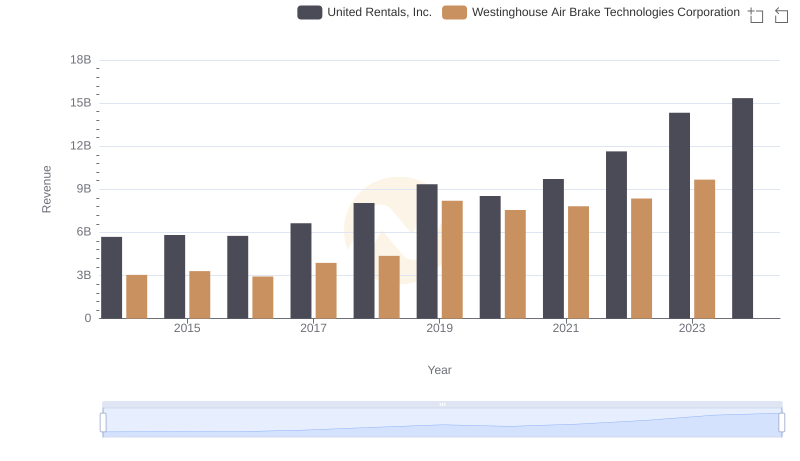

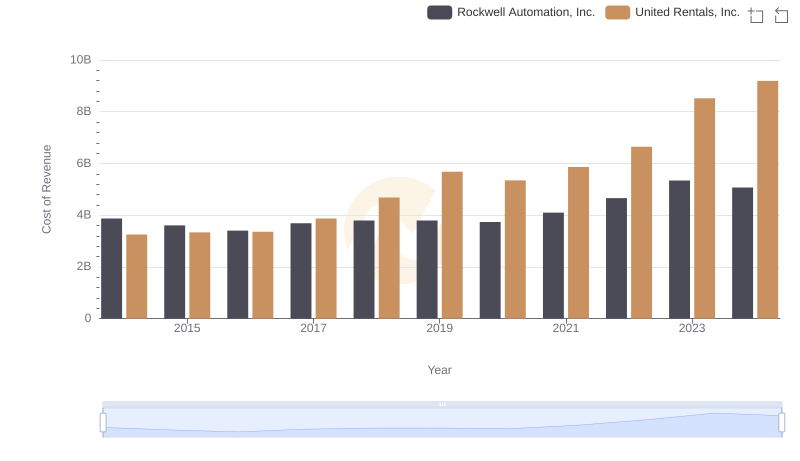

| __timestamp | United Rentals, Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 3253000000 | 2130920000 |

| Thursday, January 1, 2015 | 3337000000 | 2281845000 |

| Friday, January 1, 2016 | 3359000000 | 2029647000 |

| Sunday, January 1, 2017 | 3872000000 | 2841159000 |

| Monday, January 1, 2018 | 4683000000 | 3151816000 |

| Tuesday, January 1, 2019 | 5681000000 | 6122400000 |

| Wednesday, January 1, 2020 | 5347000000 | 5657400000 |

| Friday, January 1, 2021 | 5863000000 | 5687000000 |

| Saturday, January 1, 2022 | 6646000000 | 6070000000 |

| Sunday, January 1, 2023 | 8519000000 | 6733000000 |

| Monday, January 1, 2024 | 9195000000 | 7021000000 |

Infusing magic into the data realm

In the competitive landscape of industrial giants, cost efficiency is a critical metric. United Rentals, Inc. and Westinghouse Air Brake Technologies Corporation have been pivotal players in this arena. From 2014 to 2023, United Rentals demonstrated a robust growth trajectory, with its cost of revenue increasing by approximately 183%, peaking at $9.2 billion in 2023. This reflects a strategic expansion and operational scaling.

Conversely, Westinghouse Air Brake Technologies showed a more moderate increase of around 216% from 2014 to 2022, reaching a high of $6.7 billion. However, data for 2024 is notably absent, suggesting potential shifts or reporting delays.

This analysis underscores the dynamic nature of cost management strategies in the industrial sector, highlighting United Rentals' aggressive growth and Westinghouse's steady climb. As these companies navigate economic challenges, their cost efficiency will remain a focal point for investors and analysts alike.

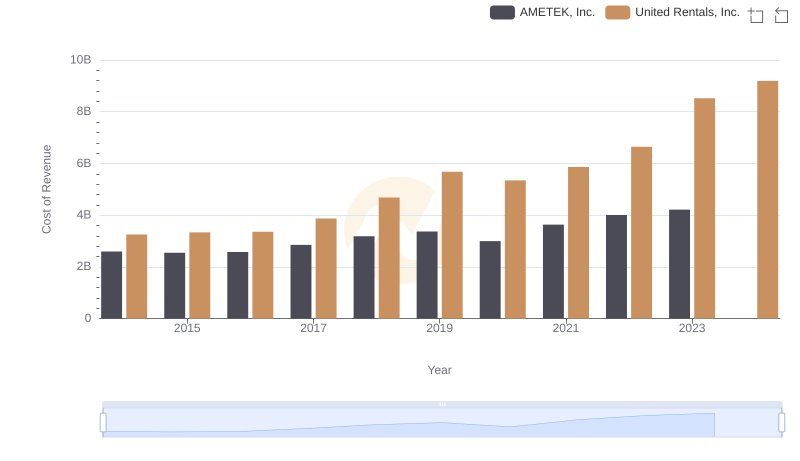

Comparing Cost of Revenue Efficiency: United Rentals, Inc. vs AMETEK, Inc.

United Rentals, Inc. and Westinghouse Air Brake Technologies Corporation: A Comprehensive Revenue Analysis

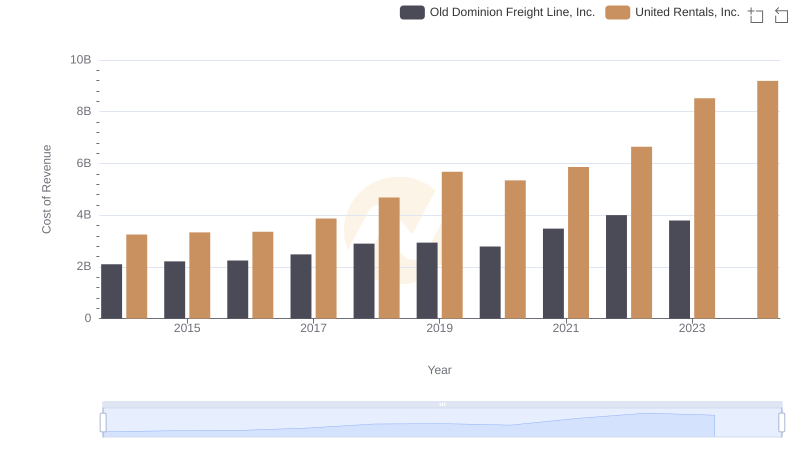

United Rentals, Inc. vs Old Dominion Freight Line, Inc.: Efficiency in Cost of Revenue Explored

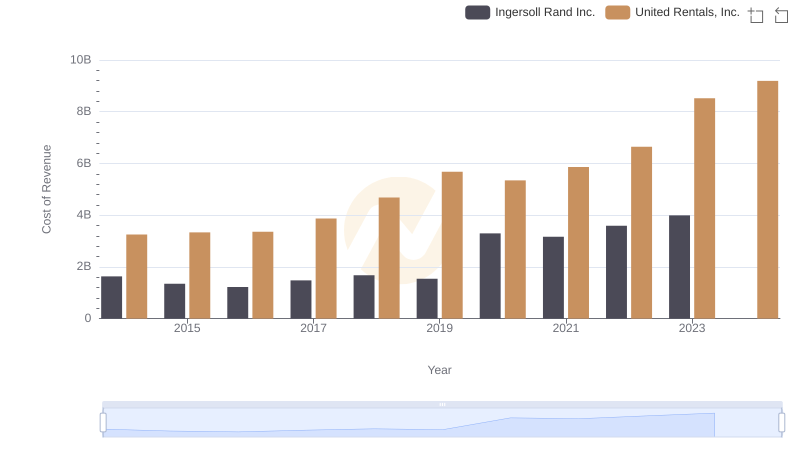

Cost of Revenue Trends: United Rentals, Inc. vs Ingersoll Rand Inc.

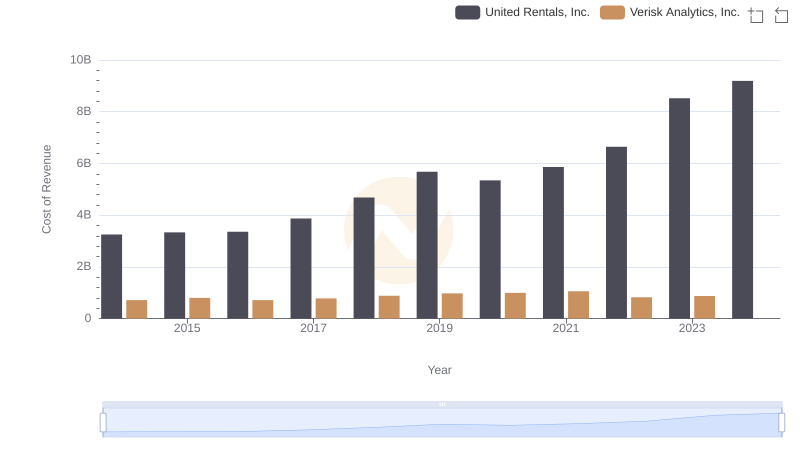

Cost of Revenue Comparison: United Rentals, Inc. vs Verisk Analytics, Inc.

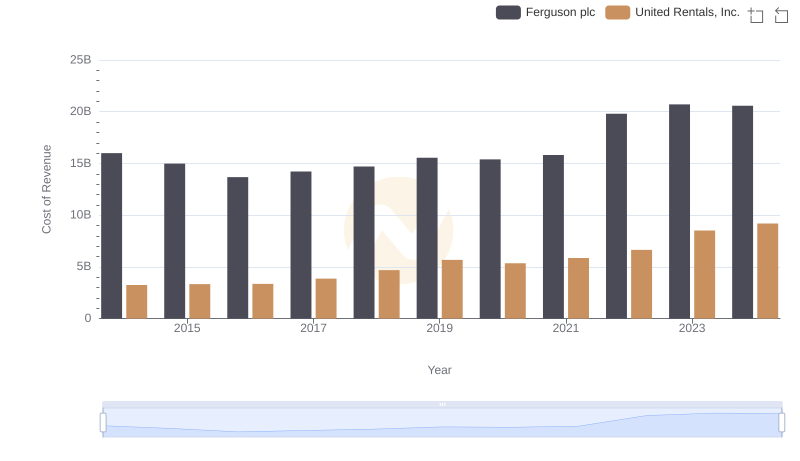

Cost of Revenue Comparison: United Rentals, Inc. vs Ferguson plc

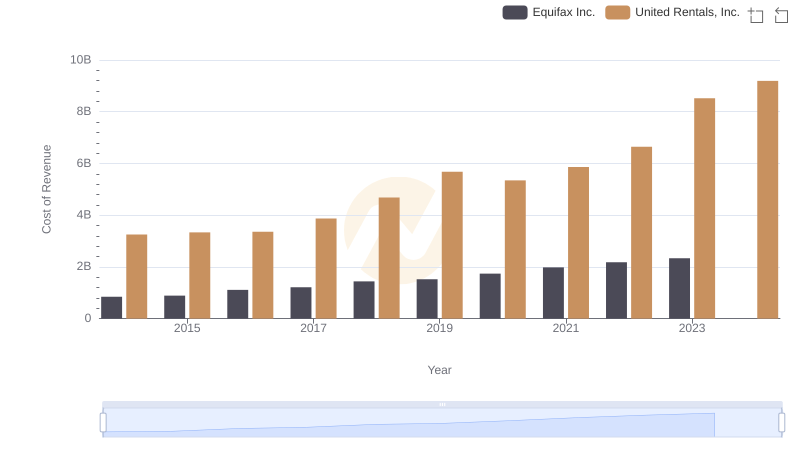

United Rentals, Inc. vs Equifax Inc.: Efficiency in Cost of Revenue Explored

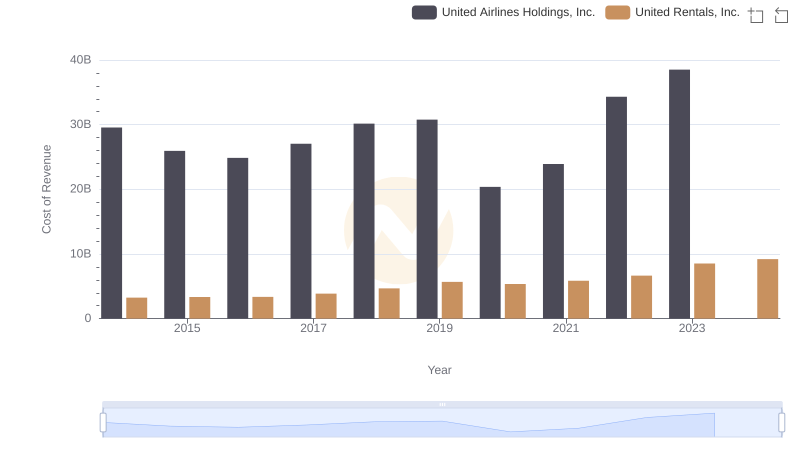

Cost Insights: Breaking Down United Rentals, Inc. and United Airlines Holdings, Inc.'s Expenses

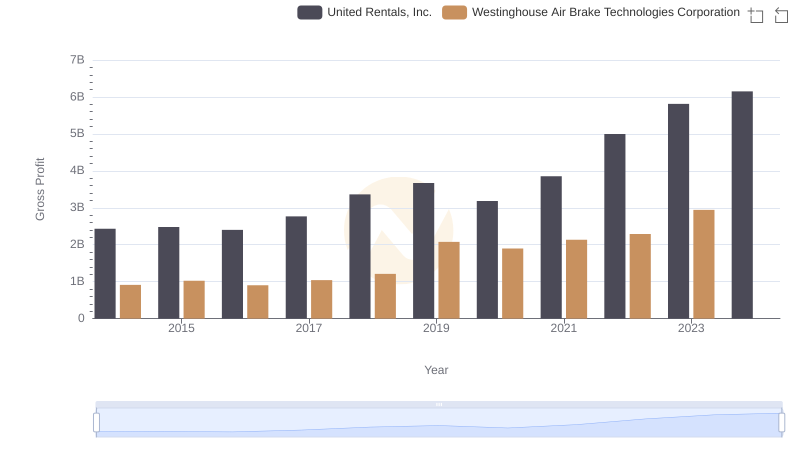

United Rentals, Inc. and Westinghouse Air Brake Technologies Corporation: A Detailed Gross Profit Analysis

Cost of Revenue Comparison: United Rentals, Inc. vs Rockwell Automation, Inc.

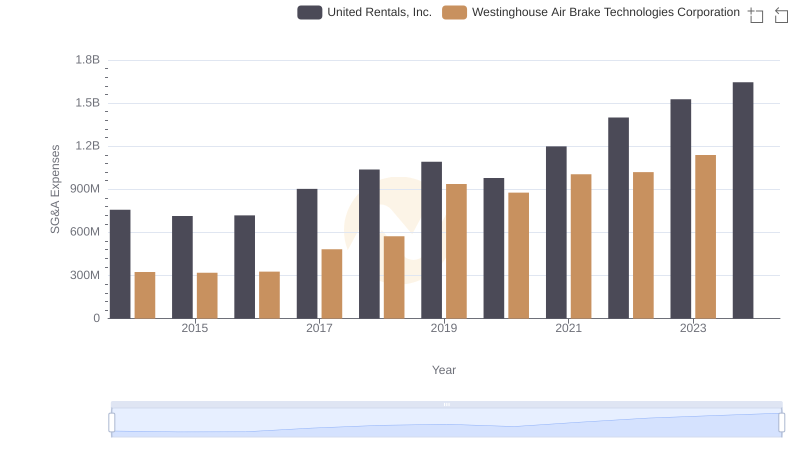

Cost Management Insights: SG&A Expenses for United Rentals, Inc. and Westinghouse Air Brake Technologies Corporation

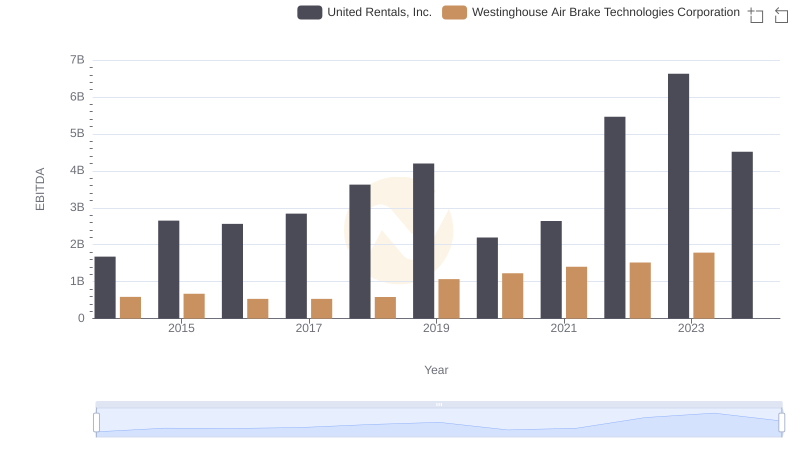

EBITDA Analysis: Evaluating United Rentals, Inc. Against Westinghouse Air Brake Technologies Corporation