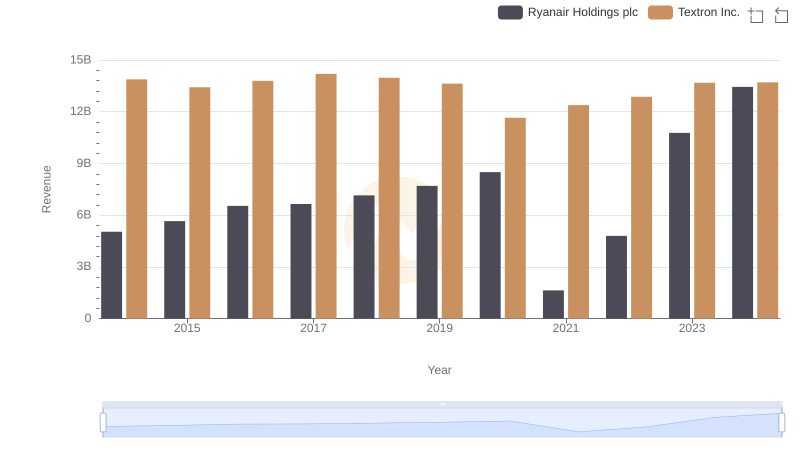

| __timestamp | Ryanair Holdings plc | Textron Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 192800000 | 1361000000 |

| Thursday, January 1, 2015 | 233900000 | 1304000000 |

| Friday, January 1, 2016 | 292700000 | 1304000000 |

| Sunday, January 1, 2017 | 322300000 | 1337000000 |

| Monday, January 1, 2018 | 410400000 | 1275000000 |

| Tuesday, January 1, 2019 | 547300000 | 1152000000 |

| Wednesday, January 1, 2020 | 578800000 | 1045000000 |

| Friday, January 1, 2021 | 201500000 | 1221000000 |

| Saturday, January 1, 2022 | 411300000 | 1186000000 |

| Sunday, January 1, 2023 | 674400000 | 1225000000 |

| Monday, January 1, 2024 | 757200000 | 1156000000 |

Infusing magic into the data realm

In the competitive world of business, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Ryanair Holdings plc and Textron Inc. offer a fascinating study in contrasts from 2014 to 2024. Ryanair, known for its cost-efficient operations, has seen its SG&A expenses grow by approximately 293%, from 19% of Textron's expenses in 2014 to 59% in 2023. Meanwhile, Textron, a leader in aerospace and defense, has maintained a relatively stable SG&A cost structure, with a notable spike in 2024. This spike, a tenfold increase, suggests strategic investments or restructuring. Ryanair's fluctuating expenses, particularly the dip in 2021, reflect its adaptive strategies in response to market conditions. As businesses navigate economic uncertainties, these insights underscore the importance of strategic SG&A management in sustaining competitive advantage.

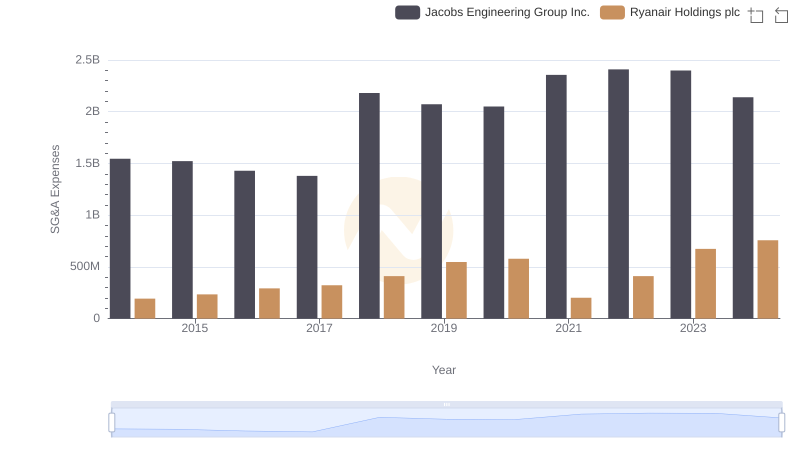

Who Optimizes SG&A Costs Better? Ryanair Holdings plc or Jacobs Engineering Group Inc.

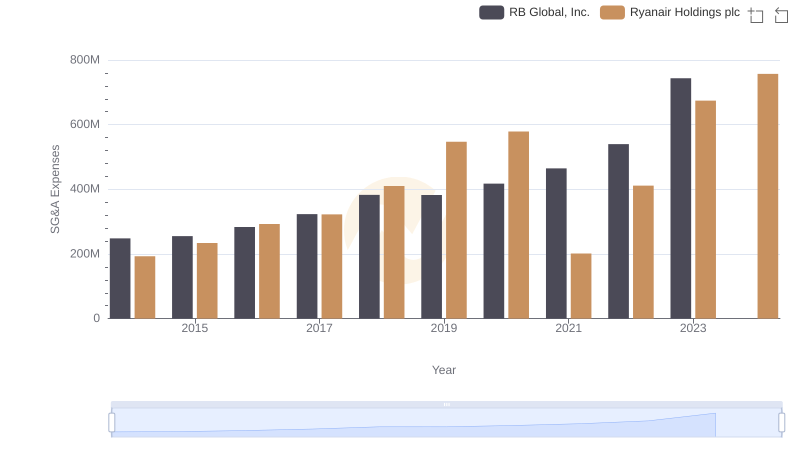

Comparing SG&A Expenses: Ryanair Holdings plc vs RB Global, Inc. Trends and Insights

Ryanair Holdings plc and Textron Inc.: A Comprehensive Revenue Analysis

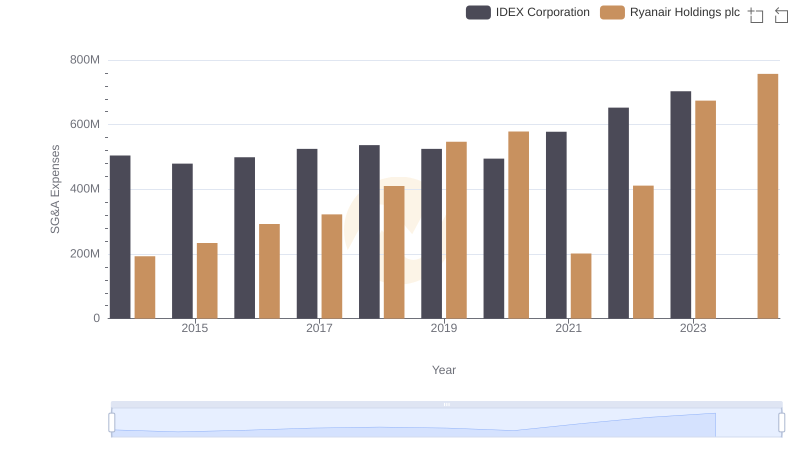

Ryanair Holdings plc and IDEX Corporation: SG&A Spending Patterns Compared

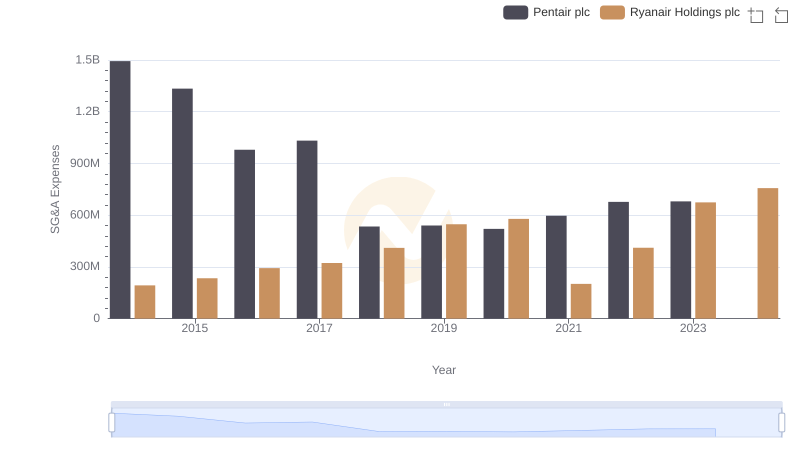

Ryanair Holdings plc and Pentair plc: SG&A Spending Patterns Compared

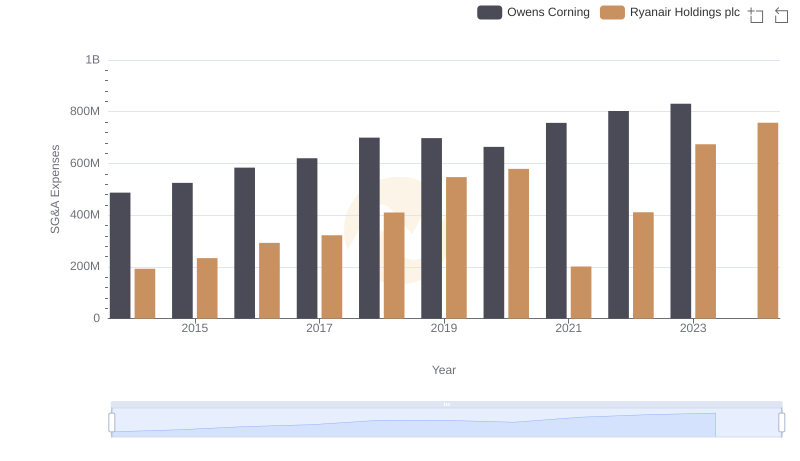

Comparing SG&A Expenses: Ryanair Holdings plc vs Owens Corning Trends and Insights

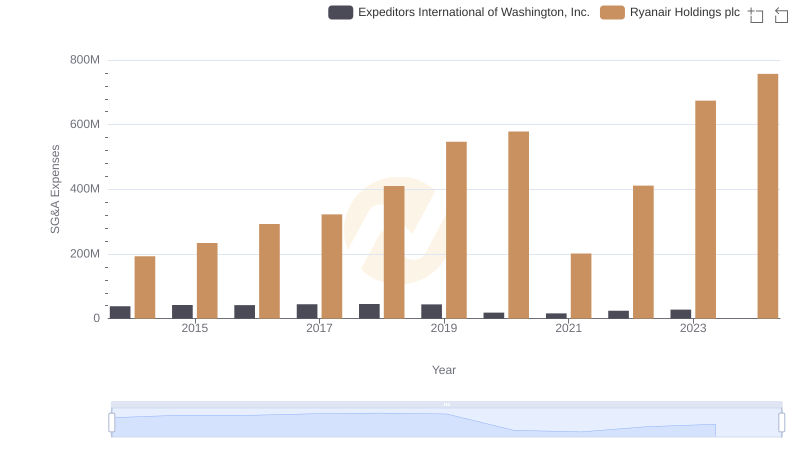

Selling, General, and Administrative Costs: Ryanair Holdings plc vs Expeditors International of Washington, Inc.

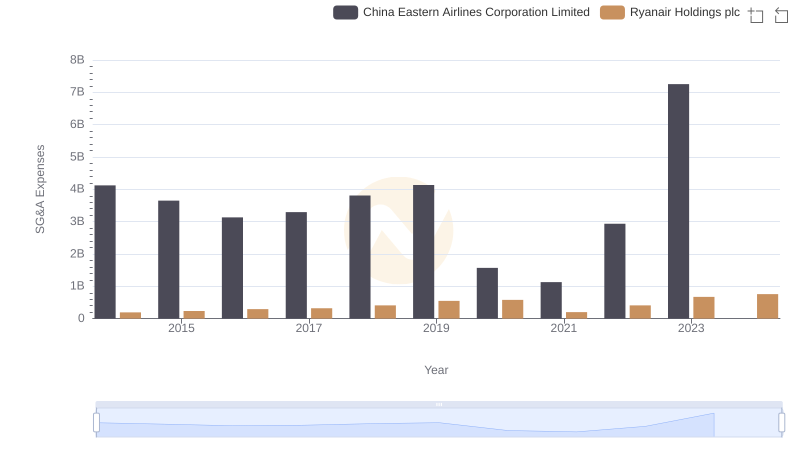

Ryanair Holdings plc vs China Eastern Airlines Corporation Limited: SG&A Expense Trends

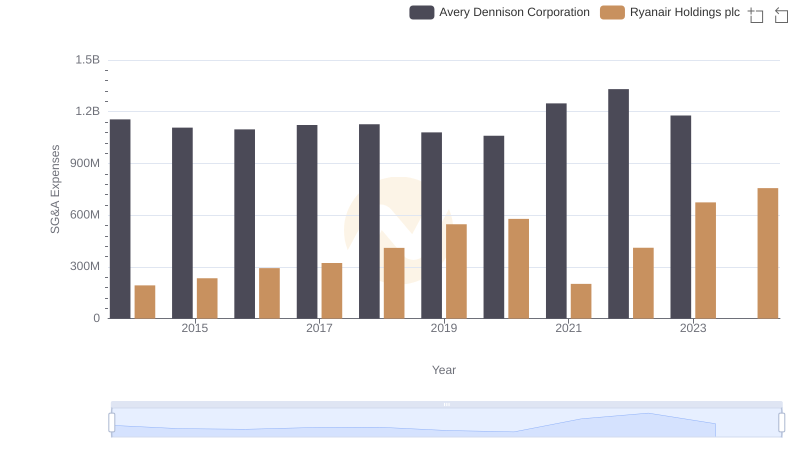

Breaking Down SG&A Expenses: Ryanair Holdings plc vs Avery Dennison Corporation

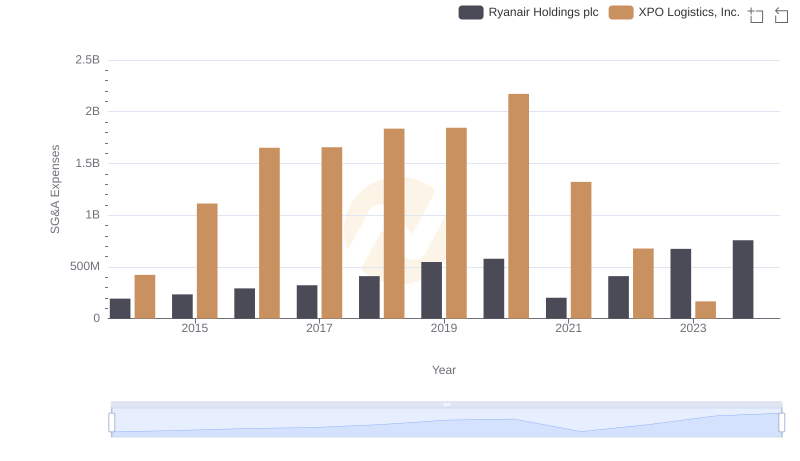

Breaking Down SG&A Expenses: Ryanair Holdings plc vs XPO Logistics, Inc.

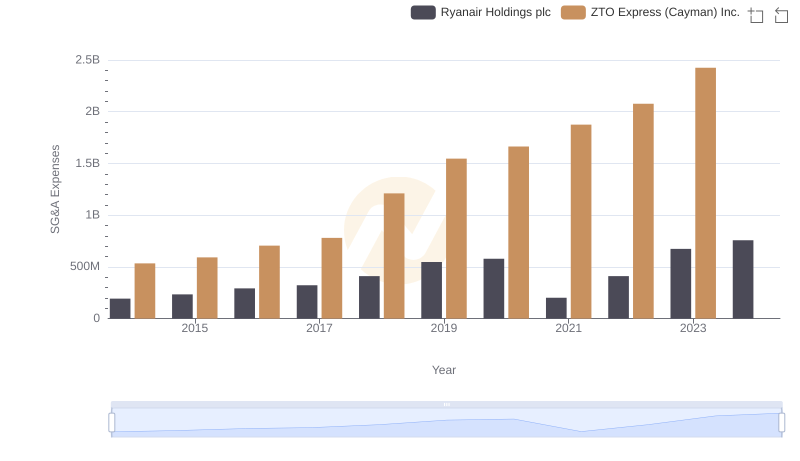

Breaking Down SG&A Expenses: Ryanair Holdings plc vs ZTO Express (Cayman) Inc.

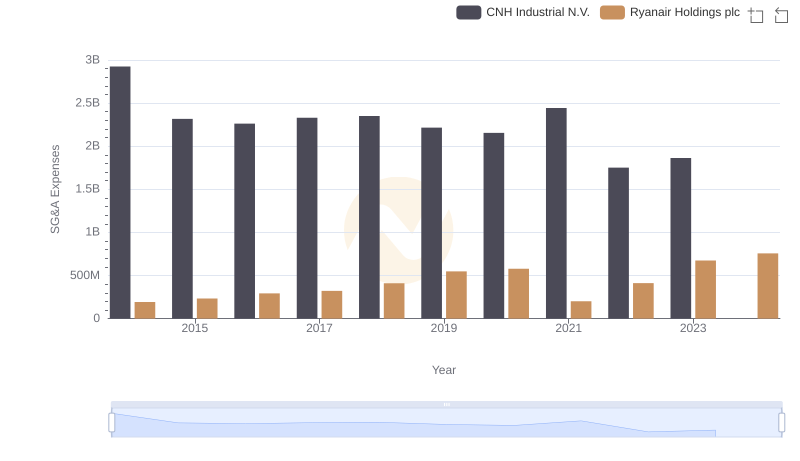

Cost Management Insights: SG&A Expenses for Ryanair Holdings plc and CNH Industrial N.V.