| __timestamp | Booz Allen Hamilton Holding Corporation | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 2229642000 | 3767000000 |

| Thursday, January 1, 2015 | 2159439000 | 3525000000 |

| Friday, January 1, 2016 | 2319592000 | 3616000000 |

| Sunday, January 1, 2017 | 2568511000 | 4094000000 |

| Monday, January 1, 2018 | 2719909000 | 4567000000 |

| Tuesday, January 1, 2019 | 2932602000 | 3909000000 |

| Wednesday, January 1, 2020 | 3334378000 | 4817000000 |

| Friday, January 1, 2021 | 3362722000 | 4157000000 |

| Saturday, January 1, 2022 | 3633150000 | 4187000000 |

| Sunday, January 1, 2023 | 4341769000 | 5168000000 |

| Monday, January 1, 2024 | 1281443000 | 5021000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of corporate America, operational efficiency is paramount. Over the past decade, from 2014 to 2023, The Boeing Company and Booz Allen Hamilton Holding Corporation have showcased contrasting trends in their Selling, General, and Administrative (SG&A) expenses. Boeing, a titan in aerospace, saw its SG&A expenses rise by approximately 37% over this period, peaking in 2023. In contrast, Booz Allen Hamilton, a leader in management consulting, experienced a more modest increase of around 95%, with a notable dip in 2024. This divergence highlights the distinct operational strategies of these industry giants. While Boeing's expenses reflect its expansive global operations, Booz Allen's fluctuations may indicate strategic shifts in response to market demands. As we look to the future, understanding these trends offers valuable insights into the financial health and strategic priorities of these corporations.

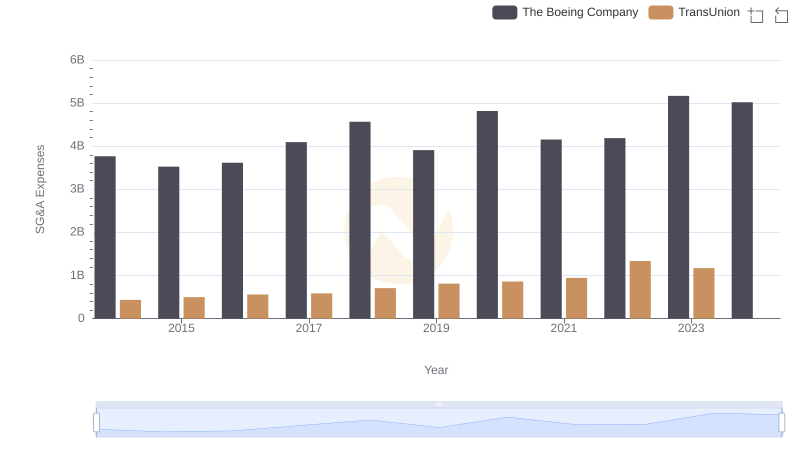

Cost Management Insights: SG&A Expenses for The Boeing Company and TransUnion

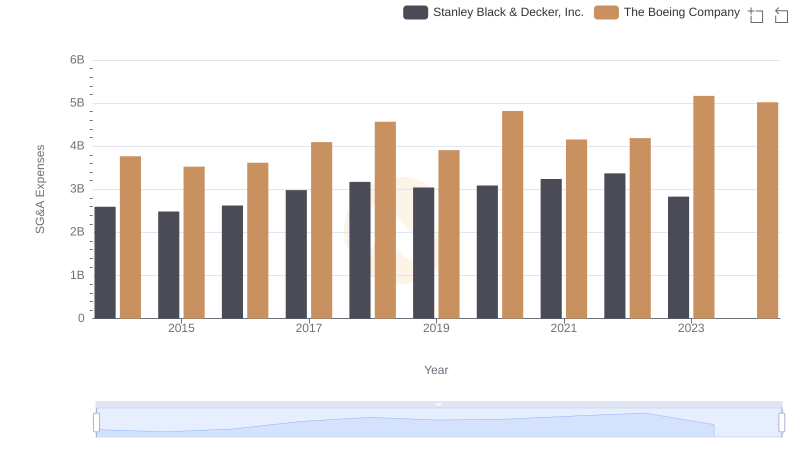

Selling, General, and Administrative Costs: The Boeing Company vs Stanley Black & Decker, Inc.

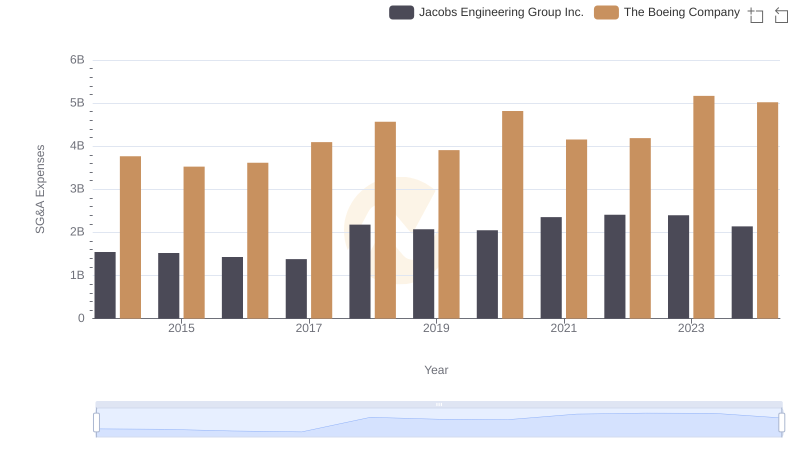

Breaking Down SG&A Expenses: The Boeing Company vs Jacobs Engineering Group Inc.

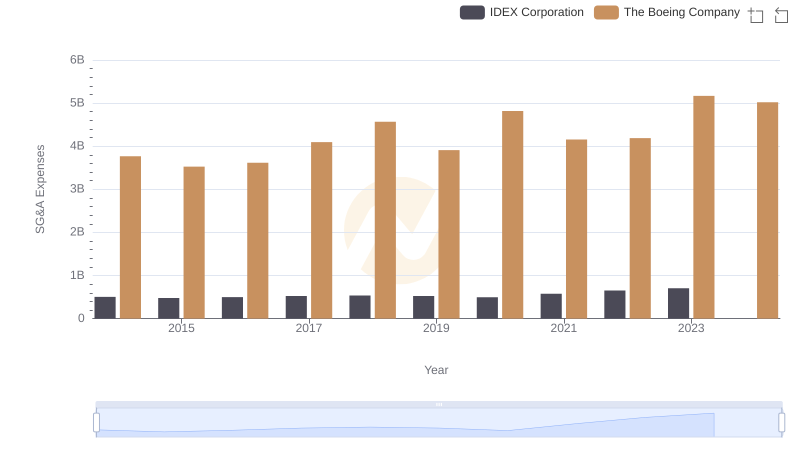

The Boeing Company and IDEX Corporation: SG&A Spending Patterns Compared

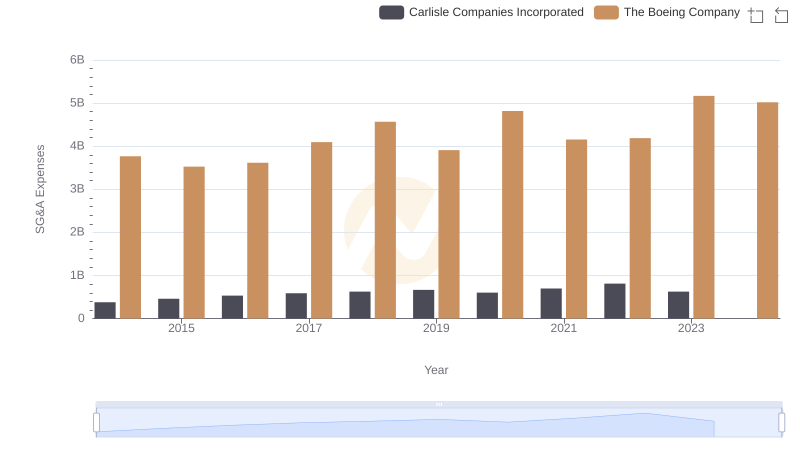

Who Optimizes SG&A Costs Better? The Boeing Company or Carlisle Companies Incorporated

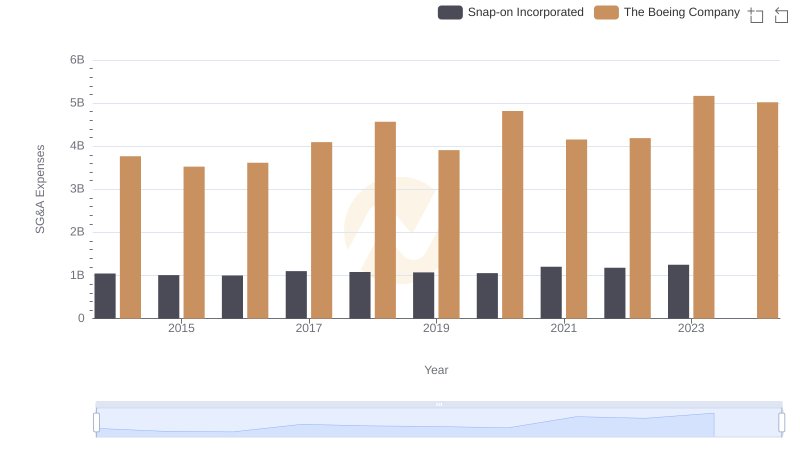

The Boeing Company or Snap-on Incorporated: Who Manages SG&A Costs Better?

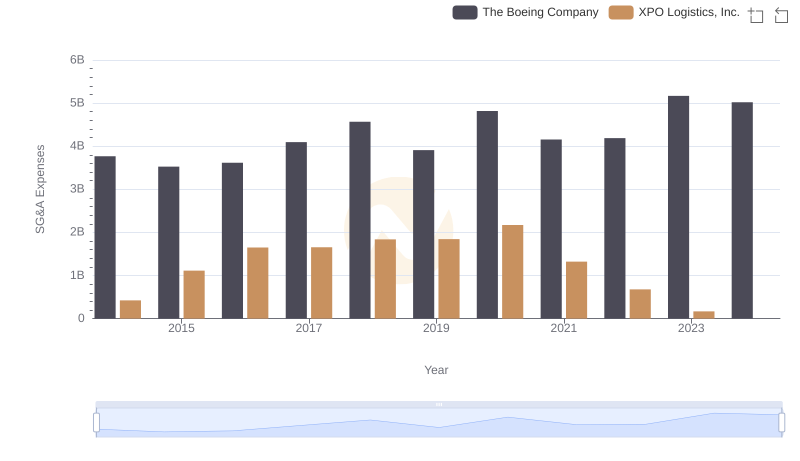

Operational Costs Compared: SG&A Analysis of The Boeing Company and XPO Logistics, Inc.