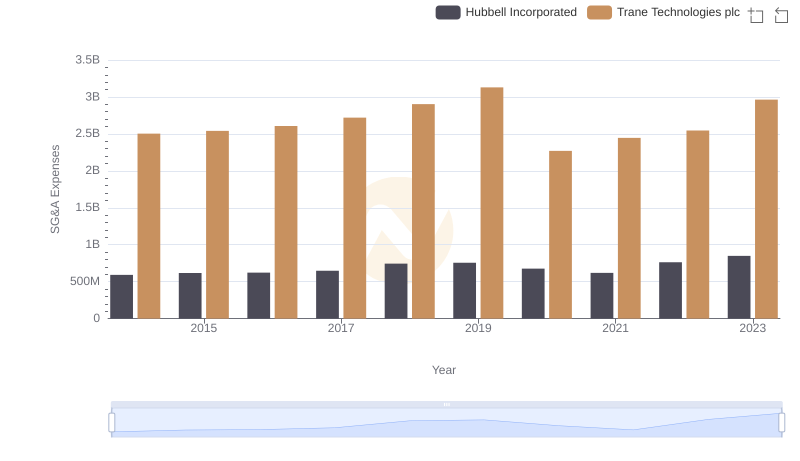

| __timestamp | Hubbell Incorporated | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 594700000 | 1757000000 |

| Thursday, January 1, 2015 | 533600000 | 1835000000 |

| Friday, January 1, 2016 | 564700000 | 2311000000 |

| Sunday, January 1, 2017 | 585600000 | 1982500000 |

| Monday, January 1, 2018 | 677500000 | 2242400000 |

| Tuesday, January 1, 2019 | 740900000 | 1931200000 |

| Wednesday, January 1, 2020 | 671400000 | 1831900000 |

| Friday, January 1, 2021 | 661000000 | 2319200000 |

| Saturday, January 1, 2022 | 854300000 | 2715500000 |

| Sunday, January 1, 2023 | 1169700000 | 3149900000 |

| Monday, January 1, 2024 | 1291200000 | 3859600000 |

Unlocking the unknown

In the ever-evolving landscape of industrial innovation, Trane Technologies plc and Hubbell Incorporated stand as paragons of financial resilience and growth. Over the past decade, these companies have demonstrated remarkable EBITDA performance, a key indicator of operational efficiency and profitability.

Since 2014, Trane Technologies has seen its EBITDA grow by approximately 79%, reaching a peak in 2023. This growth underscores the company's strategic focus on sustainable solutions and energy-efficient products, which have resonated well in the global market.

Hubbell Incorporated, while smaller in scale, has also shown impressive growth, with its EBITDA increasing by nearly 97% over the same period. This surge reflects Hubbell's commitment to innovation in electrical and utility solutions, catering to a diverse range of industries.

Both companies exemplify the power of strategic foresight and adaptability in a competitive market.

Breaking Down Revenue Trends: Trane Technologies plc vs Hubbell Incorporated

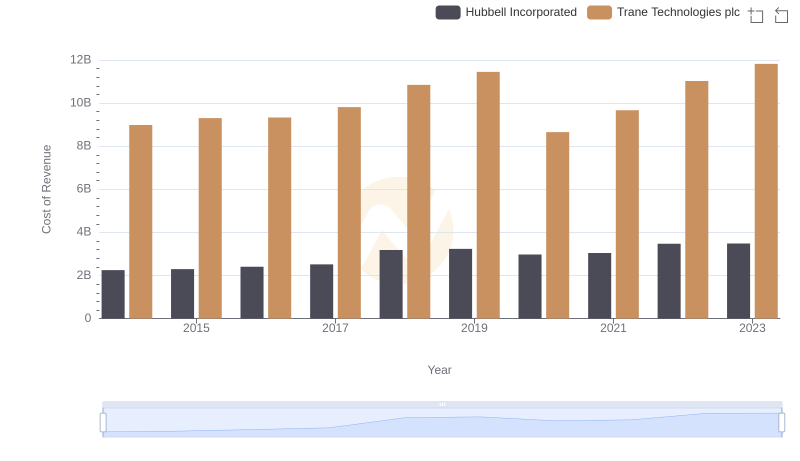

Analyzing Cost of Revenue: Trane Technologies plc and Hubbell Incorporated

Gross Profit Trends Compared: Trane Technologies plc vs Hubbell Incorporated

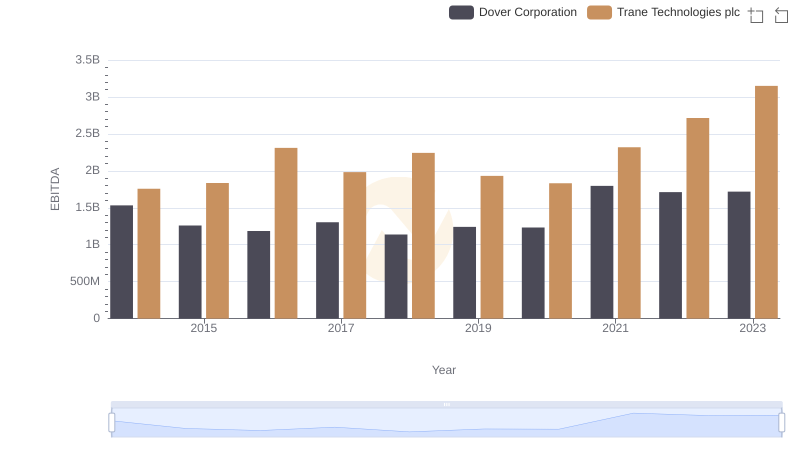

A Side-by-Side Analysis of EBITDA: Trane Technologies plc and Dover Corporation

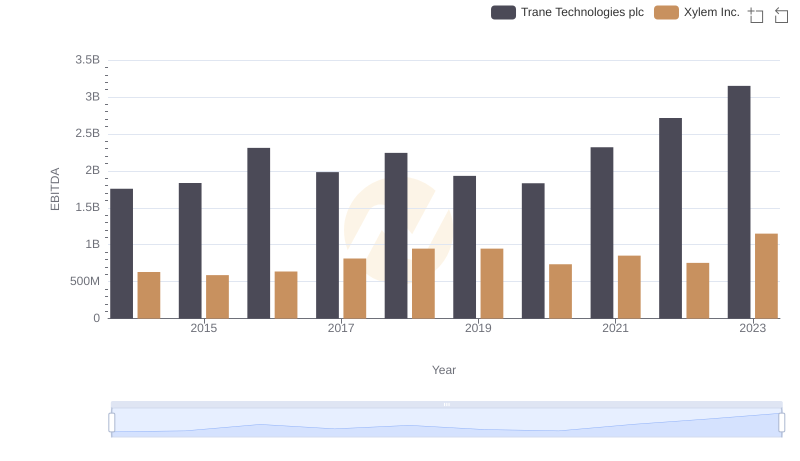

A Professional Review of EBITDA: Trane Technologies plc Compared to Xylem Inc.

SG&A Efficiency Analysis: Comparing Trane Technologies plc and Hubbell Incorporated

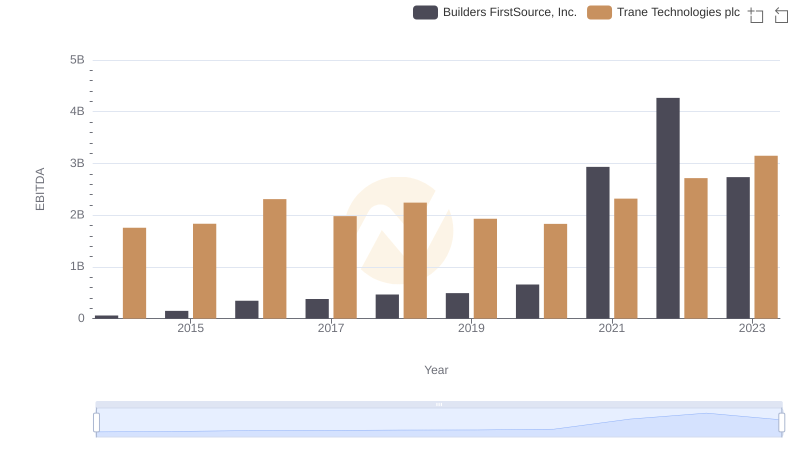

EBITDA Metrics Evaluated: Trane Technologies plc vs Builders FirstSource, Inc.

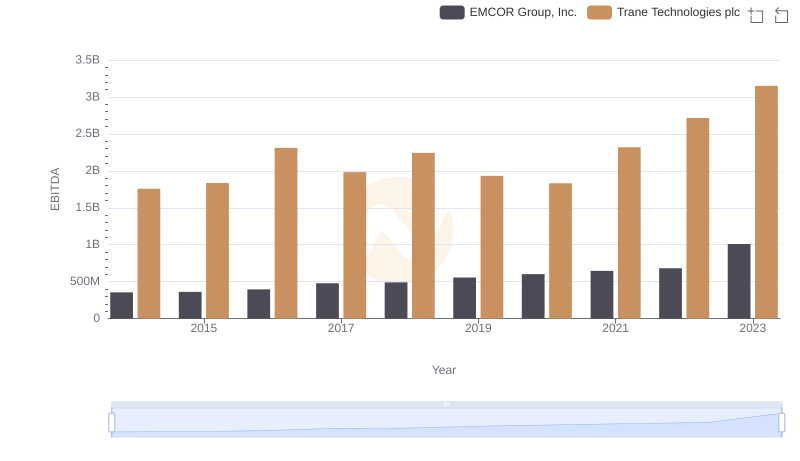

A Professional Review of EBITDA: Trane Technologies plc Compared to EMCOR Group, Inc.

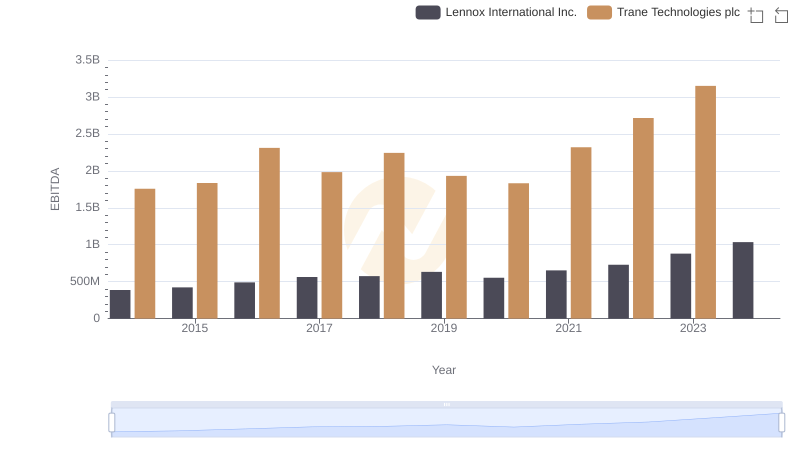

EBITDA Analysis: Evaluating Trane Technologies plc Against Lennox International Inc.

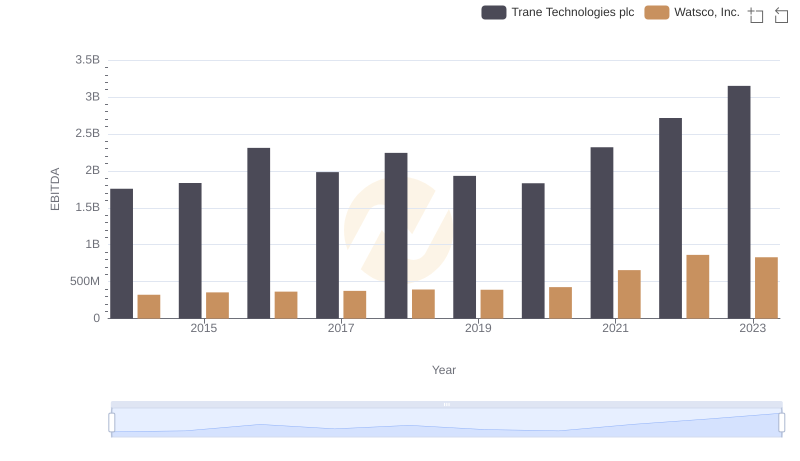

EBITDA Metrics Evaluated: Trane Technologies plc vs Watsco, Inc.

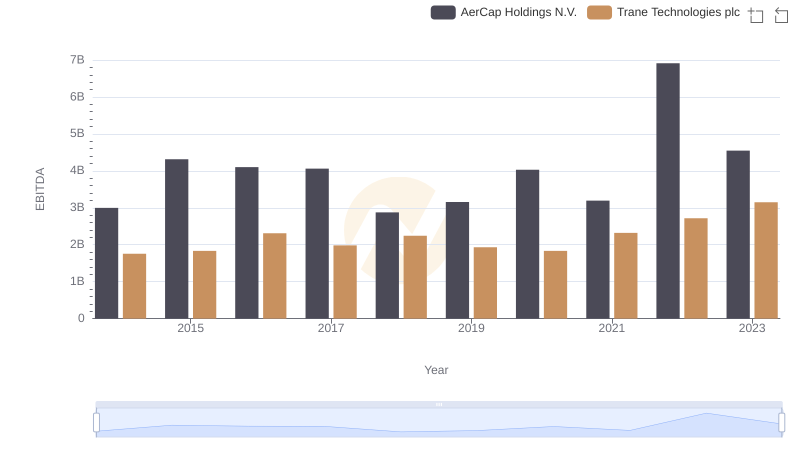

Comprehensive EBITDA Comparison: Trane Technologies plc vs AerCap Holdings N.V.

Trane Technologies plc vs TransUnion: In-Depth EBITDA Performance Comparison