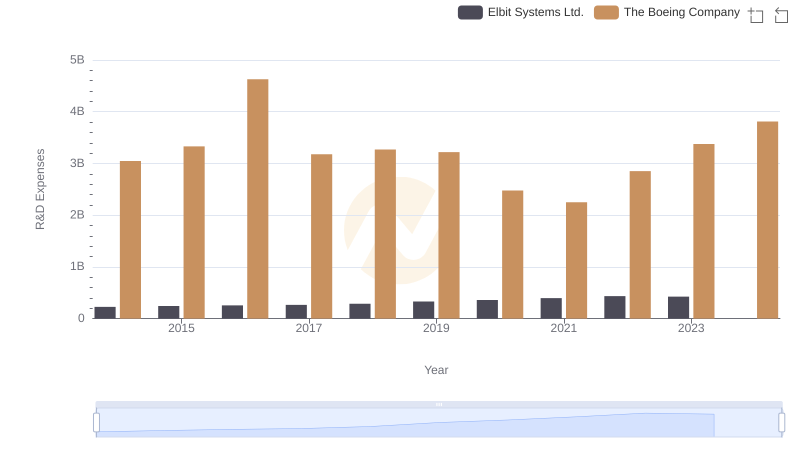

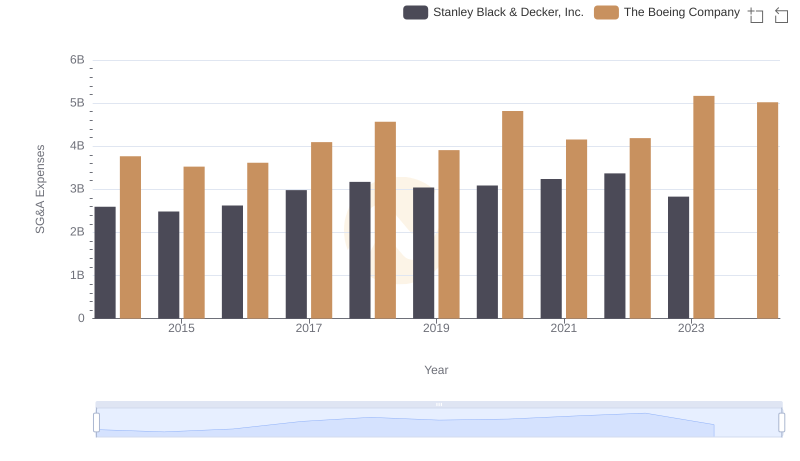

| __timestamp | Stanley Black & Decker, Inc. | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 174600000 | 3047000000 |

| Thursday, January 1, 2015 | 188000000 | 3331000000 |

| Friday, January 1, 2016 | 204400000 | 4627000000 |

| Sunday, January 1, 2017 | 252300000 | 3179000000 |

| Monday, January 1, 2018 | 275800000 | 3269000000 |

| Tuesday, January 1, 2019 | 240800000 | 3219000000 |

| Wednesday, January 1, 2020 | 200000000 | 2476000000 |

| Friday, January 1, 2021 | 276300000 | 2249000000 |

| Saturday, January 1, 2022 | 357400000 | 2852000000 |

| Sunday, January 1, 2023 | 362000000 | 3377000000 |

| Monday, January 1, 2024 | 0 | 3812000000 |

Unleashing the power of data

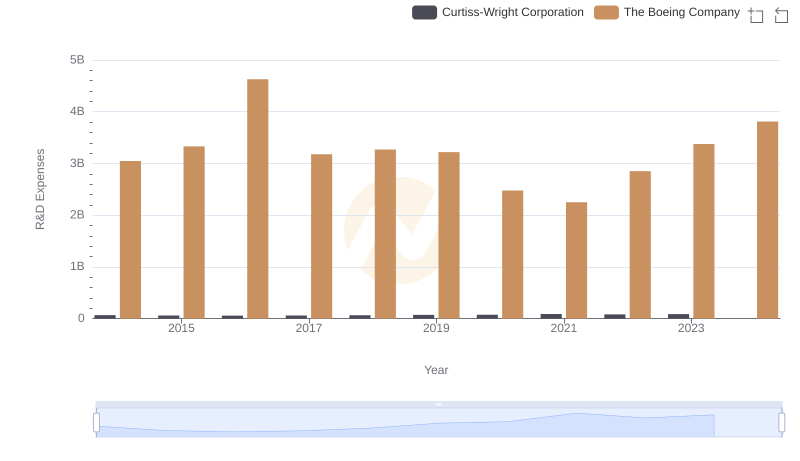

In the world of corporate innovation, research and development (R&D) spending is a key indicator of a company's commitment to future growth. Over the past decade, The Boeing Company has consistently outpaced Stanley Black & Decker, Inc. in R&D investment. From 2014 to 2023, Boeing's R&D expenses have averaged around $3.2 billion annually, peaking at $4.6 billion in 2016. In contrast, Stanley Black & Decker's R&D spending has hovered around $253 million, with a notable increase to $362 million in 2023.

Boeing's substantial investment reflects its focus on cutting-edge aerospace technology, while Stanley Black & Decker's steady growth in R&D spending highlights its commitment to innovation in tools and storage solutions. The data for 2024 is incomplete, but the trend suggests Boeing's R&D spending will continue to rise, maintaining its lead in the innovation race.

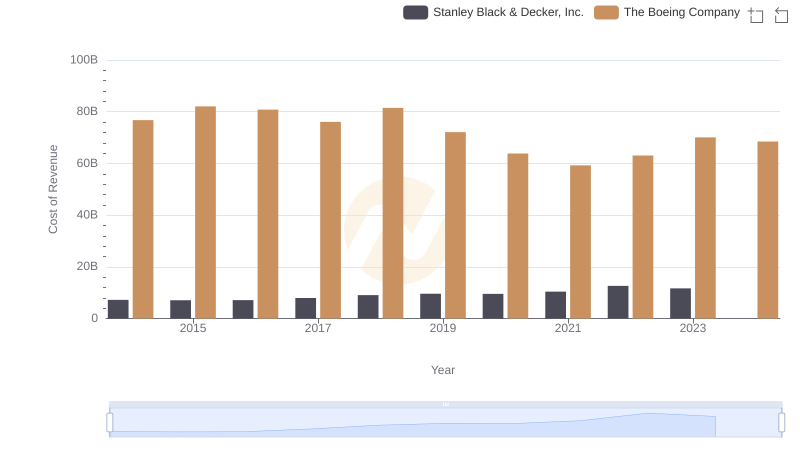

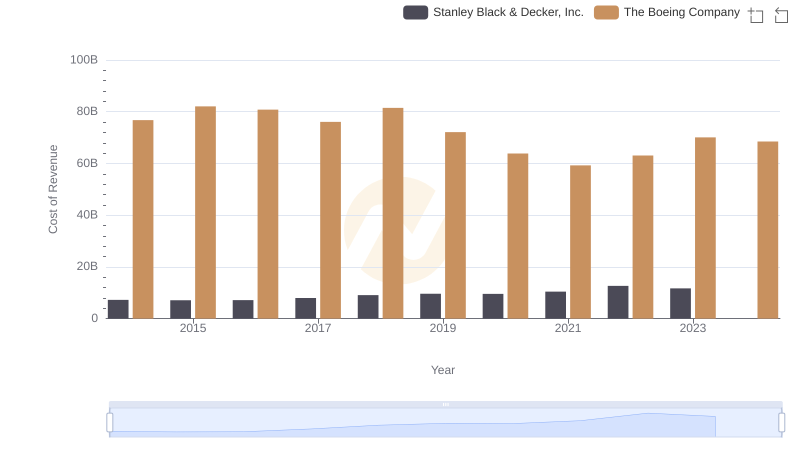

Comparing Cost of Revenue Efficiency: The Boeing Company vs Stanley Black & Decker, Inc.

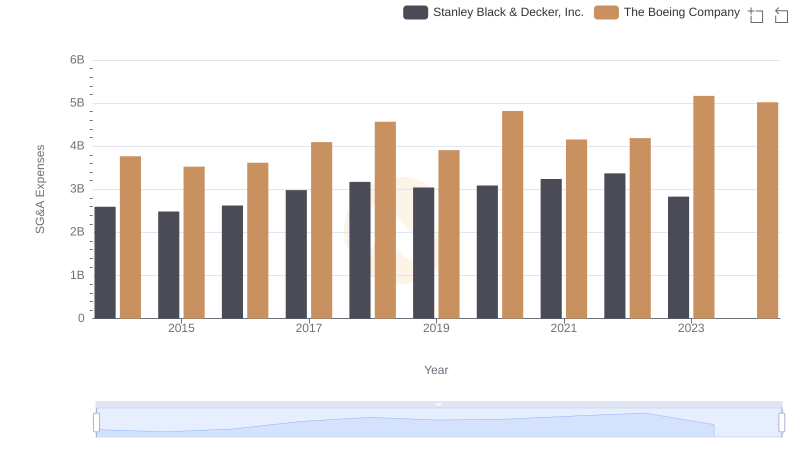

Selling, General, and Administrative Costs: The Boeing Company vs Stanley Black & Decker, Inc.

Cost of Revenue Comparison: The Boeing Company vs Stanley Black & Decker, Inc.

Who Prioritizes Innovation? R&D Spending Compared for The Boeing Company and Elbit Systems Ltd.

Research and Development Expenses Breakdown: The Boeing Company vs Curtiss-Wright Corporation

The Boeing Company or Stanley Black & Decker, Inc.: Who Manages SG&A Costs Better?