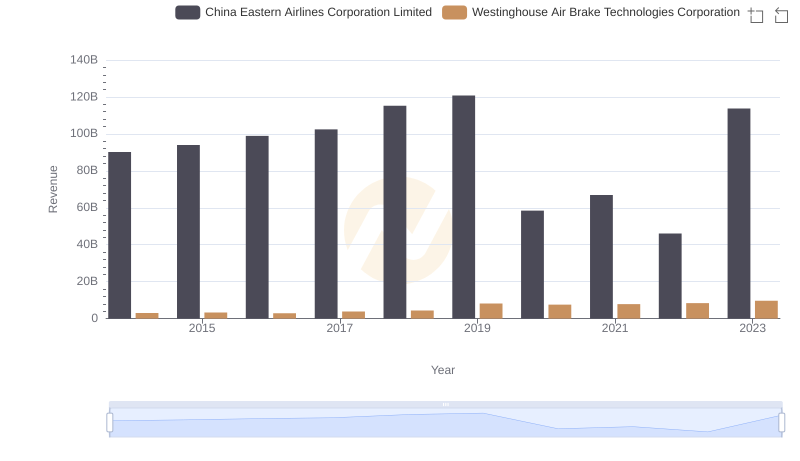

| __timestamp | China Eastern Airlines Corporation Limited | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 78741000000 | 2130920000 |

| Thursday, January 1, 2015 | 77237000000 | 2281845000 |

| Friday, January 1, 2016 | 82676000000 | 2029647000 |

| Sunday, January 1, 2017 | 91592000000 | 2841159000 |

| Monday, January 1, 2018 | 103476000000 | 3151816000 |

| Tuesday, January 1, 2019 | 108865000000 | 6122400000 |

| Wednesday, January 1, 2020 | 72523000000 | 5657400000 |

| Friday, January 1, 2021 | 81828000000 | 5687000000 |

| Saturday, January 1, 2022 | 74599000000 | 6070000000 |

| Sunday, January 1, 2023 | 112461000000 | 6733000000 |

| Monday, January 1, 2024 | 7021000000 |

Unleashing the power of data

The aviation industry has long been a cornerstone of global commerce, connecting people and goods across continents. Within this dynamic sector, companies such as China Eastern Airlines Corporation Limited and Westinghouse Air Brake Technologies Corporation have carved out significant niches. Understanding the financial health of these companies, particularly through metrics like cost of revenue, is crucial for investors, analysts, and stakeholders alike.

Cost of revenue is a critical financial metric that reflects the direct costs attributable to the production of goods sold by a company. In the context of airlines, this includes expenses related to flight operations, maintenance, fuel, and crew salaries. Analyzing trends in cost of revenue can provide insights into operational efficiency, pricing strategies, and overall profitability.

From 2014 to 2023, the cost of revenue for China Eastern Airlines exhibited a remarkable upward trajectory. Starting at approximately $78.7 billion in 2014, the figure surged to around $112.5 billion by 2023. This represents an increase of about 43% over the decade, showcasing the airline's growth and expansion in a competitive market.

In stark contrast, Westinghouse Air Brake Technologies Corporation's cost of revenue remained significantly lower, beginning at around $2.1 billion in 2014 and reaching $6.7 billion in 2023. Although this marks a substantial increase of approximately 220%, it highlights the vast difference in scale between the two companies, with China Eastern Airlines operating in a larger and more complex industry.

The data reflects not just the financial trajectories of these two companies but also the broader trends within the aviation industry. The stark contrast in cost of revenue highlights the scale and operational complexities faced by airlines compared to companies in specialized sectors like rail technology. As we move forward, understanding these trends will be essential for stakeholders looking to navigate the evolving landscape of the aviation market.

By analyzing these trends, investors can make informed decisions based on the operational efficiencies and market strategies of these leading companies. The insights drawn from this comparative analysis serve as a reminder of the importance of financial metrics in assessing corporate health and industry dynamics.

Westinghouse Air Brake Technologies Corporation vs Booz Allen Hamilton Holding Corporation: Efficiency in Cost of Revenue Explored

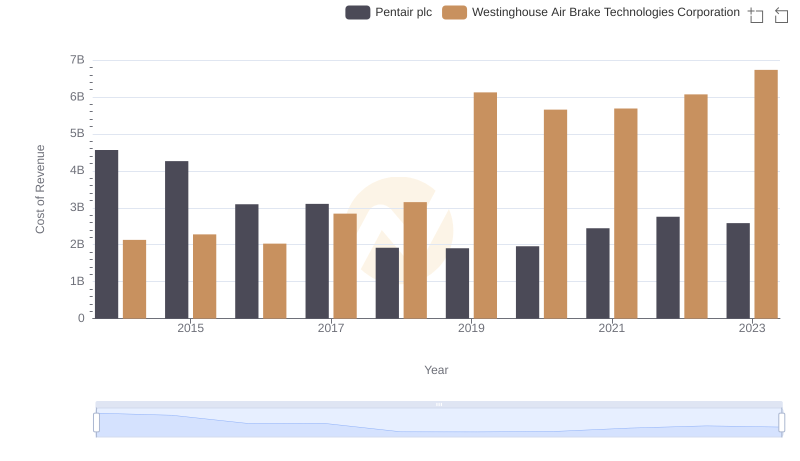

Analyzing Cost of Revenue: Westinghouse Air Brake Technologies Corporation and Pentair plc

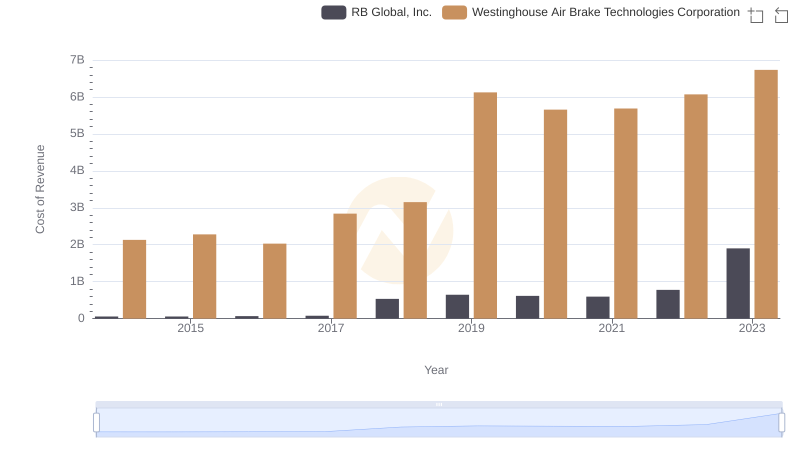

Comparing Cost of Revenue Efficiency: Westinghouse Air Brake Technologies Corporation vs RB Global, Inc.

Revenue Insights: Westinghouse Air Brake Technologies Corporation and China Eastern Airlines Corporation Limited Performance Compared

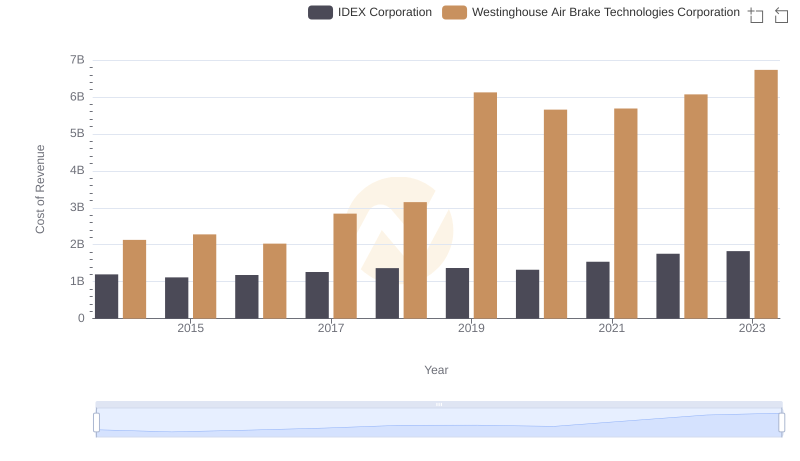

Comparing Cost of Revenue Efficiency: Westinghouse Air Brake Technologies Corporation vs IDEX Corporation

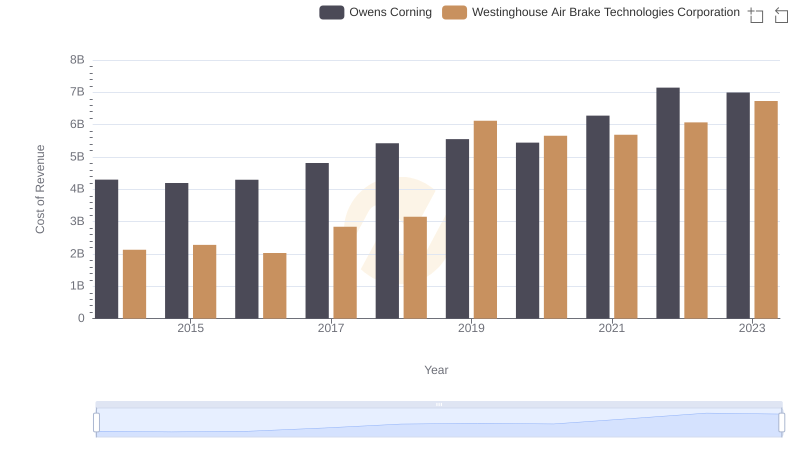

Westinghouse Air Brake Technologies Corporation vs Owens Corning: Efficiency in Cost of Revenue Explored

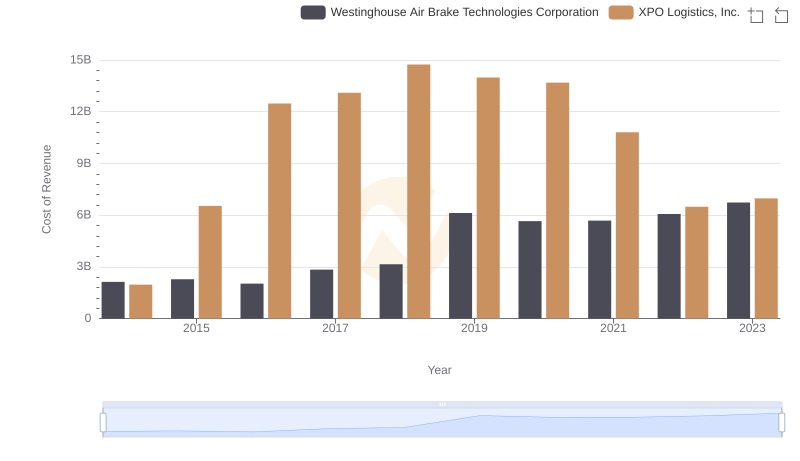

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs XPO Logistics, Inc.

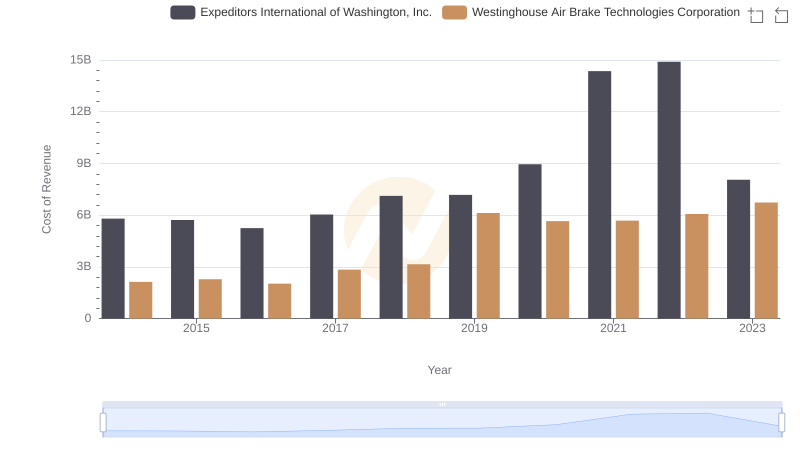

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Expeditors International of Washington, Inc.

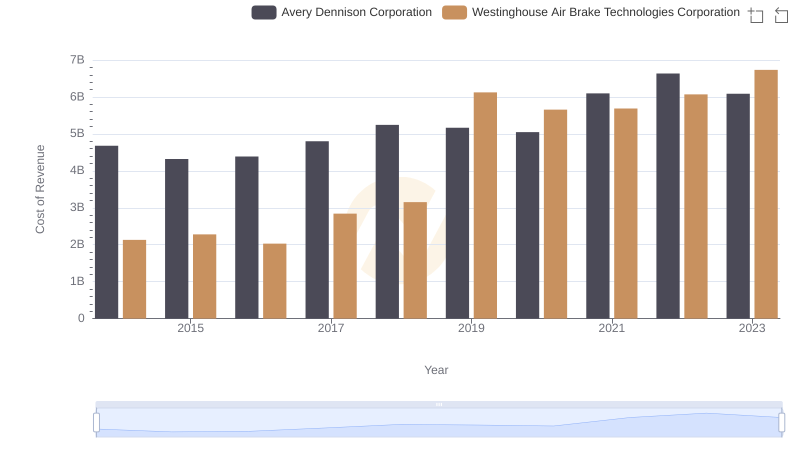

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Avery Dennison Corporation

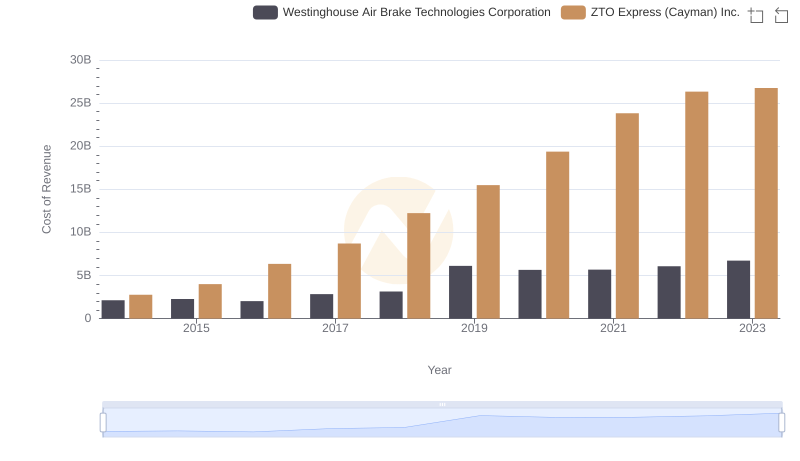

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs ZTO Express (Cayman) Inc.

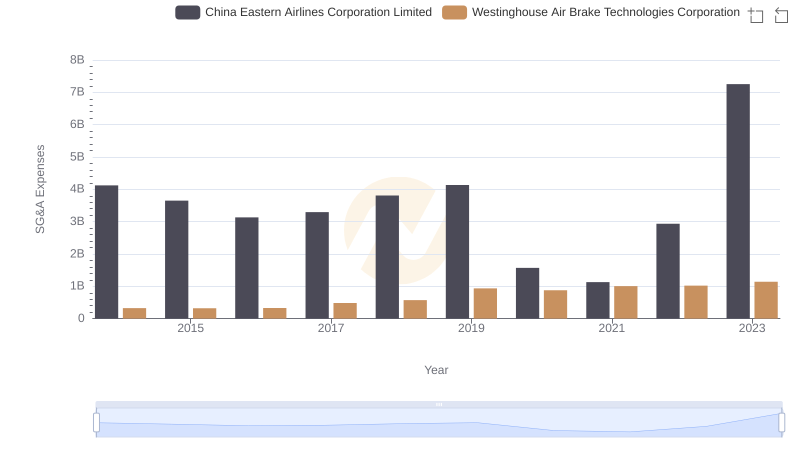

Westinghouse Air Brake Technologies Corporation or China Eastern Airlines Corporation Limited: Who Manages SG&A Costs Better?

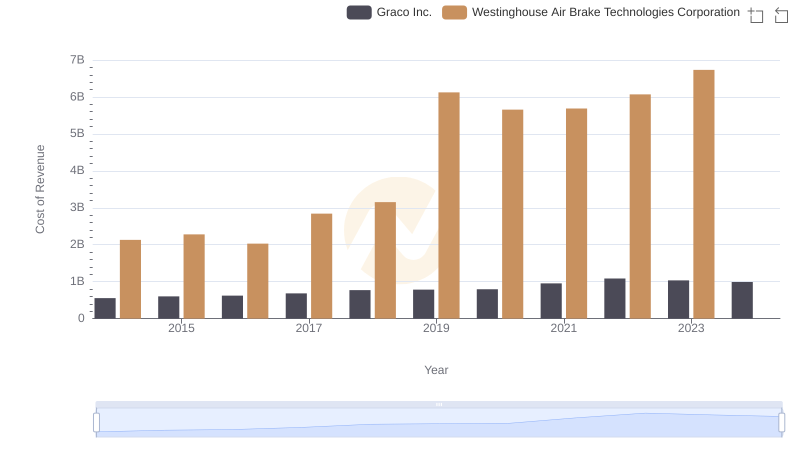

Cost of Revenue: Key Insights for Westinghouse Air Brake Technologies Corporation and Graco Inc.