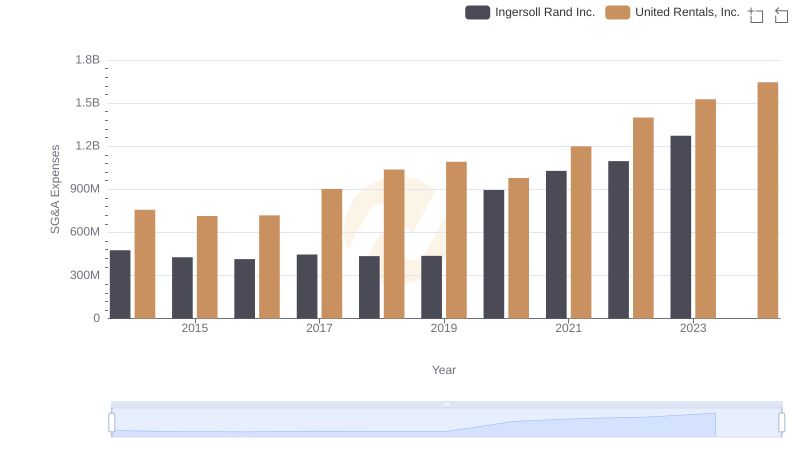

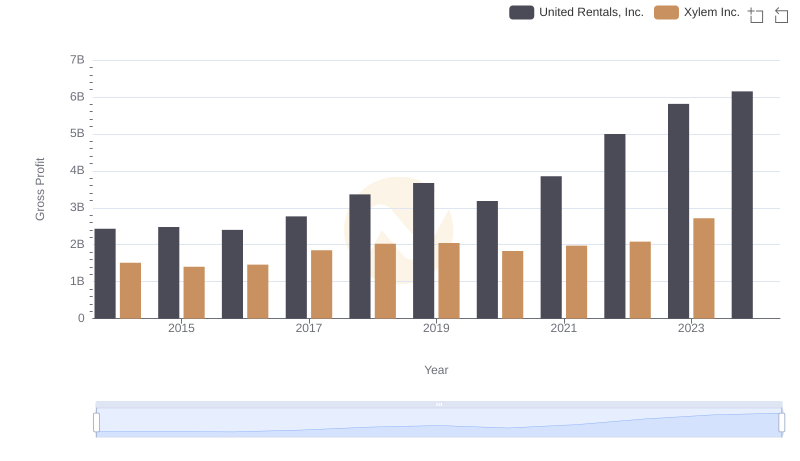

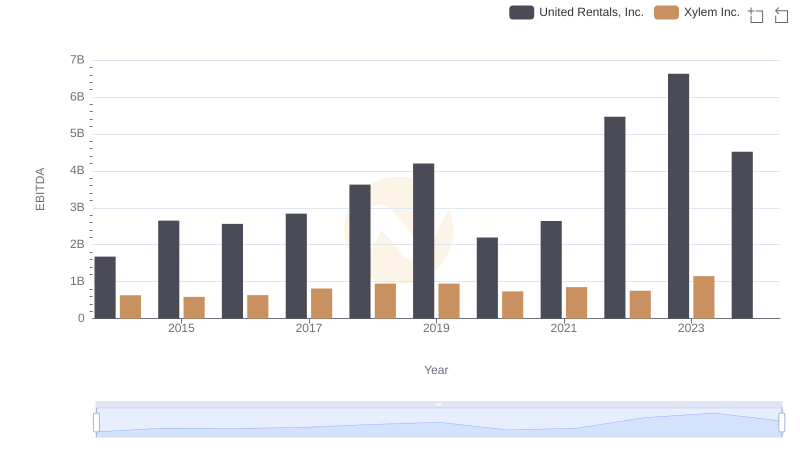

| __timestamp | United Rentals, Inc. | Xylem Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 758000000 | 920000000 |

| Thursday, January 1, 2015 | 714000000 | 854000000 |

| Friday, January 1, 2016 | 719000000 | 915000000 |

| Sunday, January 1, 2017 | 903000000 | 1090000000 |

| Monday, January 1, 2018 | 1038000000 | 1161000000 |

| Tuesday, January 1, 2019 | 1092000000 | 1158000000 |

| Wednesday, January 1, 2020 | 979000000 | 1143000000 |

| Friday, January 1, 2021 | 1199000000 | 1179000000 |

| Saturday, January 1, 2022 | 1400000000 | 1227000000 |

| Sunday, January 1, 2023 | 1527000000 | 1757000000 |

| Monday, January 1, 2024 | 1645000000 |

Data in motion

In the ever-evolving landscape of corporate finance, understanding the nuances of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, United Rentals, Inc. and Xylem Inc. have showcased distinct spending patterns. From 2014 to 2023, United Rentals saw a steady increase in SG&A expenses, peaking at approximately 1.53 billion in 2023, marking a 113% rise from 2014. Meanwhile, Xylem Inc. experienced a more volatile trajectory, with a notable surge in 2023, reaching 1.76 billion, a 91% increase from 2014. This divergence highlights differing strategic priorities and market responses. Notably, data for 2024 is incomplete, reflecting potential shifts in reporting or strategy. As businesses navigate economic challenges, these insights into SG&A trends offer a window into corporate resilience and adaptability, essential for investors and analysts alike.

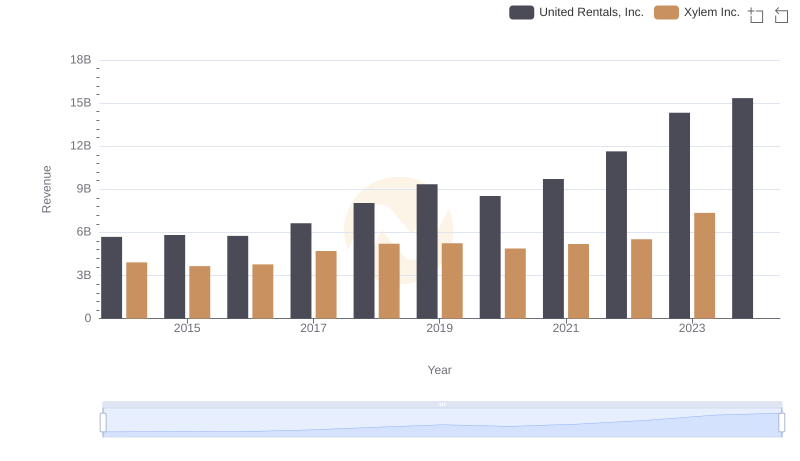

United Rentals, Inc. vs Xylem Inc.: Examining Key Revenue Metrics

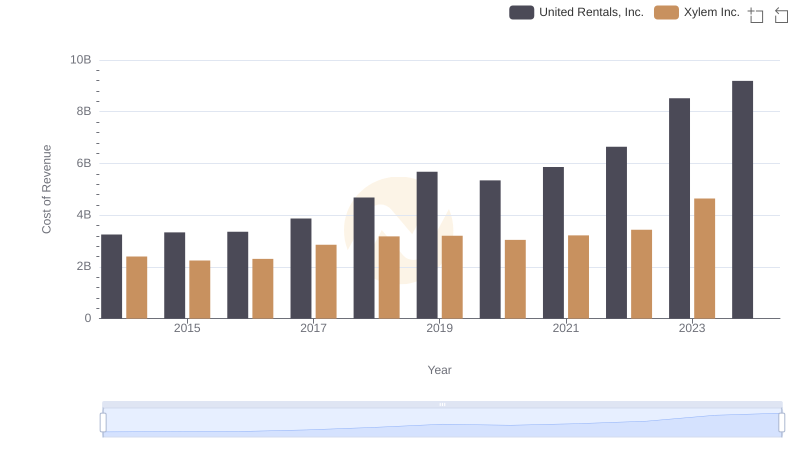

Cost of Revenue Comparison: United Rentals, Inc. vs Xylem Inc.

United Rentals, Inc. and Ingersoll Rand Inc.: SG&A Spending Patterns Compared

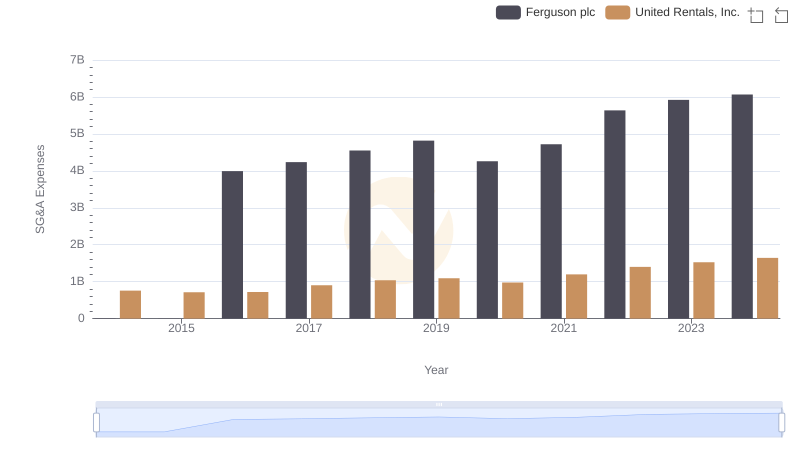

Comparing SG&A Expenses: United Rentals, Inc. vs Ferguson plc Trends and Insights

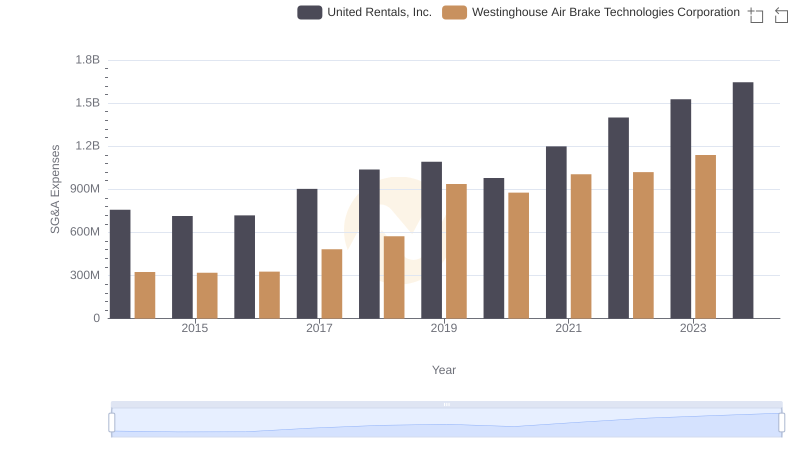

Cost Management Insights: SG&A Expenses for United Rentals, Inc. and Westinghouse Air Brake Technologies Corporation

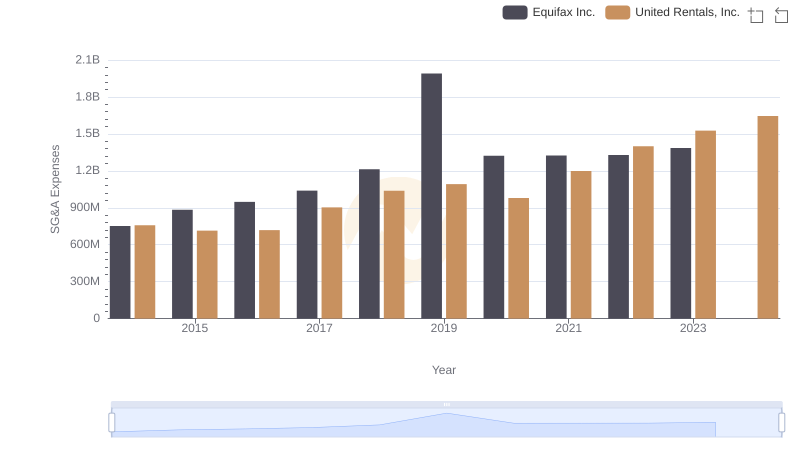

United Rentals, Inc. vs Equifax Inc.: SG&A Expense Trends

Gross Profit Comparison: United Rentals, Inc. and Xylem Inc. Trends

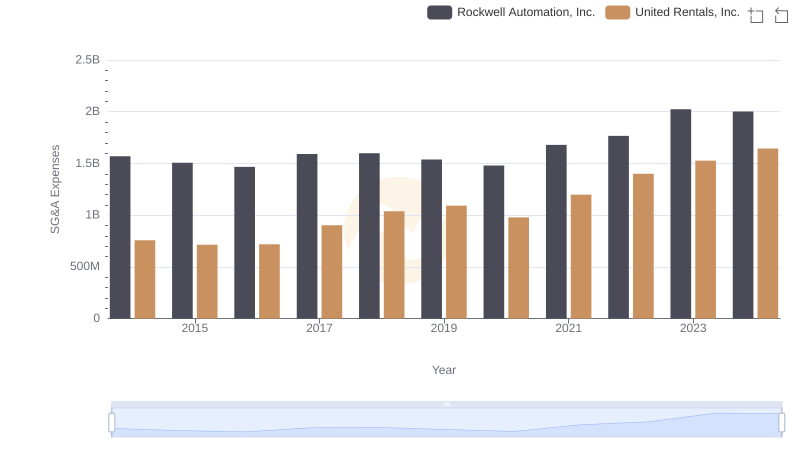

United Rentals, Inc. vs Rockwell Automation, Inc.: SG&A Expense Trends

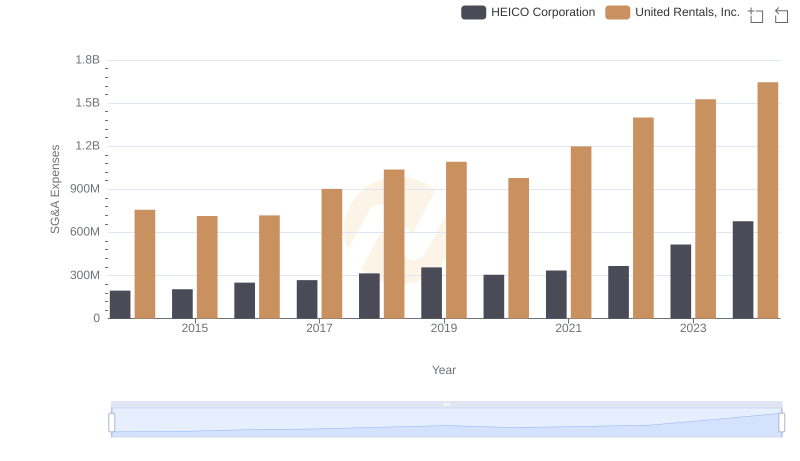

United Rentals, Inc. vs HEICO Corporation: SG&A Expense Trends

A Side-by-Side Analysis of EBITDA: United Rentals, Inc. and Xylem Inc.

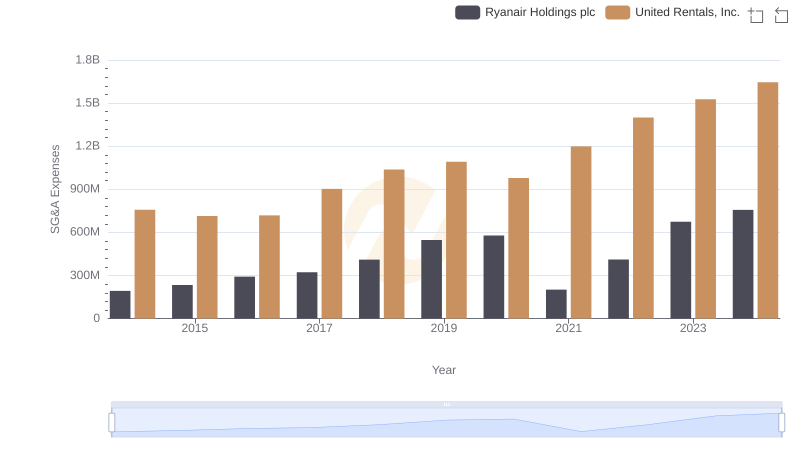

Breaking Down SG&A Expenses: United Rentals, Inc. vs Ryanair Holdings plc

United Rentals, Inc. and Global Payments Inc.: SG&A Spending Patterns Compared