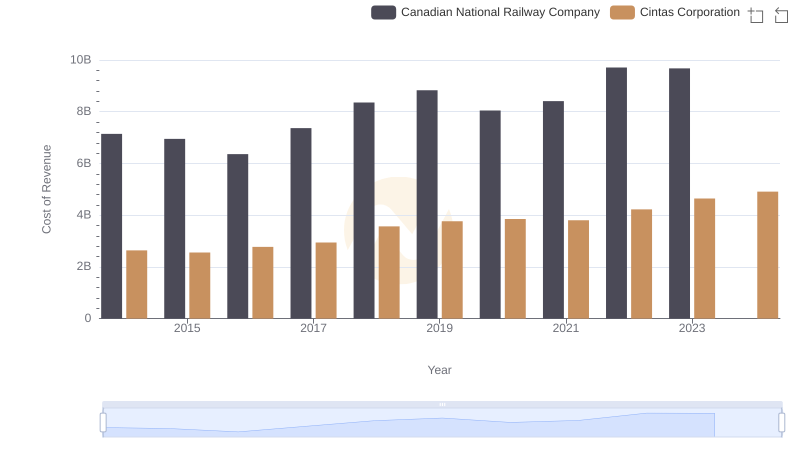

| __timestamp | Canadian National Railway Company | Cintas Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 5674000000 | 793811000 |

| Thursday, January 1, 2015 | 6424000000 | 877761000 |

| Friday, January 1, 2016 | 6537000000 | 933728000 |

| Sunday, January 1, 2017 | 6839000000 | 968293000 |

| Monday, January 1, 2018 | 7124000000 | 1227852000 |

| Tuesday, January 1, 2019 | 7999000000 | 1564228000 |

| Wednesday, January 1, 2020 | 7652000000 | 1542737000 |

| Friday, January 1, 2021 | 7607000000 | 1773591000 |

| Saturday, January 1, 2022 | 9067000000 | 1990046000 |

| Sunday, January 1, 2023 | 9027000000 | 2221676000 |

| Monday, January 1, 2024 | 2523857000 |

Unveiling the hidden dimensions of data

In the world of corporate finance, EBITDA serves as a crucial metric for evaluating a company's operational performance. This article delves into the EBITDA trends of two industry giants: Cintas Corporation and Canadian National Railway Company, from 2014 to 2023.

Over the past decade, Canadian National Railway has consistently outperformed Cintas in terms of EBITDA, with an impressive 60% increase from 2014 to 2023. In contrast, Cintas Corporation has shown a remarkable growth trajectory, with its EBITDA more than doubling during the same period.

While Canadian National Railway's EBITDA peaked in 2022, Cintas continued its upward trend into 2023, showcasing resilience and adaptability. The data for 2024 is incomplete, highlighting the need for ongoing analysis. This comparison underscores the diverse strategies and market conditions influencing these two leaders in their respective sectors.

Cost Insights: Breaking Down Cintas Corporation and Canadian National Railway Company's Expenses

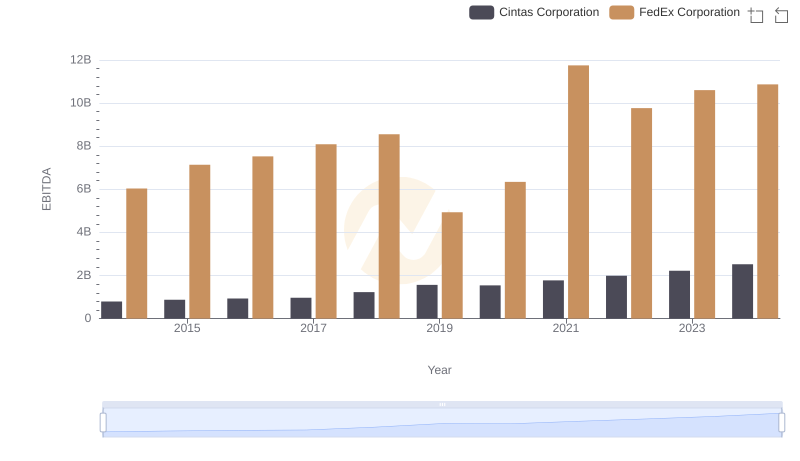

Professional EBITDA Benchmarking: Cintas Corporation vs FedEx Corporation

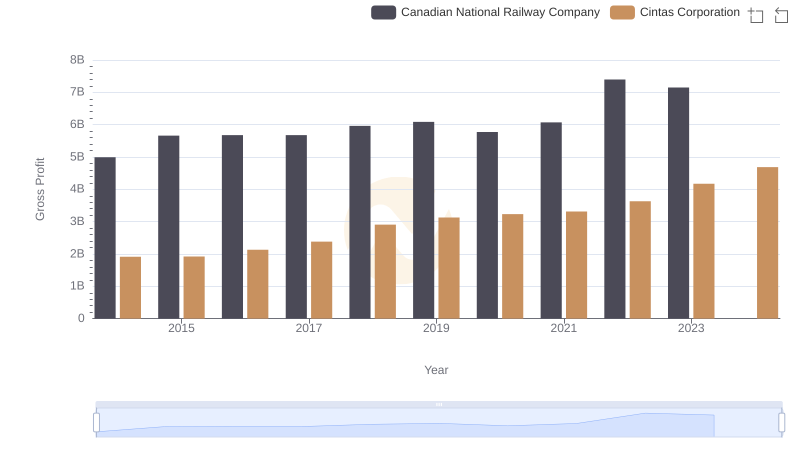

Gross Profit Trends Compared: Cintas Corporation vs Canadian National Railway Company

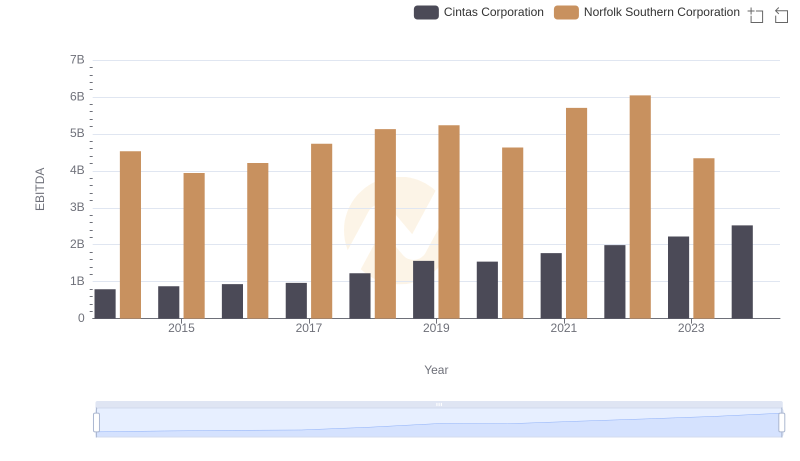

A Side-by-Side Analysis of EBITDA: Cintas Corporation and Norfolk Southern Corporation

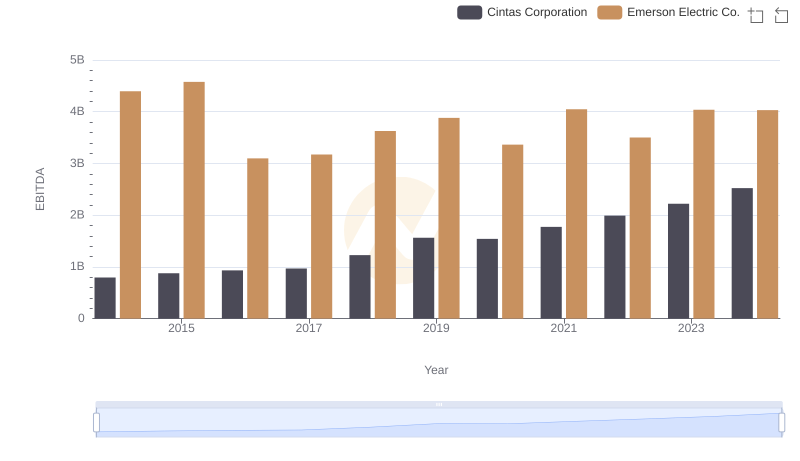

Comparative EBITDA Analysis: Cintas Corporation vs Emerson Electric Co.

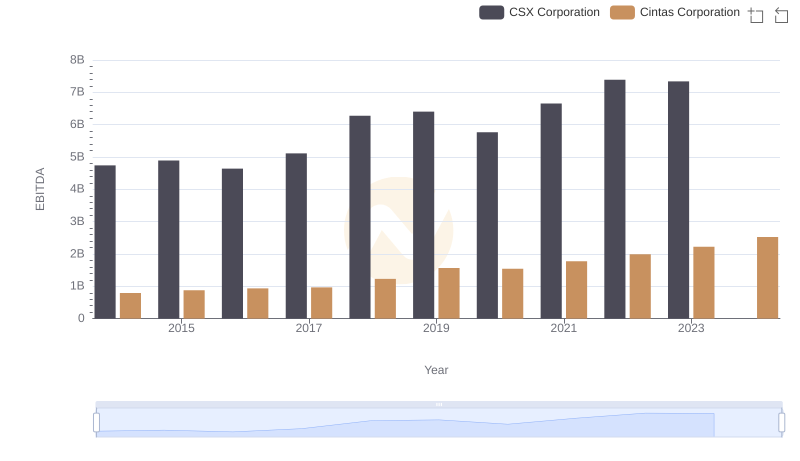

A Side-by-Side Analysis of EBITDA: Cintas Corporation and CSX Corporation

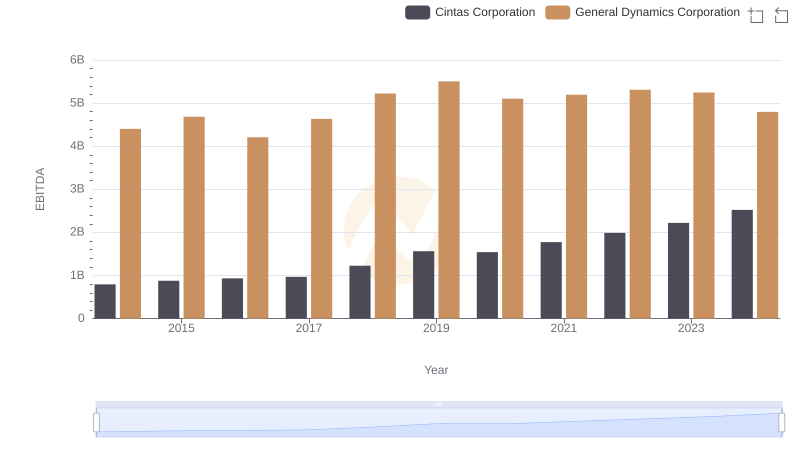

Comparative EBITDA Analysis: Cintas Corporation vs General Dynamics Corporation

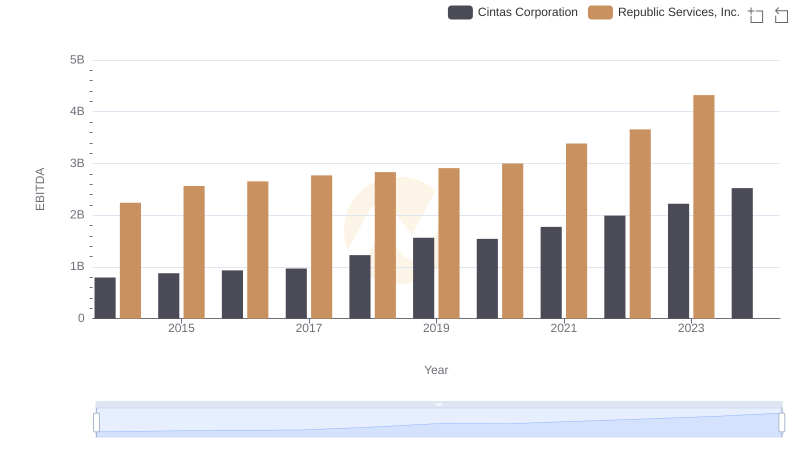

Cintas Corporation and Republic Services, Inc.: A Detailed Examination of EBITDA Performance

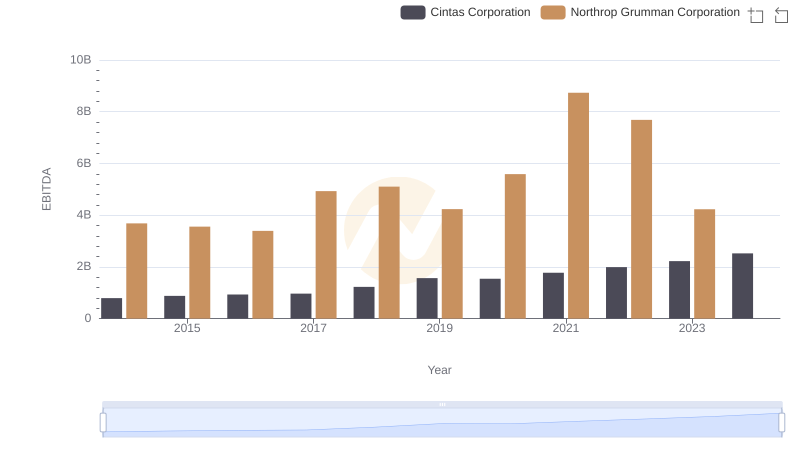

Comparative EBITDA Analysis: Cintas Corporation vs Northrop Grumman Corporation

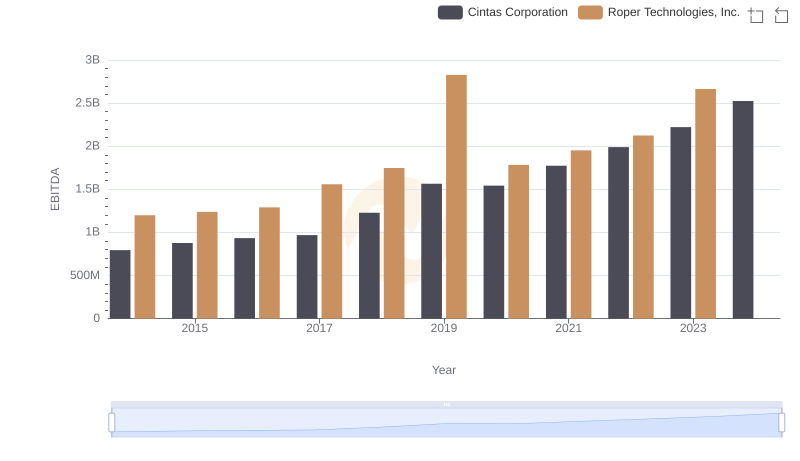

Comprehensive EBITDA Comparison: Cintas Corporation vs Roper Technologies, Inc.

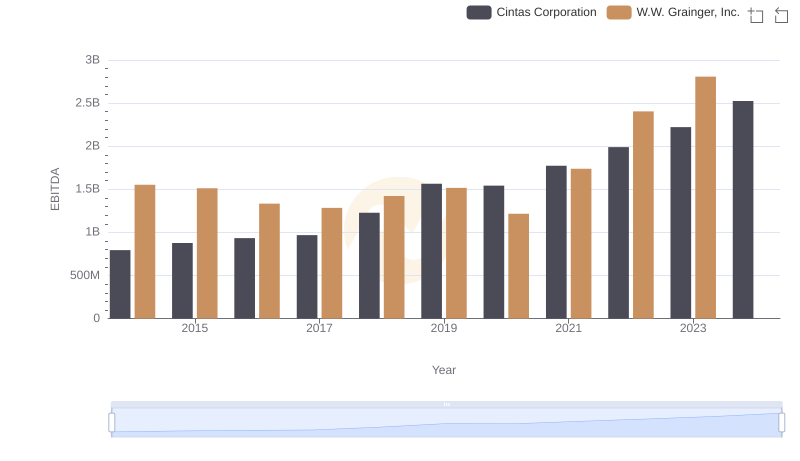

Cintas Corporation vs W.W. Grainger, Inc.: In-Depth EBITDA Performance Comparison