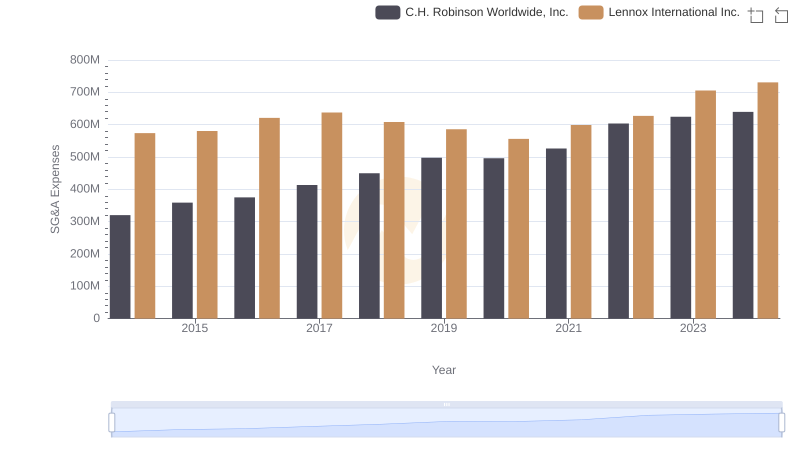

| __timestamp | Curtiss-Wright Corporation | Lennox International Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 426301000 | 573700000 |

| Thursday, January 1, 2015 | 411801000 | 580500000 |

| Friday, January 1, 2016 | 383793000 | 621000000 |

| Sunday, January 1, 2017 | 418544000 | 637700000 |

| Monday, January 1, 2018 | 433110000 | 608200000 |

| Tuesday, January 1, 2019 | 422272000 | 585900000 |

| Wednesday, January 1, 2020 | 412825000 | 555900000 |

| Friday, January 1, 2021 | 443096000 | 598900000 |

| Saturday, January 1, 2022 | 445679000 | 627200000 |

| Sunday, January 1, 2023 | 496812000 | 705500000 |

| Monday, January 1, 2024 | 518857000 | 730600000 |

In pursuit of knowledge

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. This analysis compares the SG&A efficiency of Lennox International Inc. and Curtiss-Wright Corporation from 2014 to 2023.

Lennox International Inc. consistently outpaced Curtiss-Wright Corporation in SG&A expenses, with a notable 23% higher average over the decade. In 2023, Lennox's SG&A expenses peaked at approximately $705 million, marking a 27% increase from 2014. Meanwhile, Curtiss-Wright's expenses grew by 17% over the same period, reaching around $497 million.

The data suggests Lennox's aggressive investment in administrative functions, possibly reflecting a strategy focused on growth and market expansion. In contrast, Curtiss-Wright's more conservative approach may indicate a focus on operational efficiency. The absence of 2024 data for Curtiss-Wright leaves room for speculation on future trends.

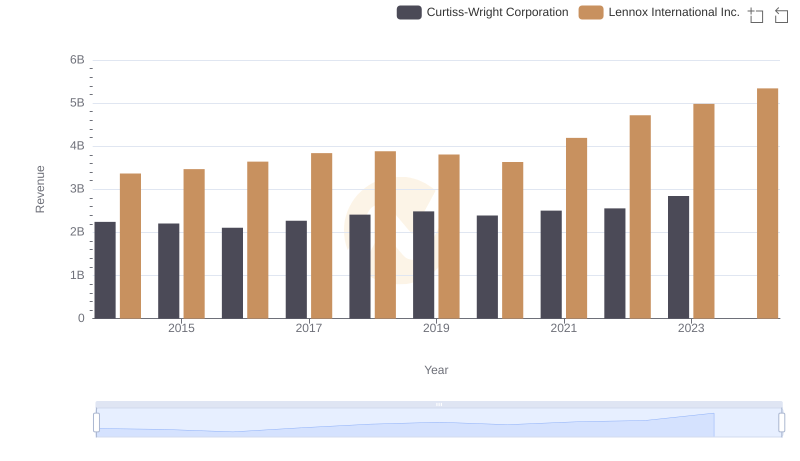

Revenue Showdown: Lennox International Inc. vs Curtiss-Wright Corporation

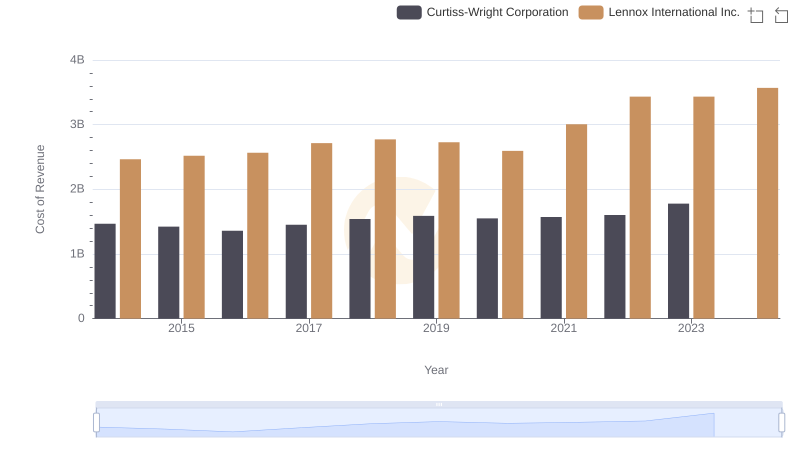

Cost of Revenue Comparison: Lennox International Inc. vs Curtiss-Wright Corporation

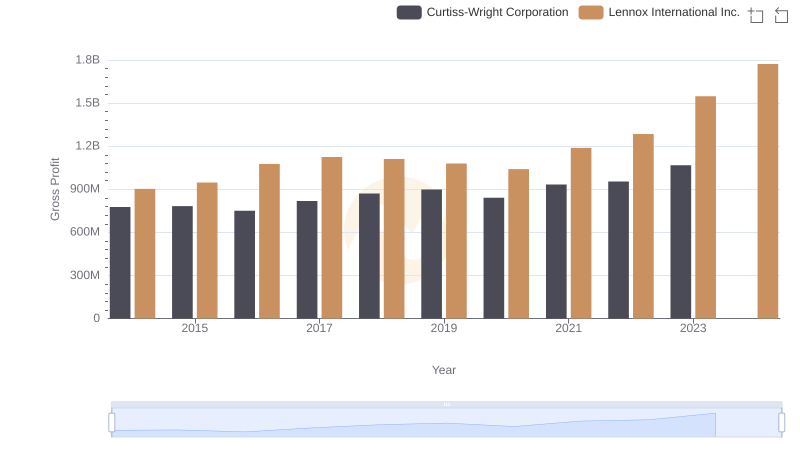

Gross Profit Trends Compared: Lennox International Inc. vs Curtiss-Wright Corporation

Comparing SG&A Expenses: Lennox International Inc. vs C.H. Robinson Worldwide, Inc. Trends and Insights

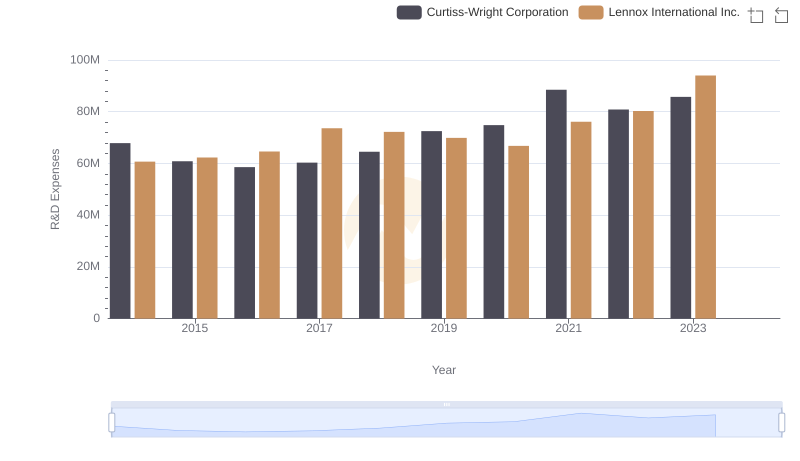

Research and Development Investment: Lennox International Inc. vs Curtiss-Wright Corporation

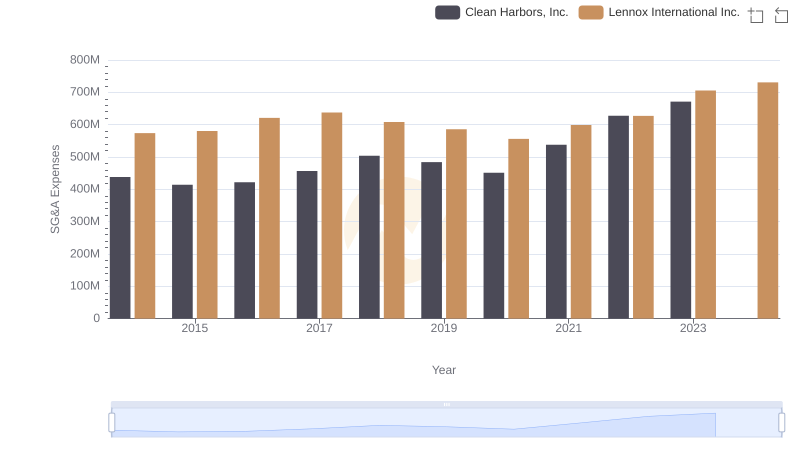

Lennox International Inc. and Clean Harbors, Inc.: SG&A Spending Patterns Compared

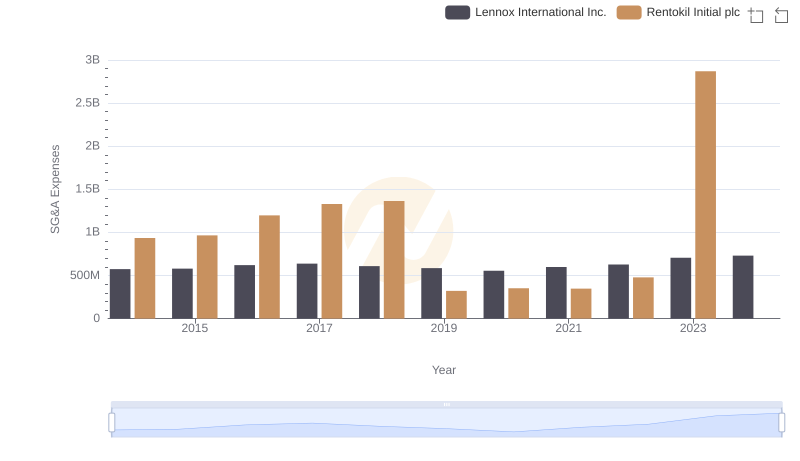

Who Optimizes SG&A Costs Better? Lennox International Inc. or Rentokil Initial plc

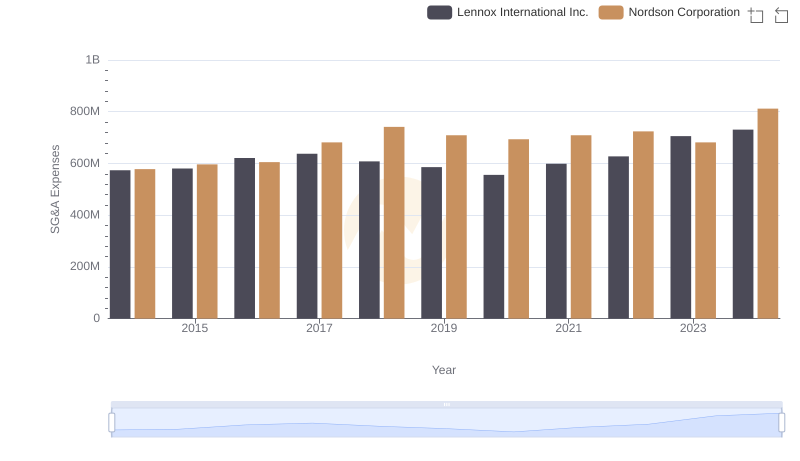

Breaking Down SG&A Expenses: Lennox International Inc. vs Nordson Corporation

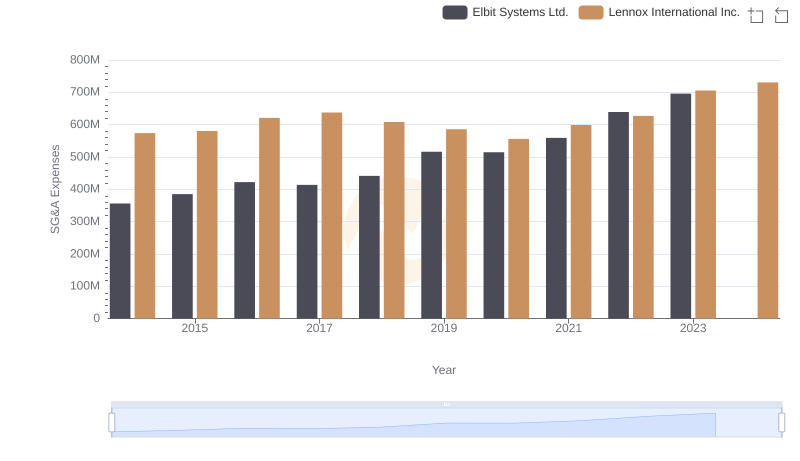

Comparing SG&A Expenses: Lennox International Inc. vs Elbit Systems Ltd. Trends and Insights

Professional EBITDA Benchmarking: Lennox International Inc. vs Curtiss-Wright Corporation

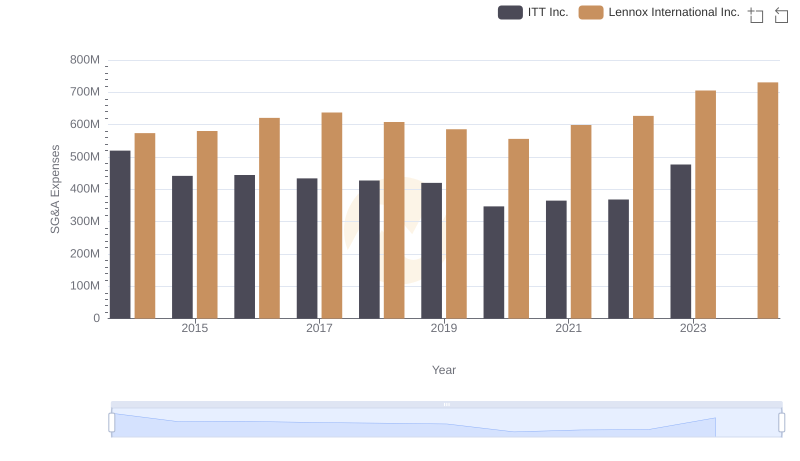

Who Optimizes SG&A Costs Better? Lennox International Inc. or ITT Inc.

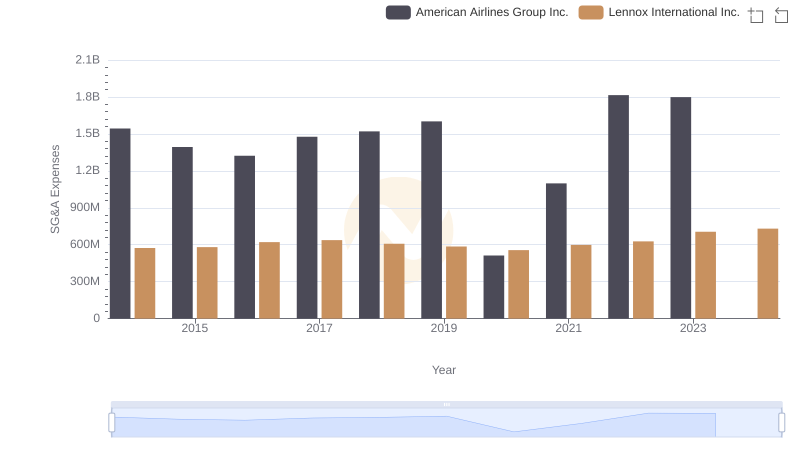

Lennox International Inc. and American Airlines Group Inc.: SG&A Spending Patterns Compared