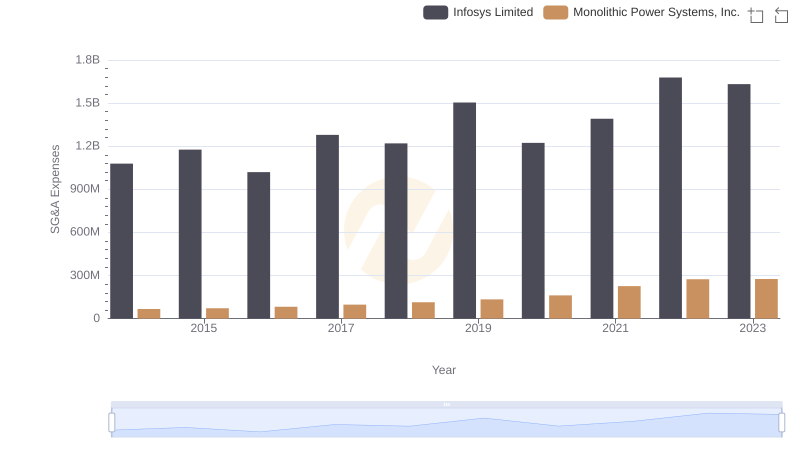

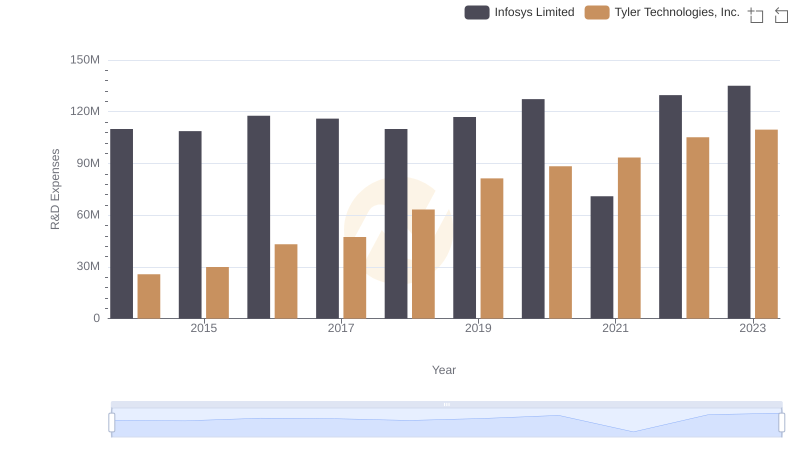

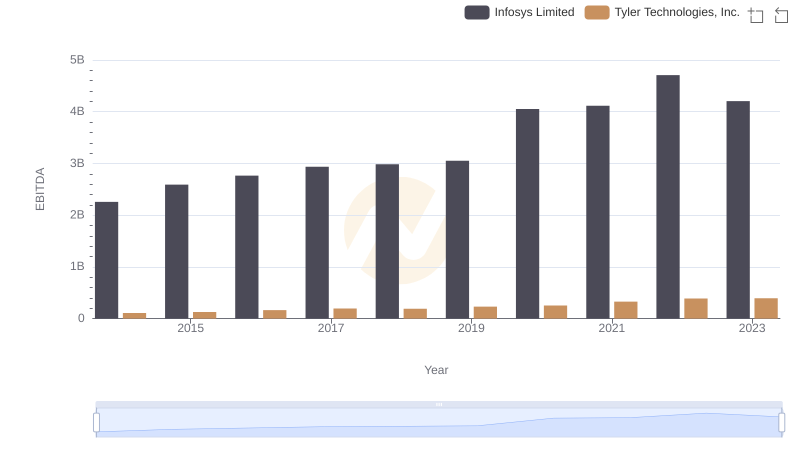

| __timestamp | Infosys Limited | Tyler Technologies, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1079000000 | 108260000 |

| Thursday, January 1, 2015 | 1176000000 | 133317000 |

| Friday, January 1, 2016 | 1020000000 | 167161000 |

| Sunday, January 1, 2017 | 1279000000 | 176974000 |

| Monday, January 1, 2018 | 1220000000 | 207605000 |

| Tuesday, January 1, 2019 | 1504000000 | 257746000 |

| Wednesday, January 1, 2020 | 1223000000 | 259561000 |

| Friday, January 1, 2021 | 1391000000 | 390579000 |

| Saturday, January 1, 2022 | 1678000000 | 403067000 |

| Sunday, January 1, 2023 | 1632000000 | 458345000 |

| Monday, January 1, 2024 | 458669000 |

Unleashing insights

In the ever-evolving landscape of global technology, understanding the financial strategies of industry leaders is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two prominent companies: Infosys Limited and Tyler Technologies, Inc., from 2014 to 2023.

Over the past decade, Infosys Limited has consistently maintained higher SG&A expenses compared to Tyler Technologies, Inc. In 2023, Infosys's SG&A expenses were approximately 3.5 times higher than Tyler's, reflecting its expansive global operations. Notably, Infosys's expenses peaked in 2022, marking a 65% increase from 2014, while Tyler Technologies saw a remarkable 323% rise in the same period, highlighting its aggressive growth strategy.

This financial trajectory underscores the contrasting business models: Infosys's focus on sustaining its global presence and Tyler's rapid expansion in the tech sector. Such insights are invaluable for investors and industry analysts alike.

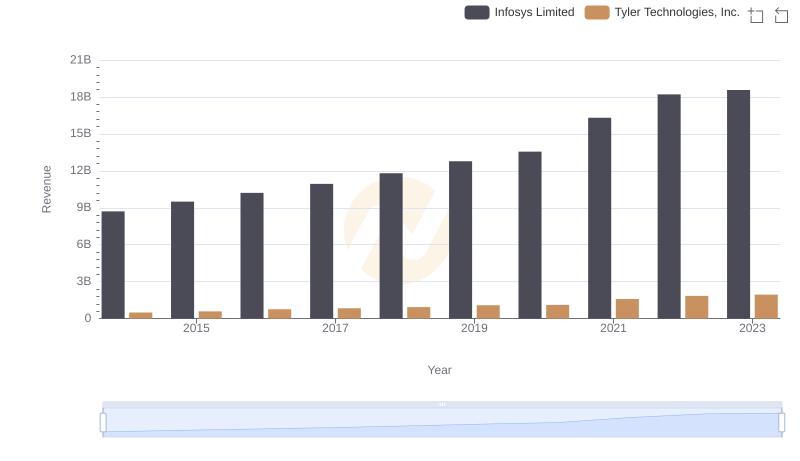

Annual Revenue Comparison: Infosys Limited vs Tyler Technologies, Inc.

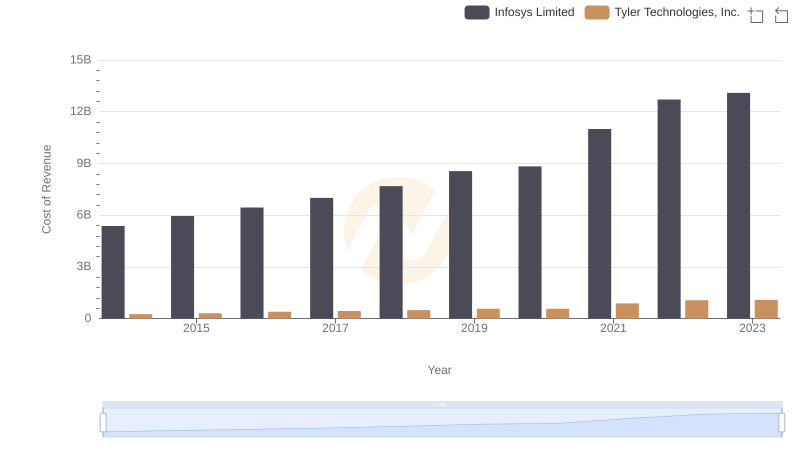

Cost of Revenue: Key Insights for Infosys Limited and Tyler Technologies, Inc.

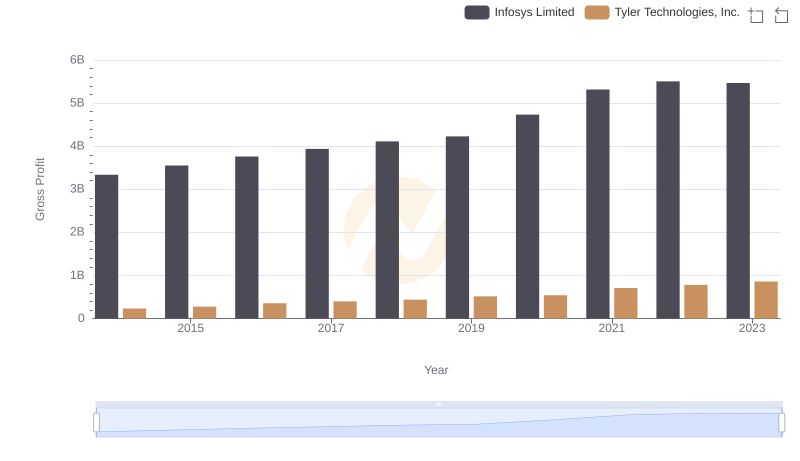

Gross Profit Trends Compared: Infosys Limited vs Tyler Technologies, Inc.

SG&A Efficiency Analysis: Comparing Infosys Limited and Monolithic Power Systems, Inc.

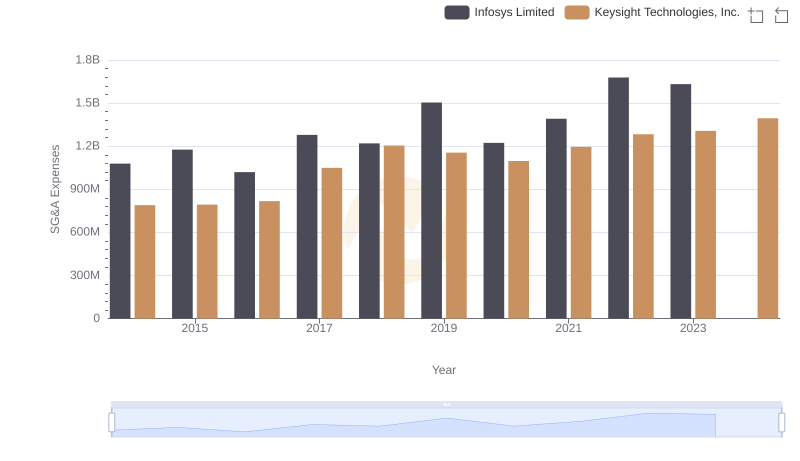

SG&A Efficiency Analysis: Comparing Infosys Limited and Keysight Technologies, Inc.

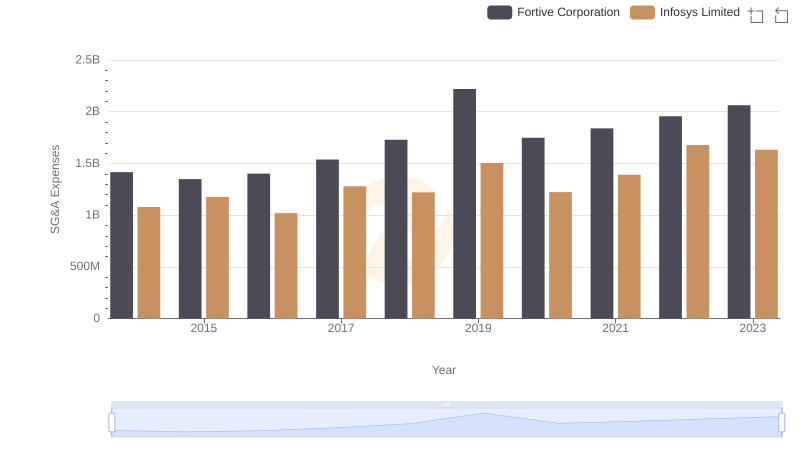

Infosys Limited vs Fortive Corporation: SG&A Expense Trends

Research and Development: Comparing Key Metrics for Infosys Limited and Tyler Technologies, Inc.

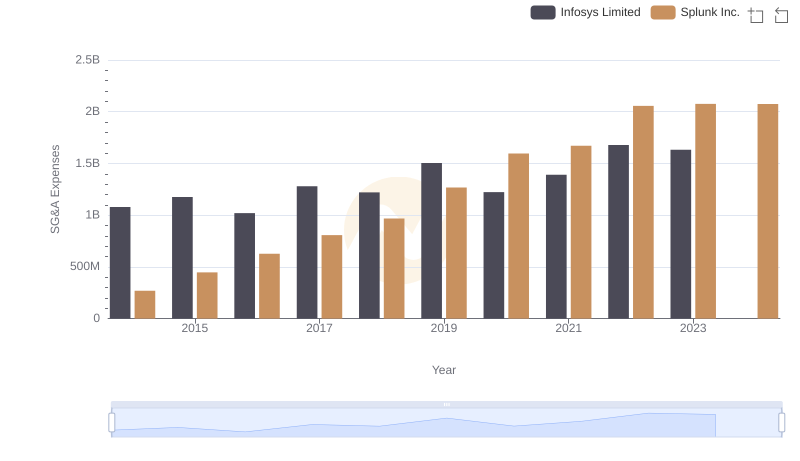

Infosys Limited vs Splunk Inc.: SG&A Expense Trends

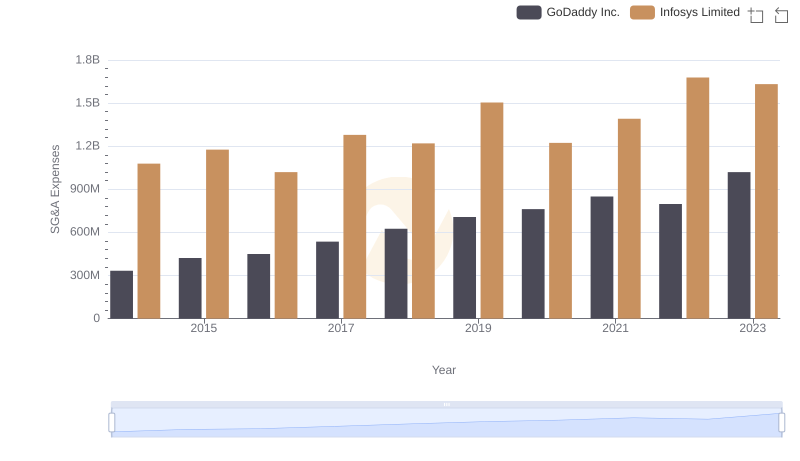

Selling, General, and Administrative Costs: Infosys Limited vs GoDaddy Inc.

Comprehensive EBITDA Comparison: Infosys Limited vs Tyler Technologies, Inc.

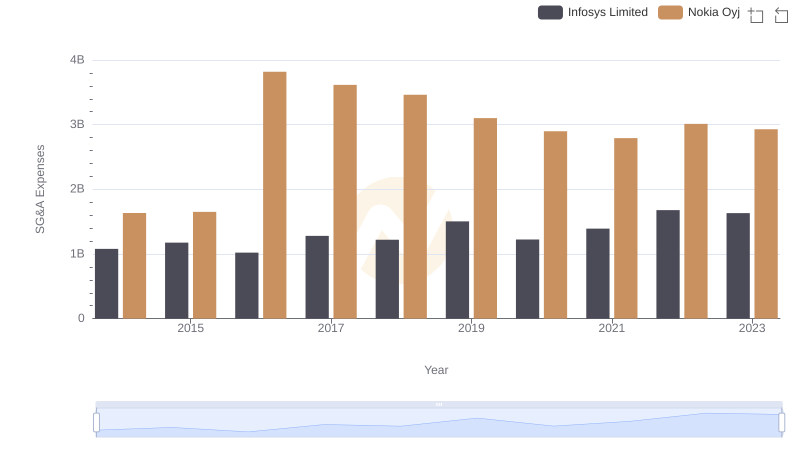

Infosys Limited and Nokia Oyj: SG&A Spending Patterns Compared

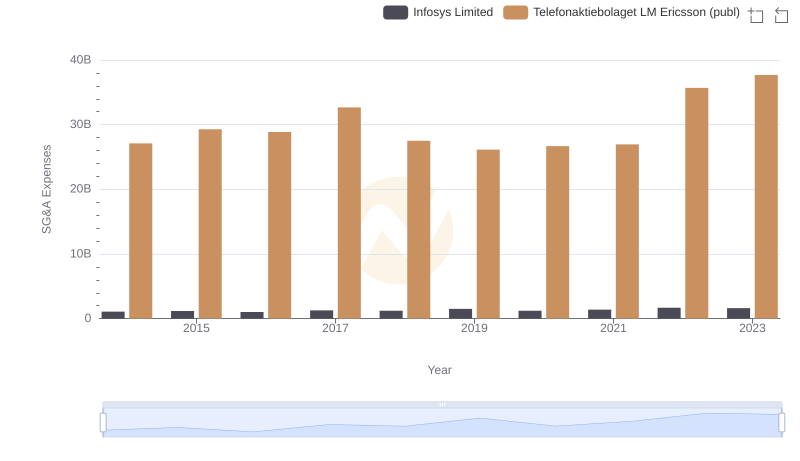

Infosys Limited or Telefonaktiebolaget LM Ericsson (publ): Who Manages SG&A Costs Better?