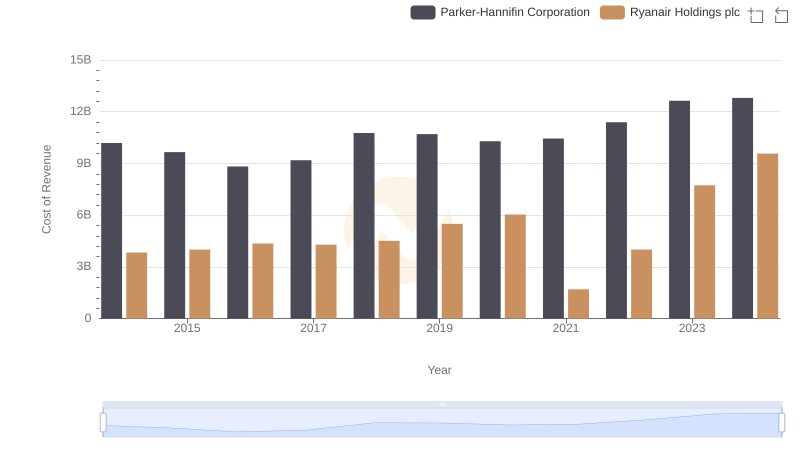

| __timestamp | Parker-Hannifin Corporation | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 1633992000 | 192800000 |

| Thursday, January 1, 2015 | 1544746000 | 233900000 |

| Friday, January 1, 2016 | 1359360000 | 292700000 |

| Sunday, January 1, 2017 | 1453935000 | 322300000 |

| Monday, January 1, 2018 | 1657152000 | 410400000 |

| Tuesday, January 1, 2019 | 1543939000 | 547300000 |

| Wednesday, January 1, 2020 | 1656553000 | 578800000 |

| Friday, January 1, 2021 | 1527302000 | 201500000 |

| Saturday, January 1, 2022 | 1627116000 | 411300000 |

| Sunday, January 1, 2023 | 3354103000 | 674400000 |

| Monday, January 1, 2024 | 3315177000 | 757200000 |

Igniting the spark of knowledge

In the world of corporate finance, understanding the spending patterns of industry leaders can offer invaluable insights. Parker-Hannifin Corporation, a stalwart in motion and control technologies, and Ryanair Holdings plc, Europe's largest low-cost airline, present a fascinating study in contrasts. From 2014 to 2024, Parker-Hannifin's Selling, General, and Administrative (SG&A) expenses have shown a steady increase, peaking at over 3.2 billion in 2024, a staggering 98% rise from 2014. In contrast, Ryanair's SG&A expenses, while significantly lower, have also seen a notable increase, growing by approximately 293% over the same period. This divergence highlights the differing operational strategies and market dynamics faced by these two giants. As Parker-Hannifin invests heavily in innovation and expansion, Ryanair focuses on maintaining its competitive edge in the cost-sensitive airline industry. These trends underscore the importance of strategic financial management in navigating complex market landscapes.

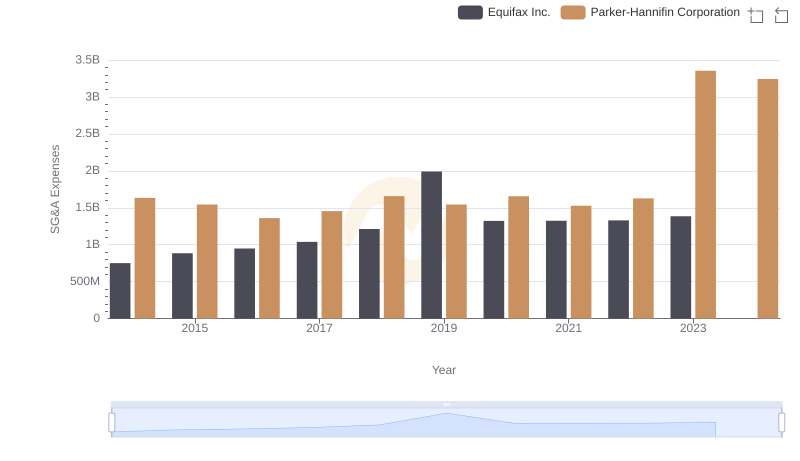

Cost Management Insights: SG&A Expenses for Parker-Hannifin Corporation and Equifax Inc.

Cost Insights: Breaking Down Parker-Hannifin Corporation and Ryanair Holdings plc's Expenses

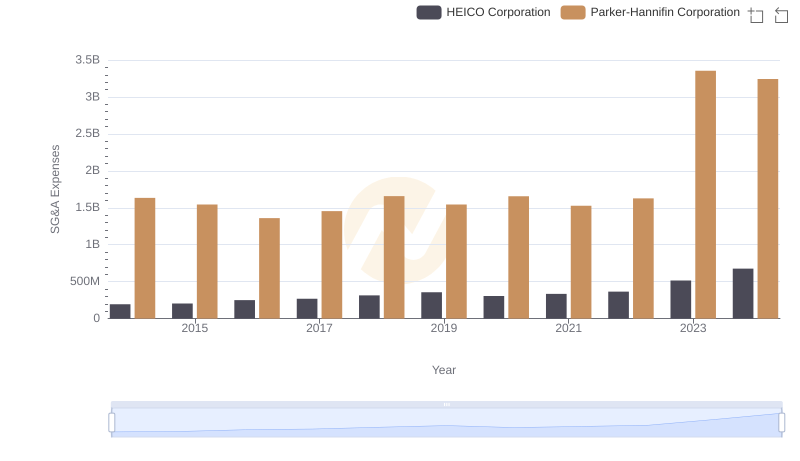

Breaking Down SG&A Expenses: Parker-Hannifin Corporation vs HEICO Corporation

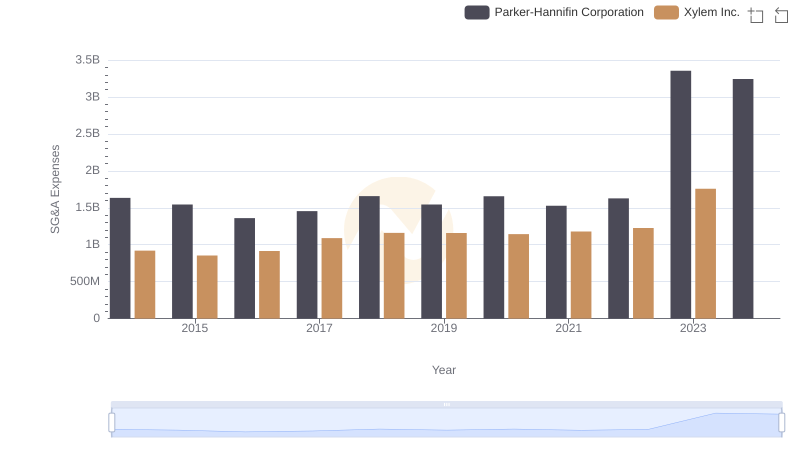

Cost Management Insights: SG&A Expenses for Parker-Hannifin Corporation and Xylem Inc.

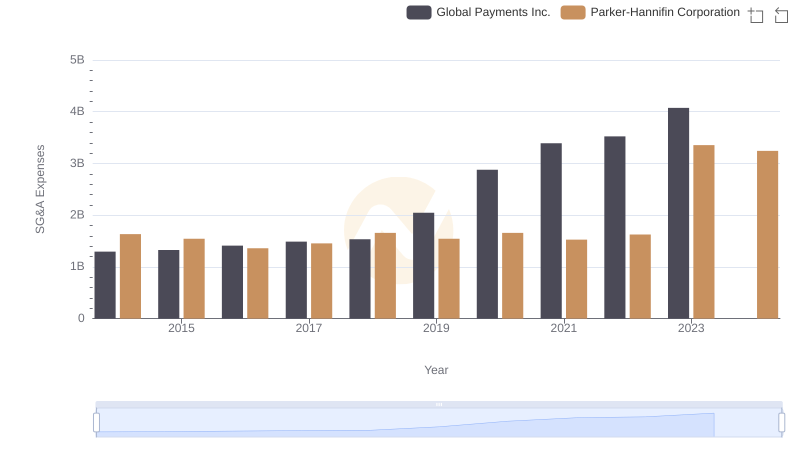

Parker-Hannifin Corporation vs Global Payments Inc.: SG&A Expense Trends

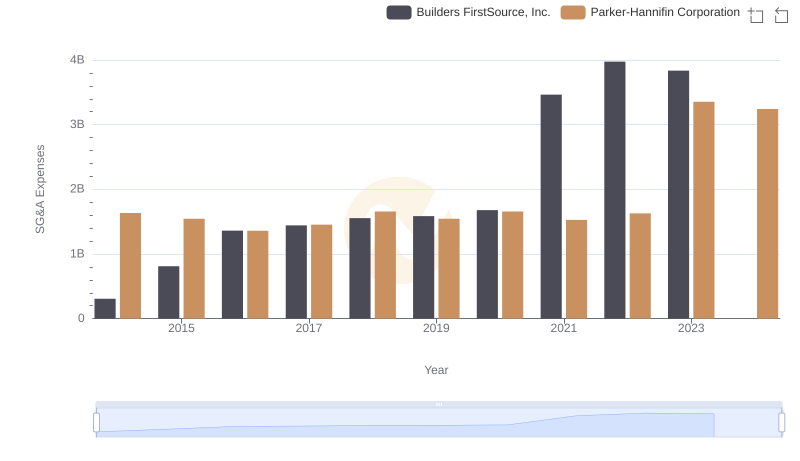

Comparing SG&A Expenses: Parker-Hannifin Corporation vs Builders FirstSource, Inc. Trends and Insights

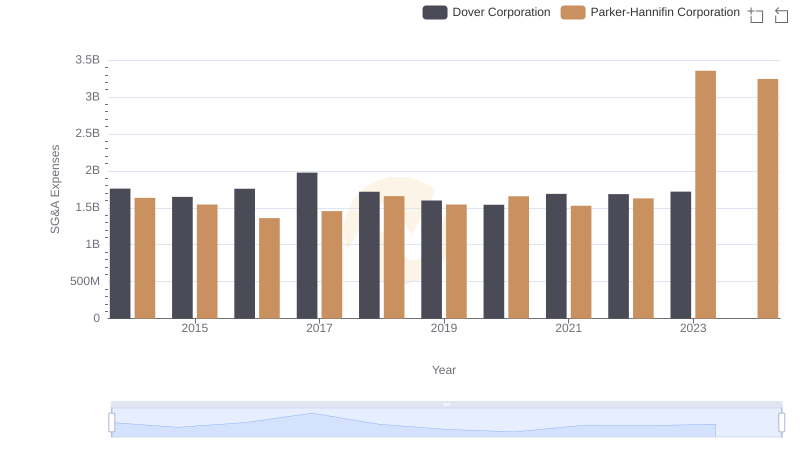

Parker-Hannifin Corporation and Dover Corporation: SG&A Spending Patterns Compared