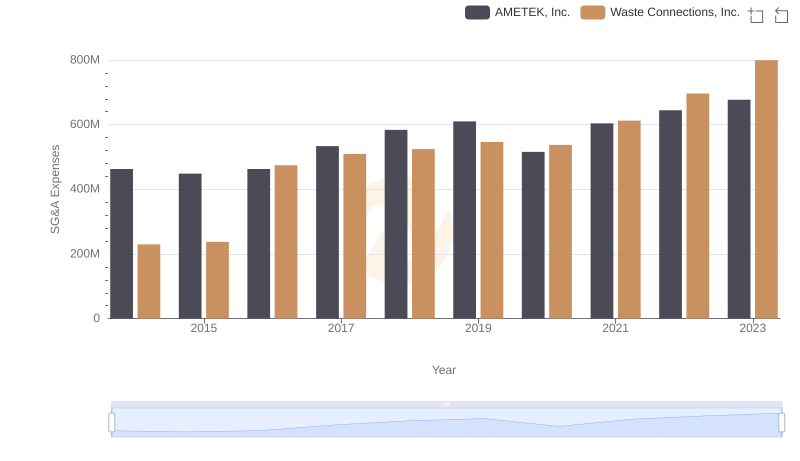

| __timestamp | Ingersoll Rand Inc. | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 476000000 | 229474000 |

| Thursday, January 1, 2015 | 427000000 | 237484000 |

| Friday, January 1, 2016 | 414339000 | 474263000 |

| Sunday, January 1, 2017 | 446600000 | 509638000 |

| Monday, January 1, 2018 | 434600000 | 524388000 |

| Tuesday, January 1, 2019 | 436400000 | 546278000 |

| Wednesday, January 1, 2020 | 894800000 | 537632000 |

| Friday, January 1, 2021 | 1028000000 | 612337000 |

| Saturday, January 1, 2022 | 1095800000 | 696467000 |

| Sunday, January 1, 2023 | 1272700000 | 799119000 |

| Monday, January 1, 2024 | 0 | 883445000 |

Unlocking the unknown

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Waste Connections, Inc. and Ingersoll Rand Inc. have been on this journey since 2014. Over the years, Ingersoll Rand has seen a significant increase in SG&A expenses, rising by approximately 167% from 2014 to 2023. In contrast, Waste Connections has managed a more modest increase of around 248% during the same period.

Ingersoll Rand's expenses surged notably in 2020, reflecting a strategic shift or market adaptation, while Waste Connections maintained a steadier growth trajectory. This data highlights the different strategies these companies employ in optimizing operational costs. As businesses navigate economic challenges, understanding these trends offers valuable insights into effective cost management strategies.

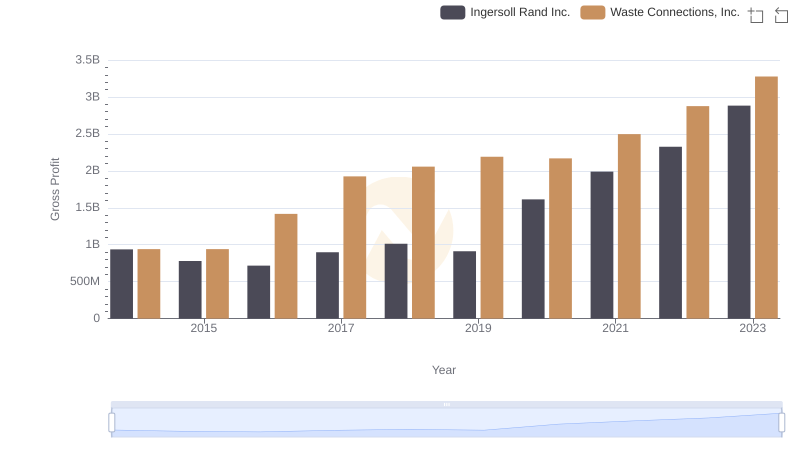

Waste Connections, Inc. vs Ingersoll Rand Inc.: A Gross Profit Performance Breakdown

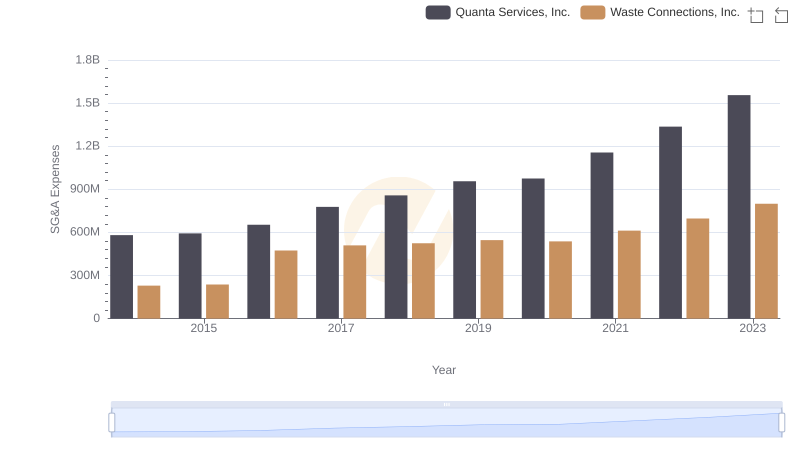

Waste Connections, Inc. vs Quanta Services, Inc.: SG&A Expense Trends

Selling, General, and Administrative Costs: Waste Connections, Inc. vs AMETEK, Inc.

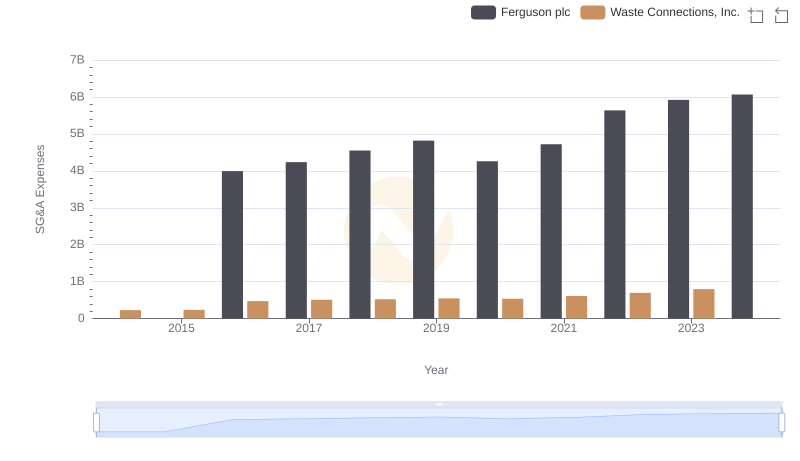

Waste Connections, Inc. or Ferguson plc: Who Manages SG&A Costs Better?

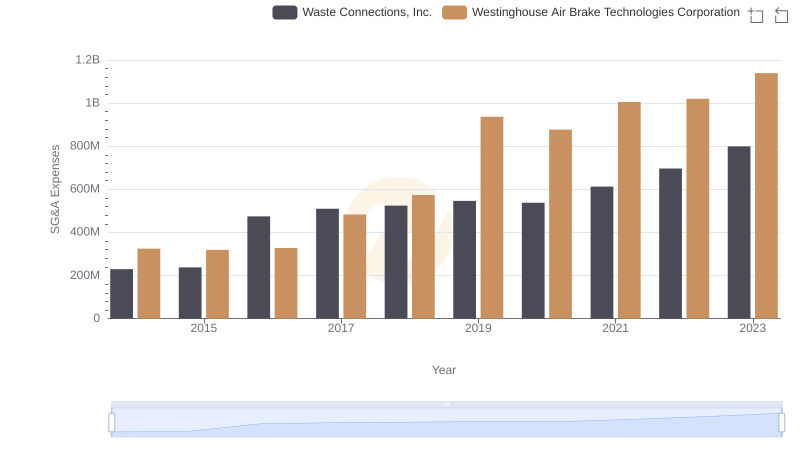

Cost Management Insights: SG&A Expenses for Waste Connections, Inc. and Westinghouse Air Brake Technologies Corporation

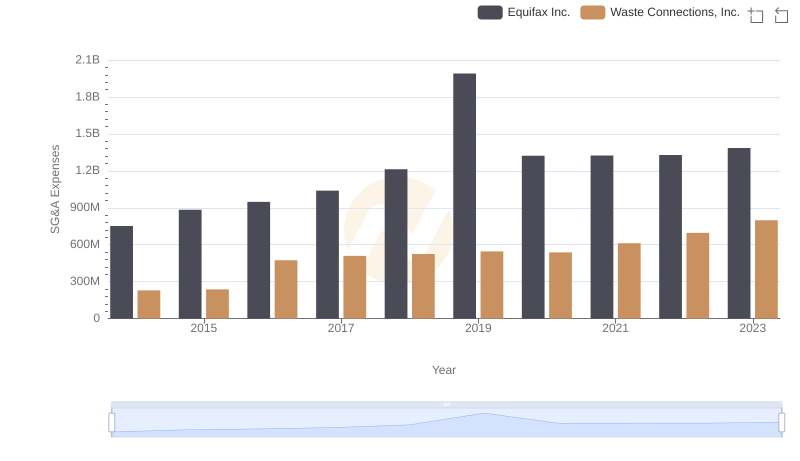

Waste Connections, Inc. and Equifax Inc.: SG&A Spending Patterns Compared