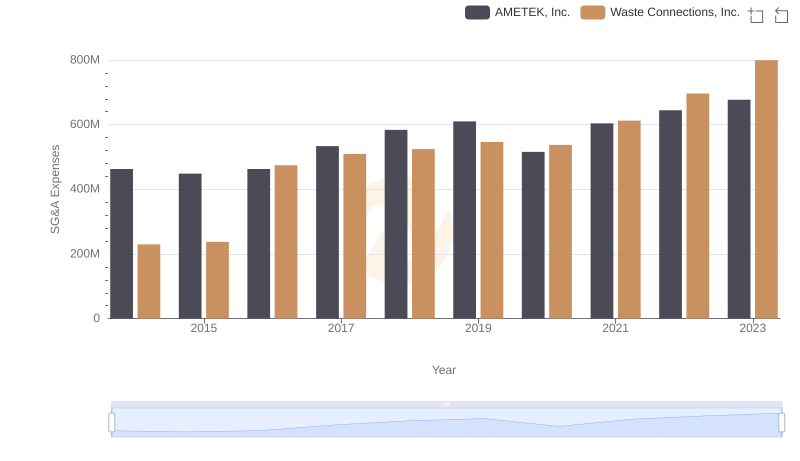

| __timestamp | Ferguson plc | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 5065428 | 229474000 |

| Thursday, January 1, 2015 | 3127932 | 237484000 |

| Friday, January 1, 2016 | 3992798135 | 474263000 |

| Sunday, January 1, 2017 | 4237396470 | 509638000 |

| Monday, January 1, 2018 | 4552000000 | 524388000 |

| Tuesday, January 1, 2019 | 4819000000 | 546278000 |

| Wednesday, January 1, 2020 | 4260000000 | 537632000 |

| Friday, January 1, 2021 | 4721000000 | 612337000 |

| Saturday, January 1, 2022 | 5635000000 | 696467000 |

| Sunday, January 1, 2023 | 5920000000 | 799119000 |

| Monday, January 1, 2024 | 6066000000 | 883445000 |

Igniting the spark of knowledge

In the competitive landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. From 2014 to 2023, Ferguson plc and Waste Connections, Inc. have shown distinct approaches to handling these costs. Ferguson plc, a leader in the building materials industry, has seen its SG&A expenses grow by approximately 20% annually, peaking at $6.06 billion in 2024. In contrast, Waste Connections, Inc., a key player in waste management, has maintained a more stable growth, with expenses increasing by about 15% annually, reaching $799 million in 2023. This data suggests that while Ferguson plc operates on a larger scale, Waste Connections, Inc. demonstrates a more controlled approach to managing its SG&A costs. The absence of 2024 data for Waste Connections, Inc. leaves room for speculation on its future financial strategies.

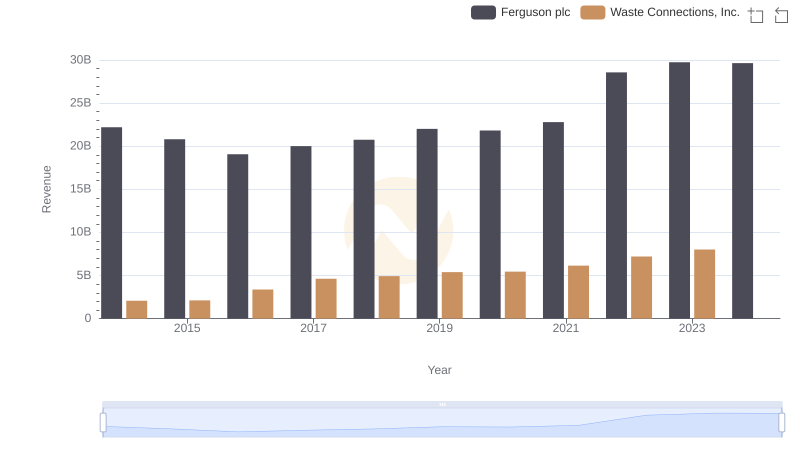

Comparing Revenue Performance: Waste Connections, Inc. or Ferguson plc?

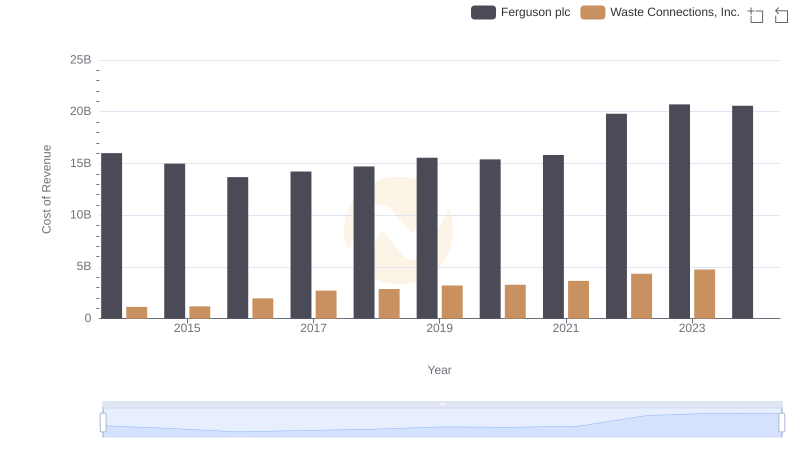

Cost of Revenue Comparison: Waste Connections, Inc. vs Ferguson plc

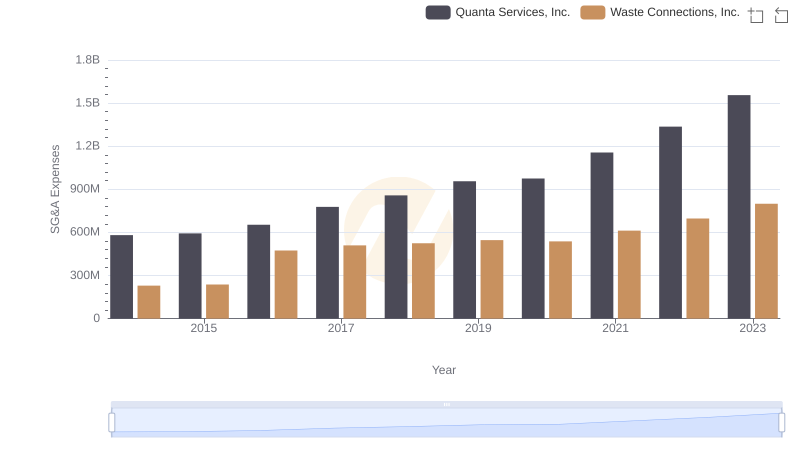

Waste Connections, Inc. vs Quanta Services, Inc.: SG&A Expense Trends

Selling, General, and Administrative Costs: Waste Connections, Inc. vs AMETEK, Inc.

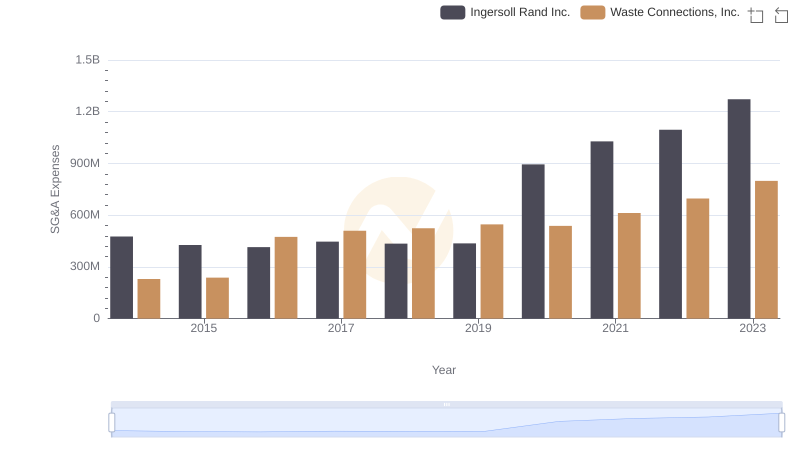

Who Optimizes SG&A Costs Better? Waste Connections, Inc. or Ingersoll Rand Inc.

EBITDA Metrics Evaluated: Waste Connections, Inc. vs Ferguson plc

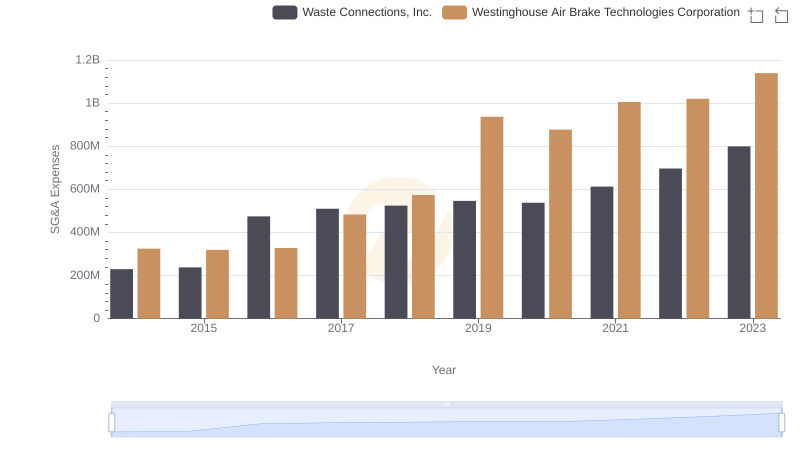

Cost Management Insights: SG&A Expenses for Waste Connections, Inc. and Westinghouse Air Brake Technologies Corporation