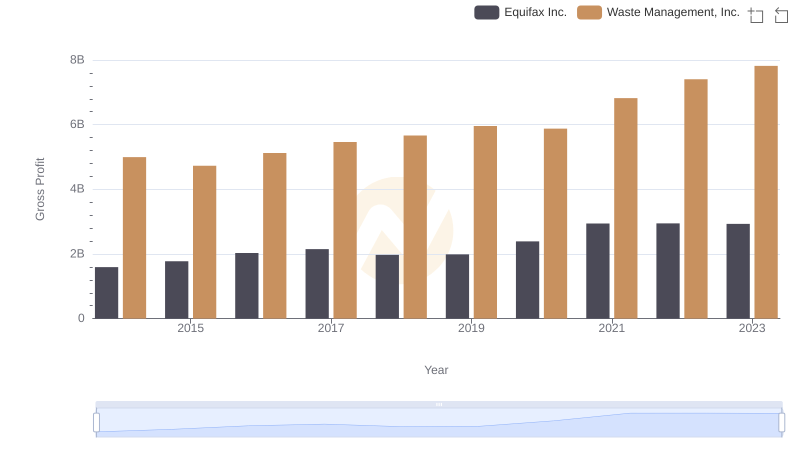

| __timestamp | Equifax Inc. | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 844700000 | 9002000000 |

| Thursday, January 1, 2015 | 887400000 | 8231000000 |

| Friday, January 1, 2016 | 1113400000 | 8486000000 |

| Sunday, January 1, 2017 | 1210700000 | 9021000000 |

| Monday, January 1, 2018 | 1440400000 | 9249000000 |

| Tuesday, January 1, 2019 | 1521700000 | 9496000000 |

| Wednesday, January 1, 2020 | 1737400000 | 9341000000 |

| Friday, January 1, 2021 | 1980900000 | 11111000000 |

| Saturday, January 1, 2022 | 2177200000 | 12294000000 |

| Sunday, January 1, 2023 | 2335100000 | 12606000000 |

| Monday, January 1, 2024 | 0 | 13383000000 |

Igniting the spark of knowledge

In the world of corporate finance, understanding cost efficiency is crucial. Waste Management, Inc. and Equifax Inc. offer a fascinating study in contrasts. Over the past decade, Waste Management has consistently maintained a cost of revenue that is approximately 6 times higher than Equifax's. This reflects the nature of their operations, with Waste Management's extensive logistics and infrastructure needs.

From 2014 to 2023, Equifax's cost of revenue grew by nearly 176%, while Waste Management saw a 40% increase. This indicates a more aggressive expansion or cost increase strategy by Equifax. Notably, in 2023, Waste Management's cost of revenue peaked at over $12.6 billion, while Equifax reached $2.3 billion. These figures highlight the scale and operational differences between the two companies, offering insights into their strategic priorities and market challenges.

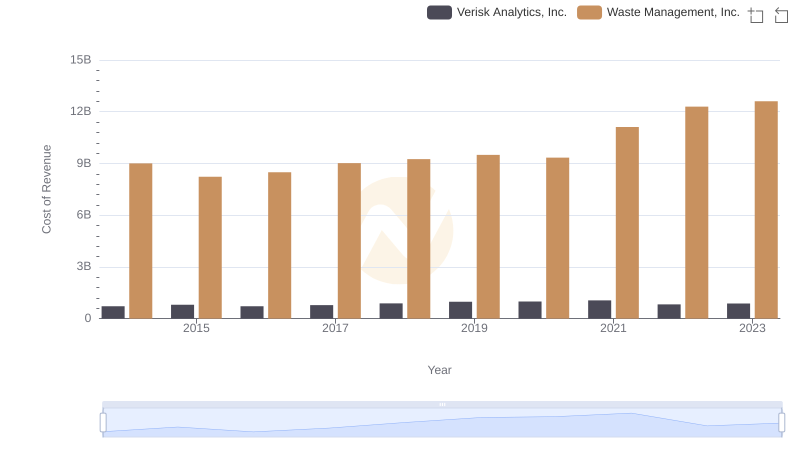

Comparing Cost of Revenue Efficiency: Waste Management, Inc. vs Verisk Analytics, Inc.

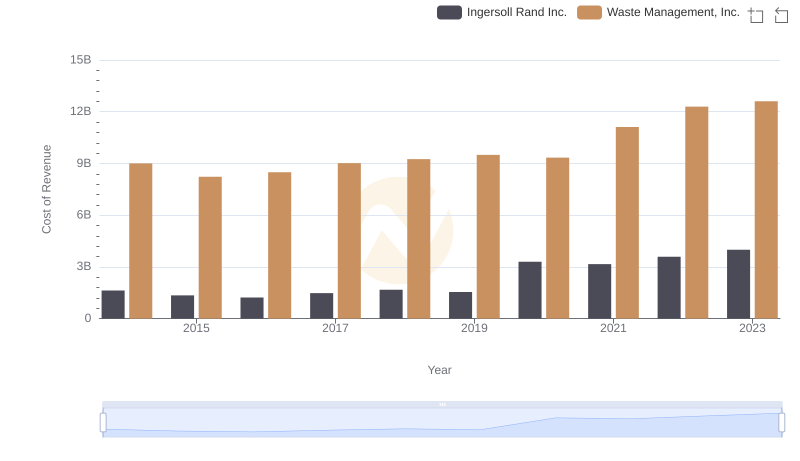

Cost of Revenue Comparison: Waste Management, Inc. vs Ingersoll Rand Inc.

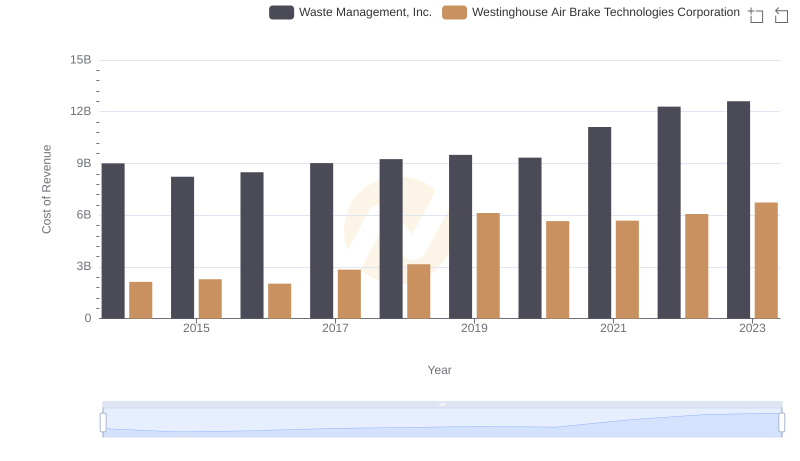

Cost of Revenue Comparison: Waste Management, Inc. vs Westinghouse Air Brake Technologies Corporation

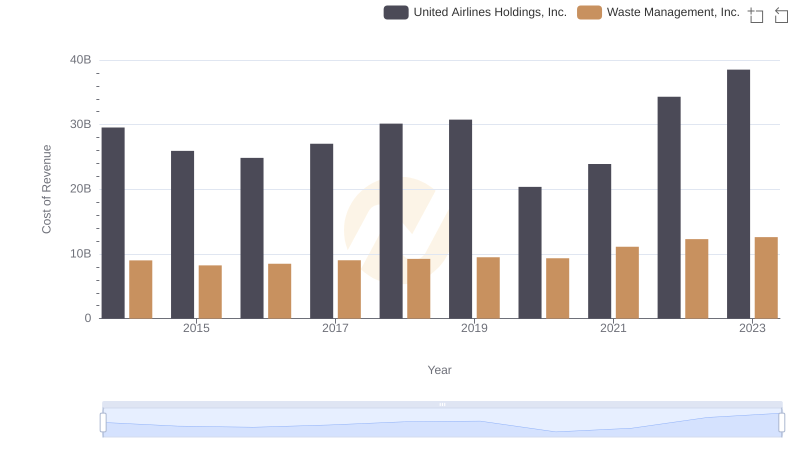

Cost Insights: Breaking Down Waste Management, Inc. and United Airlines Holdings, Inc.'s Expenses

Gross Profit Trends Compared: Waste Management, Inc. vs Equifax Inc.

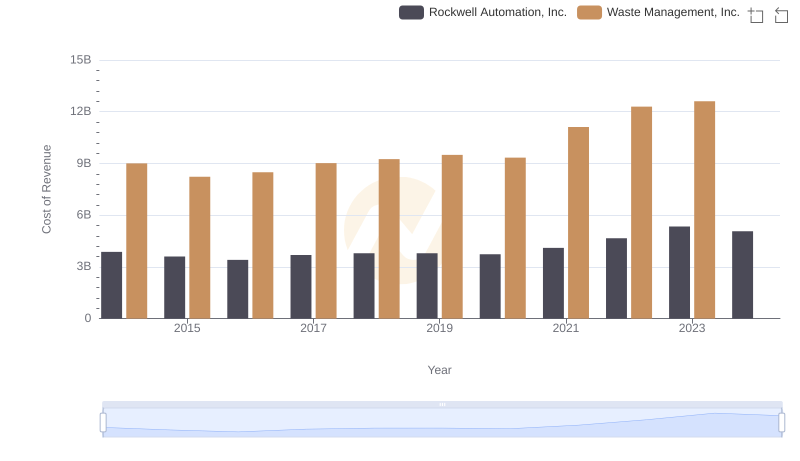

Cost of Revenue: Key Insights for Waste Management, Inc. and Rockwell Automation, Inc.

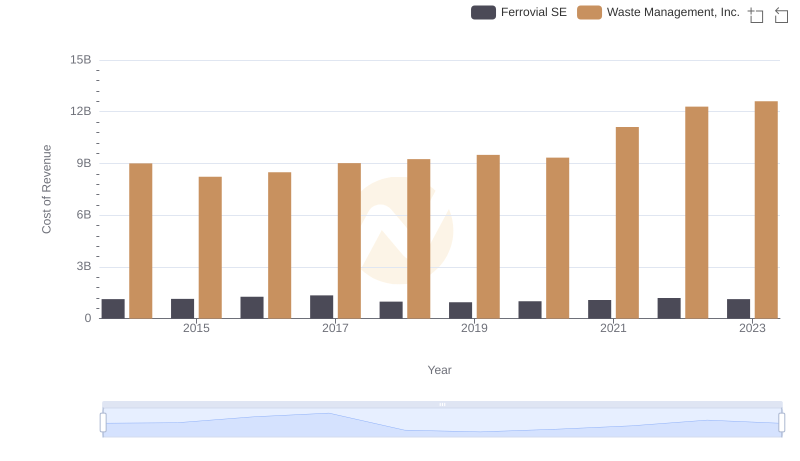

Cost of Revenue Comparison: Waste Management, Inc. vs Ferrovial SE

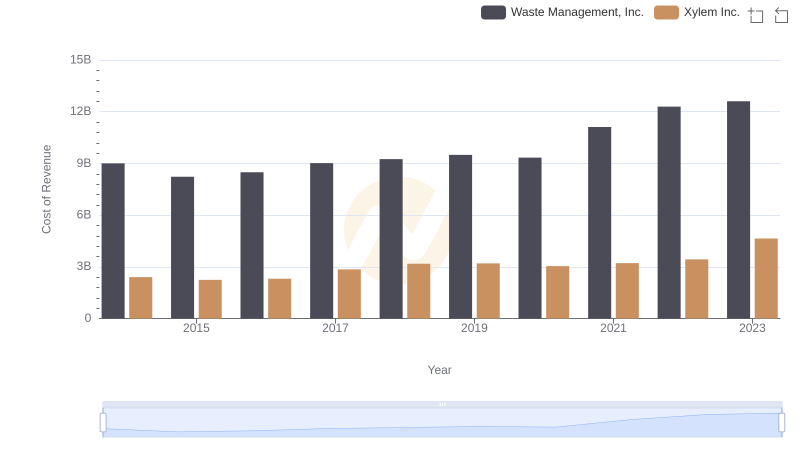

Cost of Revenue: Key Insights for Waste Management, Inc. and Xylem Inc.

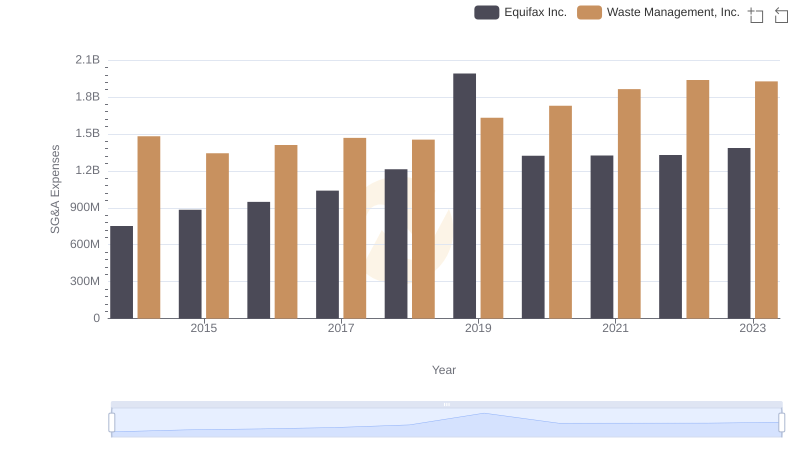

Waste Management, Inc. vs Equifax Inc.: SG&A Expense Trends