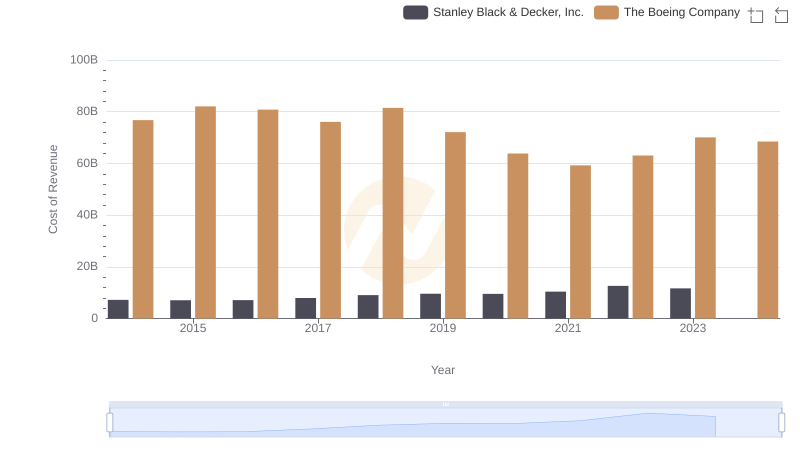

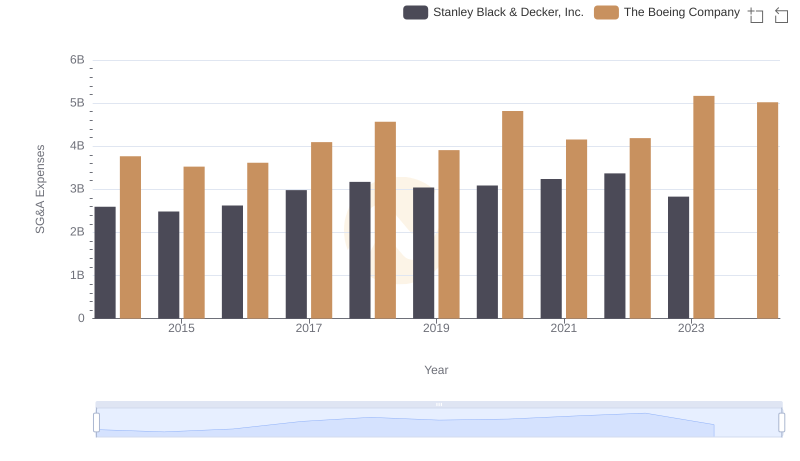

| __timestamp | Stanley Black & Decker, Inc. | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 2595900000 | 3767000000 |

| Thursday, January 1, 2015 | 2486400000 | 3525000000 |

| Friday, January 1, 2016 | 2623900000 | 3616000000 |

| Sunday, January 1, 2017 | 2980100000 | 4094000000 |

| Monday, January 1, 2018 | 3171700000 | 4567000000 |

| Tuesday, January 1, 2019 | 3041000000 | 3909000000 |

| Wednesday, January 1, 2020 | 3089600000 | 4817000000 |

| Friday, January 1, 2021 | 3240400000 | 4157000000 |

| Saturday, January 1, 2022 | 3370000000 | 4187000000 |

| Sunday, January 1, 2023 | 2829300000 | 5168000000 |

| Monday, January 1, 2024 | 3310500000 | 5021000000 |

Igniting the spark of knowledge

In the world of corporate finance, Selling, General, and Administrative (SG&A) expenses are a crucial indicator of a company's operational efficiency. Over the past decade, The Boeing Company and Stanley Black & Decker, Inc. have showcased contrasting trends in their SG&A expenses. From 2014 to 2023, Boeing's SG&A costs have seen a steady rise, peaking in 2023 with a 37% increase from 2014. In contrast, Stanley Black & Decker's expenses have remained relatively stable, with a slight dip in 2023. This divergence highlights Boeing's aggressive expansion and restructuring efforts, while Stanley Black & Decker maintains a more consistent operational strategy. Notably, the data for 2024 is incomplete, leaving room for speculation on future trends. As these industry titans navigate the complexities of their respective markets, their SG&A strategies will continue to be a focal point for investors and analysts alike.

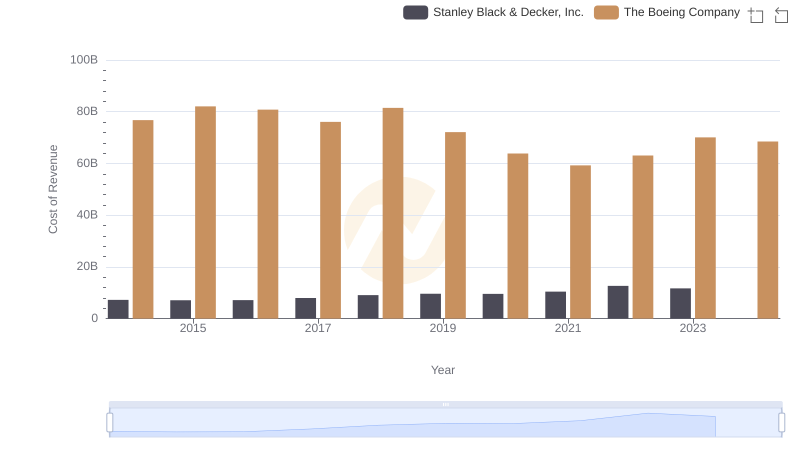

Comparing Cost of Revenue Efficiency: The Boeing Company vs Stanley Black & Decker, Inc.

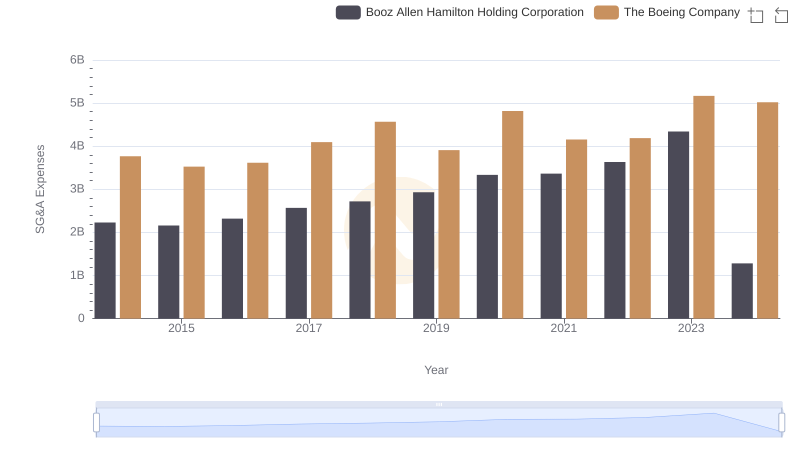

Operational Costs Compared: SG&A Analysis of The Boeing Company and Booz Allen Hamilton Holding Corporation

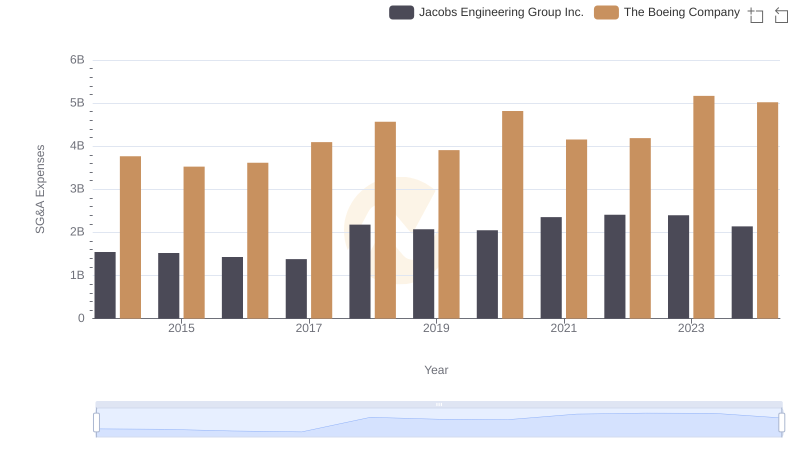

Breaking Down SG&A Expenses: The Boeing Company vs Jacobs Engineering Group Inc.

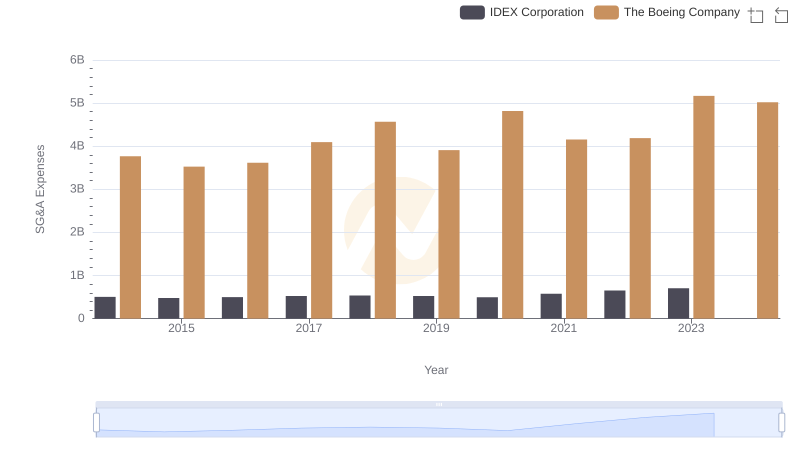

The Boeing Company and IDEX Corporation: SG&A Spending Patterns Compared

Cost of Revenue Comparison: The Boeing Company vs Stanley Black & Decker, Inc.

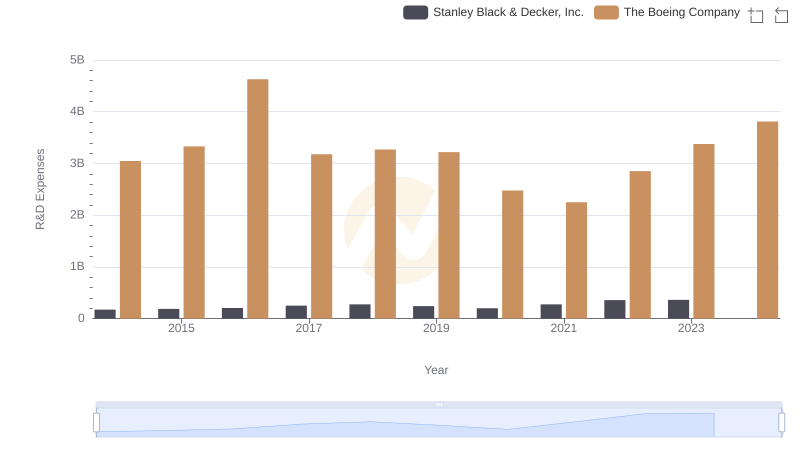

R&D Spending Showdown: The Boeing Company vs Stanley Black & Decker, Inc.

The Boeing Company or Stanley Black & Decker, Inc.: Who Manages SG&A Costs Better?