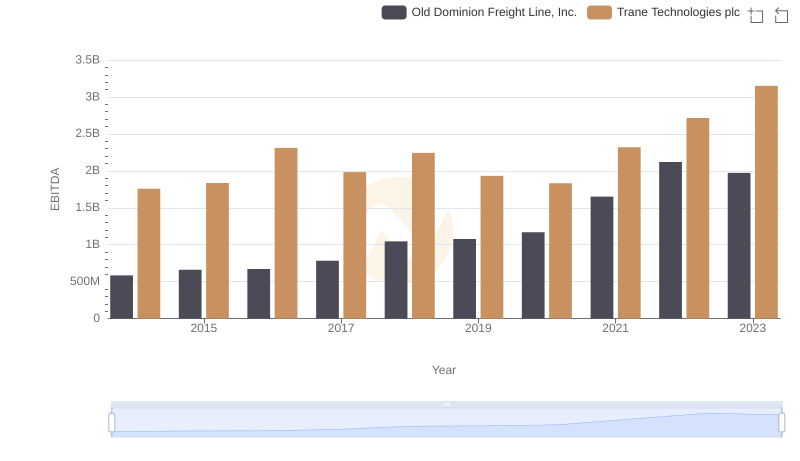

| __timestamp | Old Dominion Freight Line, Inc. | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 144817000 | 2503900000 |

| Thursday, January 1, 2015 | 153589000 | 2541100000 |

| Friday, January 1, 2016 | 152391000 | 2606500000 |

| Sunday, January 1, 2017 | 177205000 | 2720700000 |

| Monday, January 1, 2018 | 194368000 | 2903200000 |

| Tuesday, January 1, 2019 | 206125000 | 3129800000 |

| Wednesday, January 1, 2020 | 184185000 | 2270600000 |

| Friday, January 1, 2021 | 223757000 | 2446300000 |

| Saturday, January 1, 2022 | 258883000 | 2545900000 |

| Sunday, January 1, 2023 | 281053000 | 2963200000 |

| Monday, January 1, 2024 | 3580400000 |

In pursuit of knowledge

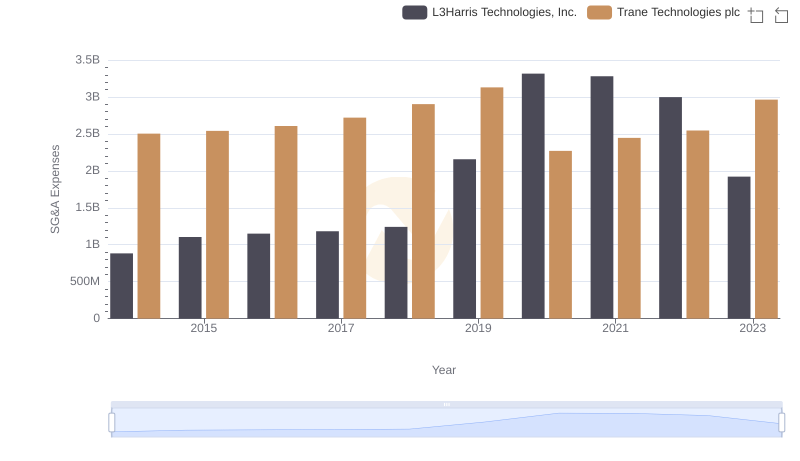

In the competitive landscape of logistics and climate solutions, Old Dominion Freight Line, Inc. and Trane Technologies plc stand out for their strategic management of Selling, General, and Administrative (SG&A) expenses. From 2014 to 2023, Old Dominion Freight Line, Inc. demonstrated a steady increase in SG&A costs, peaking at approximately 281 million in 2023, reflecting a 94% rise over the decade. Meanwhile, Trane Technologies plc, with a more substantial SG&A base, saw its expenses grow by 18% over the same period, reaching nearly 2.96 billion in 2023. This comparison highlights Old Dominion's rapid expansion and Trane's consistent cost management. As businesses navigate economic fluctuations, understanding these trends offers valuable insights into operational efficiency and strategic growth. The data underscores the importance of balancing cost management with growth ambitions in today's dynamic market.

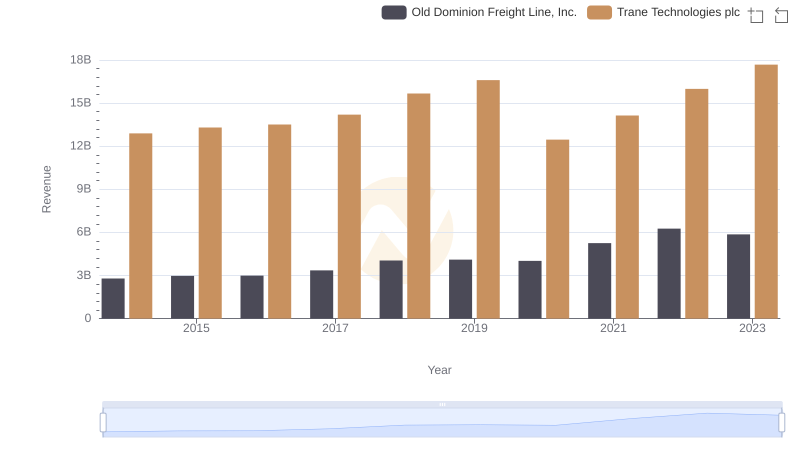

Annual Revenue Comparison: Trane Technologies plc vs Old Dominion Freight Line, Inc.

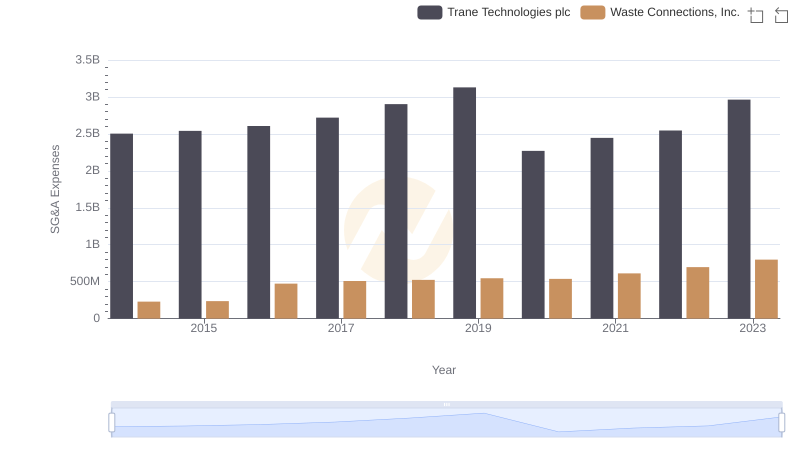

Cost Management Insights: SG&A Expenses for Trane Technologies plc and Waste Connections, Inc.

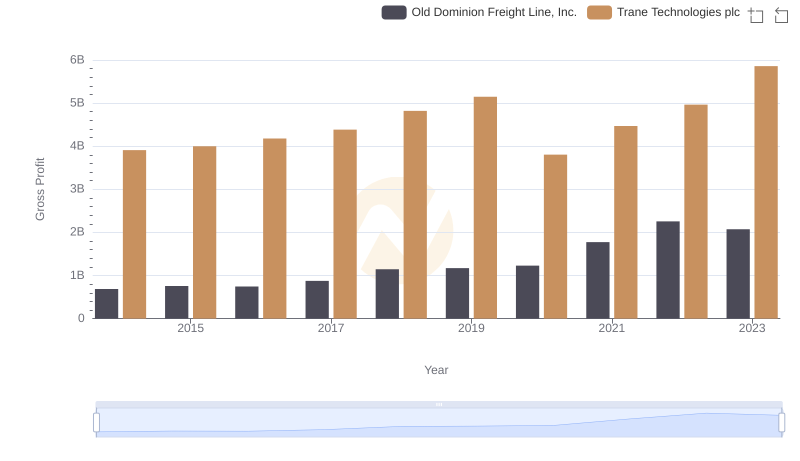

Key Insights on Gross Profit: Trane Technologies plc vs Old Dominion Freight Line, Inc.

SG&A Efficiency Analysis: Comparing Trane Technologies plc and L3Harris Technologies, Inc.

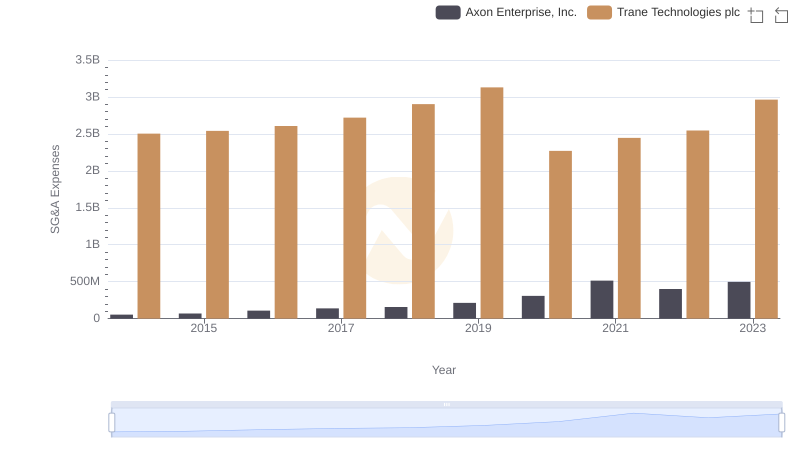

Operational Costs Compared: SG&A Analysis of Trane Technologies plc and Axon Enterprise, Inc.

EBITDA Metrics Evaluated: Trane Technologies plc vs Old Dominion Freight Line, Inc.

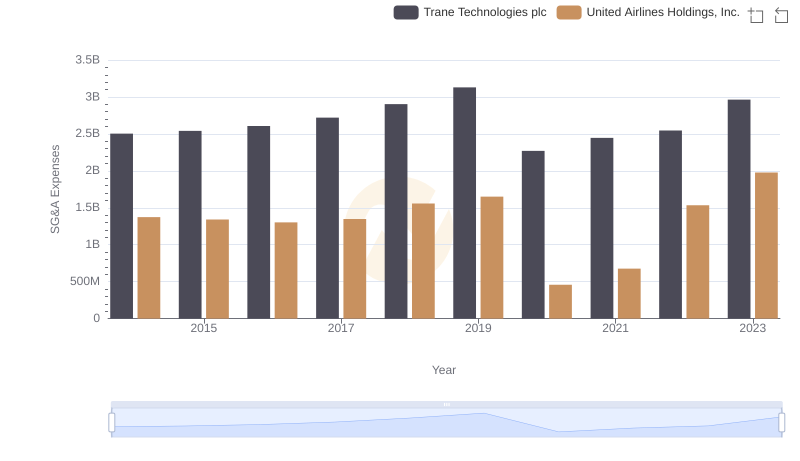

Trane Technologies plc vs United Airlines Holdings, Inc.: SG&A Expense Trends

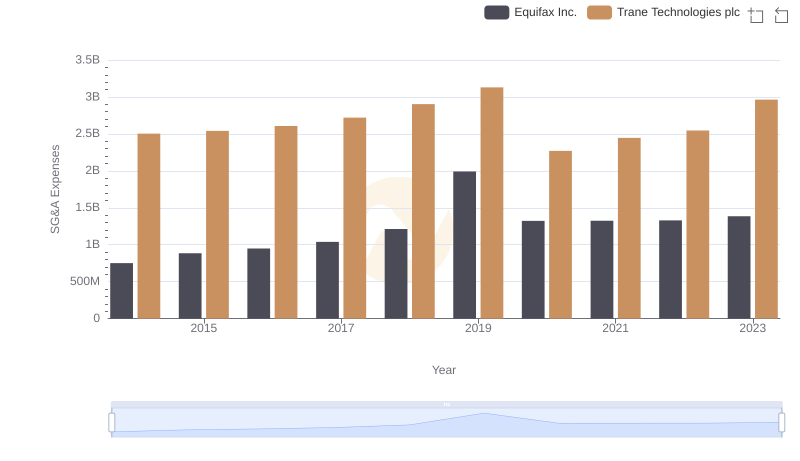

Breaking Down SG&A Expenses: Trane Technologies plc vs Equifax Inc.