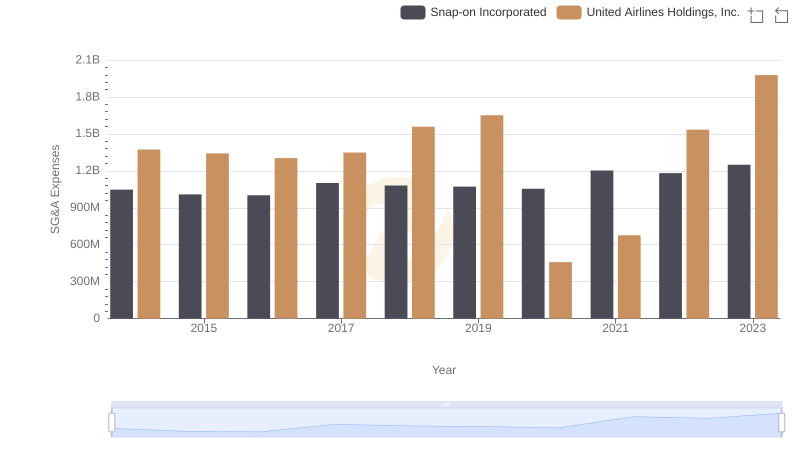

| __timestamp | Snap-on Incorporated | United Airlines Holdings, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1693400000 | 29569000000 |

| Thursday, January 1, 2015 | 1704500000 | 25952000000 |

| Friday, January 1, 2016 | 1720800000 | 24856000000 |

| Sunday, January 1, 2017 | 1862000000 | 27056000000 |

| Monday, January 1, 2018 | 1870700000 | 30165000000 |

| Tuesday, January 1, 2019 | 1886000000 | 30786000000 |

| Wednesday, January 1, 2020 | 1844000000 | 20385000000 |

| Friday, January 1, 2021 | 2141200000 | 23913000000 |

| Saturday, January 1, 2022 | 2311700000 | 34315000000 |

| Sunday, January 1, 2023 | 2488500000 | 38518000000 |

| Monday, January 1, 2024 | 2329500000 | 37643000000 |

In pursuit of knowledge

In the ever-evolving landscape of corporate efficiency, the cost of revenue is a critical metric. From 2014 to 2023, United Airlines Holdings, Inc. and Snap-on Incorporated have demonstrated contrasting approaches to managing this key financial indicator. United Airlines, a titan in the aviation industry, has seen its cost of revenue fluctuate, peaking at approximately $38.5 billion in 2023, a 30% increase from its 2014 figures. Meanwhile, Snap-on, a leader in the manufacturing of tools and equipment, has maintained a more stable trajectory, with a 47% increase over the same period, reaching around $2.5 billion in 2023. This comparison highlights the diverse challenges and strategies in different sectors, offering valuable insights into how companies navigate economic pressures and operational demands.

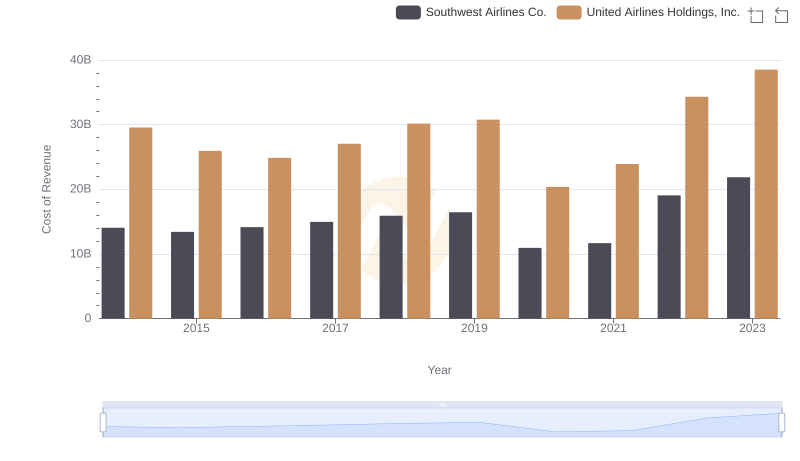

Cost of Revenue Trends: United Airlines Holdings, Inc. vs Southwest Airlines Co.

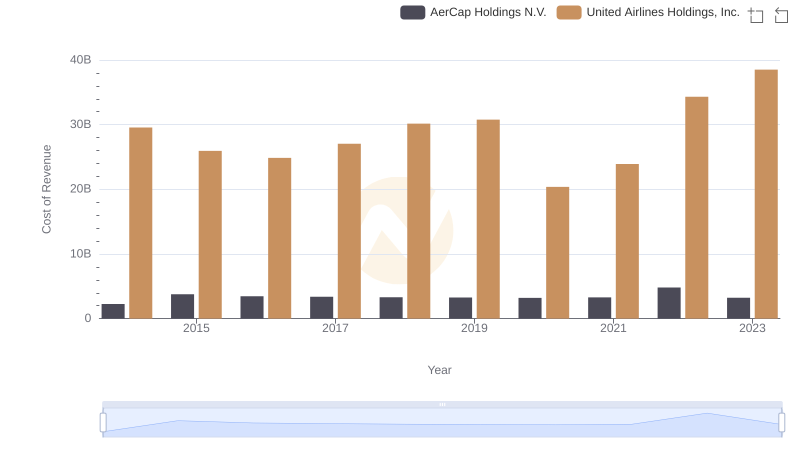

Analyzing Cost of Revenue: United Airlines Holdings, Inc. and AerCap Holdings N.V.

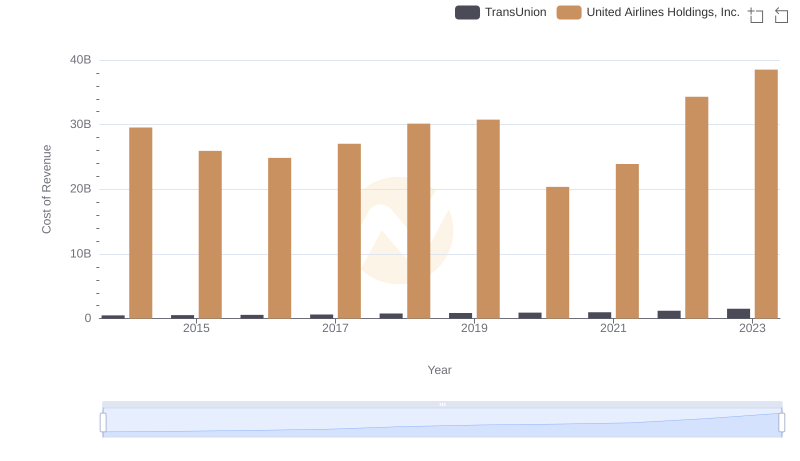

United Airlines Holdings, Inc. vs TransUnion: Efficiency in Cost of Revenue Explored

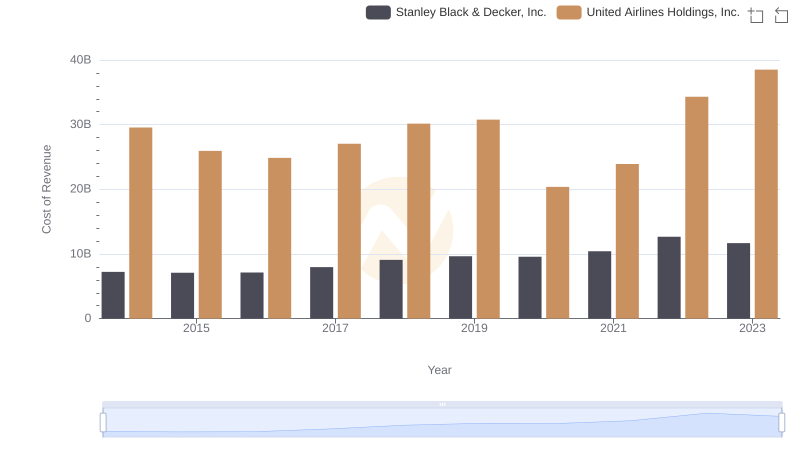

Comparing Cost of Revenue Efficiency: United Airlines Holdings, Inc. vs Stanley Black & Decker, Inc.

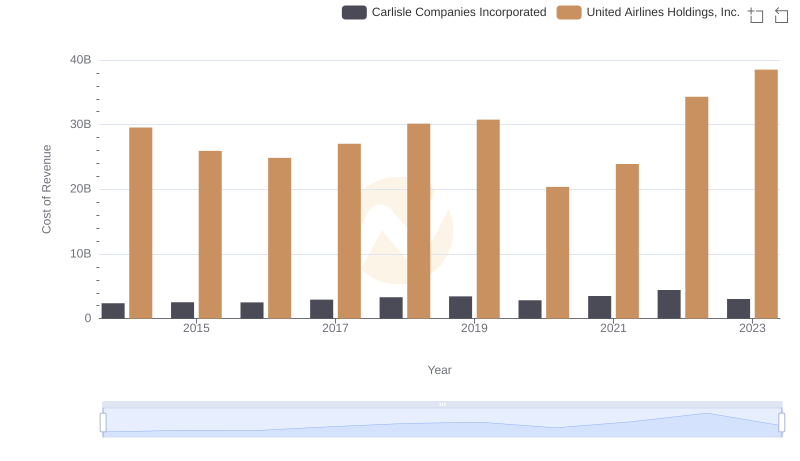

Analyzing Cost of Revenue: United Airlines Holdings, Inc. and Carlisle Companies Incorporated

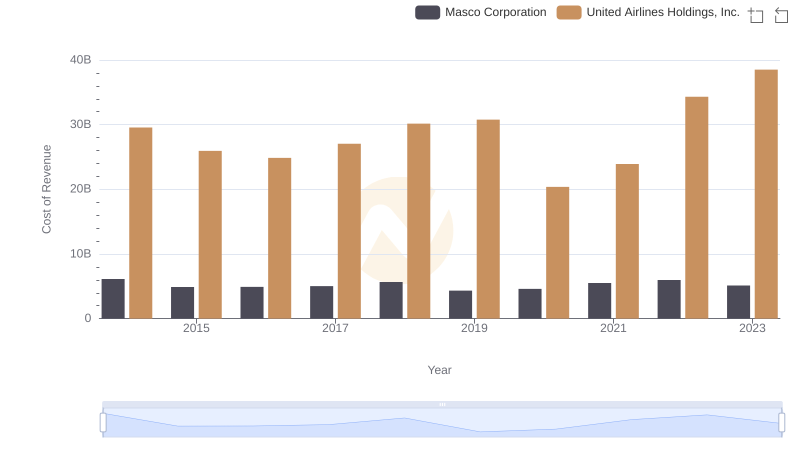

Cost of Revenue Trends: United Airlines Holdings, Inc. vs Masco Corporation

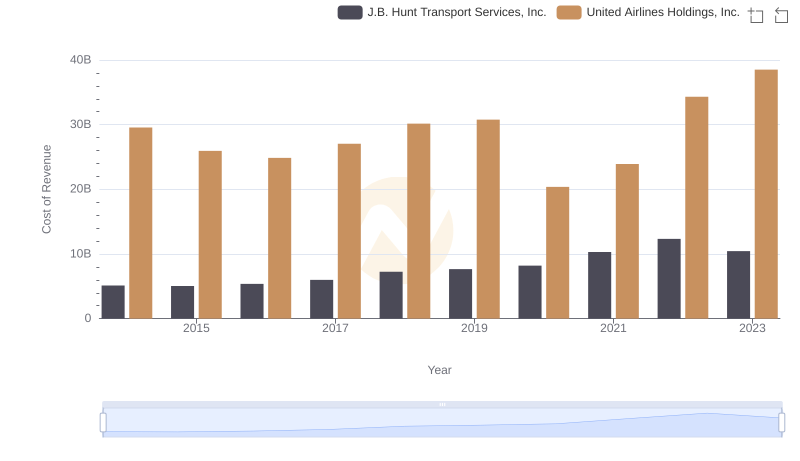

Cost of Revenue Trends: United Airlines Holdings, Inc. vs J.B. Hunt Transport Services, Inc.

Breaking Down SG&A Expenses: United Airlines Holdings, Inc. vs Snap-on Incorporated