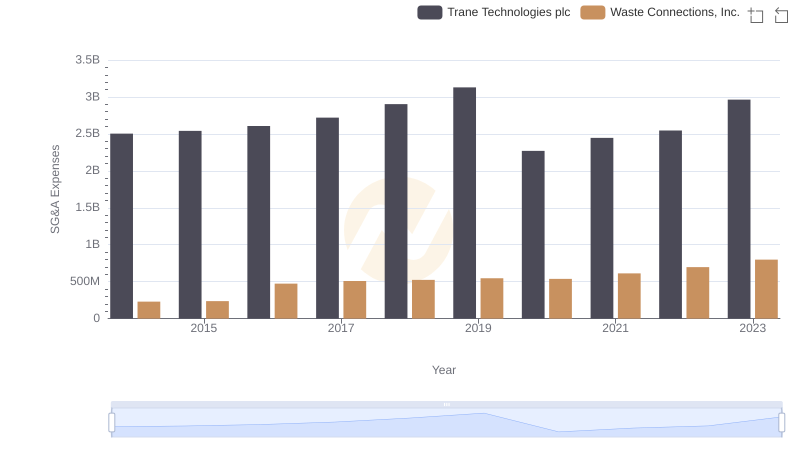

| __timestamp | L3Harris Technologies, Inc. | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 883000000 | 2503900000 |

| Thursday, January 1, 2015 | 1105000000 | 2541100000 |

| Friday, January 1, 2016 | 1150000000 | 2606500000 |

| Sunday, January 1, 2017 | 1182000000 | 2720700000 |

| Monday, January 1, 2018 | 1242000000 | 2903200000 |

| Tuesday, January 1, 2019 | 2156000000 | 3129800000 |

| Wednesday, January 1, 2020 | 3315000000 | 2270600000 |

| Friday, January 1, 2021 | 3280000000 | 2446300000 |

| Saturday, January 1, 2022 | 2998000000 | 2545900000 |

| Sunday, January 1, 2023 | 1921000000 | 2963200000 |

| Monday, January 1, 2024 | 3568000000 | 3580400000 |

Unleashing the power of data

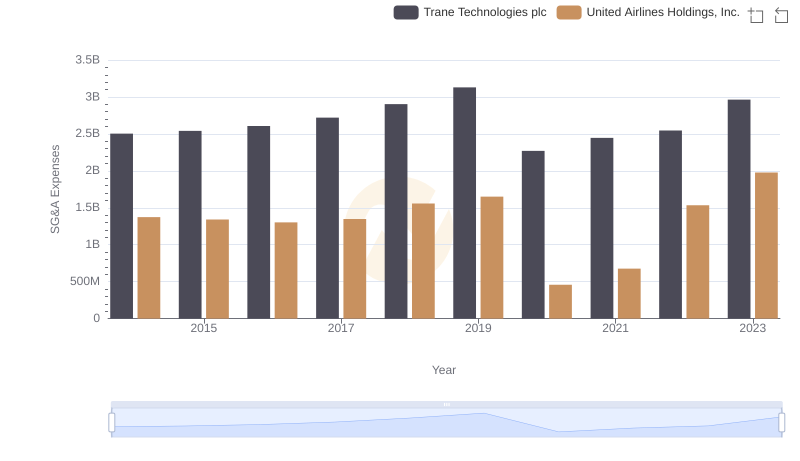

In the competitive landscape of industrial and defense sectors, understanding SG&A (Selling, General, and Administrative) efficiency is crucial. Trane Technologies plc and L3Harris Technologies, Inc. have shown distinct trends over the past decade. From 2014 to 2023, Trane Technologies consistently maintained higher SG&A expenses, peaking at approximately $3.13 billion in 2019. In contrast, L3Harris saw a significant rise in 2020, reaching around $3.32 billion, before stabilizing.

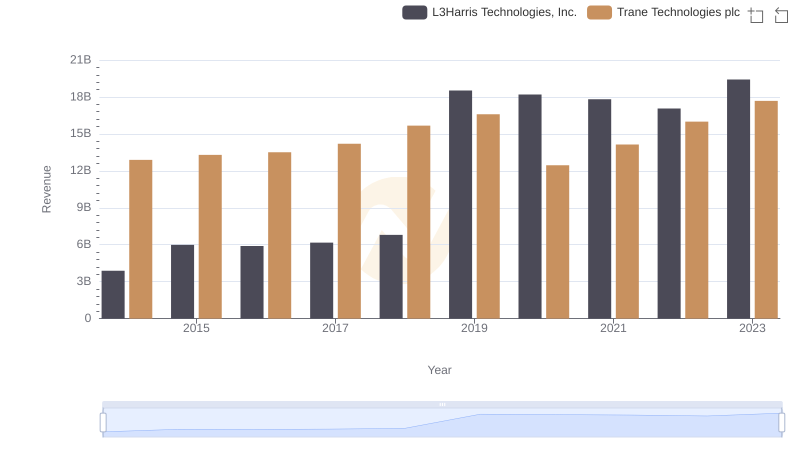

Trane Technologies plc vs L3Harris Technologies, Inc.: Examining Key Revenue Metrics

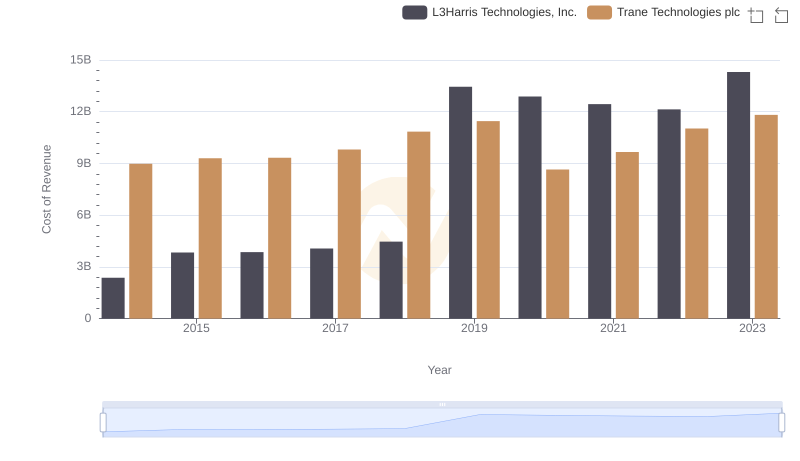

Trane Technologies plc vs L3Harris Technologies, Inc.: Efficiency in Cost of Revenue Explored

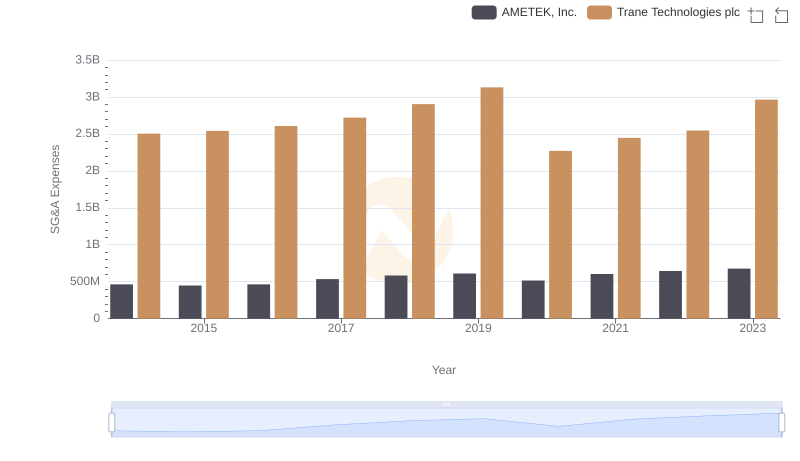

Trane Technologies plc vs AMETEK, Inc.: SG&A Expense Trends

Cost Management Insights: SG&A Expenses for Trane Technologies plc and Waste Connections, Inc.

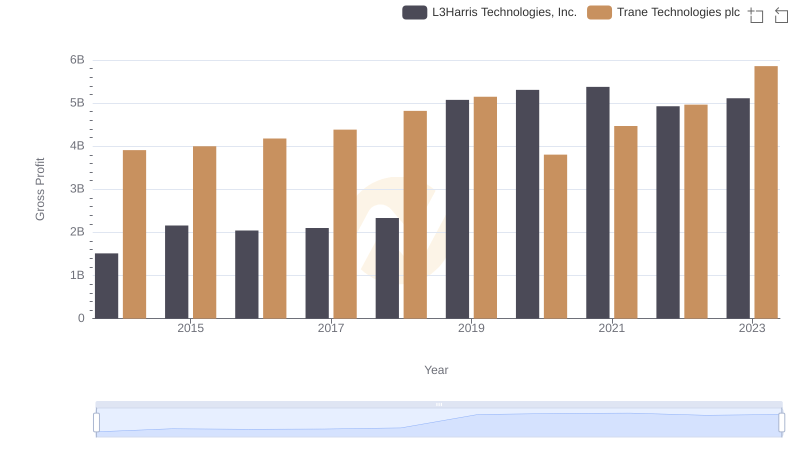

Gross Profit Comparison: Trane Technologies plc and L3Harris Technologies, Inc. Trends

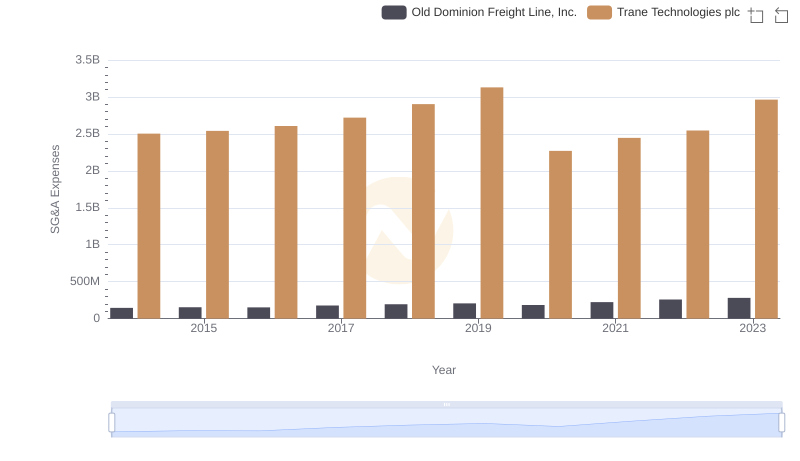

Trane Technologies plc or Old Dominion Freight Line, Inc.: Who Manages SG&A Costs Better?

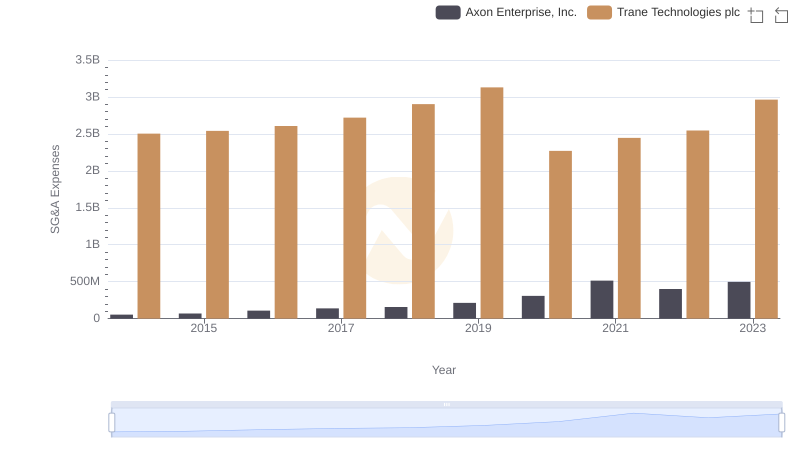

Operational Costs Compared: SG&A Analysis of Trane Technologies plc and Axon Enterprise, Inc.

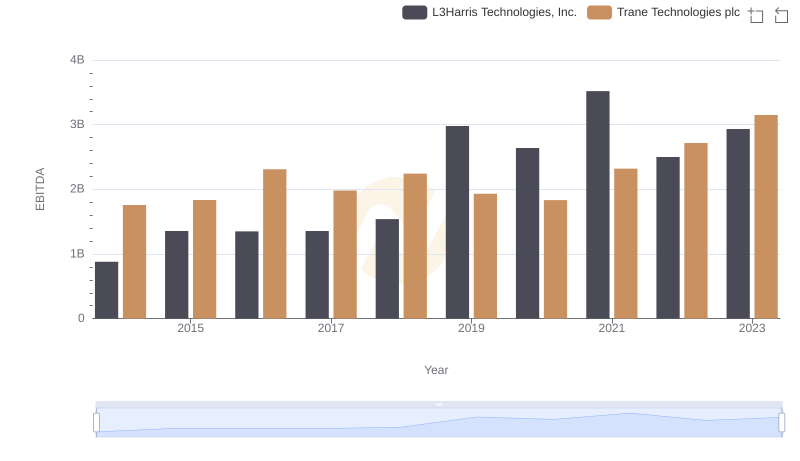

Comparative EBITDA Analysis: Trane Technologies plc vs L3Harris Technologies, Inc.

Trane Technologies plc vs United Airlines Holdings, Inc.: SG&A Expense Trends