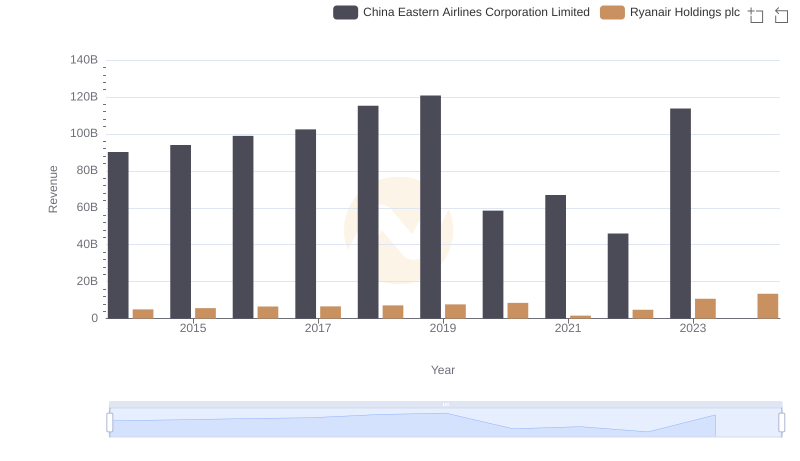

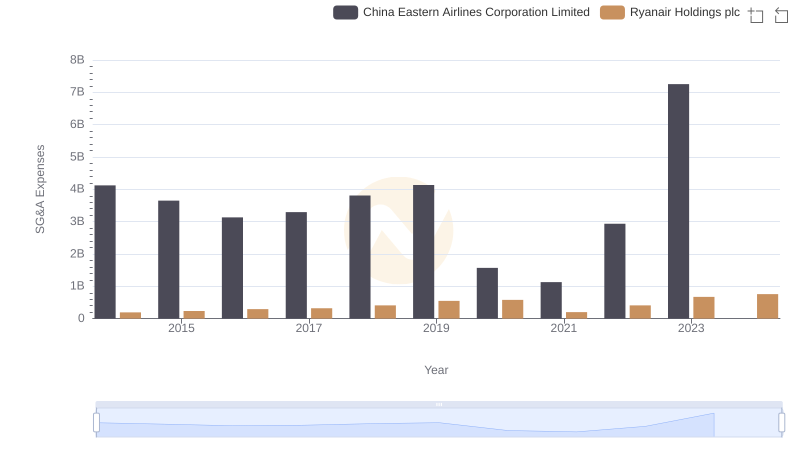

| __timestamp | China Eastern Airlines Corporation Limited | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 78741000000 | 3838100000 |

| Thursday, January 1, 2015 | 77237000000 | 3999600000 |

| Friday, January 1, 2016 | 82676000000 | 4355900000 |

| Sunday, January 1, 2017 | 91592000000 | 4294000000 |

| Monday, January 1, 2018 | 103476000000 | 4512300000 |

| Tuesday, January 1, 2019 | 108865000000 | 5492800000 |

| Wednesday, January 1, 2020 | 72523000000 | 6039900000 |

| Friday, January 1, 2021 | 81828000000 | 1702700000 |

| Saturday, January 1, 2022 | 74599000000 | 4009800000 |

| Sunday, January 1, 2023 | 112461000000 | 7735000000 |

| Monday, January 1, 2024 | 9566400000 |

Unleashing insights

In the competitive skies of global aviation, cost efficiency is a critical factor for success. This analysis delves into the cost of revenue trends for Ryanair Holdings plc and China Eastern Airlines Corporation Limited from 2014 to 2023. Ryanair, known for its low-cost model, consistently maintained a cost of revenue below $10 billion, peaking at approximately $9.6 billion in 2024. In contrast, China Eastern Airlines, a major player in Asia, exhibited a more volatile cost structure, with figures ranging from $72 billion to $112 billion. Notably, 2023 marked a significant year for China Eastern, with costs soaring to $112 billion, a 50% increase from 2020. This disparity highlights Ryanair's strategic efficiency, achieving lower costs despite market fluctuations. Missing data for China Eastern in 2024 suggests potential reporting delays or strategic shifts. As the aviation industry evolves, these insights underscore the importance of cost management in sustaining competitive advantage.

Ryanair Holdings plc vs China Eastern Airlines Corporation Limited: Examining Key Revenue Metrics

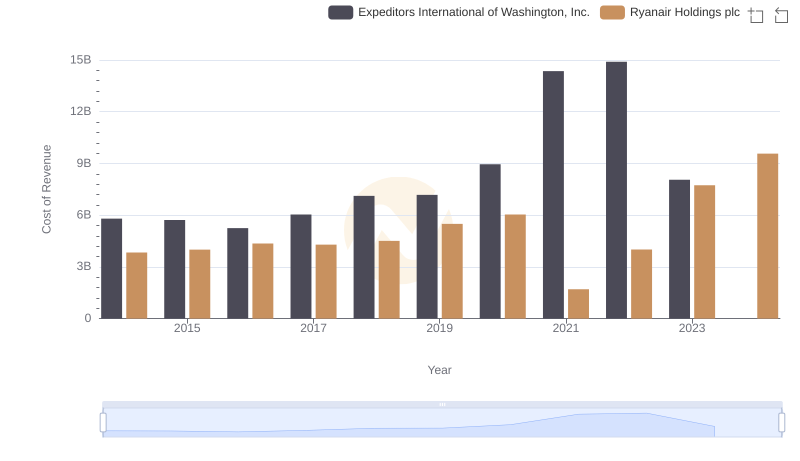

Cost Insights: Breaking Down Ryanair Holdings plc and Expeditors International of Washington, Inc.'s Expenses

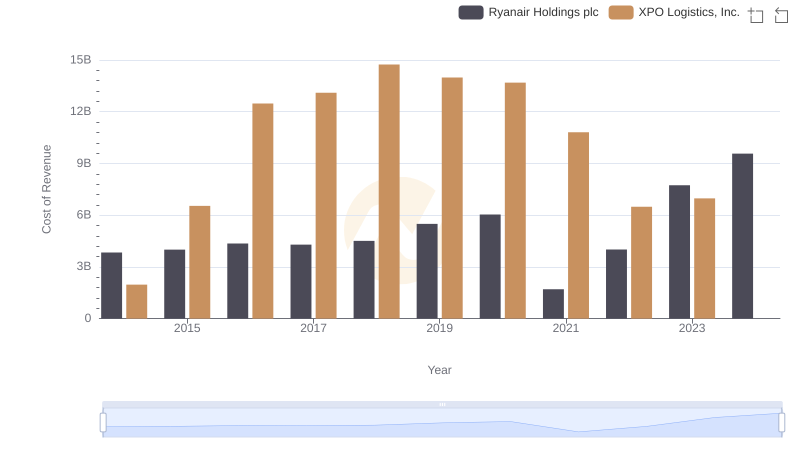

Cost of Revenue: Key Insights for Ryanair Holdings plc and XPO Logistics, Inc.

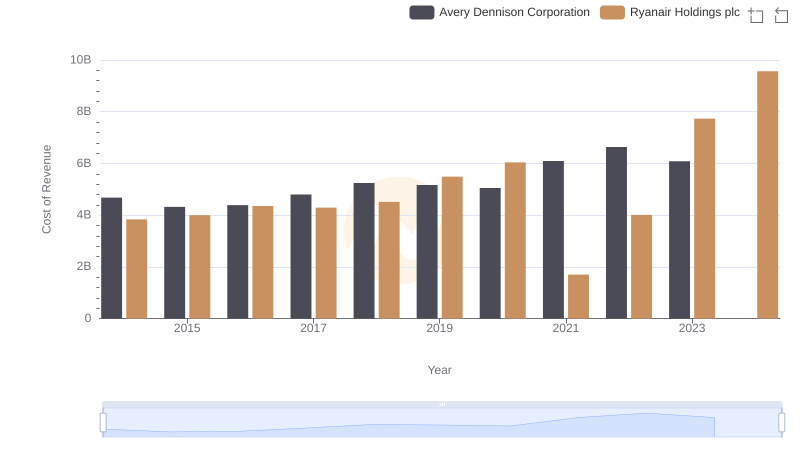

Ryanair Holdings plc vs Avery Dennison Corporation: Efficiency in Cost of Revenue Explored

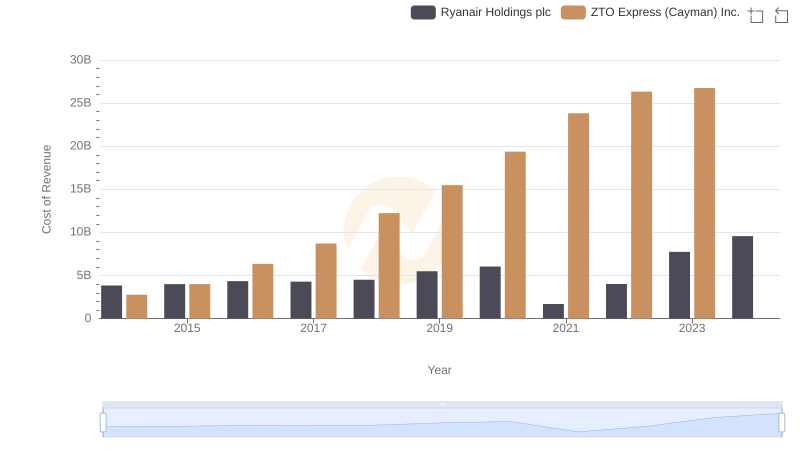

Cost Insights: Breaking Down Ryanair Holdings plc and ZTO Express (Cayman) Inc.'s Expenses

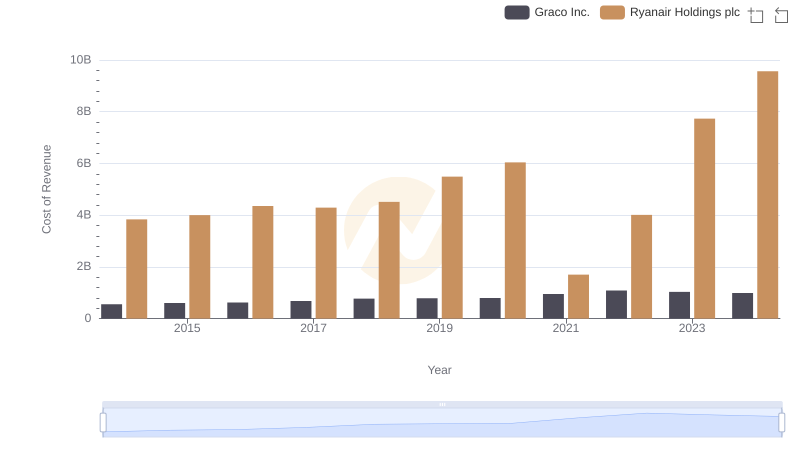

Ryanair Holdings plc vs Graco Inc.: Efficiency in Cost of Revenue Explored

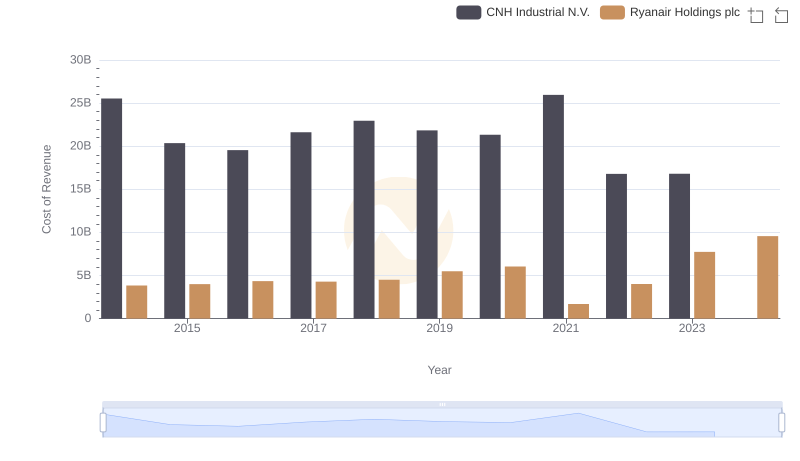

Analyzing Cost of Revenue: Ryanair Holdings plc and CNH Industrial N.V.

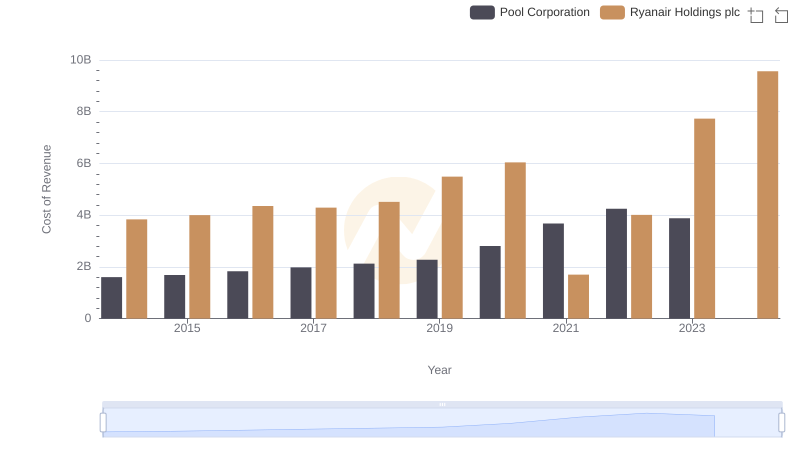

Cost Insights: Breaking Down Ryanair Holdings plc and Pool Corporation's Expenses

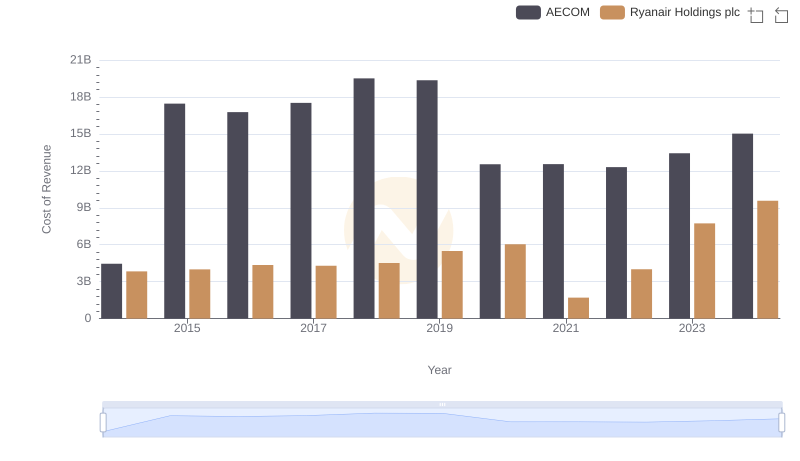

Cost Insights: Breaking Down Ryanair Holdings plc and AECOM's Expenses

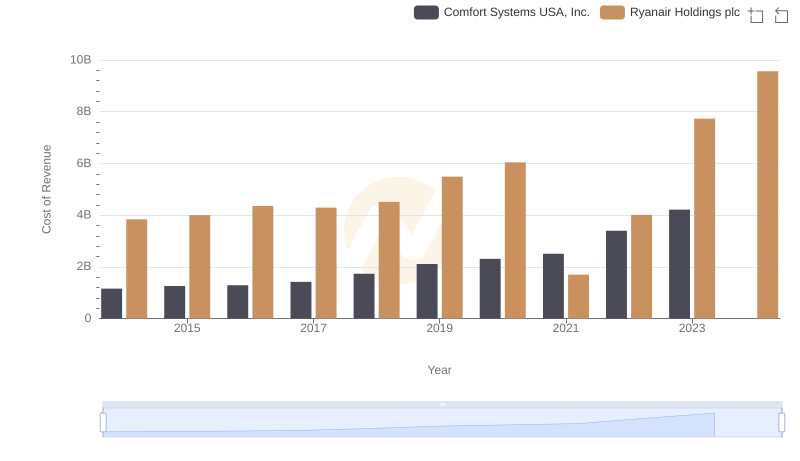

Cost of Revenue Trends: Ryanair Holdings plc vs Comfort Systems USA, Inc.

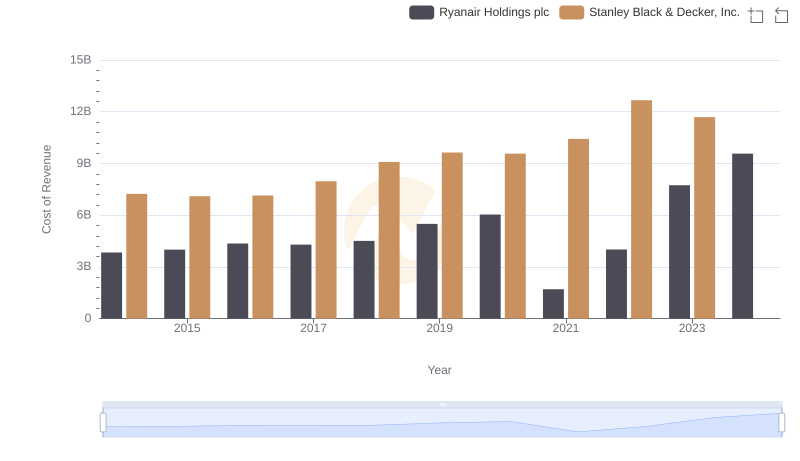

Cost of Revenue Comparison: Ryanair Holdings plc vs Stanley Black & Decker, Inc.

Ryanair Holdings plc vs China Eastern Airlines Corporation Limited: SG&A Expense Trends