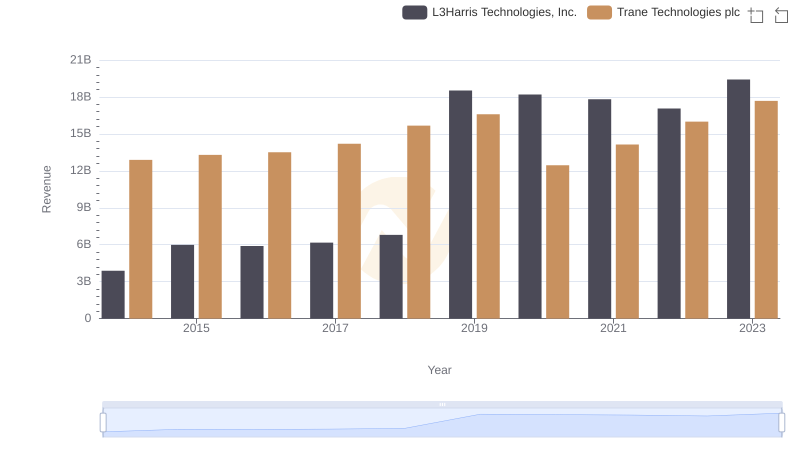

| __timestamp | L3Harris Technologies, Inc. | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 2370000000 | 8982800000 |

| Thursday, January 1, 2015 | 3832000000 | 9301600000 |

| Friday, January 1, 2016 | 3854000000 | 9329300000 |

| Sunday, January 1, 2017 | 4066000000 | 9811600000 |

| Monday, January 1, 2018 | 4467000000 | 10847600000 |

| Tuesday, January 1, 2019 | 13452000000 | 11451500000 |

| Wednesday, January 1, 2020 | 12886000000 | 8651300000 |

| Friday, January 1, 2021 | 12438000000 | 9666800000 |

| Saturday, January 1, 2022 | 12135000000 | 11026900000 |

| Sunday, January 1, 2023 | 14306000000 | 11820400000 |

| Monday, January 1, 2024 | 15801000000 | 12757700000 |

Unveiling the hidden dimensions of data

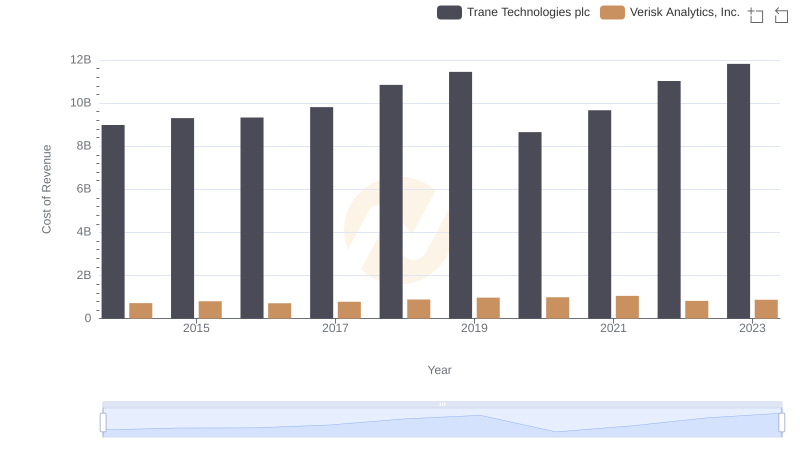

In the ever-evolving landscape of industrial giants, understanding cost efficiency is paramount. Trane Technologies plc and L3Harris Technologies, Inc. have been pivotal players in their respective sectors. From 2014 to 2023, these companies have showcased distinct trajectories in managing their cost of revenue.

Trane Technologies has consistently maintained a robust cost structure, with its cost of revenue peaking at approximately $11.8 billion in 2023, marking a 32% increase from 2014. This steady growth reflects their strategic investments and operational efficiencies. In contrast, L3Harris Technologies experienced a more volatile journey, with a significant surge in 2019, reaching a cost of revenue of $13.5 billion, a staggering 470% increase from 2014. This spike aligns with their aggressive expansion and acquisition strategies.

As we delve into these figures, it becomes evident that while both companies have navigated challenges, their approaches to cost management reveal unique insights into their operational philosophies.

Trane Technologies plc vs L3Harris Technologies, Inc.: Examining Key Revenue Metrics

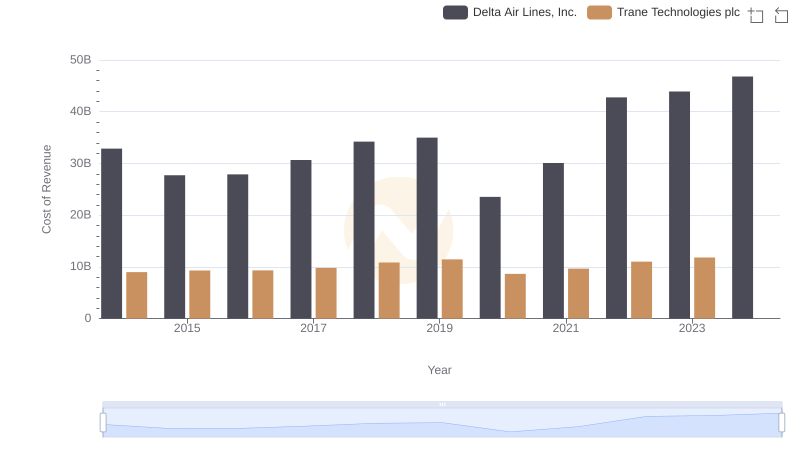

Analyzing Cost of Revenue: Trane Technologies plc and Delta Air Lines, Inc.

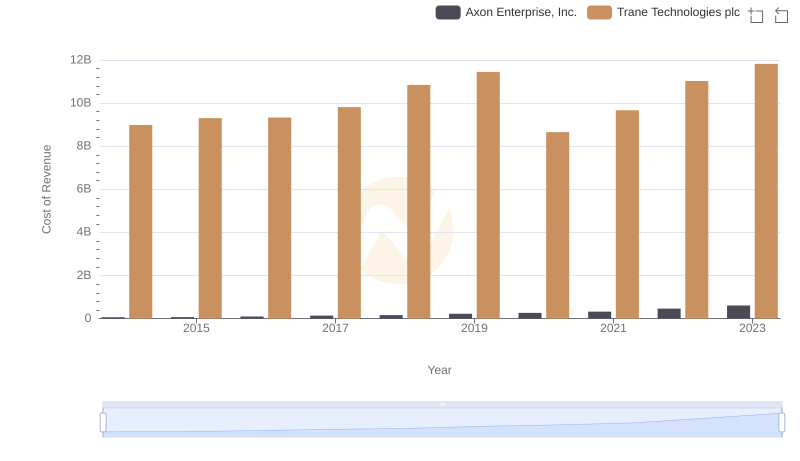

Cost of Revenue: Key Insights for Trane Technologies plc and Axon Enterprise, Inc.

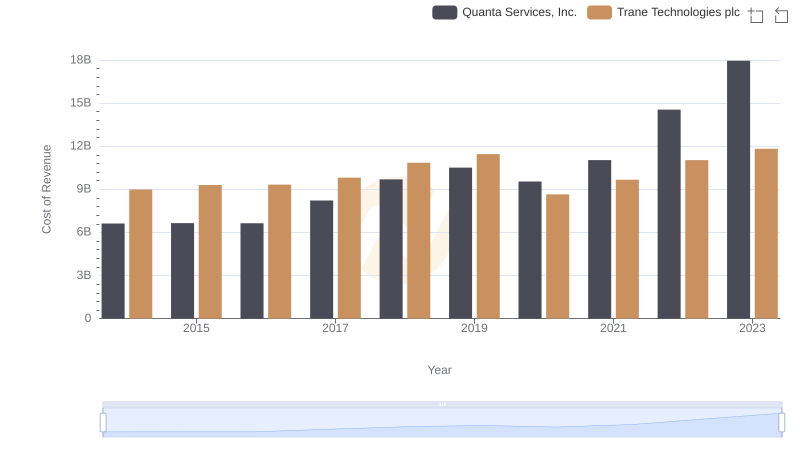

Comparing Cost of Revenue Efficiency: Trane Technologies plc vs Quanta Services, Inc.

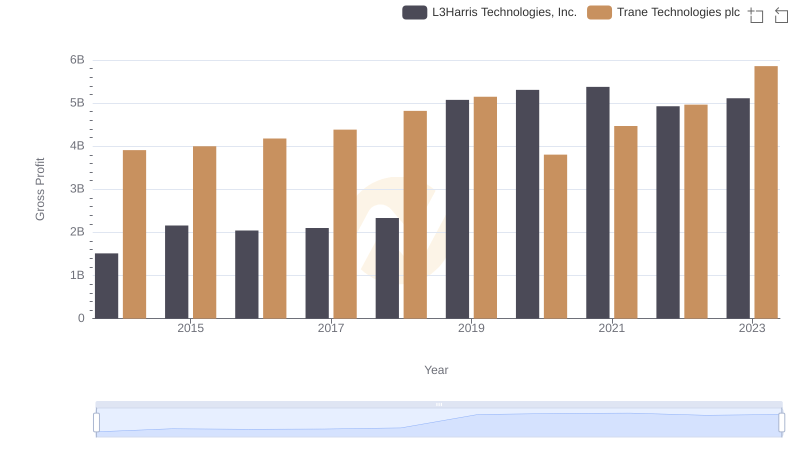

Gross Profit Comparison: Trane Technologies plc and L3Harris Technologies, Inc. Trends

Cost of Revenue Trends: Trane Technologies plc vs Verisk Analytics, Inc.

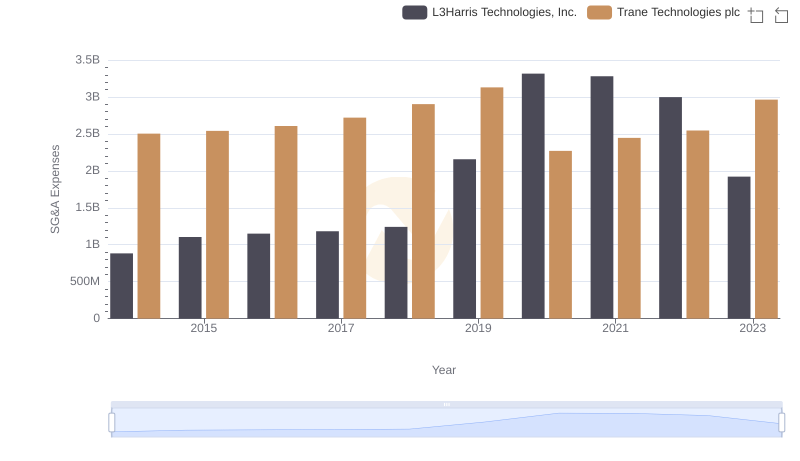

SG&A Efficiency Analysis: Comparing Trane Technologies plc and L3Harris Technologies, Inc.

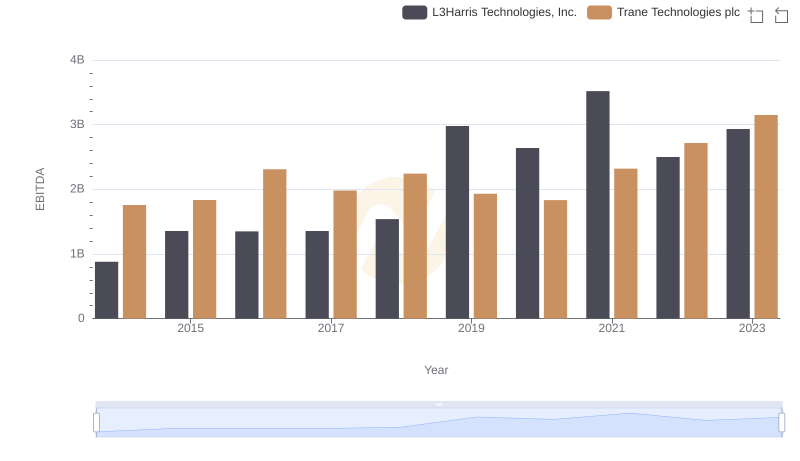

Comparative EBITDA Analysis: Trane Technologies plc vs L3Harris Technologies, Inc.