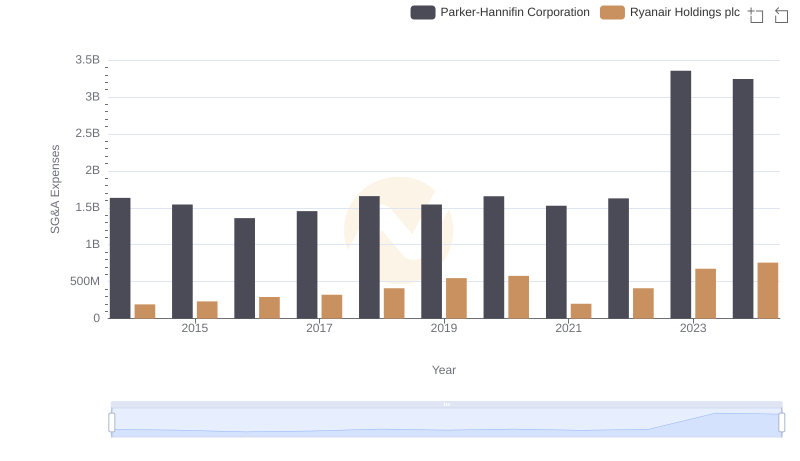

| __timestamp | Parker-Hannifin Corporation | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 10188227000 | 3838100000 |

| Thursday, January 1, 2015 | 9655245000 | 3999600000 |

| Friday, January 1, 2016 | 8823384000 | 4355900000 |

| Sunday, January 1, 2017 | 9188962000 | 4294000000 |

| Monday, January 1, 2018 | 10762841000 | 4512300000 |

| Tuesday, January 1, 2019 | 10703484000 | 5492800000 |

| Wednesday, January 1, 2020 | 10286518000 | 6039900000 |

| Friday, January 1, 2021 | 10449680000 | 1702700000 |

| Saturday, January 1, 2022 | 11387267000 | 4009800000 |

| Sunday, January 1, 2023 | 12635892000 | 7735000000 |

| Monday, January 1, 2024 | 12801816000 | 9566400000 |

Unlocking the unknown

In the ever-evolving landscape of global business, understanding cost structures is crucial. Parker-Hannifin Corporation, a leader in motion and control technologies, and Ryanair Holdings plc, Europe's largest low-cost airline, offer intriguing insights into their financial strategies over the past decade. From 2014 to 2024, Parker-Hannifin's cost of revenue has shown a steady increase, peaking at approximately 28% higher in 2024 compared to 2014. This reflects their strategic investments in innovation and expansion. Meanwhile, Ryanair's cost of revenue has seen a more volatile trajectory, with a significant dip in 2021, likely due to the pandemic's impact on the airline industry. However, by 2024, Ryanair's costs surged by over 150% from their 2021 low, indicating a robust recovery. These trends highlight the resilience and adaptability of both companies in navigating economic challenges and seizing growth opportunities.

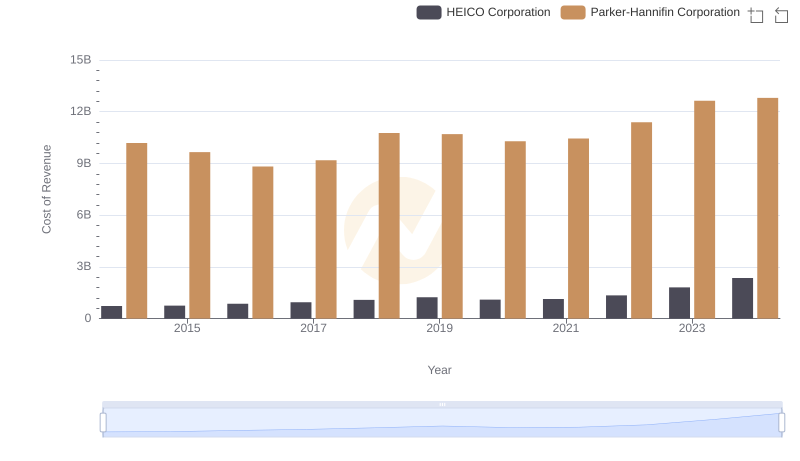

Cost of Revenue Comparison: Parker-Hannifin Corporation vs HEICO Corporation

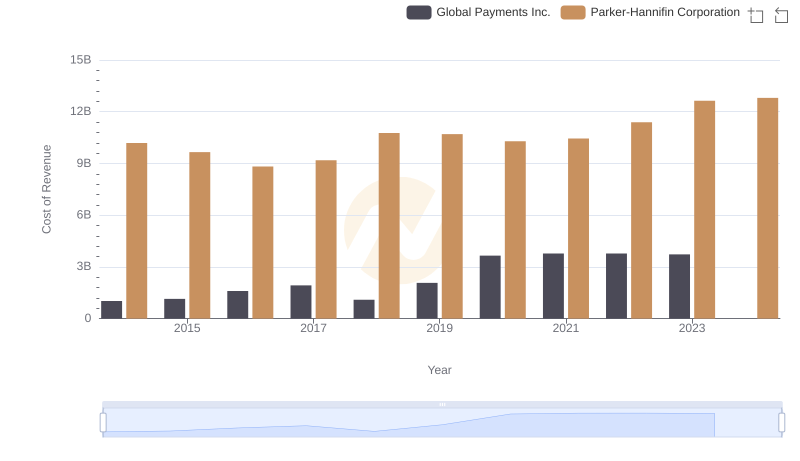

Cost Insights: Breaking Down Parker-Hannifin Corporation and Global Payments Inc.'s Expenses

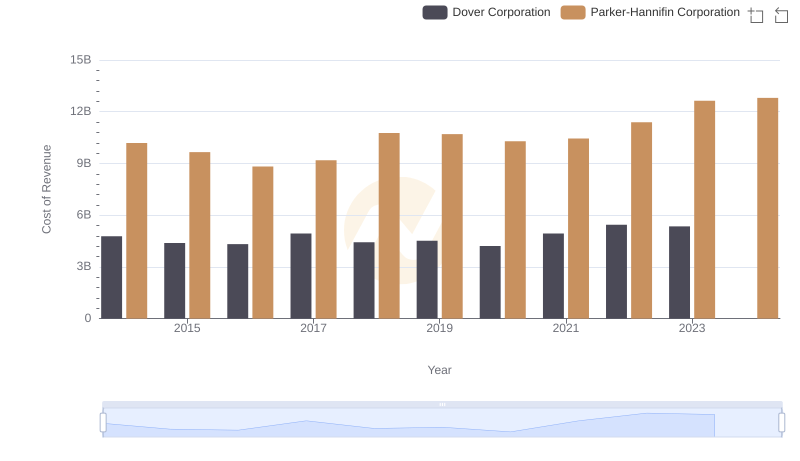

Cost Insights: Breaking Down Parker-Hannifin Corporation and Dover Corporation's Expenses

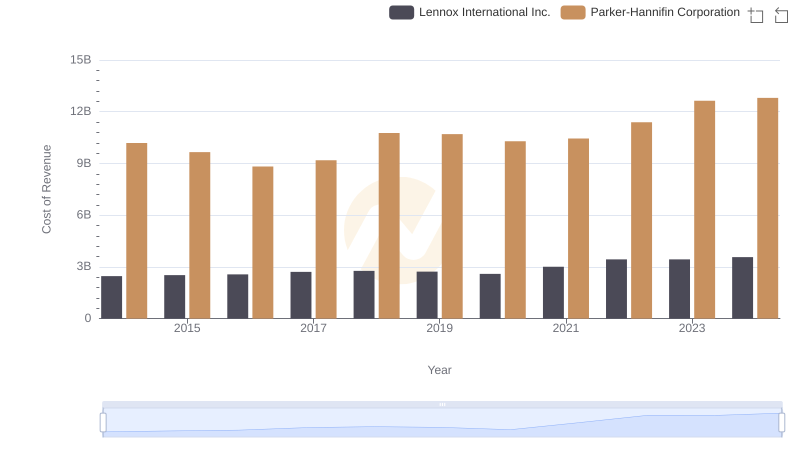

Analyzing Cost of Revenue: Parker-Hannifin Corporation and Lennox International Inc.

Analyzing Cost of Revenue: Parker-Hannifin Corporation and Builders FirstSource, Inc.

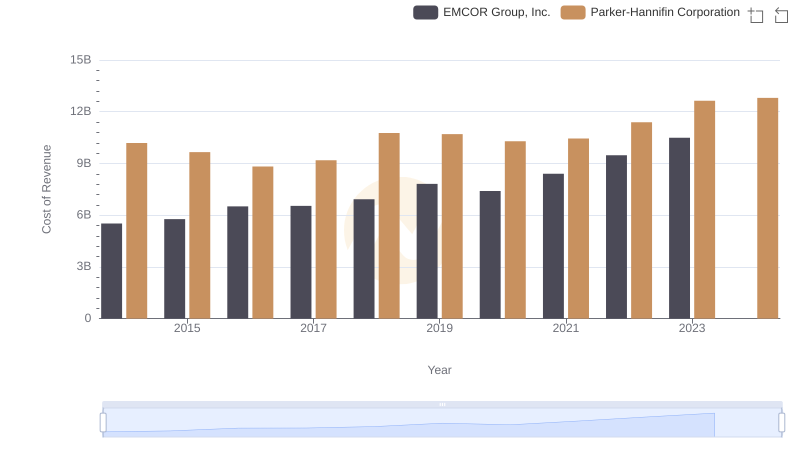

Cost Insights: Breaking Down Parker-Hannifin Corporation and EMCOR Group, Inc.'s Expenses

Parker-Hannifin Corporation and Ryanair Holdings plc: SG&A Spending Patterns Compared

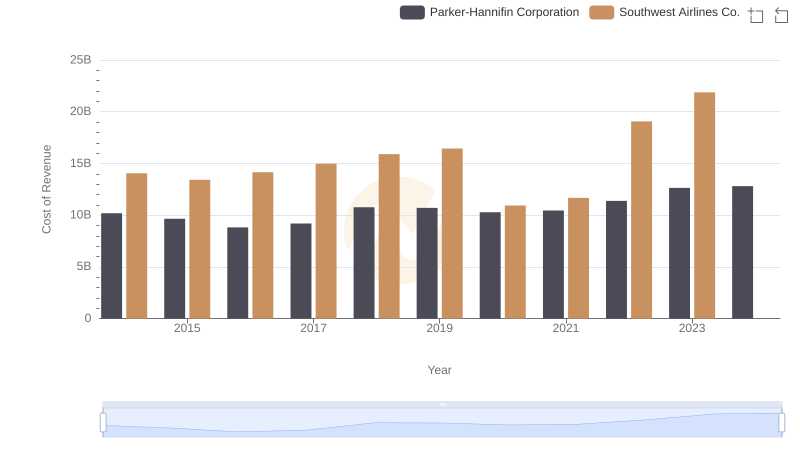

Comparing Cost of Revenue Efficiency: Parker-Hannifin Corporation vs Southwest Airlines Co.