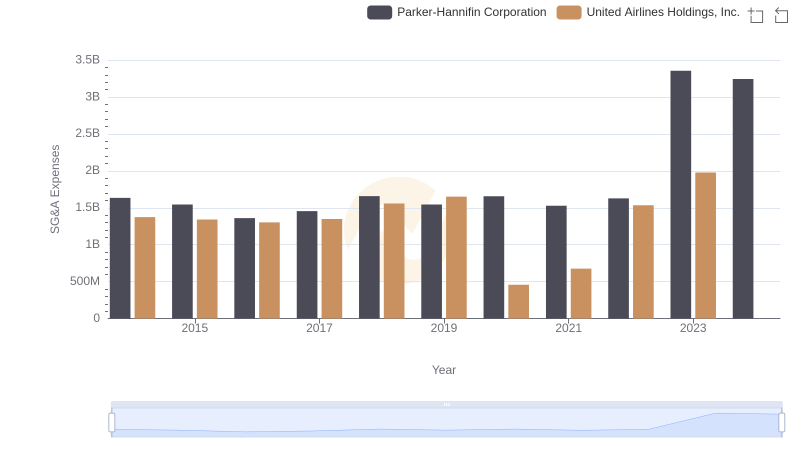

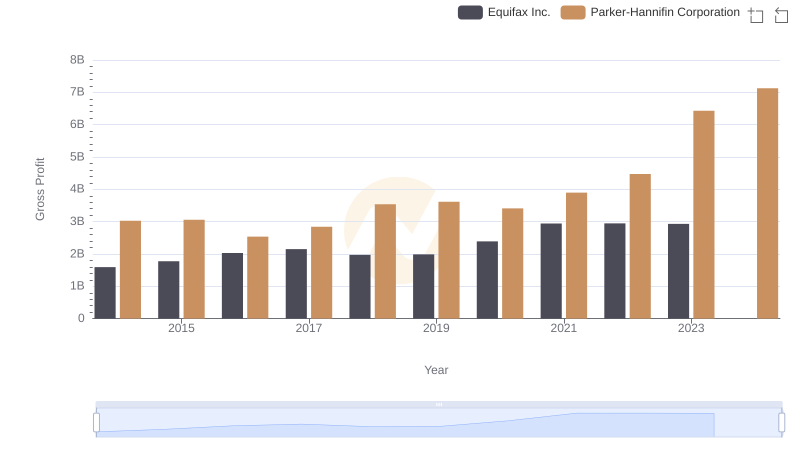

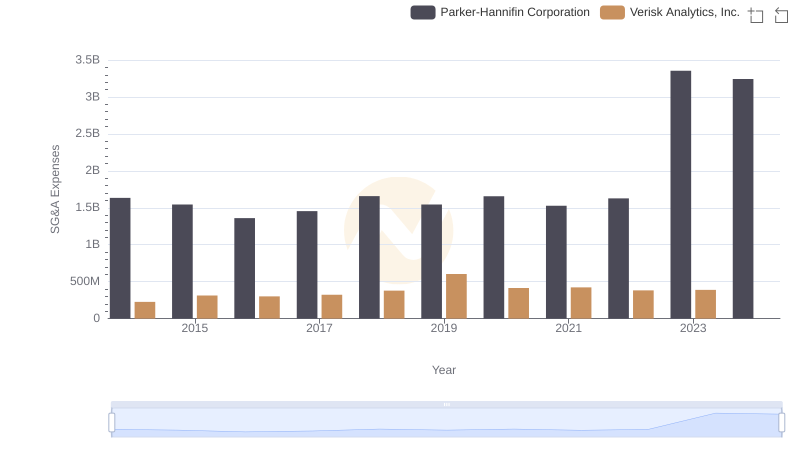

| __timestamp | Equifax Inc. | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 751700000 | 1633992000 |

| Thursday, January 1, 2015 | 884300000 | 1544746000 |

| Friday, January 1, 2016 | 948200000 | 1359360000 |

| Sunday, January 1, 2017 | 1039100000 | 1453935000 |

| Monday, January 1, 2018 | 1213300000 | 1657152000 |

| Tuesday, January 1, 2019 | 1990200000 | 1543939000 |

| Wednesday, January 1, 2020 | 1322500000 | 1656553000 |

| Friday, January 1, 2021 | 1324600000 | 1527302000 |

| Saturday, January 1, 2022 | 1328900000 | 1627116000 |

| Sunday, January 1, 2023 | 1385700000 | 3354103000 |

| Monday, January 1, 2024 | 1450500000 | 3315177000 |

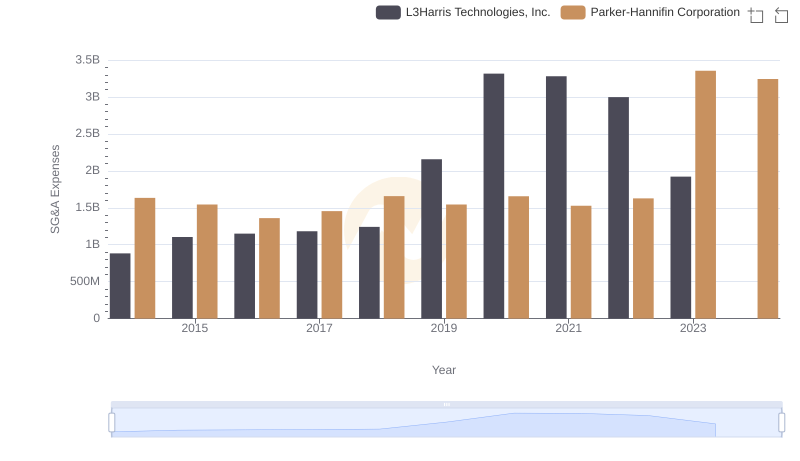

Unveiling the hidden dimensions of data

In the ever-evolving landscape of corporate finance, understanding Selling, General, and Administrative (SG&A) expenses is crucial for effective cost management. This analysis delves into the SG&A expenses of Parker-Hannifin Corporation and Equifax Inc. from 2014 to 2023.

Parker-Hannifin has demonstrated a consistent upward trend in SG&A expenses, peaking in 2023 with a staggering 105% increase from 2014. This growth reflects strategic investments and expansion efforts.

Equifax's SG&A expenses have been more volatile, with a notable spike in 2019, reaching 166% of their 2014 levels. However, the subsequent years show a stabilization, indicating a recalibration of their cost strategies.

This comparative analysis highlights the diverse approaches to cost management, offering valuable insights for stakeholders and investors.

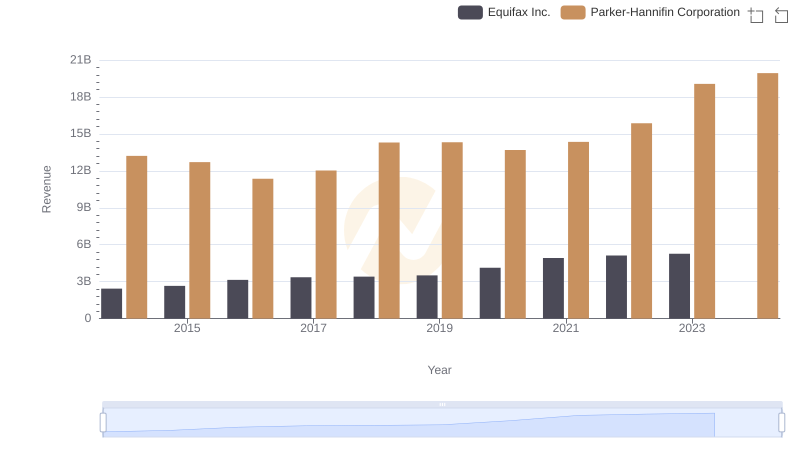

Parker-Hannifin Corporation vs Equifax Inc.: Annual Revenue Growth Compared

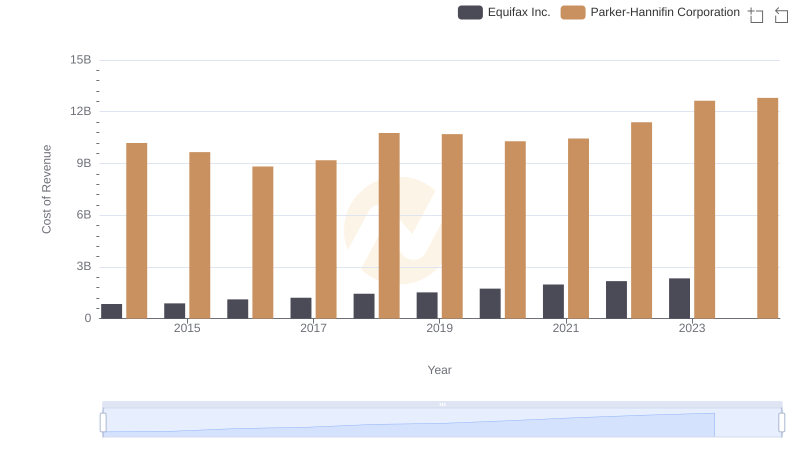

Analyzing Cost of Revenue: Parker-Hannifin Corporation and Equifax Inc.

Who Optimizes SG&A Costs Better? Parker-Hannifin Corporation or L3Harris Technologies, Inc.

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs United Airlines Holdings, Inc.

Parker-Hannifin Corporation and Equifax Inc.: A Detailed Gross Profit Analysis

Comparing SG&A Expenses: Parker-Hannifin Corporation vs Verisk Analytics, Inc. Trends and Insights

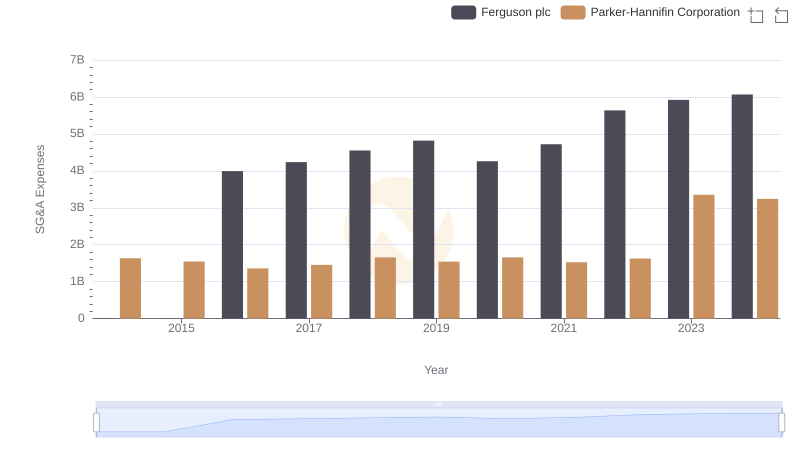

SG&A Efficiency Analysis: Comparing Parker-Hannifin Corporation and Ferguson plc

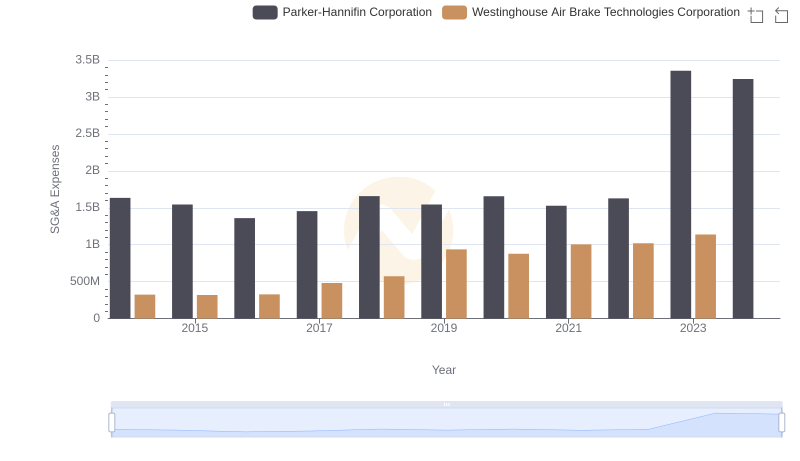

Cost Management Insights: SG&A Expenses for Parker-Hannifin Corporation and Westinghouse Air Brake Technologies Corporation

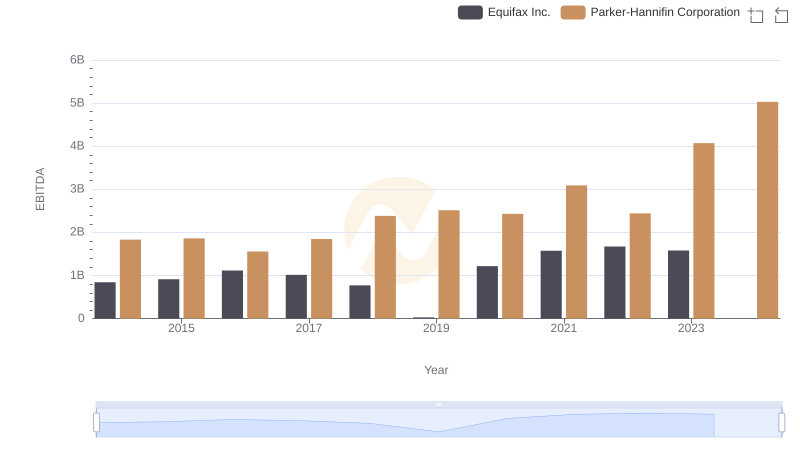

Parker-Hannifin Corporation vs Equifax Inc.: In-Depth EBITDA Performance Comparison

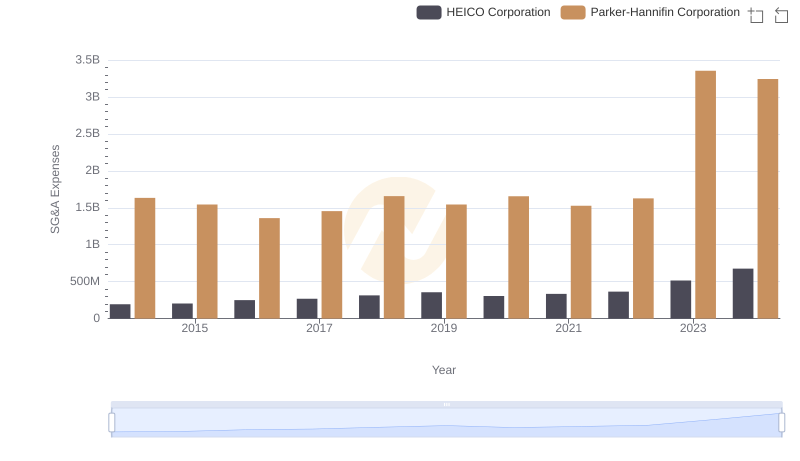

Breaking Down SG&A Expenses: Parker-Hannifin Corporation vs HEICO Corporation

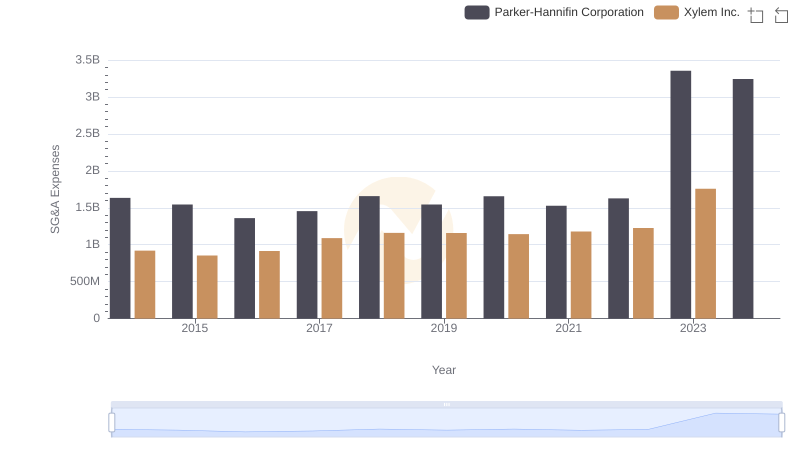

Cost Management Insights: SG&A Expenses for Parker-Hannifin Corporation and Xylem Inc.