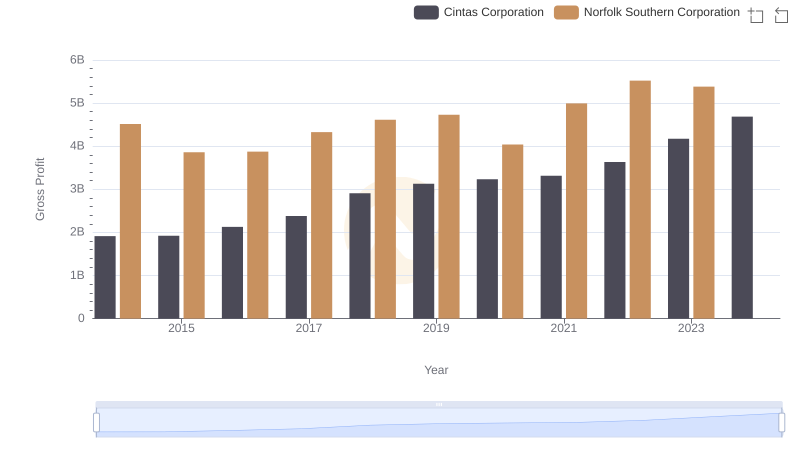

| __timestamp | Cintas Corporation | Norfolk Southern Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 793811000 | 4531000000 |

| Thursday, January 1, 2015 | 877761000 | 3943000000 |

| Friday, January 1, 2016 | 933728000 | 4212000000 |

| Sunday, January 1, 2017 | 968293000 | 4733000000 |

| Monday, January 1, 2018 | 1227852000 | 5128000000 |

| Tuesday, January 1, 2019 | 1564228000 | 5233000000 |

| Wednesday, January 1, 2020 | 1542737000 | 4632000000 |

| Friday, January 1, 2021 | 1773591000 | 5705000000 |

| Saturday, January 1, 2022 | 1990046000 | 6043000000 |

| Sunday, January 1, 2023 | 2221676000 | 4340000000 |

| Monday, January 1, 2024 | 2523857000 | 4071000000 |

Unleashing insights

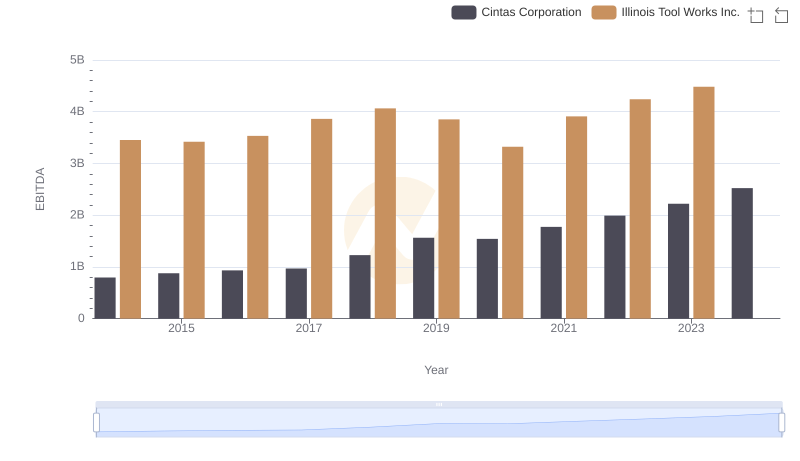

In the ever-evolving landscape of American business, Cintas Corporation and Norfolk Southern Corporation stand as titans in their respective industries. Over the past decade, Cintas has demonstrated a remarkable growth trajectory, with its EBITDA increasing by over 200% from 2014 to 2023. This growth reflects Cintas's strategic expansion and operational efficiency in the uniform and facility services sector.

Conversely, Norfolk Southern, a leader in the rail transportation industry, has experienced a more modest EBITDA growth of approximately 33% over the same period. Despite a dip in 2023, Norfolk Southern's financial resilience is evident in its ability to maintain a strong EBITDA, peaking in 2022.

This side-by-side analysis highlights the dynamic nature of these industries and underscores the importance of strategic adaptability in achieving sustained financial success.

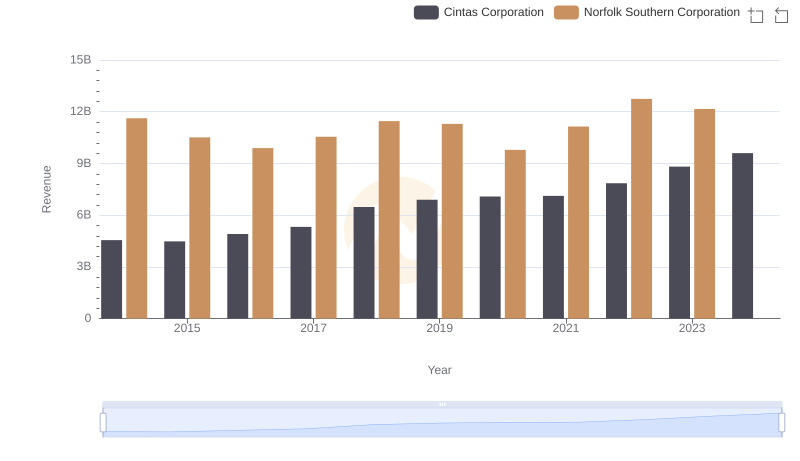

Cintas Corporation or Norfolk Southern Corporation: Who Leads in Yearly Revenue?

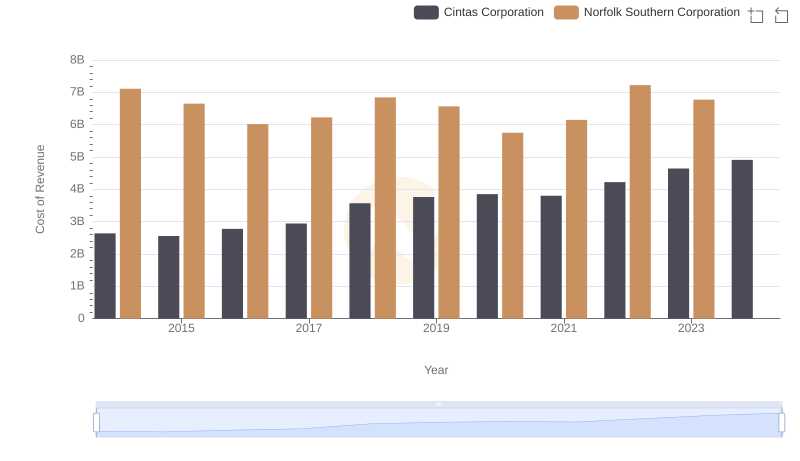

Cost of Revenue: Key Insights for Cintas Corporation and Norfolk Southern Corporation

Cintas Corporation vs Illinois Tool Works Inc.: In-Depth EBITDA Performance Comparison

Gross Profit Analysis: Comparing Cintas Corporation and Norfolk Southern Corporation

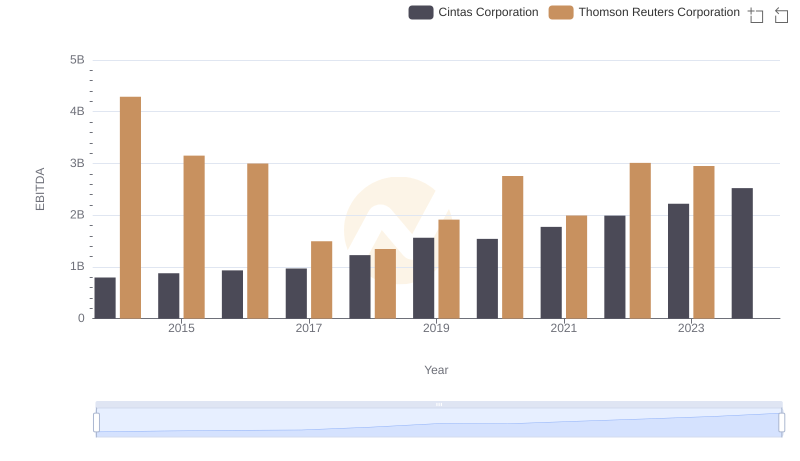

EBITDA Analysis: Evaluating Cintas Corporation Against Thomson Reuters Corporation

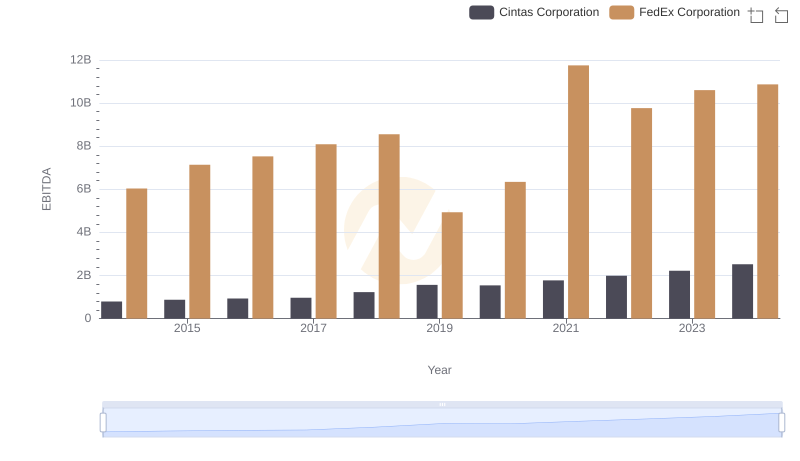

Professional EBITDA Benchmarking: Cintas Corporation vs FedEx Corporation

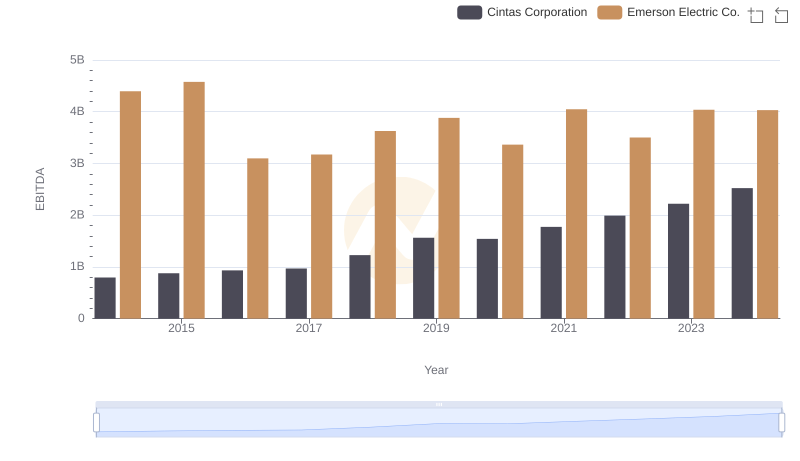

Comparative EBITDA Analysis: Cintas Corporation vs Emerson Electric Co.

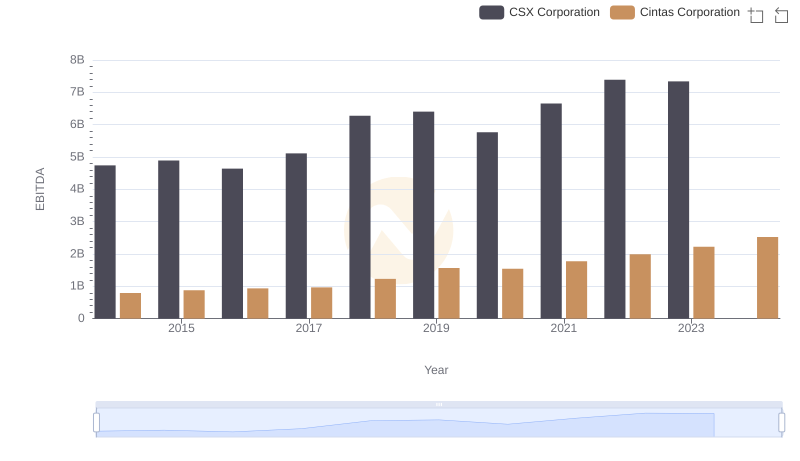

A Side-by-Side Analysis of EBITDA: Cintas Corporation and CSX Corporation

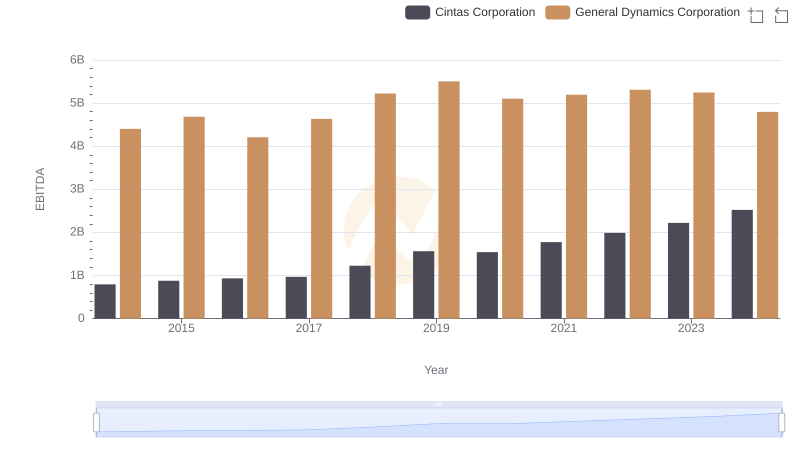

Comparative EBITDA Analysis: Cintas Corporation vs General Dynamics Corporation

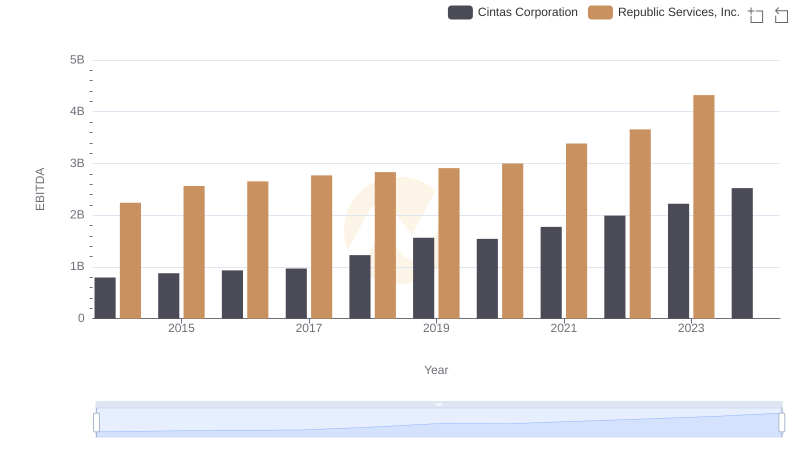

Cintas Corporation and Republic Services, Inc.: A Detailed Examination of EBITDA Performance

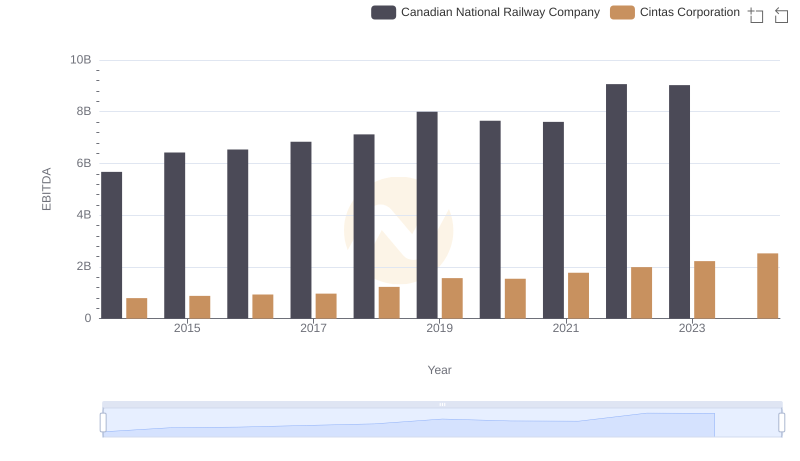

Professional EBITDA Benchmarking: Cintas Corporation vs Canadian National Railway Company

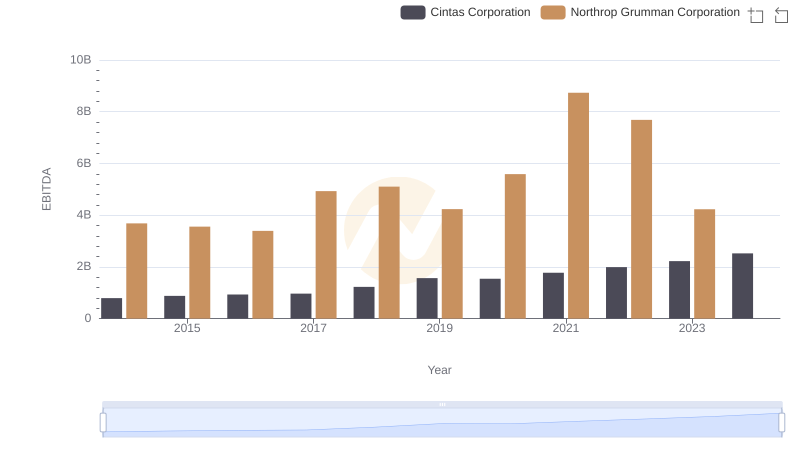

Comparative EBITDA Analysis: Cintas Corporation vs Northrop Grumman Corporation