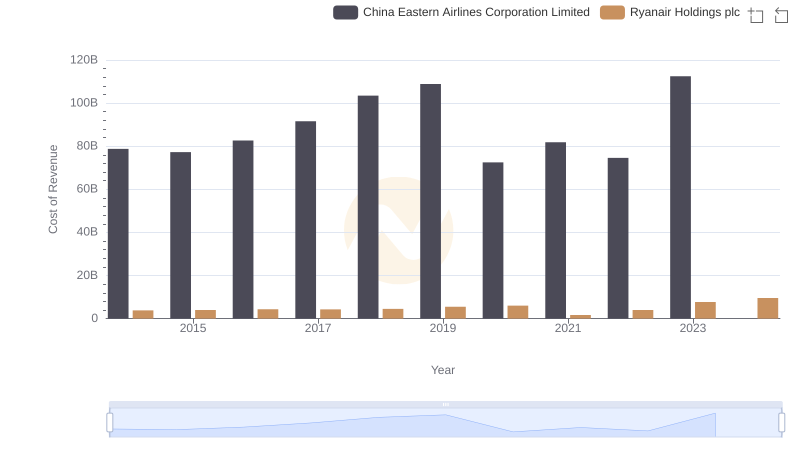

| __timestamp | China Eastern Airlines Corporation Limited | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 90185000000 | 5036700000 |

| Thursday, January 1, 2015 | 93969000000 | 5654000000 |

| Friday, January 1, 2016 | 98904000000 | 6535800000 |

| Sunday, January 1, 2017 | 102475000000 | 6647800000 |

| Monday, January 1, 2018 | 115210000000 | 7151000000 |

| Tuesday, January 1, 2019 | 120796000000 | 7697400000 |

| Wednesday, January 1, 2020 | 58470000000 | 8494799999 |

| Friday, January 1, 2021 | 66887000000 | 1635800000 |

| Saturday, January 1, 2022 | 46111000000 | 4800900000 |

| Sunday, January 1, 2023 | 113741000000 | 10775200000 |

| Monday, January 1, 2024 | 13443800000 |

Data in motion

In the ever-evolving aviation industry, Ryanair Holdings plc and China Eastern Airlines Corporation Limited stand as giants from Europe and Asia, respectively. Over the past decade, these airlines have navigated turbulent skies, with their revenue trajectories offering a fascinating glimpse into their strategic maneuvers.

From 2014 to 2023, China Eastern Airlines consistently outpaced Ryanair in revenue, peaking in 2019 with a staggering 120% increase from its 2014 figures. However, the pandemic-induced downturn in 2020 saw its revenue plummet by over 50%, a stark contrast to Ryanair's more resilient performance, which only saw a 20% dip. By 2023, Ryanair's revenue had rebounded impressively, nearly doubling from its 2020 low, while China Eastern's recovery was more modest.

This comparison underscores the resilience and adaptability of these airlines, highlighting the diverse challenges and opportunities in the global aviation landscape.

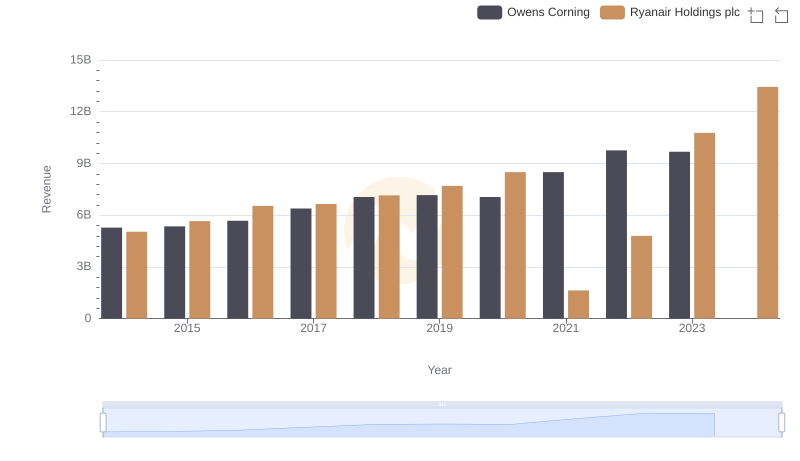

Revenue Showdown: Ryanair Holdings plc vs Owens Corning

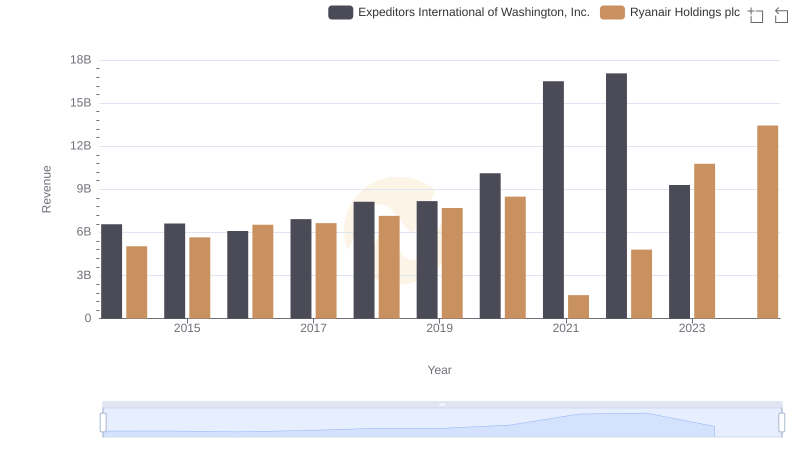

Revenue Insights: Ryanair Holdings plc and Expeditors International of Washington, Inc. Performance Compared

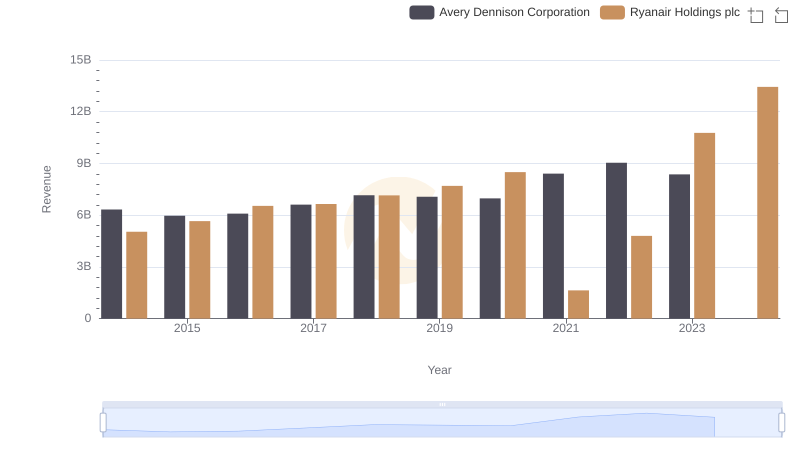

Breaking Down Revenue Trends: Ryanair Holdings plc vs Avery Dennison Corporation

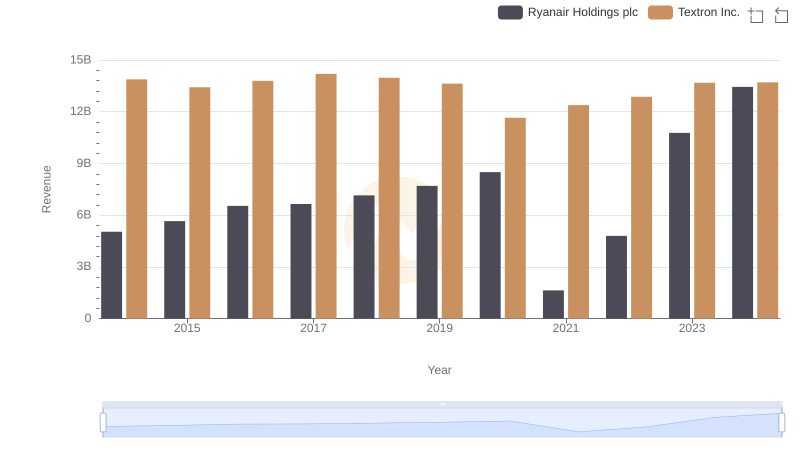

Ryanair Holdings plc and Textron Inc.: A Comprehensive Revenue Analysis

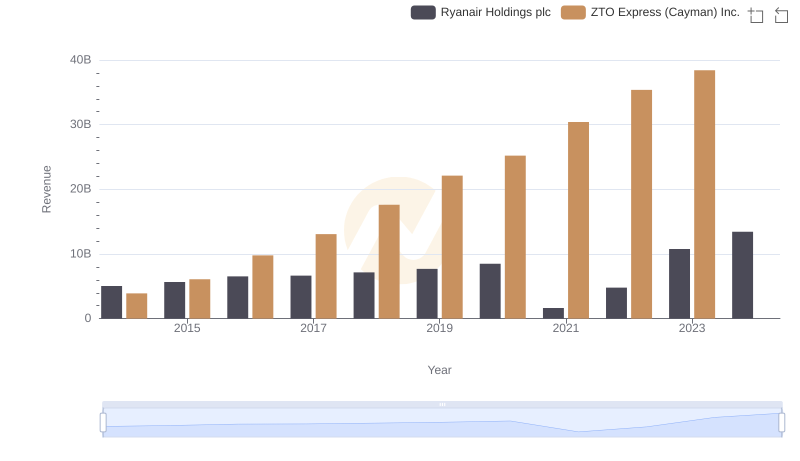

Who Generates More Revenue? Ryanair Holdings plc or ZTO Express (Cayman) Inc.

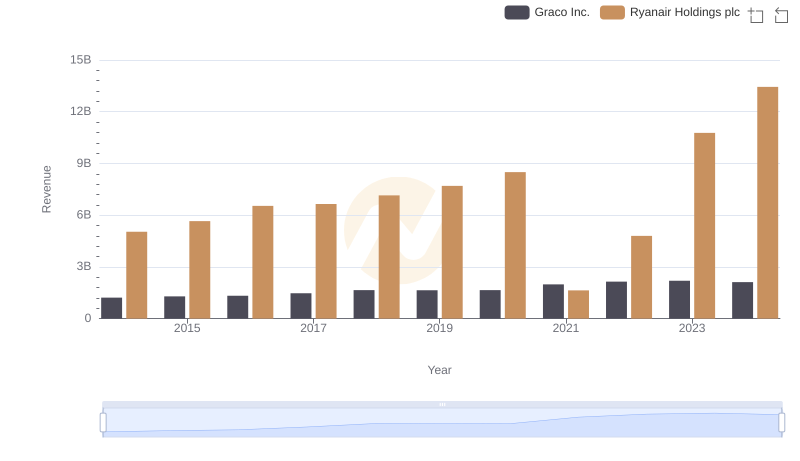

Ryanair Holdings plc and Graco Inc.: A Comprehensive Revenue Analysis

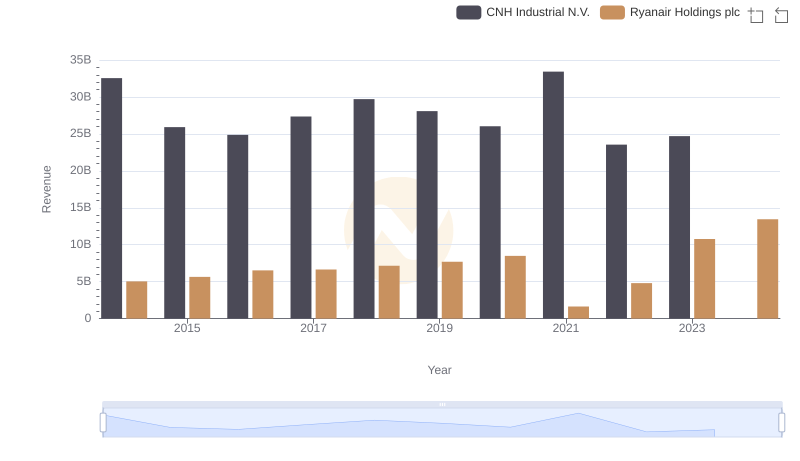

Breaking Down Revenue Trends: Ryanair Holdings plc vs CNH Industrial N.V.

Ryanair Holdings plc vs China Eastern Airlines Corporation Limited: Efficiency in Cost of Revenue Explored

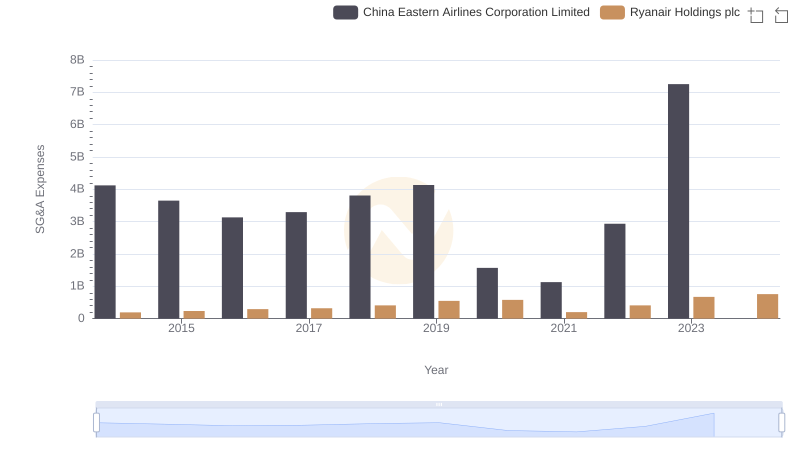

Ryanair Holdings plc vs China Eastern Airlines Corporation Limited: SG&A Expense Trends