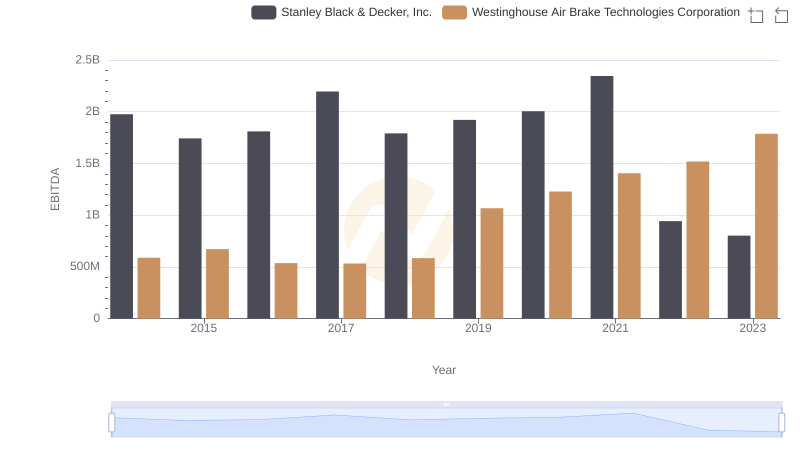

Westinghouse Air Brake Technologies Corporation and Stanley Black & Decker, Inc.: A Detailed Examination of EBITDA Performance

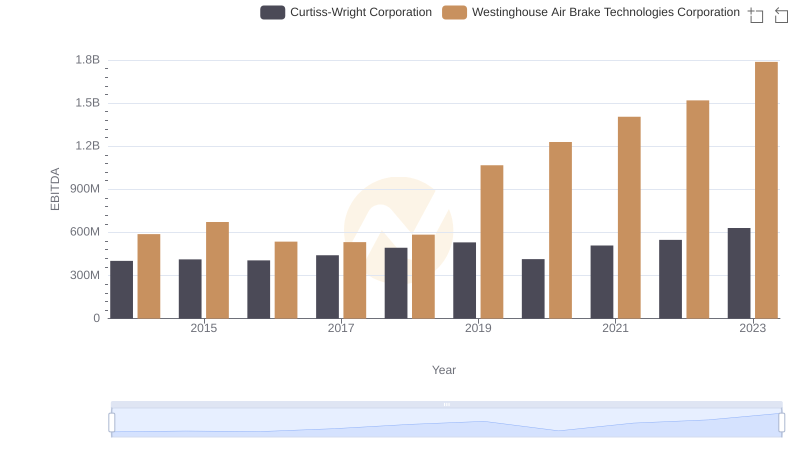

A Professional Review of EBITDA: Westinghouse Air Brake Technologies Corporation Compared to Curtiss-Wright Corporation