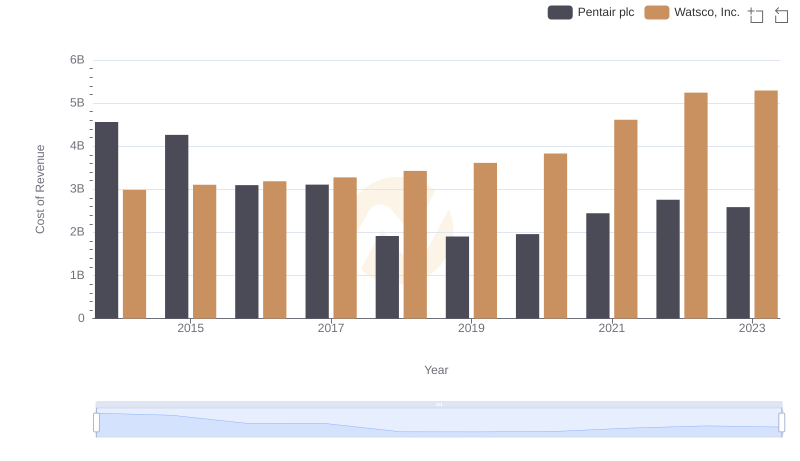

| __timestamp | Pentair plc | Watsco, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 7039000000 | 3944540000 |

| Thursday, January 1, 2015 | 6449000000 | 4113239000 |

| Friday, January 1, 2016 | 4890000000 | 4220702000 |

| Sunday, January 1, 2017 | 4936500000 | 4341955000 |

| Monday, January 1, 2018 | 2965100000 | 4546653000 |

| Tuesday, January 1, 2019 | 2957200000 | 4770362000 |

| Wednesday, January 1, 2020 | 3017800000 | 5054928000 |

| Friday, January 1, 2021 | 3764800000 | 6280192000 |

| Saturday, January 1, 2022 | 4121800000 | 7274344000 |

| Sunday, January 1, 2023 | 4104500000 | 7283767000 |

| Monday, January 1, 2024 | 4082800000 | 7618317000 |

In pursuit of knowledge

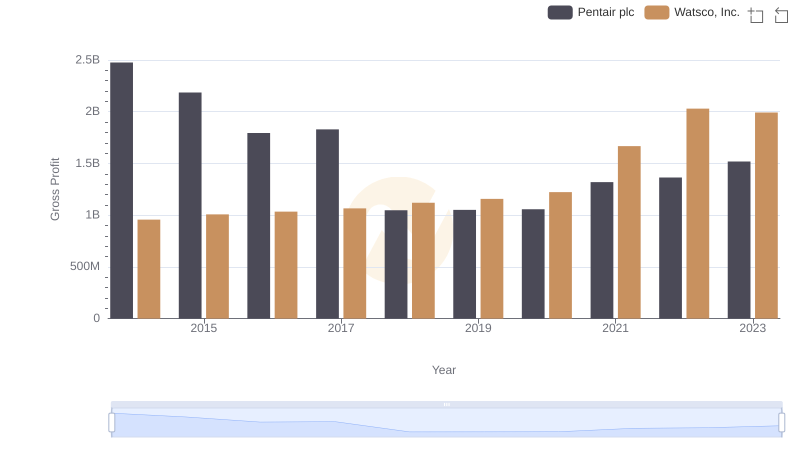

In the ever-evolving landscape of industrial giants, Watsco, Inc. and Pentair plc have carved distinct paths over the past decade. From 2014 to 2023, these companies have showcased contrasting revenue trajectories, reflecting their strategic maneuvers and market dynamics.

Watsco, Inc. has demonstrated a robust growth pattern, with revenues surging by approximately 85% from 2014 to 2023. This consistent upward trend underscores the company's resilience and adaptability in the HVAC distribution sector, culminating in a peak revenue of over $7.28 billion in 2023.

Conversely, Pentair plc experienced a revenue decline of around 42% from its 2014 high. Despite challenges, the company has shown signs of recovery, with a modest uptick in recent years, reaching $4.10 billion in 2023. This reflects Pentair's strategic shifts and market recalibrations.

This comparative analysis highlights the divergent paths of Watsco, Inc. and Pentair plc, offering valuable insights into their market strategies and future potential.

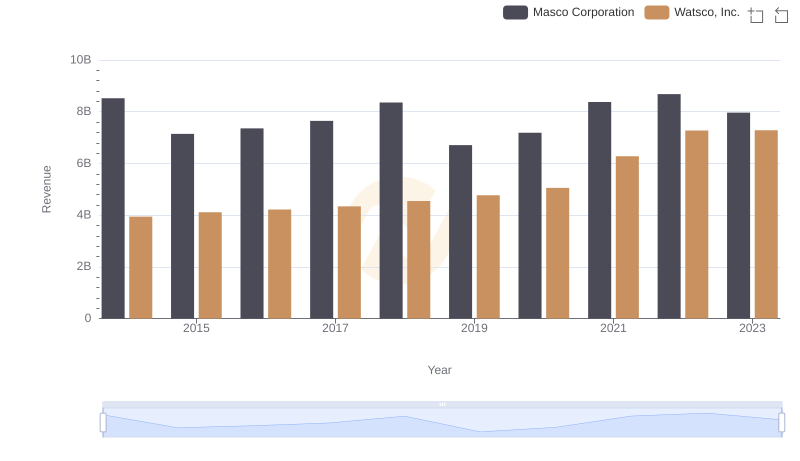

Revenue Insights: Watsco, Inc. and Masco Corporation Performance Compared

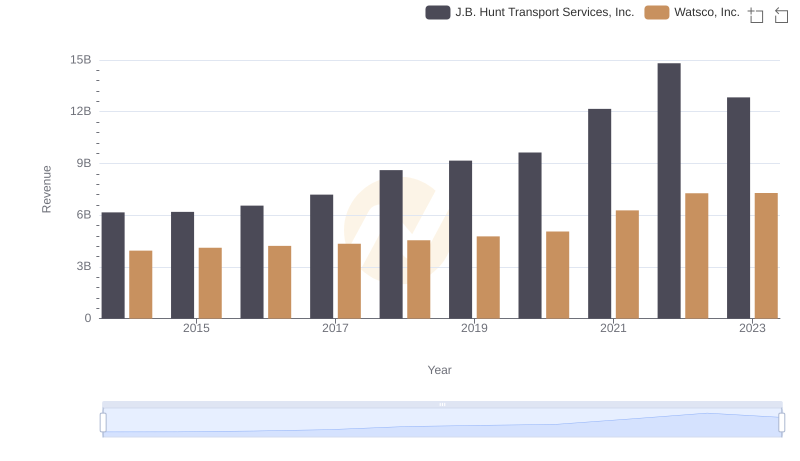

Watsco, Inc. vs J.B. Hunt Transport Services, Inc.: Annual Revenue Growth Compared

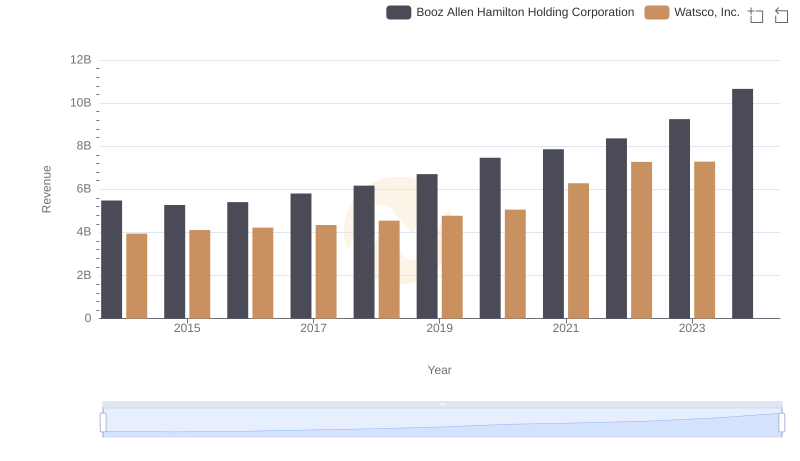

Watsco, Inc. vs Booz Allen Hamilton Holding Corporation: Annual Revenue Growth Compared

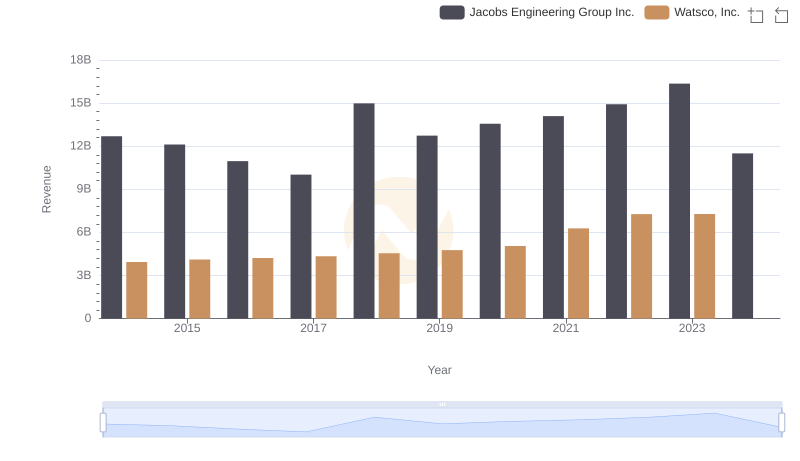

Breaking Down Revenue Trends: Watsco, Inc. vs Jacobs Engineering Group Inc.

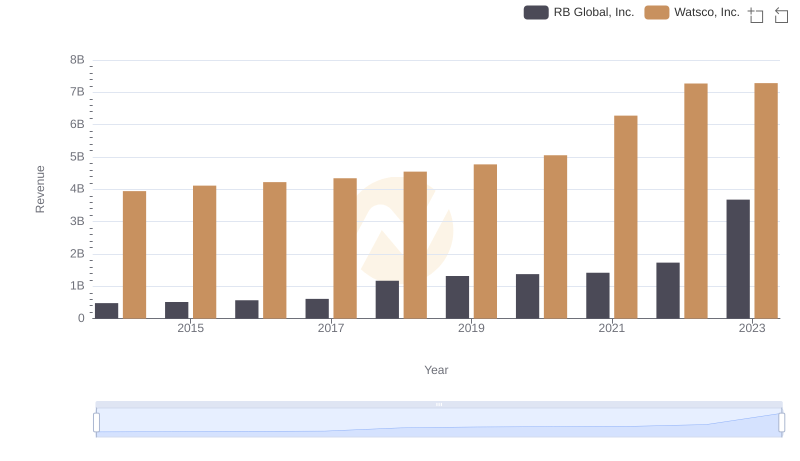

Breaking Down Revenue Trends: Watsco, Inc. vs RB Global, Inc.

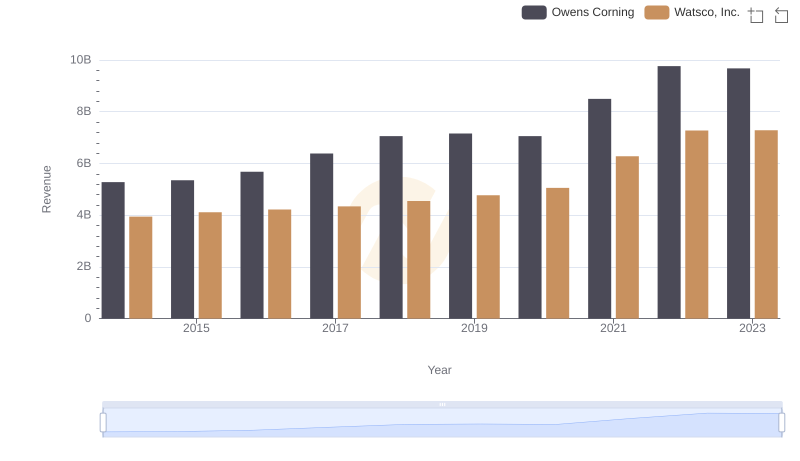

Watsco, Inc. vs Owens Corning: Annual Revenue Growth Compared

Cost of Revenue Trends: Watsco, Inc. vs Pentair plc

Gross Profit Comparison: Watsco, Inc. and Pentair plc Trends

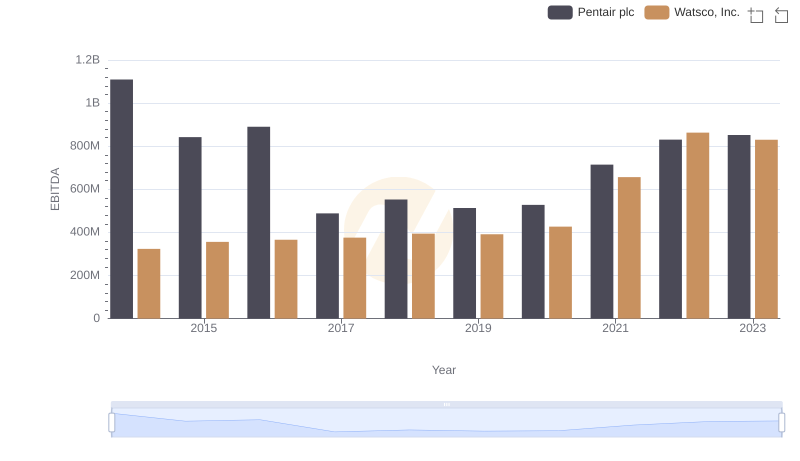

EBITDA Performance Review: Watsco, Inc. vs Pentair plc