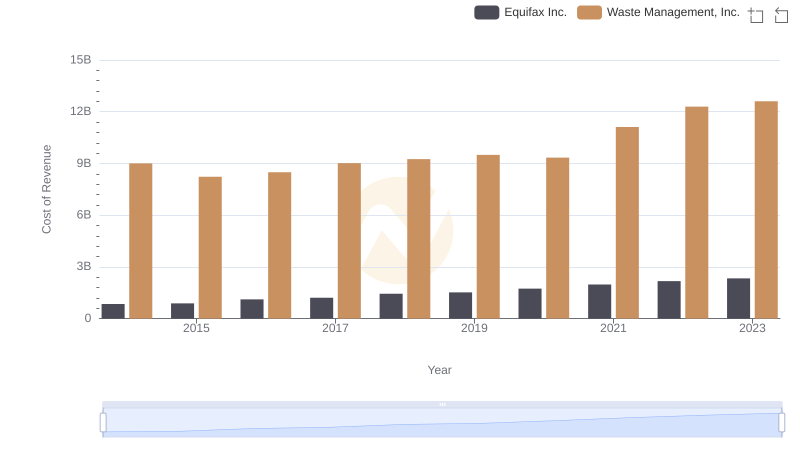

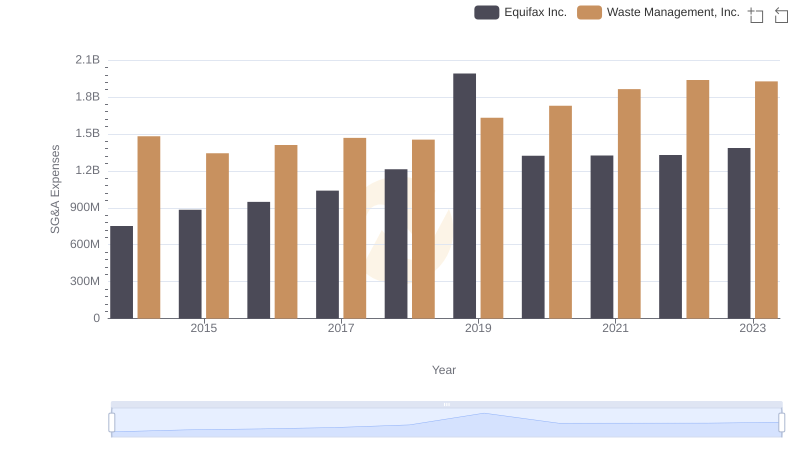

| __timestamp | Equifax Inc. | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1591700000 | 4994000000 |

| Thursday, January 1, 2015 | 1776200000 | 4730000000 |

| Friday, January 1, 2016 | 2031500000 | 5123000000 |

| Sunday, January 1, 2017 | 2151500000 | 5464000000 |

| Monday, January 1, 2018 | 1971700000 | 5665000000 |

| Tuesday, January 1, 2019 | 1985900000 | 5959000000 |

| Wednesday, January 1, 2020 | 2390100000 | 5877000000 |

| Friday, January 1, 2021 | 2943000000 | 6820000000 |

| Saturday, January 1, 2022 | 2945000000 | 7404000000 |

| Sunday, January 1, 2023 | 2930100000 | 7820000000 |

| Monday, January 1, 2024 | 5681100000 | 8680000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of corporate finance, understanding the gross profit trends of industry giants like Waste Management, Inc. and Equifax Inc. offers valuable insights. Over the past decade, Waste Management has consistently outperformed Equifax in terms of gross profit, showcasing a robust growth trajectory. From 2014 to 2023, Waste Management's gross profit surged by approximately 57%, peaking at $7.82 billion in 2023. In contrast, Equifax experienced a more modest growth of around 84% during the same period, reaching $2.93 billion in 2023.

This comparison highlights Waste Management's dominance in the waste management sector, driven by strategic expansions and operational efficiencies. Meanwhile, Equifax's steady growth reflects its resilience in the competitive credit reporting industry. As we look to the future, these trends underscore the importance of strategic planning and market adaptation in sustaining financial success.

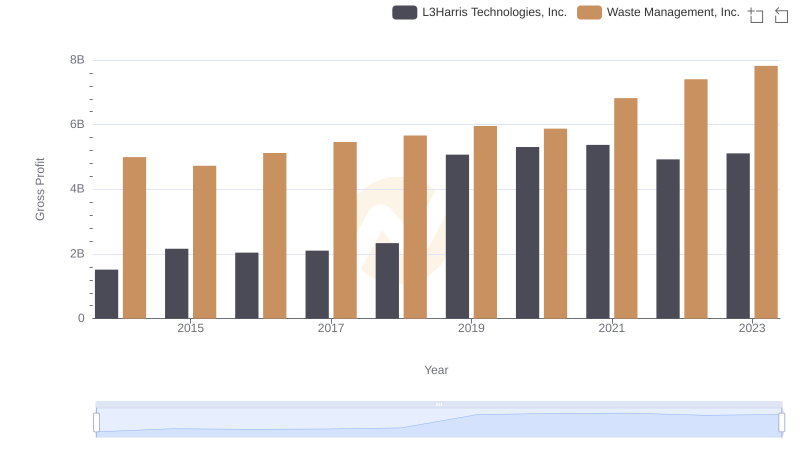

Who Generates Higher Gross Profit? Waste Management, Inc. or L3Harris Technologies, Inc.

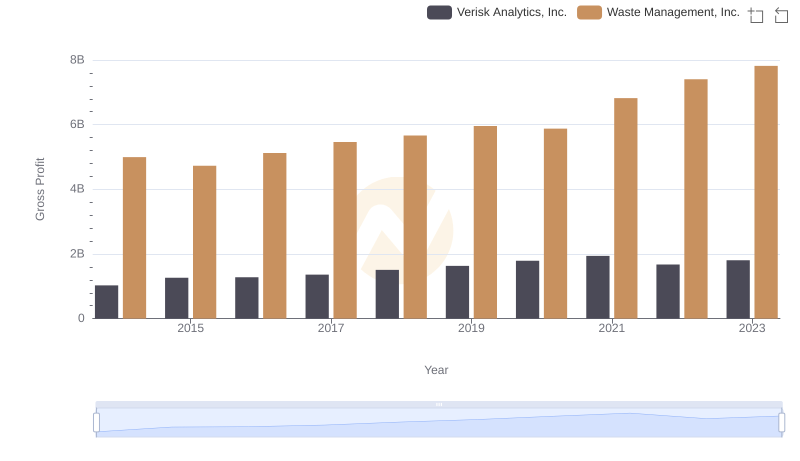

Key Insights on Gross Profit: Waste Management, Inc. vs Verisk Analytics, Inc.

Comparing Cost of Revenue Efficiency: Waste Management, Inc. vs Equifax Inc.

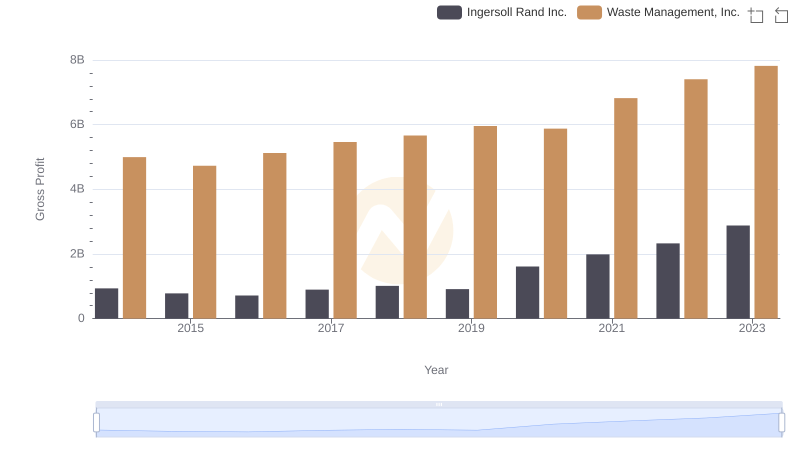

Key Insights on Gross Profit: Waste Management, Inc. vs Ingersoll Rand Inc.

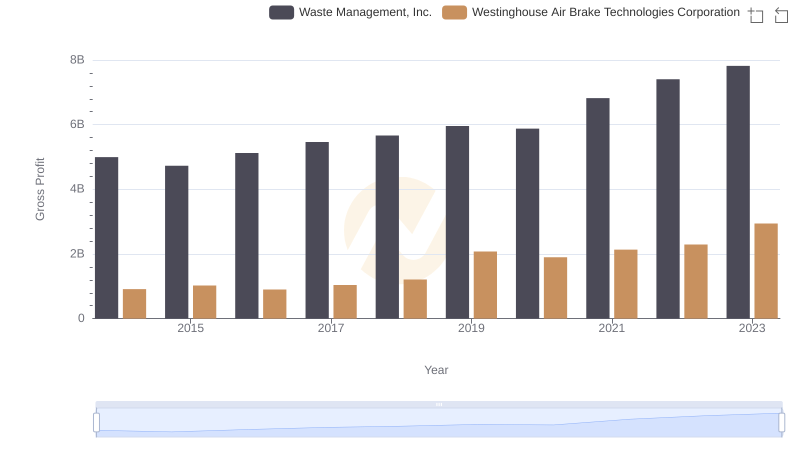

Who Generates Higher Gross Profit? Waste Management, Inc. or Westinghouse Air Brake Technologies Corporation

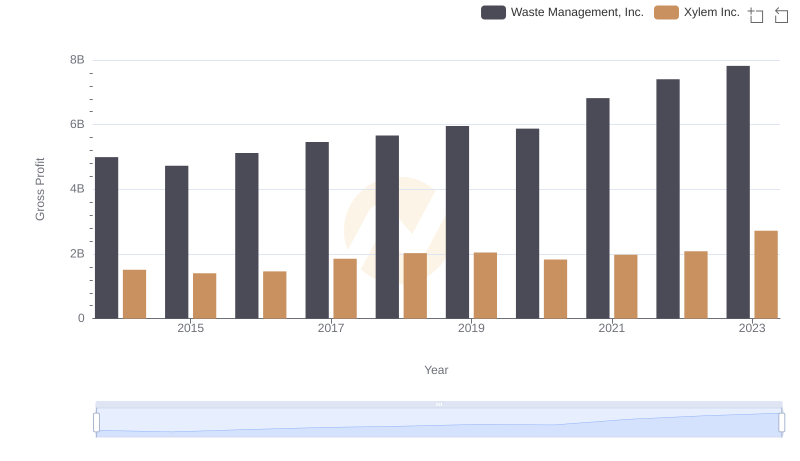

Gross Profit Trends Compared: Waste Management, Inc. vs Xylem Inc.

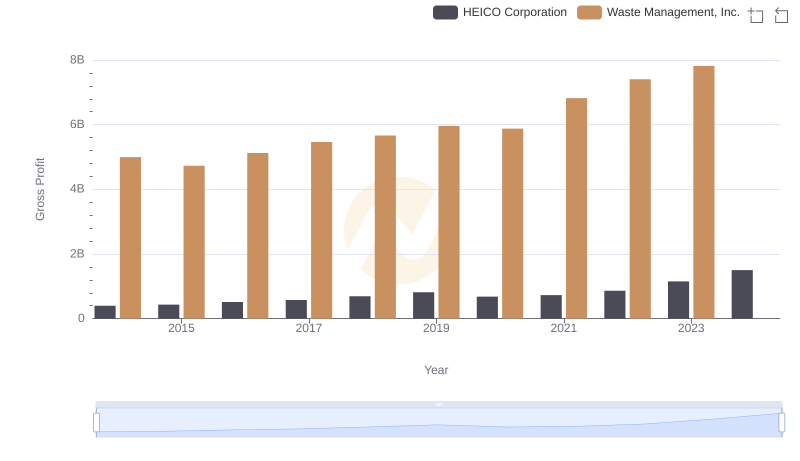

Gross Profit Analysis: Comparing Waste Management, Inc. and HEICO Corporation

Waste Management, Inc. vs Equifax Inc.: SG&A Expense Trends

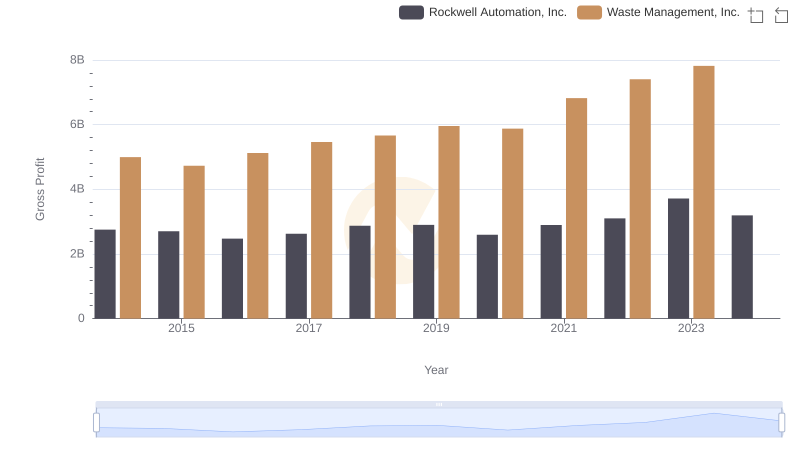

Gross Profit Comparison: Waste Management, Inc. and Rockwell Automation, Inc. Trends

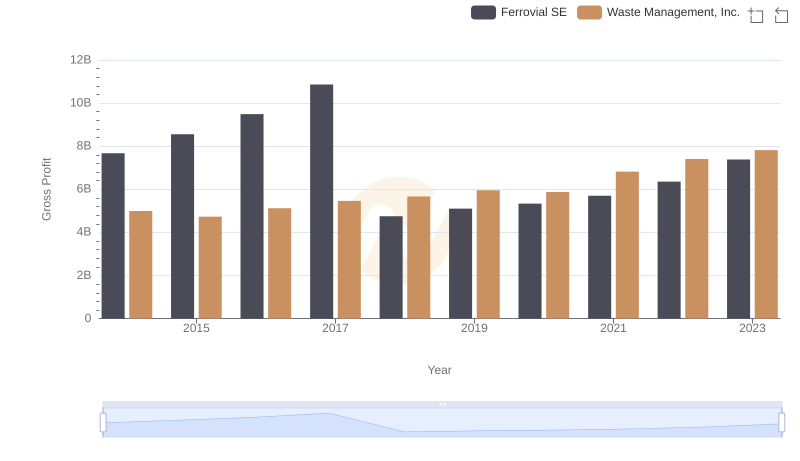

Key Insights on Gross Profit: Waste Management, Inc. vs Ferrovial SE