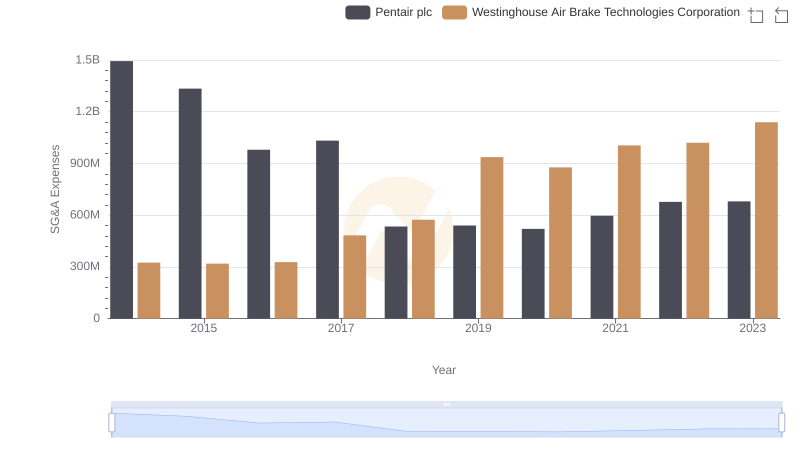

| __timestamp | Pentair plc | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1109300000 | 588370000 |

| Thursday, January 1, 2015 | 842400000 | 672301000 |

| Friday, January 1, 2016 | 890400000 | 535893000 |

| Sunday, January 1, 2017 | 488600000 | 532795000 |

| Monday, January 1, 2018 | 552800000 | 584199000 |

| Tuesday, January 1, 2019 | 513200000 | 1067300000 |

| Wednesday, January 1, 2020 | 527600000 | 1229400000 |

| Friday, January 1, 2021 | 714400000 | 1405000000 |

| Saturday, January 1, 2022 | 830400000 | 1519000000 |

| Sunday, January 1, 2023 | 852000000 | 1787000000 |

| Monday, January 1, 2024 | 803800000 | 1609000000 |

Unleashing insights

In the ever-evolving landscape of industrial giants, Westinghouse Air Brake Technologies Corporation and Pentair plc have showcased intriguing EBITDA trends over the past decade. From 2014 to 2023, Westinghouse has consistently outperformed Pentair, with a notable 60% increase in EBITDA, peaking in 2023. This growth trajectory highlights Westinghouse's strategic advancements and market adaptability.

Conversely, Pentair's EBITDA journey reflects a more volatile path, with a significant dip in 2017, followed by a gradual recovery. By 2023, Pentair's EBITDA had rebounded by approximately 74% from its 2017 low, underscoring its resilience and strategic recalibration.

These trends not only reflect the companies' financial health but also their ability to navigate economic challenges and capitalize on market opportunities. As we look to the future, these insights offer a glimpse into the strategic directions these industrial titans might pursue.

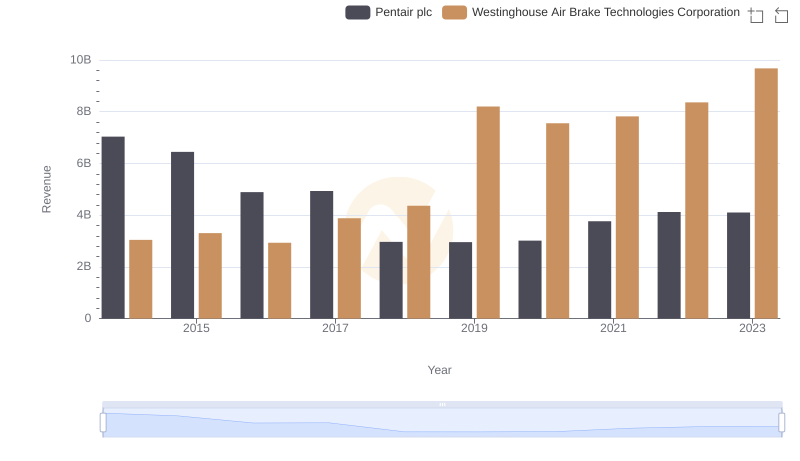

Revenue Showdown: Westinghouse Air Brake Technologies Corporation vs Pentair plc

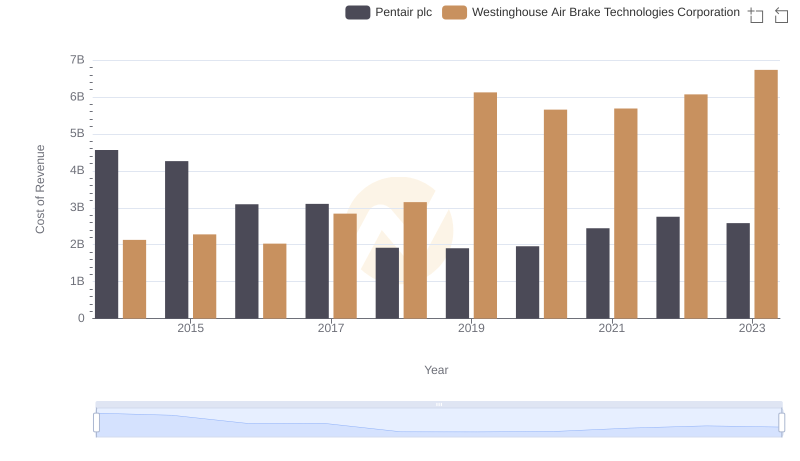

Analyzing Cost of Revenue: Westinghouse Air Brake Technologies Corporation and Pentair plc

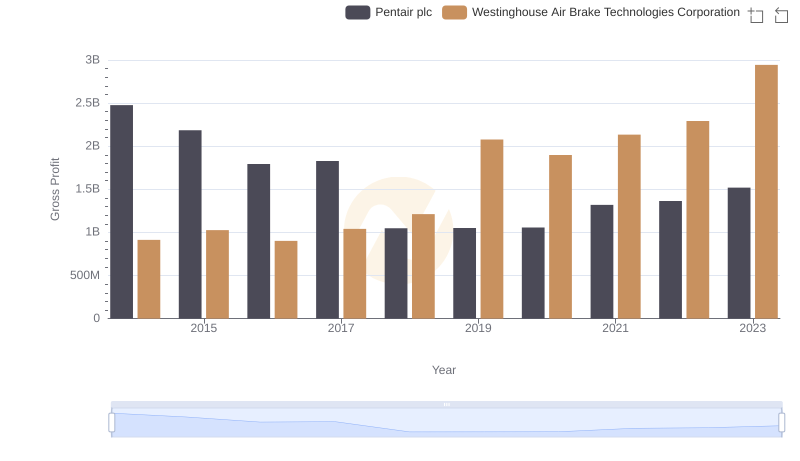

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and Pentair plc Trends

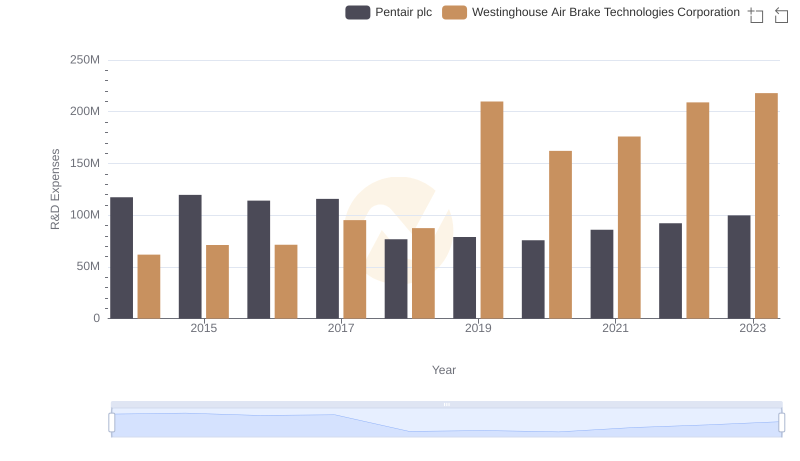

Comparing Innovation Spending: Westinghouse Air Brake Technologies Corporation and Pentair plc

Westinghouse Air Brake Technologies Corporation or Pentair plc: Who Manages SG&A Costs Better?

Comprehensive EBITDA Comparison: Westinghouse Air Brake Technologies Corporation vs Booz Allen Hamilton Holding Corporation

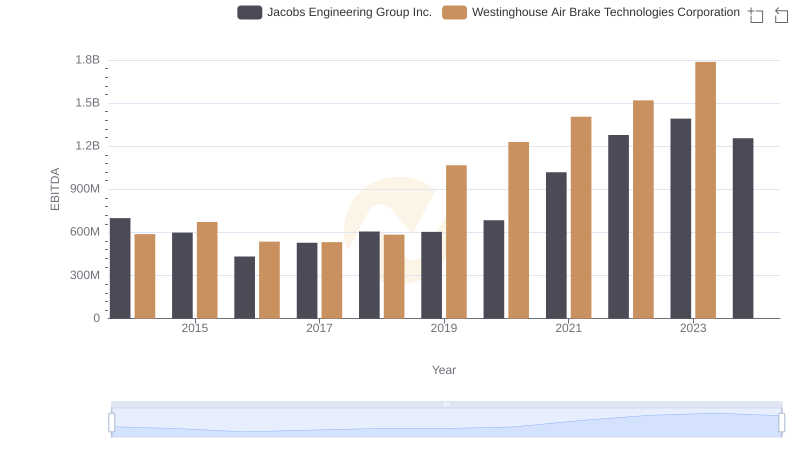

EBITDA Performance Review: Westinghouse Air Brake Technologies Corporation vs Jacobs Engineering Group Inc.

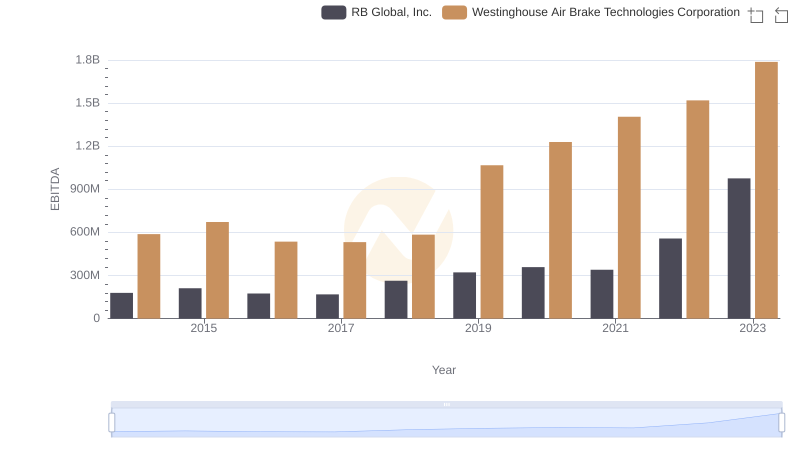

EBITDA Analysis: Evaluating Westinghouse Air Brake Technologies Corporation Against RB Global, Inc.

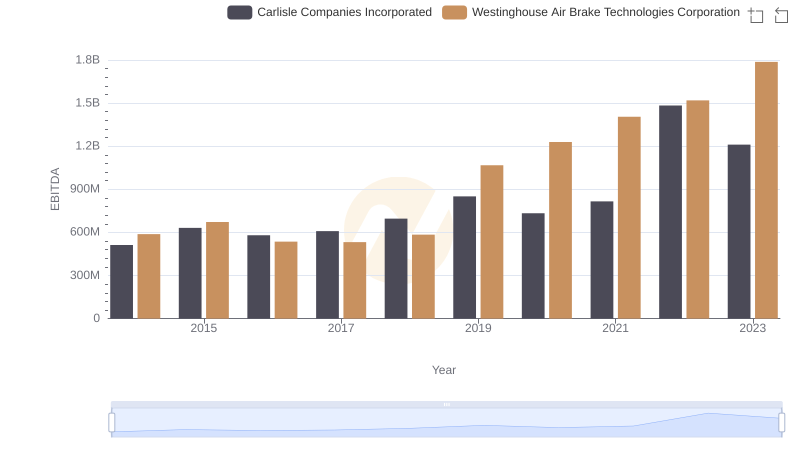

A Side-by-Side Analysis of EBITDA: Westinghouse Air Brake Technologies Corporation and Carlisle Companies Incorporated

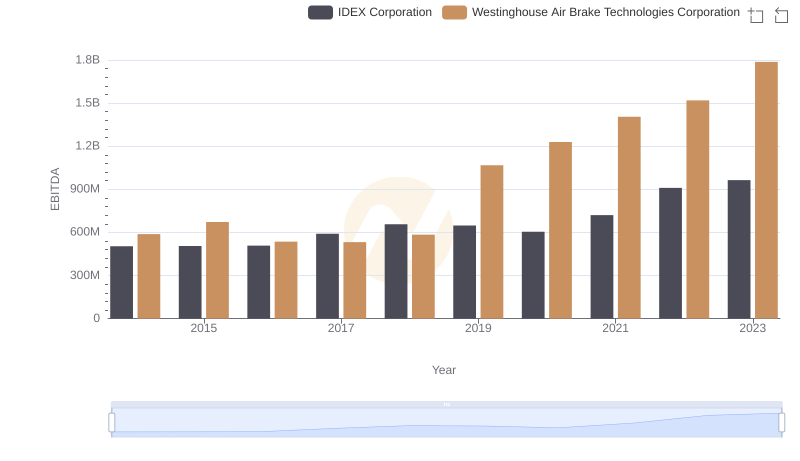

A Professional Review of EBITDA: Westinghouse Air Brake Technologies Corporation Compared to IDEX Corporation

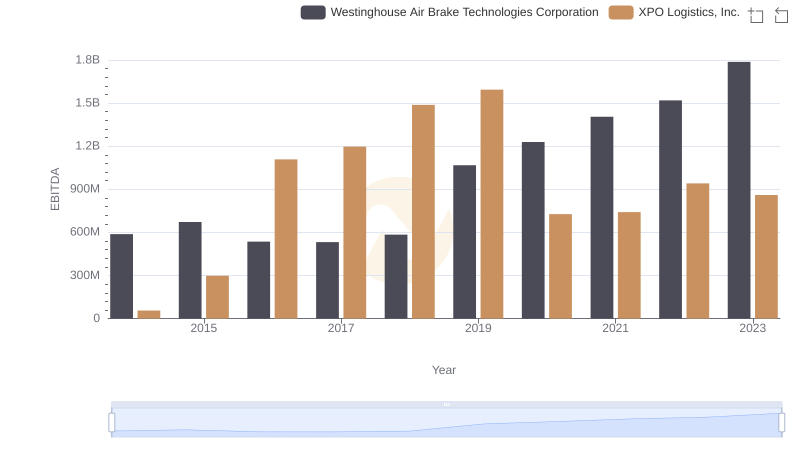

Professional EBITDA Benchmarking: Westinghouse Air Brake Technologies Corporation vs XPO Logistics, Inc.

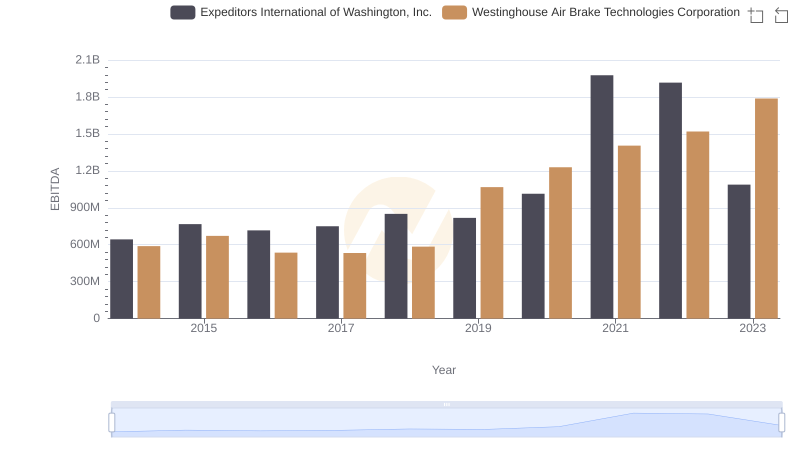

A Professional Review of EBITDA: Westinghouse Air Brake Technologies Corporation Compared to Expeditors International of Washington, Inc.