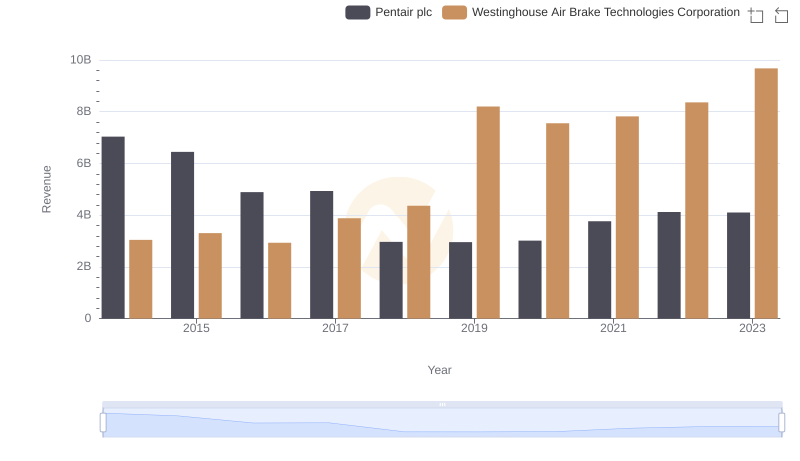

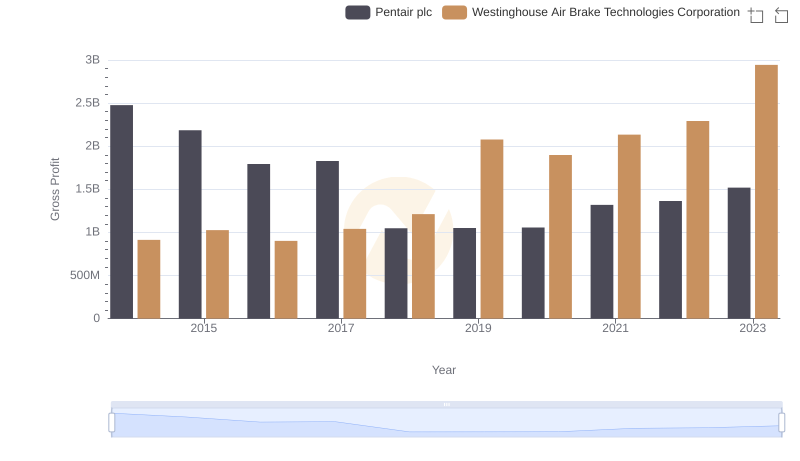

| __timestamp | Pentair plc | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 4563000000 | 2130920000 |

| Thursday, January 1, 2015 | 4263200000 | 2281845000 |

| Friday, January 1, 2016 | 3095900000 | 2029647000 |

| Sunday, January 1, 2017 | 3107400000 | 2841159000 |

| Monday, January 1, 2018 | 1917400000 | 3151816000 |

| Tuesday, January 1, 2019 | 1905700000 | 6122400000 |

| Wednesday, January 1, 2020 | 1960200000 | 5657400000 |

| Friday, January 1, 2021 | 2445600000 | 5687000000 |

| Saturday, January 1, 2022 | 2757200000 | 6070000000 |

| Sunday, January 1, 2023 | 2585300000 | 6733000000 |

| Monday, January 1, 2024 | 2484000000 | 7021000000 |

Unleashing the power of data

In the ever-evolving landscape of industrial technology, Westinghouse Air Brake Technologies Corporation and Pentair plc stand as titans. From 2014 to 2023, these companies have showcased contrasting trajectories in their cost of revenue. Pentair plc, once leading with a cost of revenue peaking at 4.56 billion in 2014, saw a significant decline of nearly 58% by 2019. Meanwhile, Westinghouse Air Brake Technologies Corporation experienced a robust growth, with its cost of revenue surging by over 215% from 2014 to 2023, reaching a peak of 6.73 billion. This divergence highlights the dynamic nature of industrial operations and strategic shifts. As Pentair streamlined its operations, Westinghouse expanded its footprint, reflecting broader industry trends. This analysis offers a window into the strategic decisions shaping the future of these industrial giants.

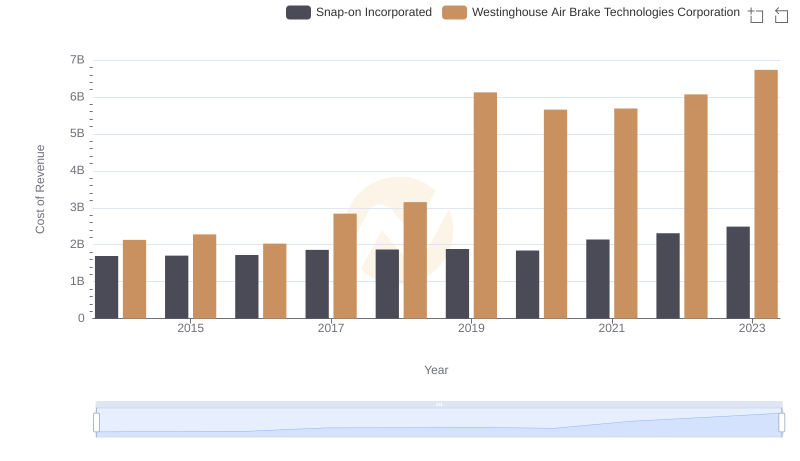

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Snap-on Incorporated

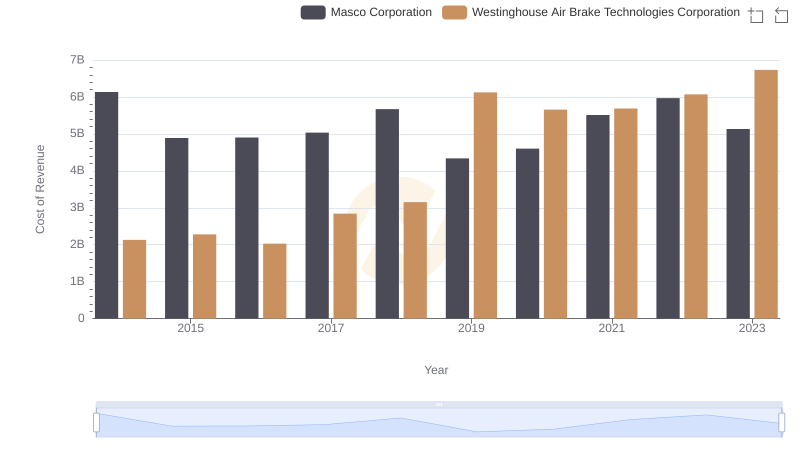

Cost Insights: Breaking Down Westinghouse Air Brake Technologies Corporation and Masco Corporation's Expenses

Revenue Showdown: Westinghouse Air Brake Technologies Corporation vs Pentair plc

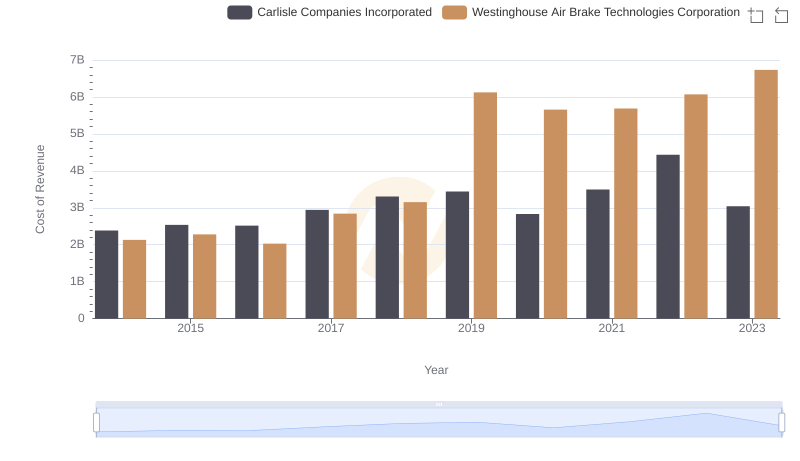

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Carlisle Companies Incorporated

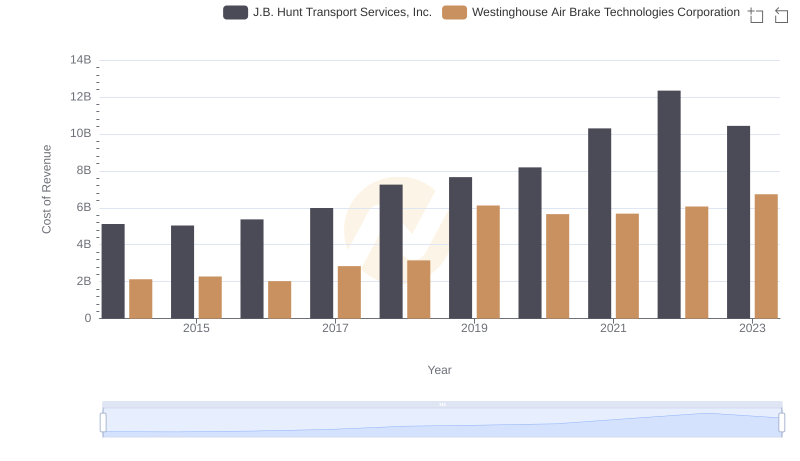

Comparing Cost of Revenue Efficiency: Westinghouse Air Brake Technologies Corporation vs J.B. Hunt Transport Services, Inc.

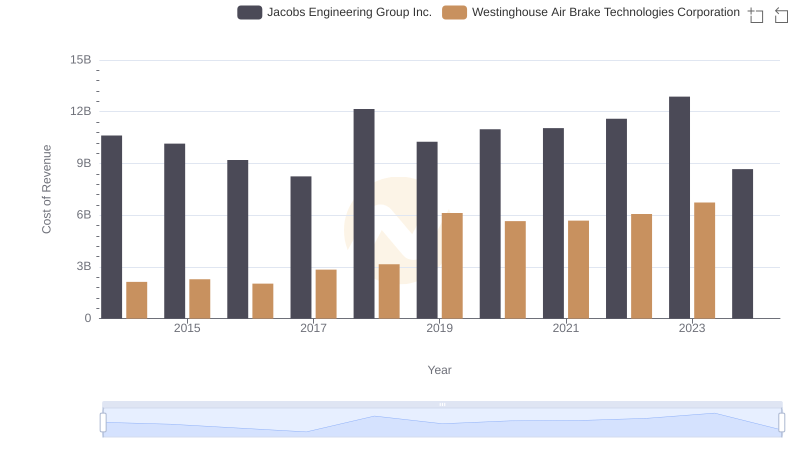

Cost Insights: Breaking Down Westinghouse Air Brake Technologies Corporation and Jacobs Engineering Group Inc.'s Expenses

Westinghouse Air Brake Technologies Corporation vs Booz Allen Hamilton Holding Corporation: Efficiency in Cost of Revenue Explored

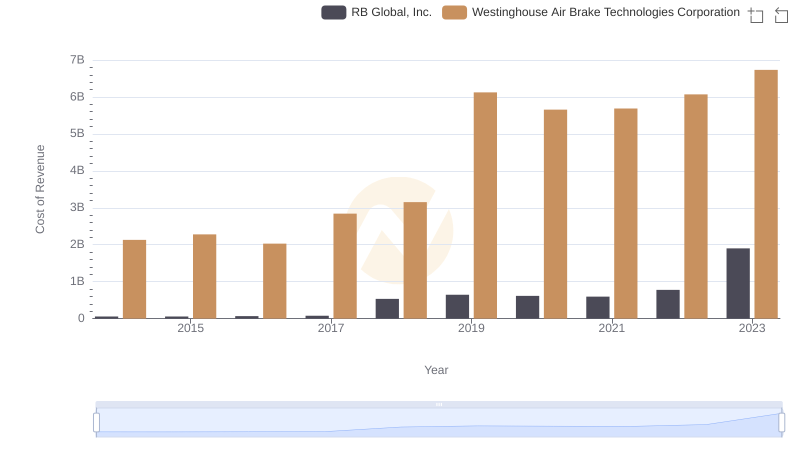

Comparing Cost of Revenue Efficiency: Westinghouse Air Brake Technologies Corporation vs RB Global, Inc.

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and Pentair plc Trends

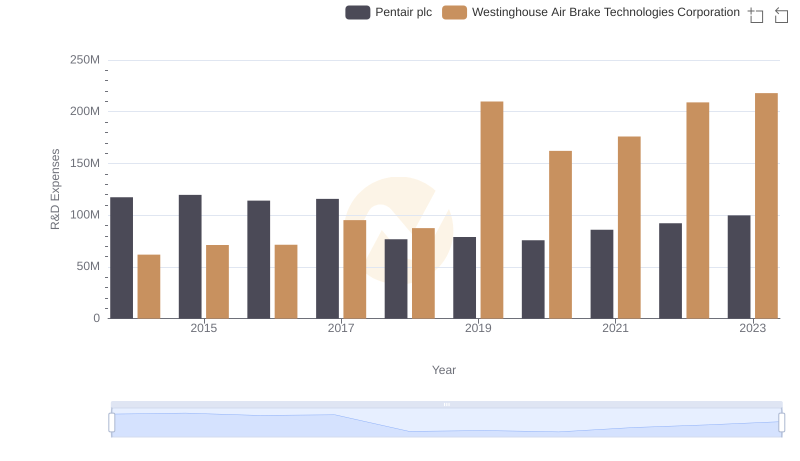

Comparing Innovation Spending: Westinghouse Air Brake Technologies Corporation and Pentair plc

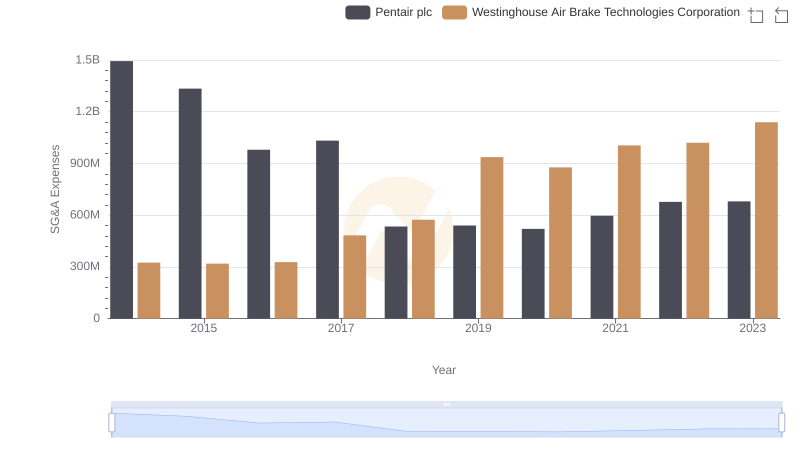

Westinghouse Air Brake Technologies Corporation or Pentair plc: Who Manages SG&A Costs Better?

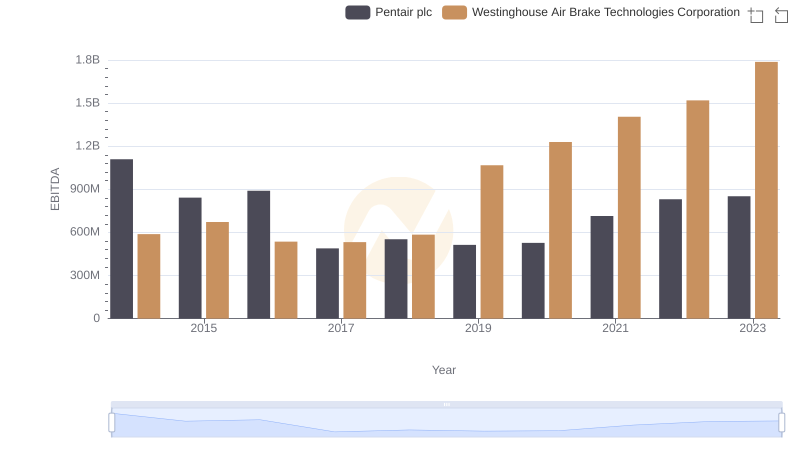

EBITDA Metrics Evaluated: Westinghouse Air Brake Technologies Corporation vs Pentair plc