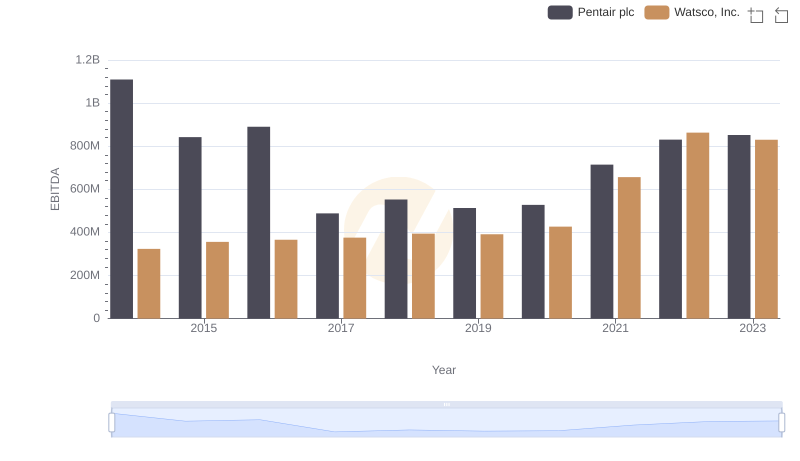

| __timestamp | Pentair plc | Watsco, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2476000000 | 956402000 |

| Thursday, January 1, 2015 | 2185800000 | 1007357000 |

| Friday, January 1, 2016 | 1794100000 | 1034584000 |

| Sunday, January 1, 2017 | 1829100000 | 1065659000 |

| Monday, January 1, 2018 | 1047700000 | 1120252000 |

| Tuesday, January 1, 2019 | 1051500000 | 1156956000 |

| Wednesday, January 1, 2020 | 1057600000 | 1222821000 |

| Friday, January 1, 2021 | 1319200000 | 1667545000 |

| Saturday, January 1, 2022 | 1364600000 | 2030289000 |

| Sunday, January 1, 2023 | 1519200000 | 1992140000 |

| Monday, January 1, 2024 | 1598800000 | 2044713000 |

Data in motion

In the ever-evolving landscape of industrial giants, Watsco, Inc. and Pentair plc have carved out significant niches. Over the past decade, these companies have demonstrated contrasting trajectories in their gross profit margins. From 2014 to 2023, Pentair plc experienced a notable decline of approximately 39% in gross profit, starting at a peak in 2014 and reaching its lowest in 2018. However, a recovery trend is evident, with a 45% increase from 2018 to 2023. Meanwhile, Watsco, Inc. has shown a consistent upward trend, with gross profits nearly doubling over the same period. This growth highlights Watsco's resilience and strategic prowess in navigating market challenges. As we delve into these trends, it becomes clear that while Pentair is on a recovery path, Watsco continues to strengthen its market position, making it a fascinating study in industrial dynamics.

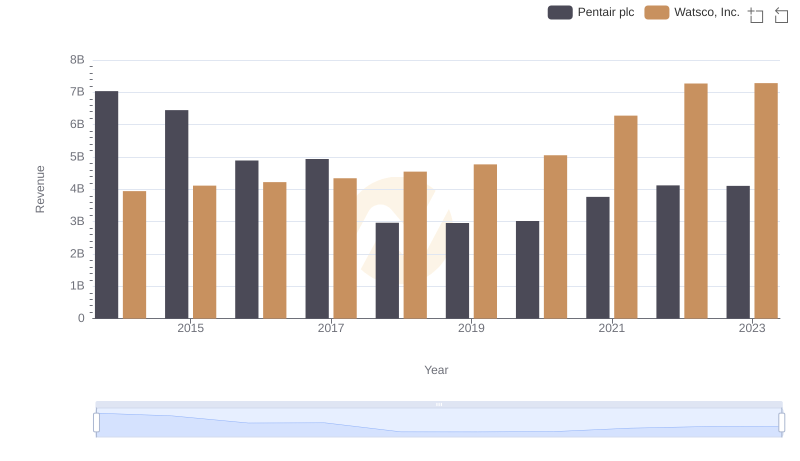

Revenue Insights: Watsco, Inc. and Pentair plc Performance Compared

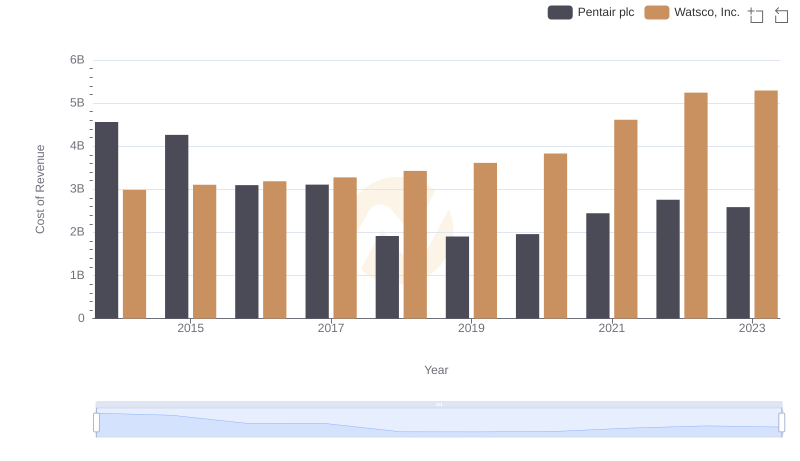

Cost of Revenue Trends: Watsco, Inc. vs Pentair plc

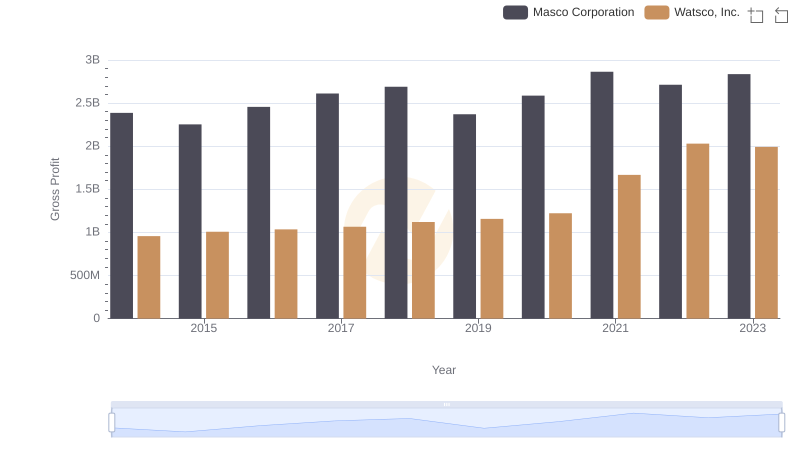

Gross Profit Trends Compared: Watsco, Inc. vs Masco Corporation

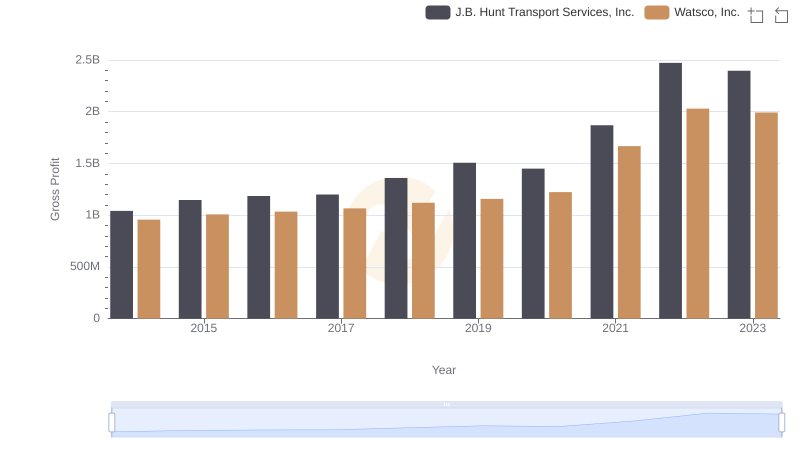

Key Insights on Gross Profit: Watsco, Inc. vs J.B. Hunt Transport Services, Inc.

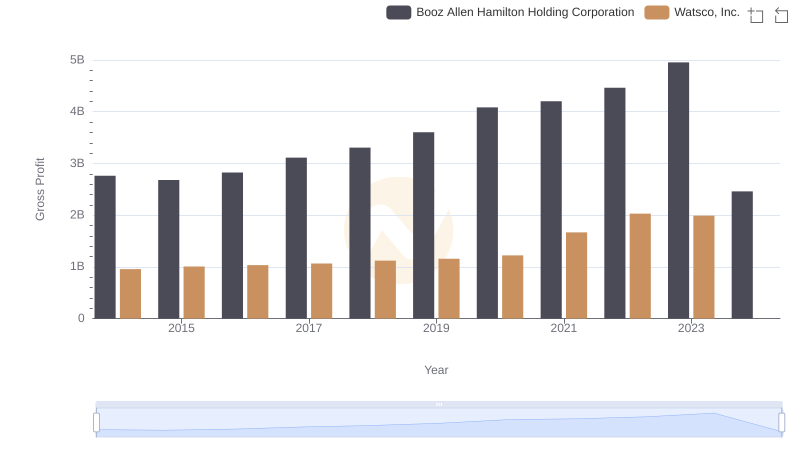

Who Generates Higher Gross Profit? Watsco, Inc. or Booz Allen Hamilton Holding Corporation

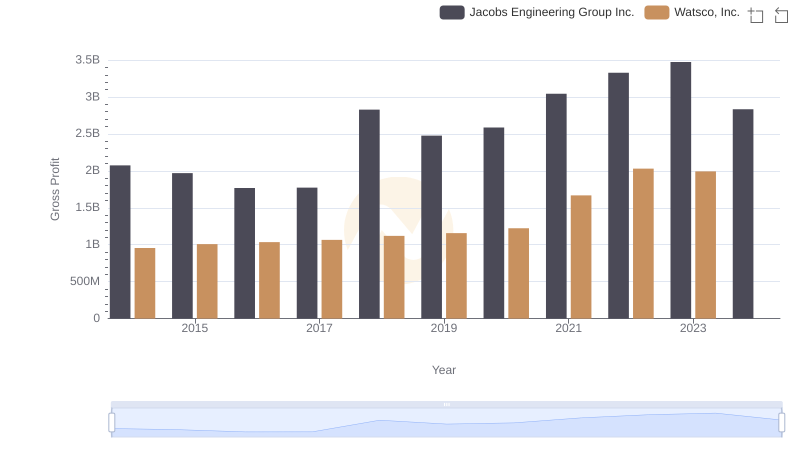

Key Insights on Gross Profit: Watsco, Inc. vs Jacobs Engineering Group Inc.

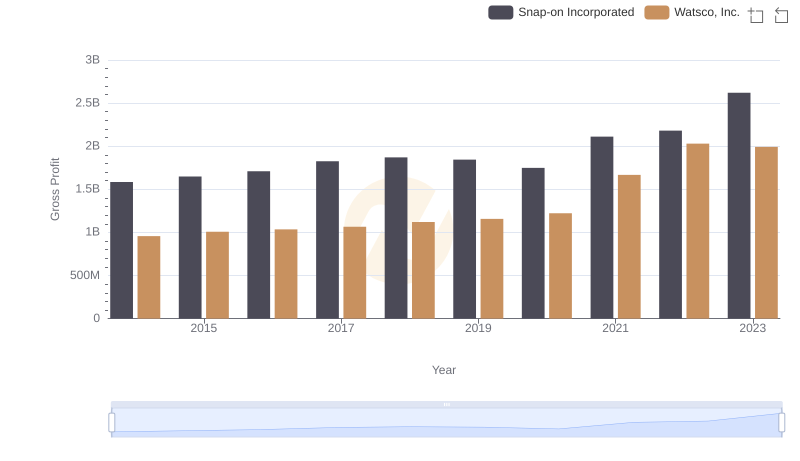

Gross Profit Comparison: Watsco, Inc. and Snap-on Incorporated Trends

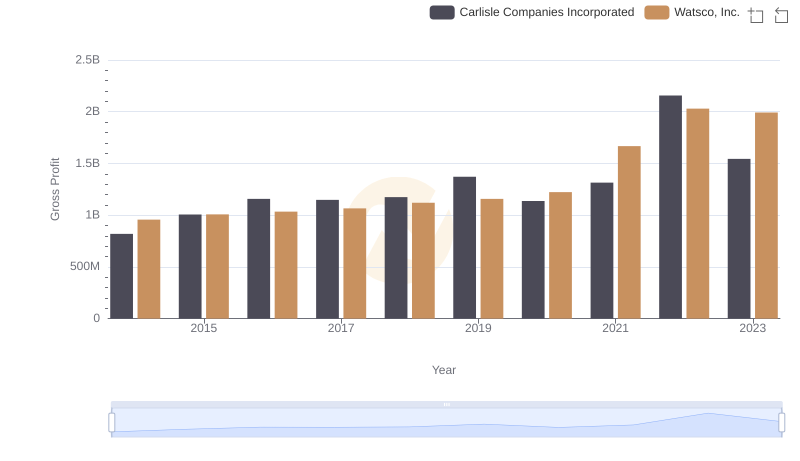

Key Insights on Gross Profit: Watsco, Inc. vs Carlisle Companies Incorporated

EBITDA Performance Review: Watsco, Inc. vs Pentair plc