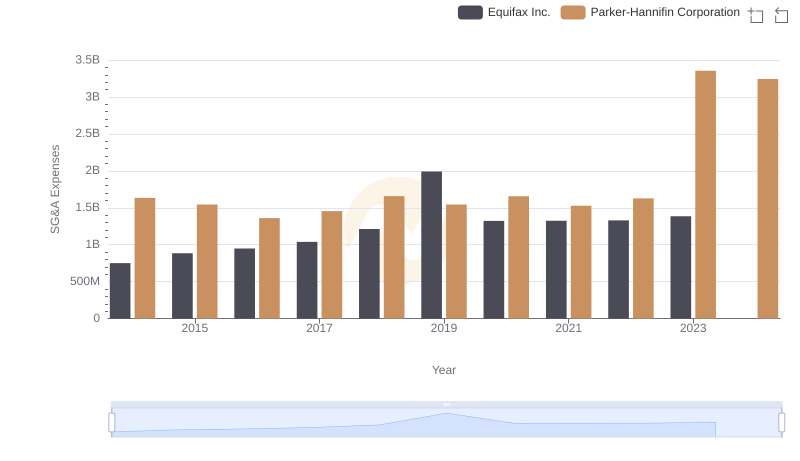

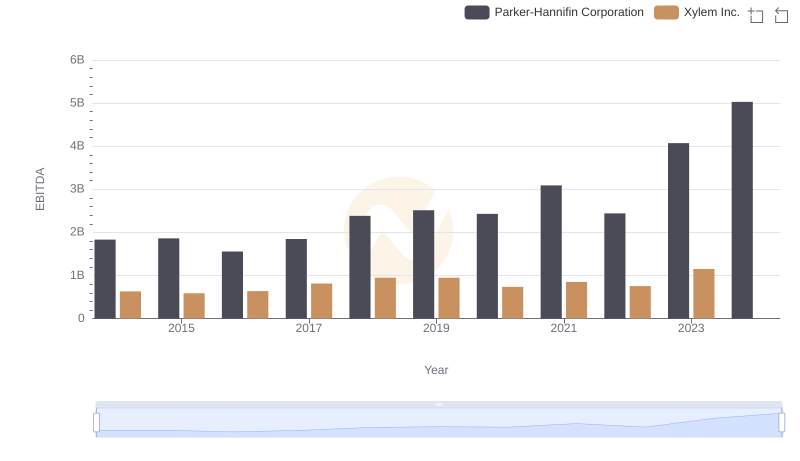

| __timestamp | Parker-Hannifin Corporation | Xylem Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1633992000 | 920000000 |

| Thursday, January 1, 2015 | 1544746000 | 854000000 |

| Friday, January 1, 2016 | 1359360000 | 915000000 |

| Sunday, January 1, 2017 | 1453935000 | 1090000000 |

| Monday, January 1, 2018 | 1657152000 | 1161000000 |

| Tuesday, January 1, 2019 | 1543939000 | 1158000000 |

| Wednesday, January 1, 2020 | 1656553000 | 1143000000 |

| Friday, January 1, 2021 | 1527302000 | 1179000000 |

| Saturday, January 1, 2022 | 1627116000 | 1227000000 |

| Sunday, January 1, 2023 | 3354103000 | 1757000000 |

| Monday, January 1, 2024 | 3315177000 |

Igniting the spark of knowledge

In the ever-evolving landscape of industrial manufacturing, effective cost management is crucial. Parker-Hannifin Corporation and Xylem Inc., two industry titans, have demonstrated contrasting trends in their Selling, General, and Administrative (SG&A) expenses over the past decade. From 2014 to 2023, Parker-Hannifin's SG&A expenses surged by over 100%, peaking in 2023, while Xylem Inc. saw a steady increase of approximately 91% during the same period. Notably, Parker-Hannifin's expenses doubled in 2023, a significant leap that warrants attention. Meanwhile, Xylem's expenses showed consistent growth, reflecting a stable cost management strategy. The data for 2024 is incomplete, highlighting the dynamic nature of financial forecasting. These insights underscore the importance of strategic planning in maintaining competitive advantage in the global market.

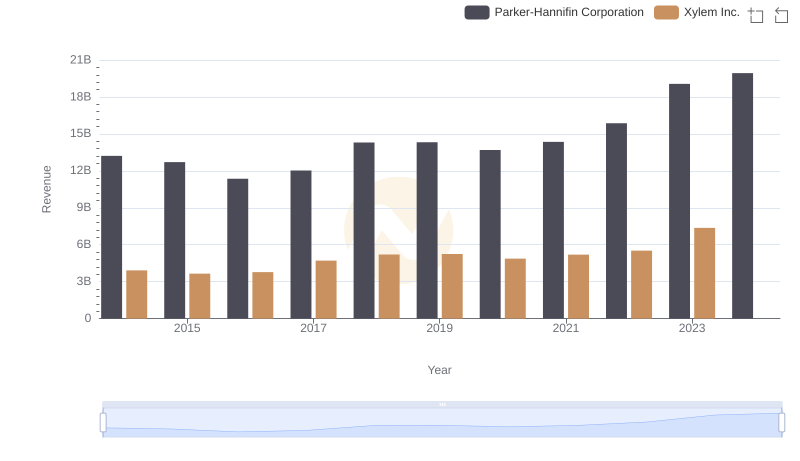

Annual Revenue Comparison: Parker-Hannifin Corporation vs Xylem Inc.

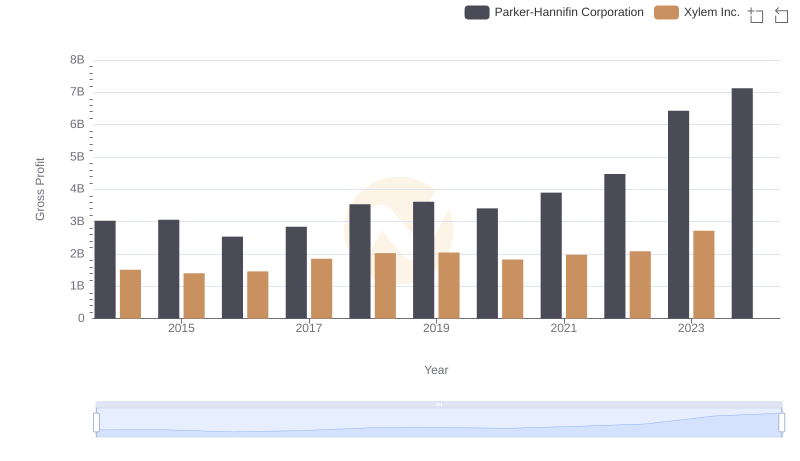

Gross Profit Analysis: Comparing Parker-Hannifin Corporation and Xylem Inc.

Cost Management Insights: SG&A Expenses for Parker-Hannifin Corporation and Equifax Inc.

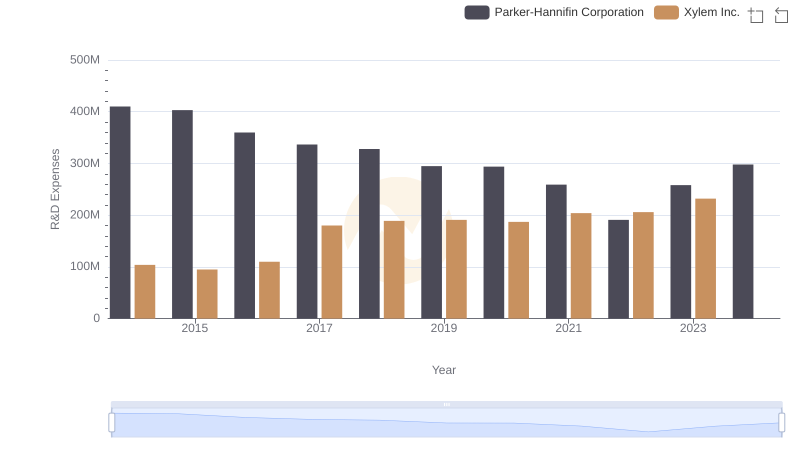

Research and Development Expenses Breakdown: Parker-Hannifin Corporation vs Xylem Inc.

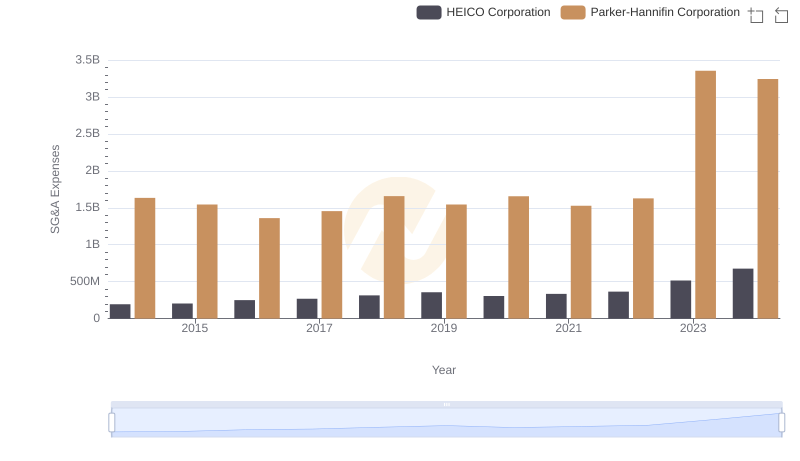

Breaking Down SG&A Expenses: Parker-Hannifin Corporation vs HEICO Corporation

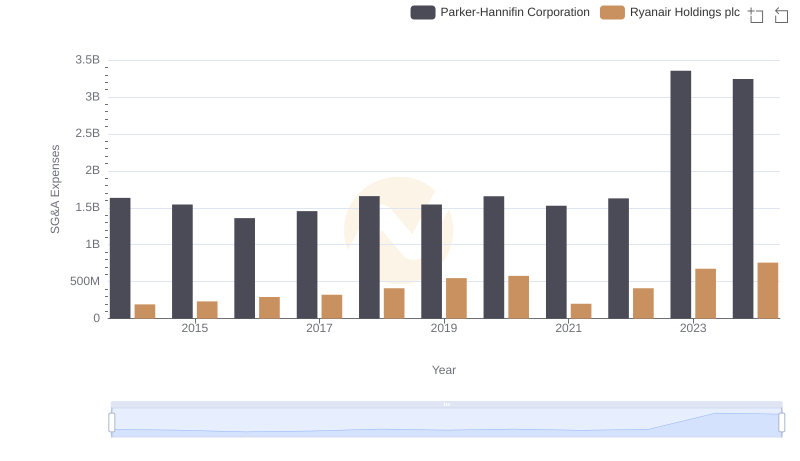

Parker-Hannifin Corporation and Ryanair Holdings plc: SG&A Spending Patterns Compared

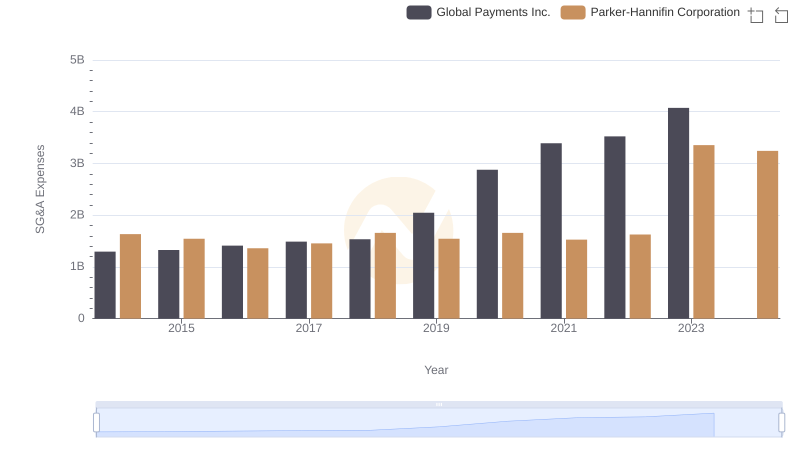

Parker-Hannifin Corporation vs Global Payments Inc.: SG&A Expense Trends

A Professional Review of EBITDA: Parker-Hannifin Corporation Compared to Xylem Inc.