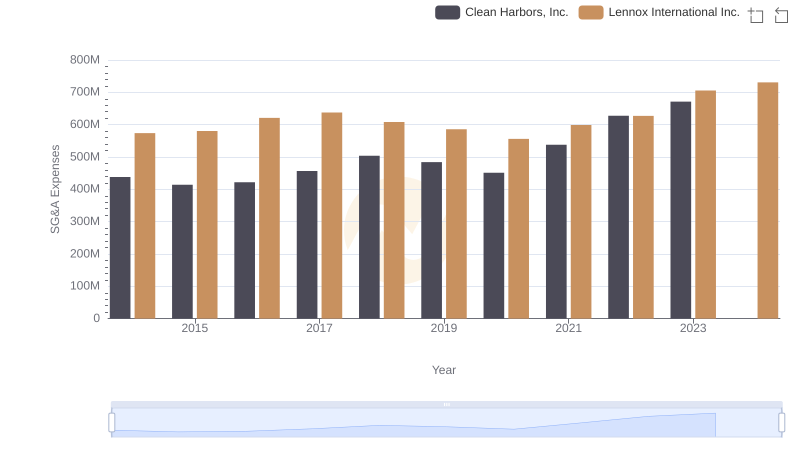

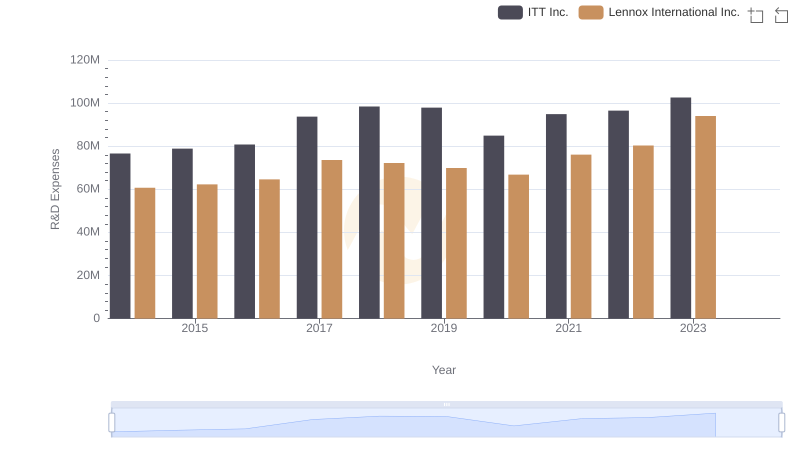

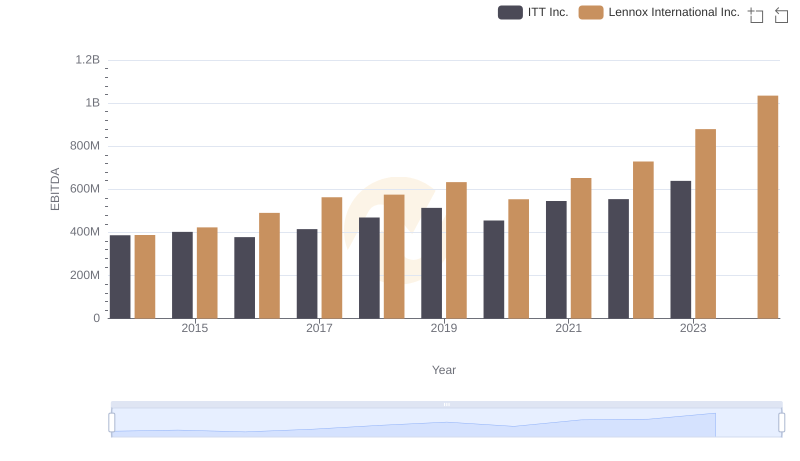

| __timestamp | ITT Inc. | Lennox International Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 519500000 | 573700000 |

| Thursday, January 1, 2015 | 441500000 | 580500000 |

| Friday, January 1, 2016 | 444100000 | 621000000 |

| Sunday, January 1, 2017 | 433700000 | 637700000 |

| Monday, January 1, 2018 | 427300000 | 608200000 |

| Tuesday, January 1, 2019 | 420000000 | 585900000 |

| Wednesday, January 1, 2020 | 347200000 | 555900000 |

| Friday, January 1, 2021 | 365100000 | 598900000 |

| Saturday, January 1, 2022 | 368500000 | 627200000 |

| Sunday, January 1, 2023 | 476600000 | 705500000 |

| Monday, January 1, 2024 | 502300000 | 730600000 |

In pursuit of knowledge

In the competitive world of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. This analysis compares the SG&A cost optimization strategies of Lennox International Inc. and ITT Inc. over the past decade.

From 2014 to 2023, Lennox International Inc. consistently reported higher SG&A expenses compared to ITT Inc., with a peak in 2023 at approximately 7.1 billion. In contrast, ITT Inc. maintained a more stable SG&A expense profile, peaking in 2014 and 2023 at around 5.2 billion and 4.8 billion, respectively. Notably, ITT Inc. achieved a 33% reduction in SG&A expenses from 2014 to 2020, showcasing effective cost management.

While Lennox International Inc. experienced a 23% increase in SG&A expenses from 2014 to 2023, their strategic investments may indicate a focus on growth. The absence of 2024 data for ITT Inc. suggests a need for further analysis to understand future trends.

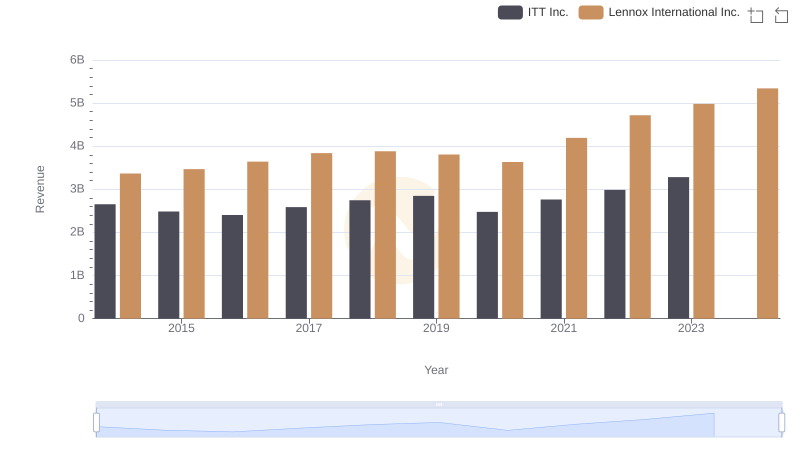

Annual Revenue Comparison: Lennox International Inc. vs ITT Inc.

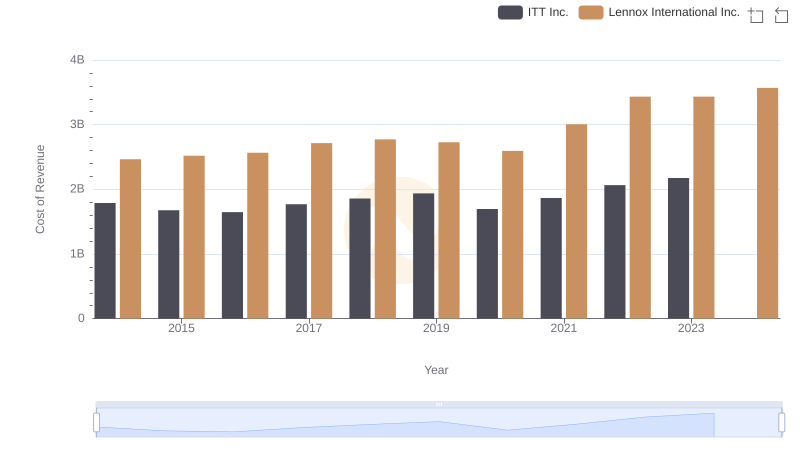

Cost Insights: Breaking Down Lennox International Inc. and ITT Inc.'s Expenses

Lennox International Inc. and Clean Harbors, Inc.: SG&A Spending Patterns Compared

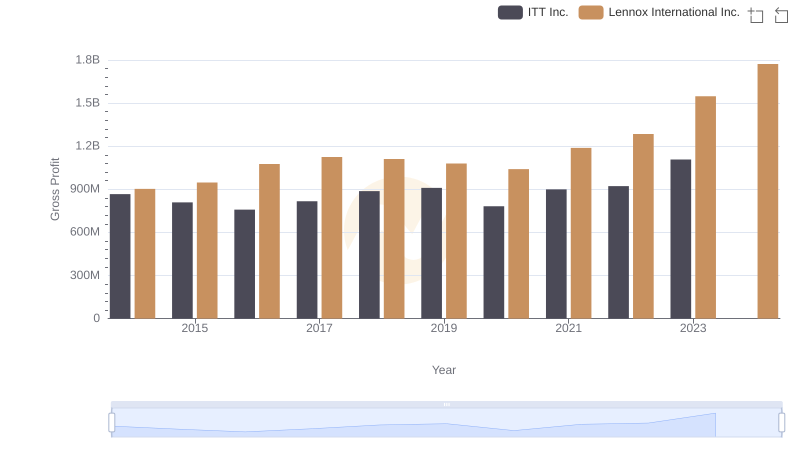

Gross Profit Trends Compared: Lennox International Inc. vs ITT Inc.

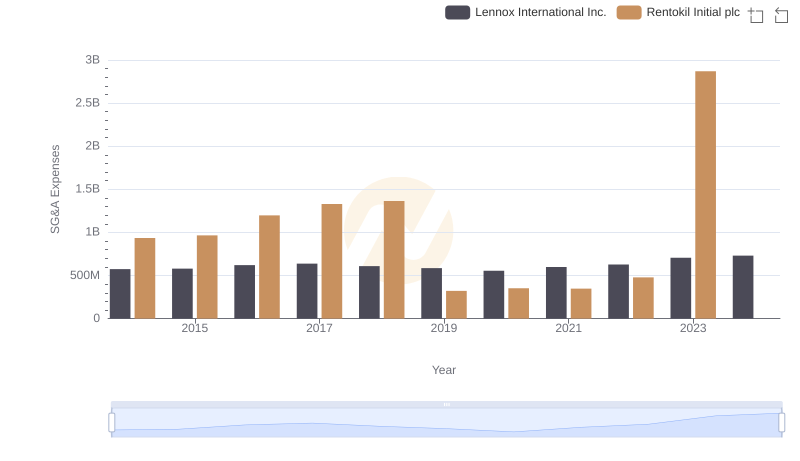

Who Optimizes SG&A Costs Better? Lennox International Inc. or Rentokil Initial plc

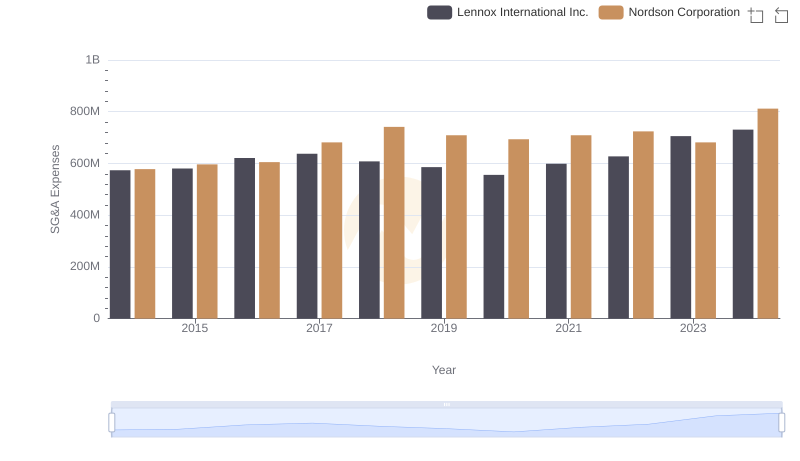

Breaking Down SG&A Expenses: Lennox International Inc. vs Nordson Corporation

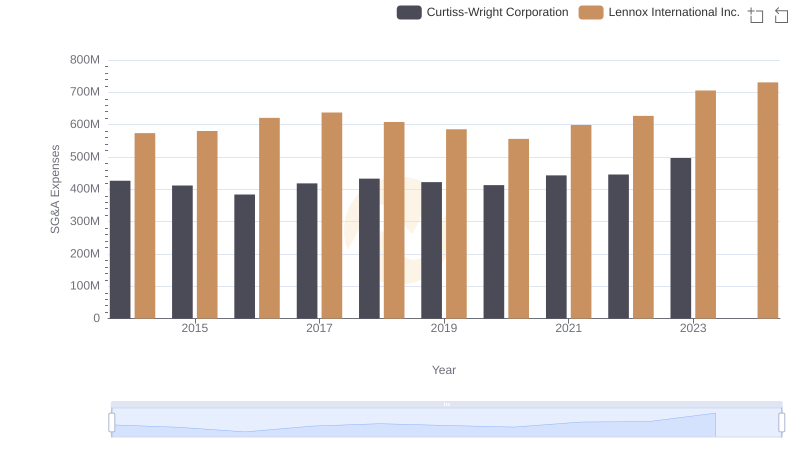

SG&A Efficiency Analysis: Comparing Lennox International Inc. and Curtiss-Wright Corporation

Lennox International Inc. or ITT Inc.: Who Invests More in Innovation?

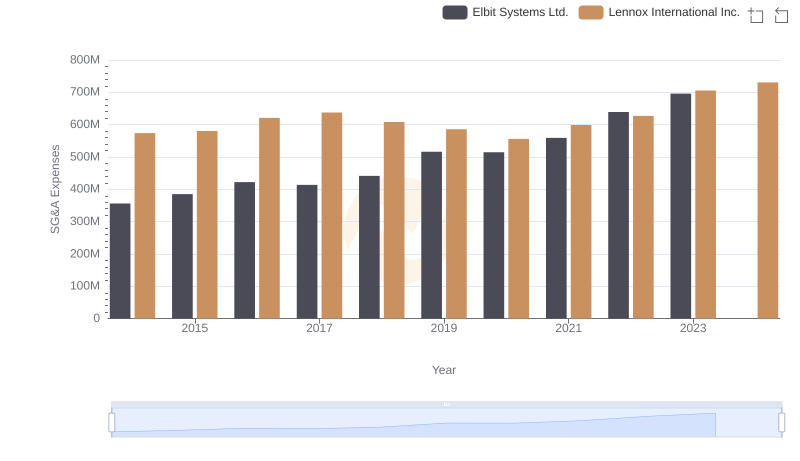

Comparing SG&A Expenses: Lennox International Inc. vs Elbit Systems Ltd. Trends and Insights

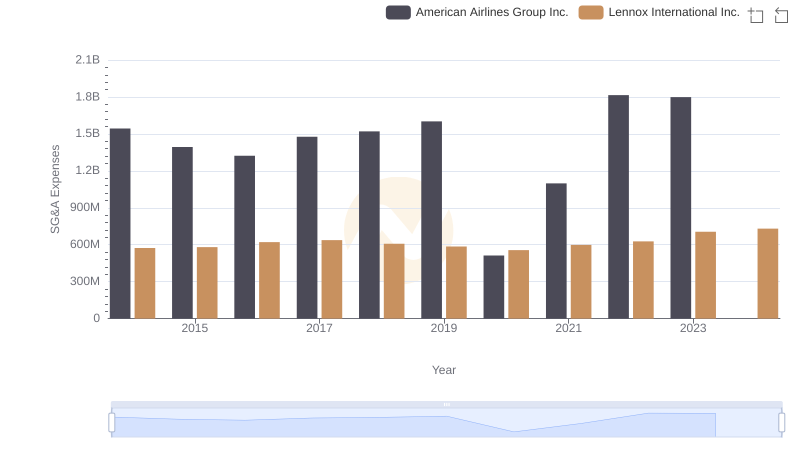

Lennox International Inc. and American Airlines Group Inc.: SG&A Spending Patterns Compared

Comprehensive EBITDA Comparison: Lennox International Inc. vs ITT Inc.

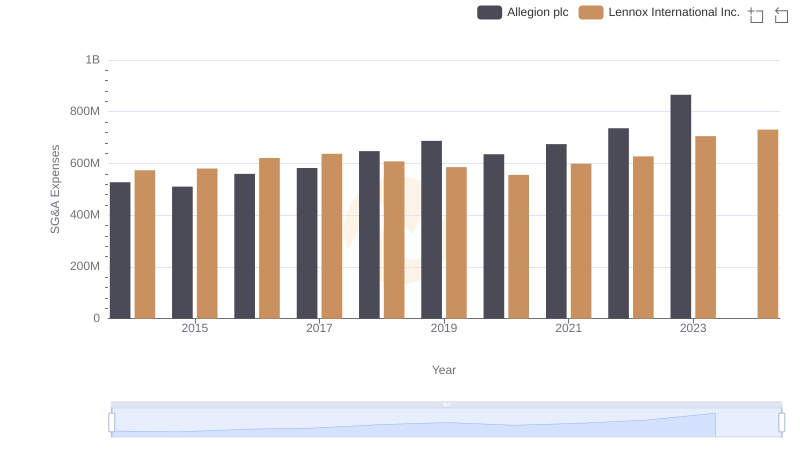

Who Optimizes SG&A Costs Better? Lennox International Inc. or Allegion plc