| __timestamp | Ferguson plc | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 5065428 | 2503900000 |

| Thursday, January 1, 2015 | 3127932 | 2541100000 |

| Friday, January 1, 2016 | 3992798135 | 2606500000 |

| Sunday, January 1, 2017 | 4237396470 | 2720700000 |

| Monday, January 1, 2018 | 4552000000 | 2903200000 |

| Tuesday, January 1, 2019 | 4819000000 | 3129800000 |

| Wednesday, January 1, 2020 | 4260000000 | 2270600000 |

| Friday, January 1, 2021 | 4721000000 | 2446300000 |

| Saturday, January 1, 2022 | 5635000000 | 2545900000 |

| Sunday, January 1, 2023 | 5920000000 | 2963200000 |

| Monday, January 1, 2024 | 6066000000 | 3580400000 |

In pursuit of knowledge

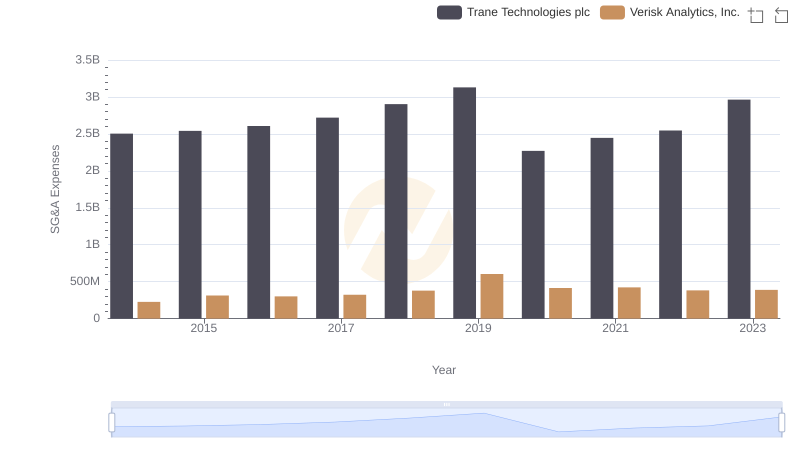

In the ever-evolving landscape of global business, understanding the financial health of industry leaders is crucial. Trane Technologies plc and Ferguson plc, two titans in their respective fields, have shown distinct trends in their Selling, General, and Administrative (SG&A) expenses over the past decade.

From 2014 to 2023, Ferguson plc's SG&A expenses surged by approximately 20%, peaking in 2023. This upward trajectory highlights their aggressive expansion and operational scaling. In contrast, Trane Technologies plc maintained a more stable SG&A expense pattern, with a slight increase of around 18% over the same period, reflecting their strategic focus on efficiency and cost management.

Interestingly, the data for 2024 shows a gap for Trane Technologies, suggesting a potential shift or anomaly in their financial reporting. As these companies continue to navigate the complexities of the global market, their SG&A trends offer valuable insights into their strategic priorities and operational efficiencies.

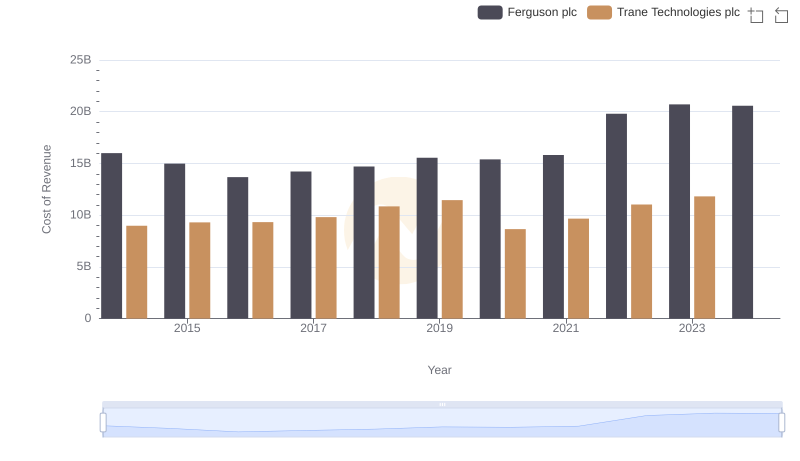

Analyzing Cost of Revenue: Trane Technologies plc and Ferguson plc

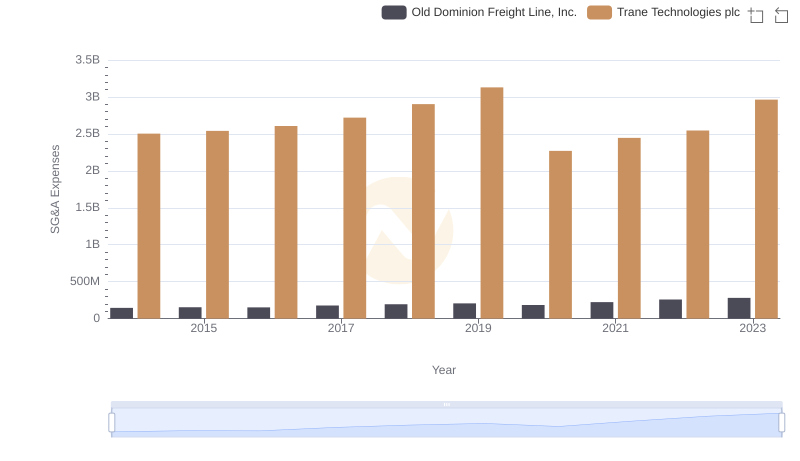

Trane Technologies plc or Old Dominion Freight Line, Inc.: Who Manages SG&A Costs Better?

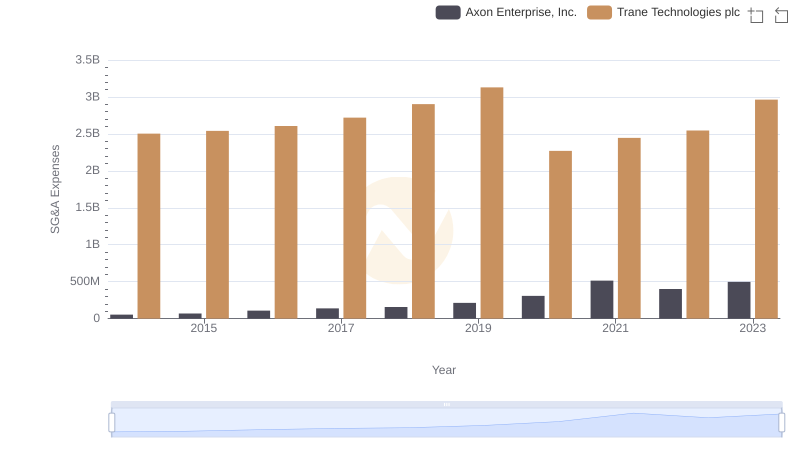

Operational Costs Compared: SG&A Analysis of Trane Technologies plc and Axon Enterprise, Inc.

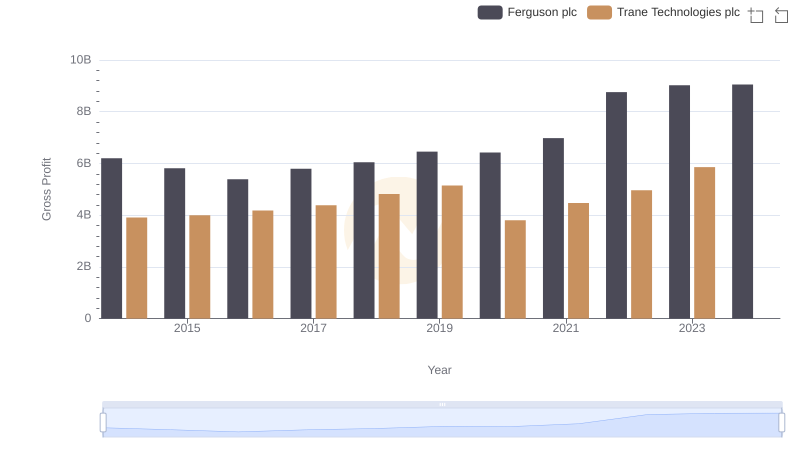

Trane Technologies plc vs Ferguson plc: A Gross Profit Performance Breakdown

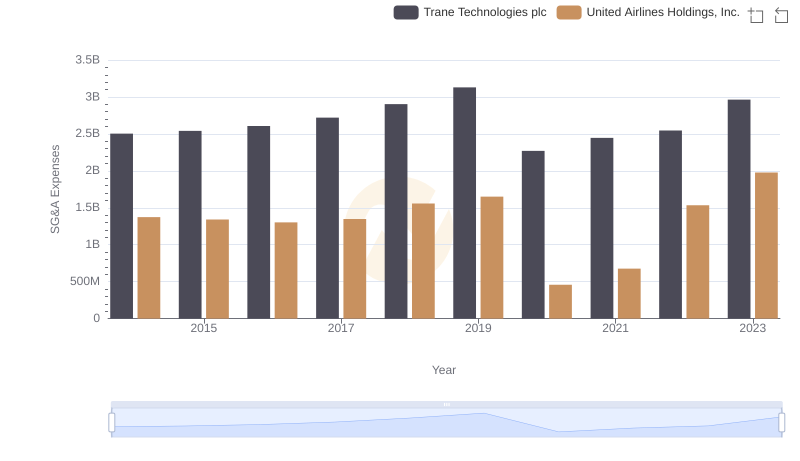

Trane Technologies plc vs United Airlines Holdings, Inc.: SG&A Expense Trends

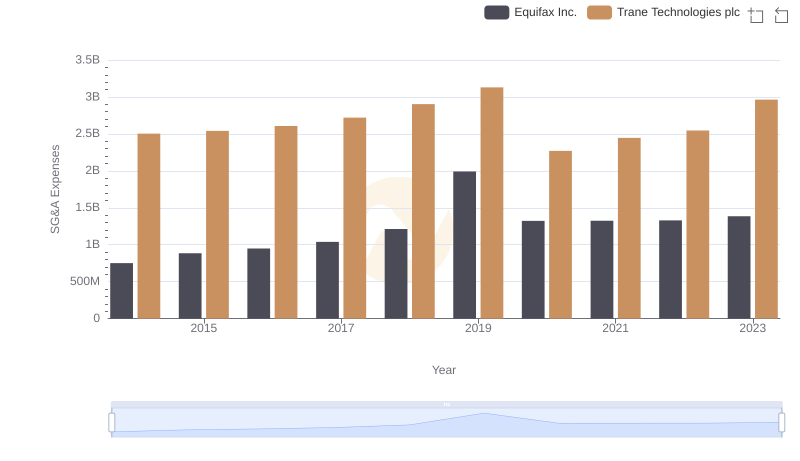

Breaking Down SG&A Expenses: Trane Technologies plc vs Equifax Inc.

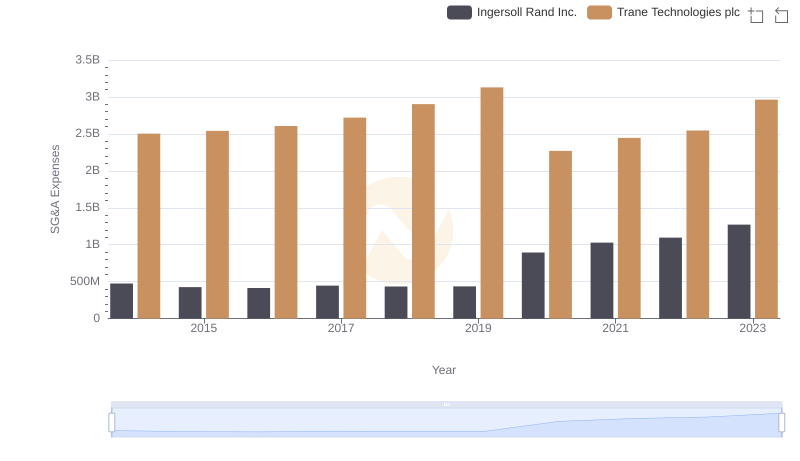

Comparing SG&A Expenses: Trane Technologies plc vs Ingersoll Rand Inc. Trends and Insights

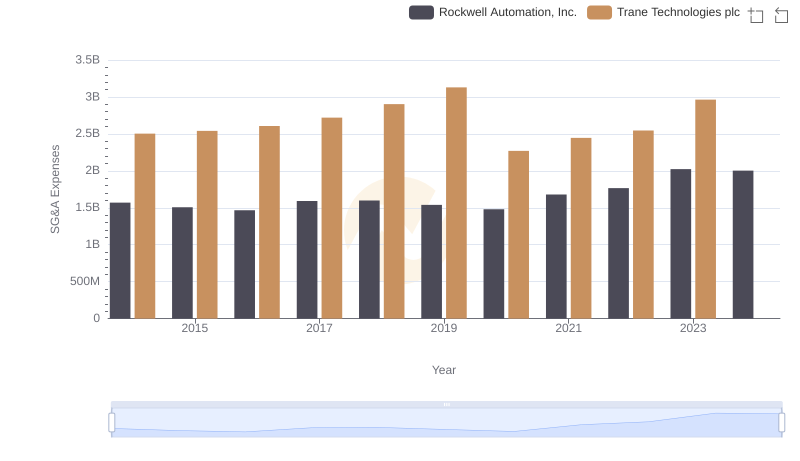

SG&A Efficiency Analysis: Comparing Trane Technologies plc and Rockwell Automation, Inc.

Cost Management Insights: SG&A Expenses for Trane Technologies plc and Verisk Analytics, Inc.