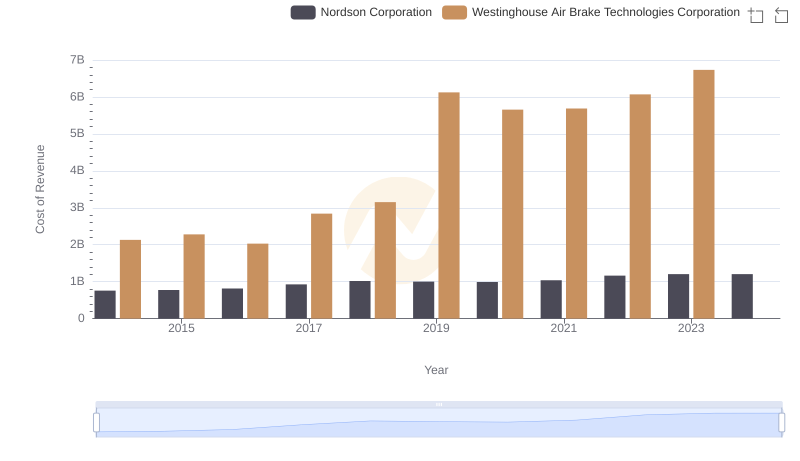

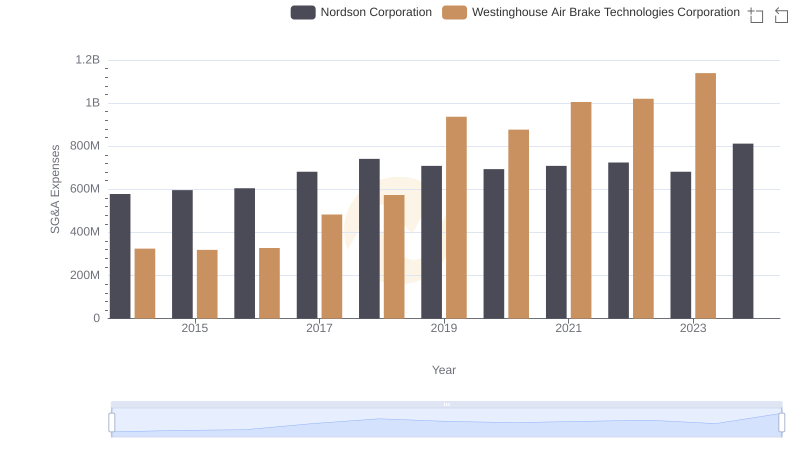

| __timestamp | Nordson Corporation | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 945098000 | 913534000 |

| Thursday, January 1, 2015 | 913964000 | 1026153000 |

| Friday, January 1, 2016 | 993499000 | 901541000 |

| Sunday, January 1, 2017 | 1139001000 | 1040597000 |

| Monday, January 1, 2018 | 1235965000 | 1211731000 |

| Tuesday, January 1, 2019 | 1192103000 | 2077600000 |

| Wednesday, January 1, 2020 | 1130468000 | 1898700000 |

| Friday, January 1, 2021 | 1324080000 | 2135000000 |

| Saturday, January 1, 2022 | 1426536000 | 2292000000 |

| Sunday, January 1, 2023 | 1425405000 | 2944000000 |

| Monday, January 1, 2024 | 1486129000 | 3366000000 |

Unveiling the hidden dimensions of data

In the competitive landscape of industrial manufacturing, Westinghouse Air Brake Technologies Corporation and Nordson Corporation have showcased intriguing gross profit trajectories over the past decade. From 2014 to 2023, Westinghouse Air Brake Technologies Corporation demonstrated a robust growth, with its gross profit peaking at nearly 2.9 billion in 2023, marking an impressive increase of over 220% from its 2014 figures. Meanwhile, Nordson Corporation maintained a steady upward trend, achieving a gross profit of approximately 1.5 billion in 2023, reflecting a 57% growth since 2014.

These trends underscore the dynamic nature of the industrial sector, with each company navigating its unique path to profitability.

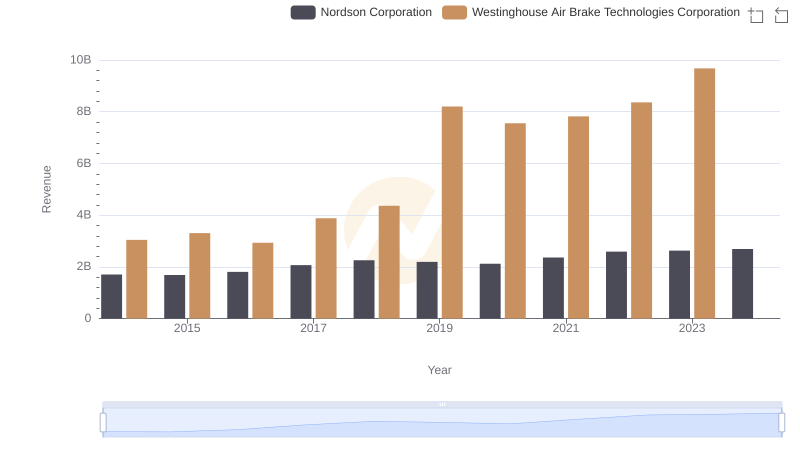

Annual Revenue Comparison: Westinghouse Air Brake Technologies Corporation vs Nordson Corporation

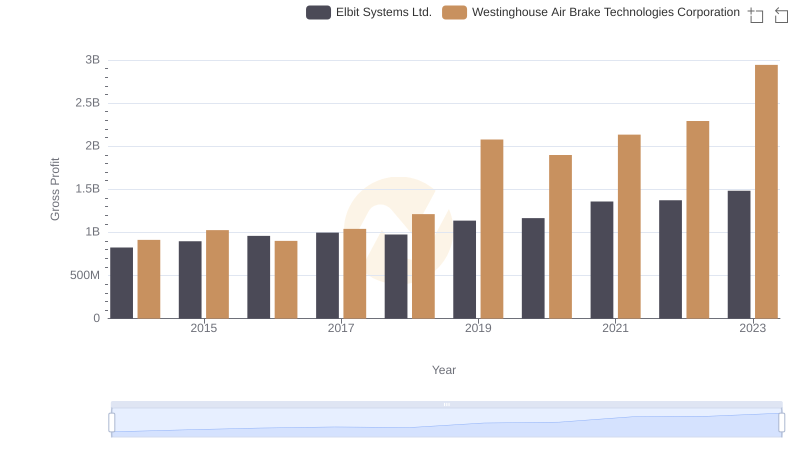

Westinghouse Air Brake Technologies Corporation and Elbit Systems Ltd.: A Detailed Gross Profit Analysis

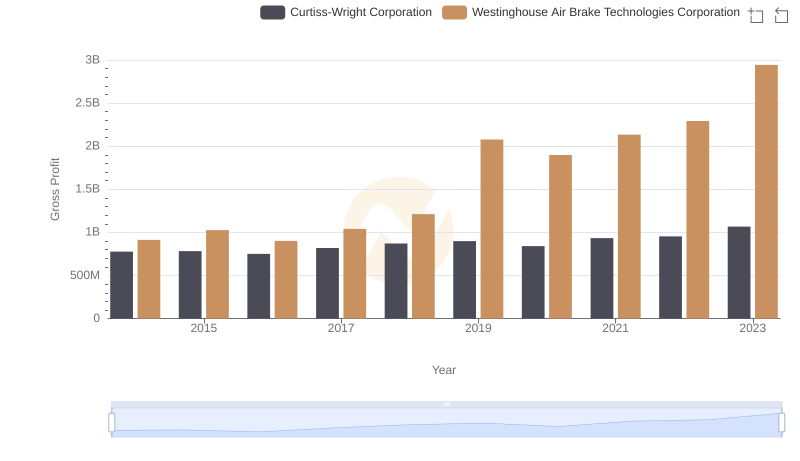

Westinghouse Air Brake Technologies Corporation vs Curtiss-Wright Corporation: A Gross Profit Performance Breakdown

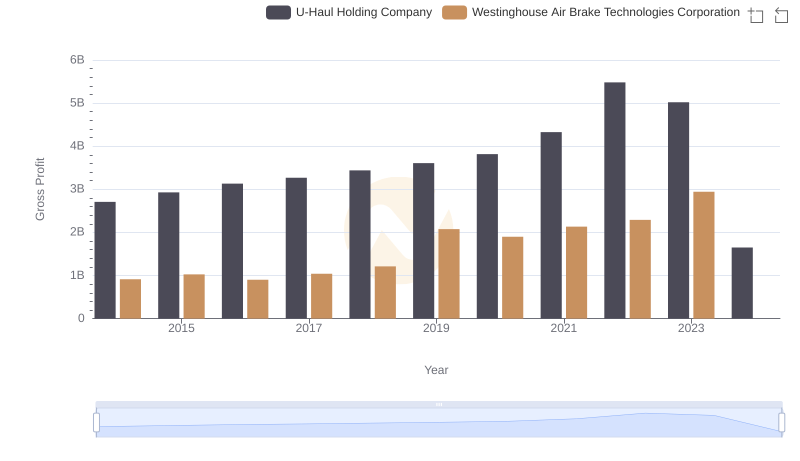

Gross Profit Analysis: Comparing Westinghouse Air Brake Technologies Corporation and U-Haul Holding Company

Cost Insights: Breaking Down Westinghouse Air Brake Technologies Corporation and Nordson Corporation's Expenses

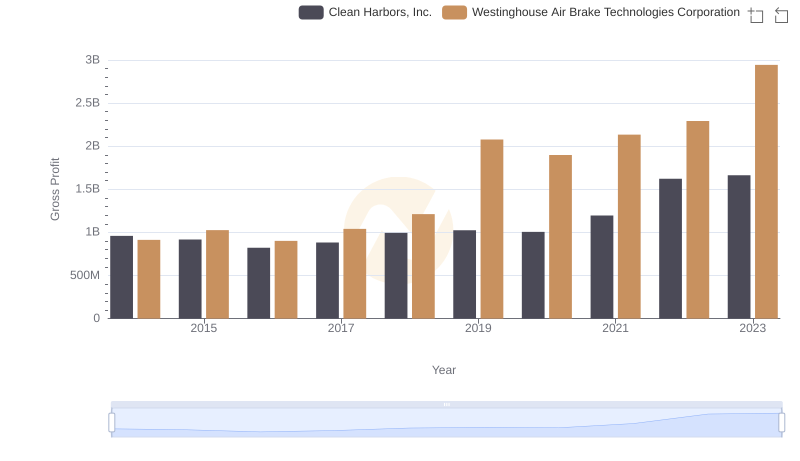

Key Insights on Gross Profit: Westinghouse Air Brake Technologies Corporation vs Clean Harbors, Inc.

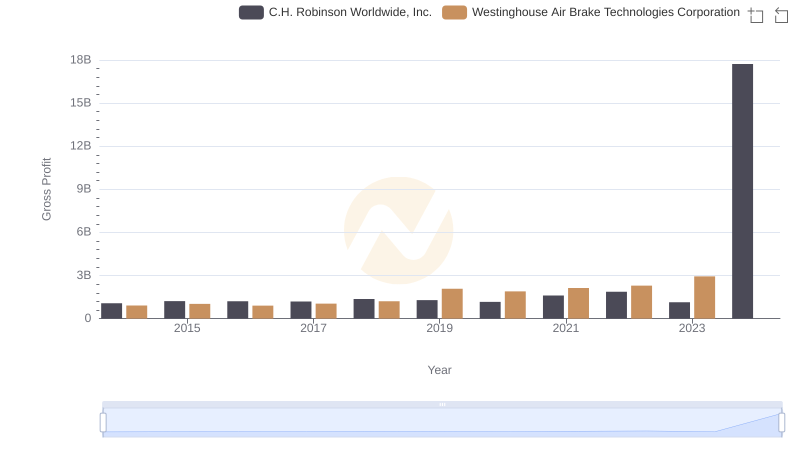

Westinghouse Air Brake Technologies Corporation and C.H. Robinson Worldwide, Inc.: A Detailed Gross Profit Analysis

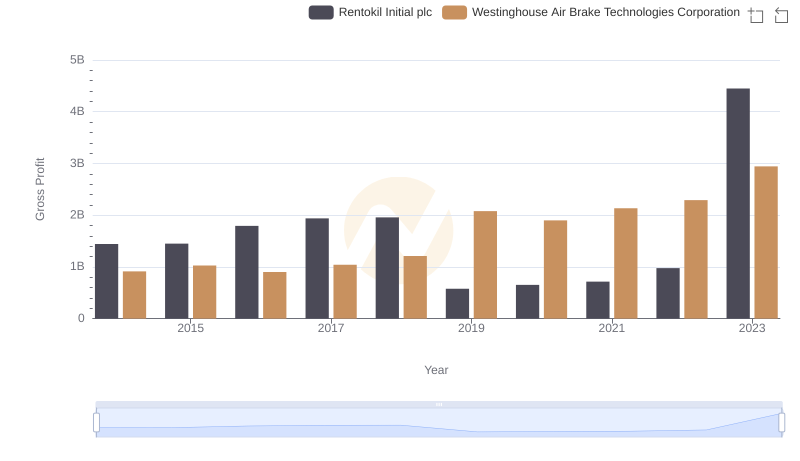

Who Generates Higher Gross Profit? Westinghouse Air Brake Technologies Corporation or Rentokil Initial plc

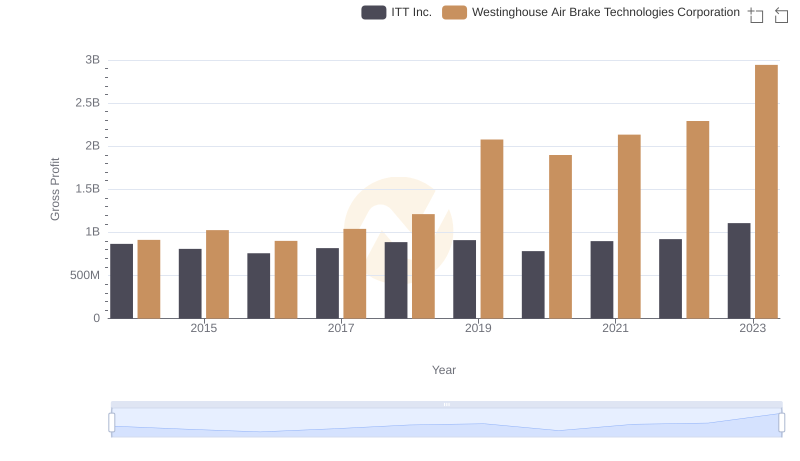

Gross Profit Analysis: Comparing Westinghouse Air Brake Technologies Corporation and ITT Inc.

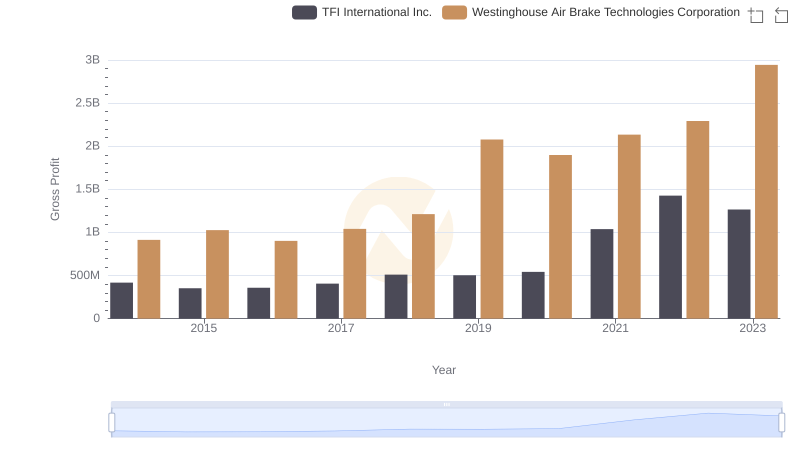

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and TFI International Inc. Trends

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Nordson Corporation