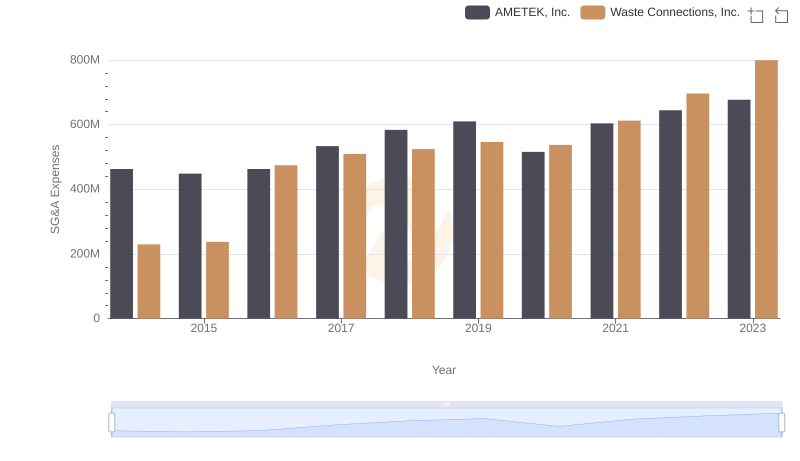

| __timestamp | Quanta Services, Inc. | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 580730000 | 229474000 |

| Thursday, January 1, 2015 | 592863000 | 237484000 |

| Friday, January 1, 2016 | 653338000 | 474263000 |

| Sunday, January 1, 2017 | 777920000 | 509638000 |

| Monday, January 1, 2018 | 857574000 | 524388000 |

| Tuesday, January 1, 2019 | 955991000 | 546278000 |

| Wednesday, January 1, 2020 | 975074000 | 537632000 |

| Friday, January 1, 2021 | 1155956000 | 612337000 |

| Saturday, January 1, 2022 | 1336711000 | 696467000 |

| Sunday, January 1, 2023 | 1555137000 | 799119000 |

| Monday, January 1, 2024 | 883445000 |

In pursuit of knowledge

In the ever-evolving landscape of corporate America, understanding the financial health of industry leaders is crucial. Waste Connections, Inc. and Quanta Services, Inc. have been pivotal players in their respective sectors. Over the past decade, from 2014 to 2023, these companies have shown distinct trends in their Selling, General, and Administrative (SG&A) expenses.

Quanta Services, Inc. has seen a staggering 168% increase in SG&A expenses, reflecting its aggressive expansion and operational scaling. In contrast, Waste Connections, Inc. has experienced a more modest 248% rise, indicating a steady growth trajectory. This divergence highlights the strategic differences between the two companies, with Quanta focusing on rapid growth and Waste Connections prioritizing sustainable expansion.

These insights offer a window into the strategic priorities and operational efficiencies of these industry titans, providing valuable lessons for investors and business leaders alike.

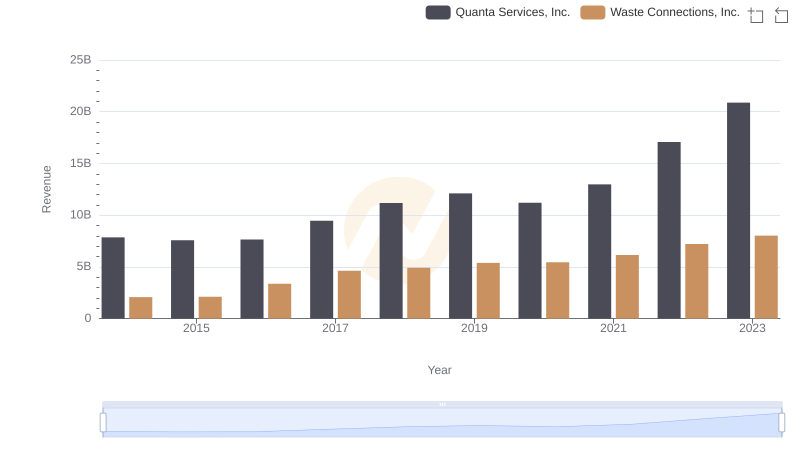

Comparing Revenue Performance: Waste Connections, Inc. or Quanta Services, Inc.?

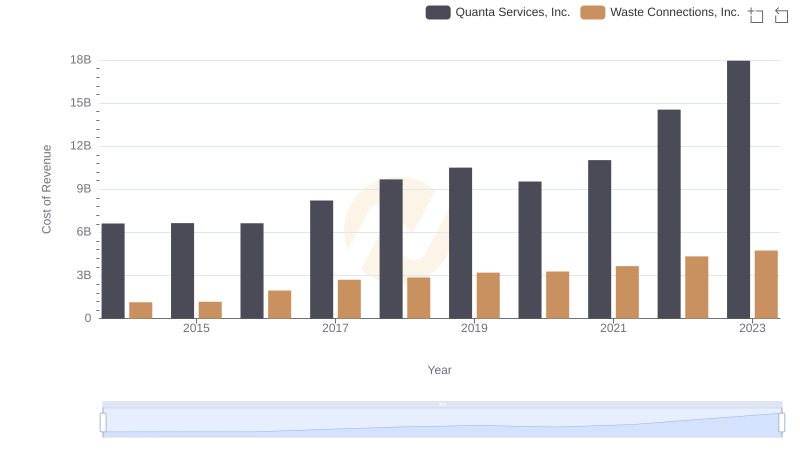

Cost of Revenue: Key Insights for Waste Connections, Inc. and Quanta Services, Inc.

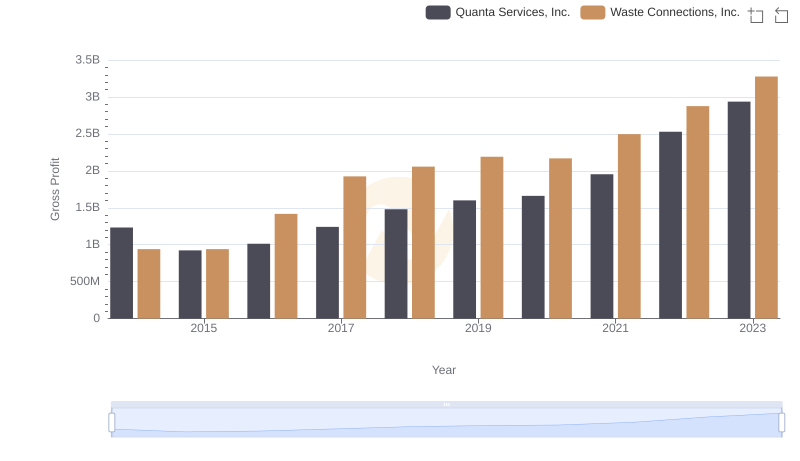

Gross Profit Comparison: Waste Connections, Inc. and Quanta Services, Inc. Trends

Selling, General, and Administrative Costs: Waste Connections, Inc. vs AMETEK, Inc.

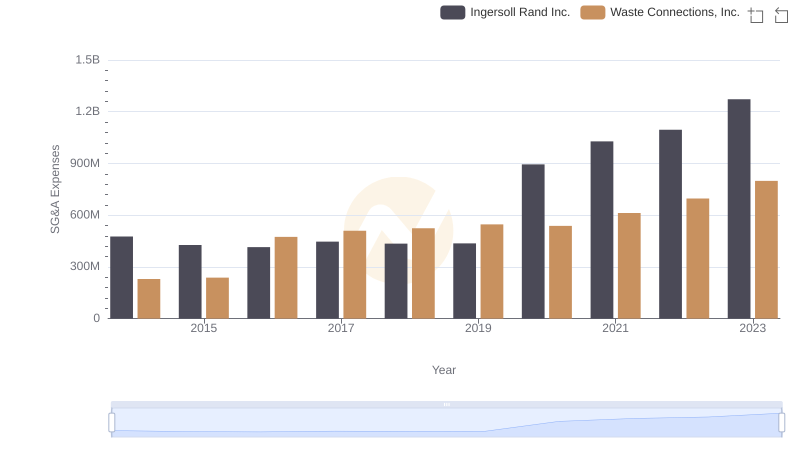

Who Optimizes SG&A Costs Better? Waste Connections, Inc. or Ingersoll Rand Inc.

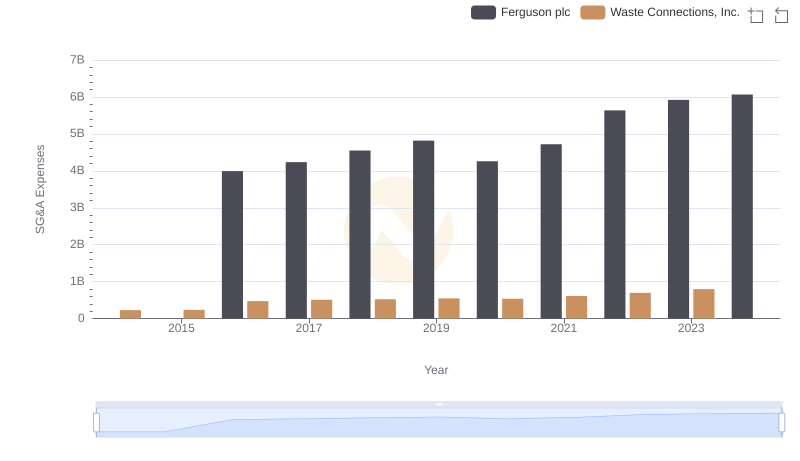

Waste Connections, Inc. or Ferguson plc: Who Manages SG&A Costs Better?

EBITDA Metrics Evaluated: Waste Connections, Inc. vs Quanta Services, Inc.