| __timestamp | Textron Inc. | Watsco, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1361000000 | 650655000 |

| Thursday, January 1, 2015 | 1304000000 | 670609000 |

| Friday, January 1, 2016 | 1304000000 | 688952000 |

| Sunday, January 1, 2017 | 1337000000 | 715671000 |

| Monday, January 1, 2018 | 1275000000 | 757452000 |

| Tuesday, January 1, 2019 | 1152000000 | 800328000 |

| Wednesday, January 1, 2020 | 1045000000 | 833051000 |

| Friday, January 1, 2021 | 1221000000 | 1058316000 |

| Saturday, January 1, 2022 | 1186000000 | 1221382000 |

| Sunday, January 1, 2023 | 1225000000 | 1185626000 |

| Monday, January 1, 2024 | 1156000000 | 1262938000 |

Data in motion

In the ever-evolving landscape of corporate finance, understanding operational costs is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry giants: Watsco, Inc. and Textron Inc., from 2014 to 2023. Over this decade, Textron Inc. consistently reported higher SG&A expenses, peaking in 2024 with a staggering 10-fold increase compared to previous years. In contrast, Watsco, Inc. demonstrated a steady growth, with expenses rising by approximately 87% from 2014 to 2022. Notably, 2023 marked a pivotal year where Watsco's expenses nearly matched Textron's, highlighting a significant shift in operational dynamics. This trend underscores the importance of strategic cost management in maintaining competitive advantage. As businesses navigate the complexities of the modern market, these insights offer valuable lessons in financial stewardship.

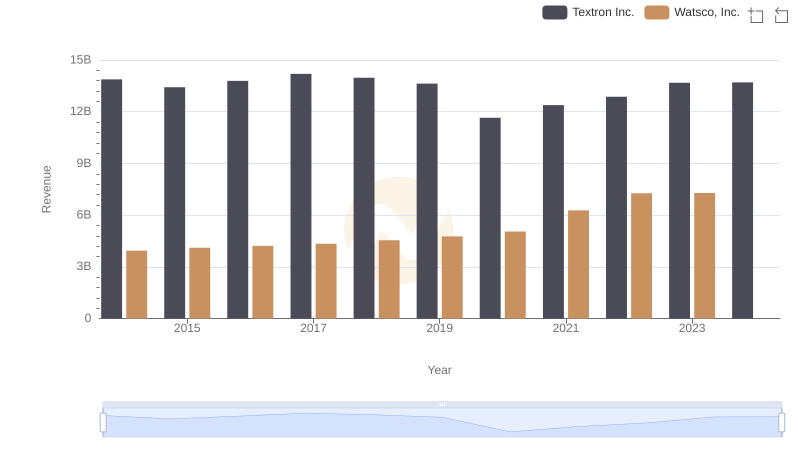

Breaking Down Revenue Trends: Watsco, Inc. vs Textron Inc.

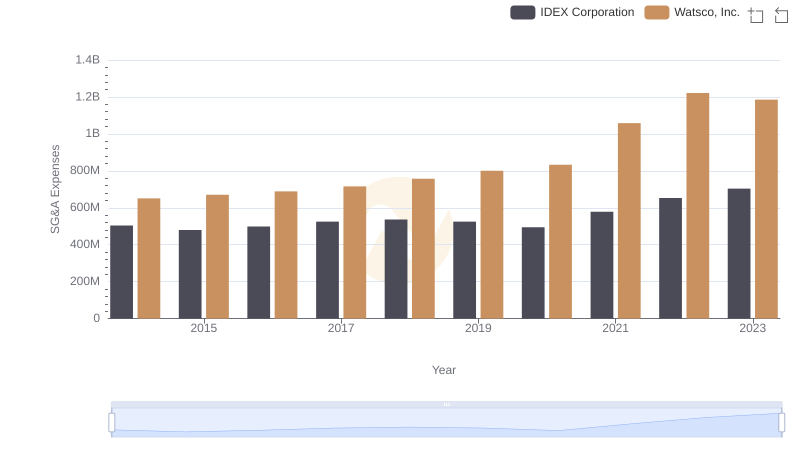

Comparing SG&A Expenses: Watsco, Inc. vs IDEX Corporation Trends and Insights

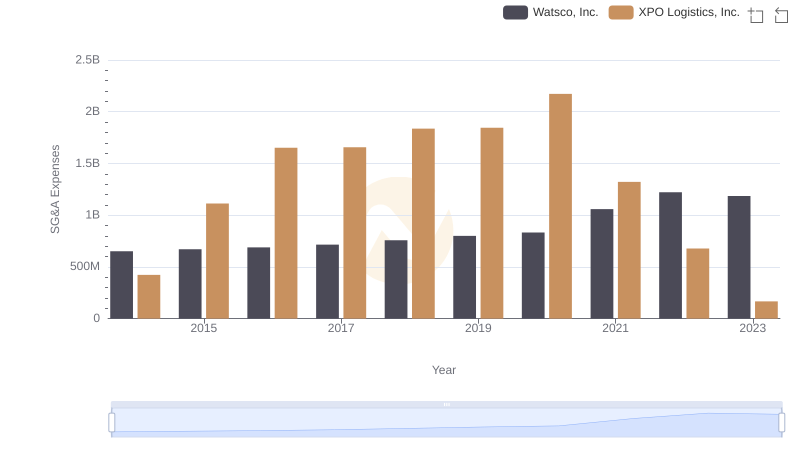

Breaking Down SG&A Expenses: Watsco, Inc. vs XPO Logistics, Inc.

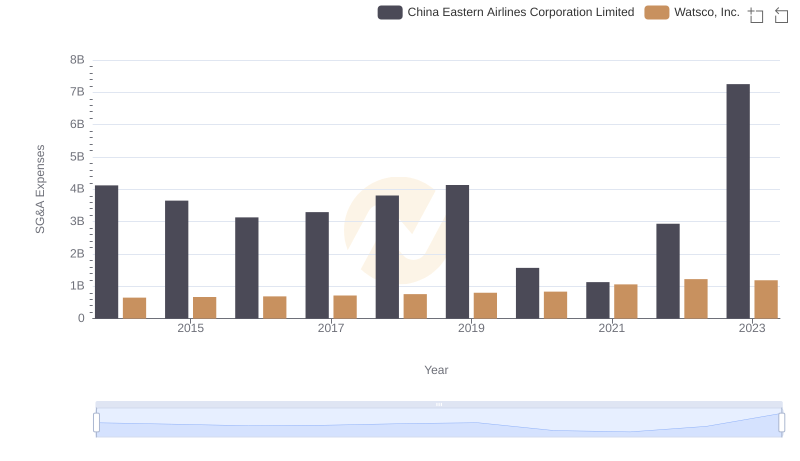

Cost Management Insights: SG&A Expenses for Watsco, Inc. and China Eastern Airlines Corporation Limited

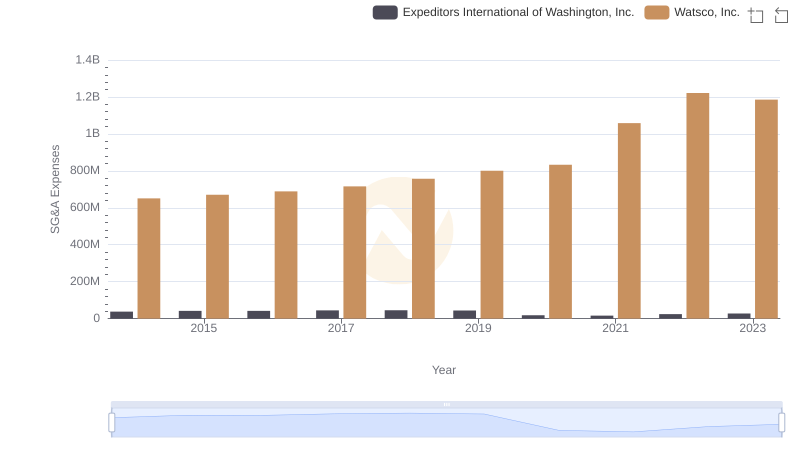

SG&A Efficiency Analysis: Comparing Watsco, Inc. and Expeditors International of Washington, Inc.

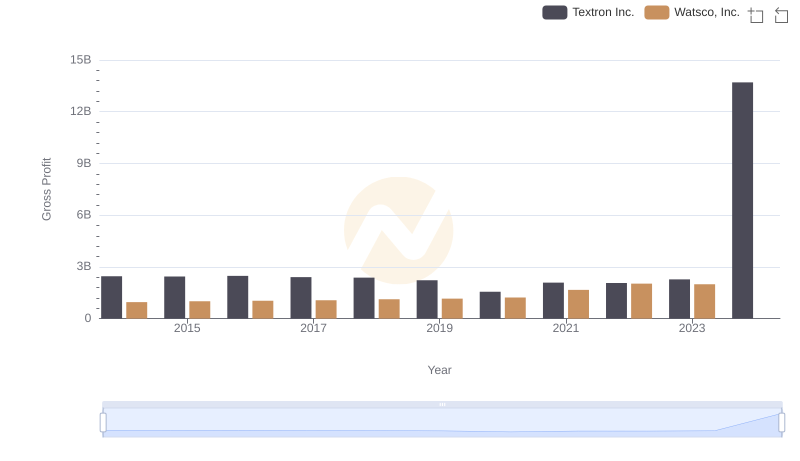

Watsco, Inc. vs Textron Inc.: A Gross Profit Performance Breakdown

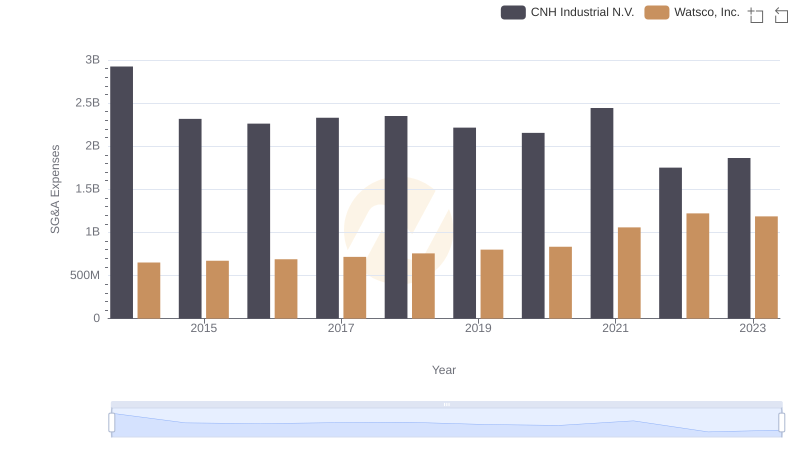

Selling, General, and Administrative Costs: Watsco, Inc. vs CNH Industrial N.V.

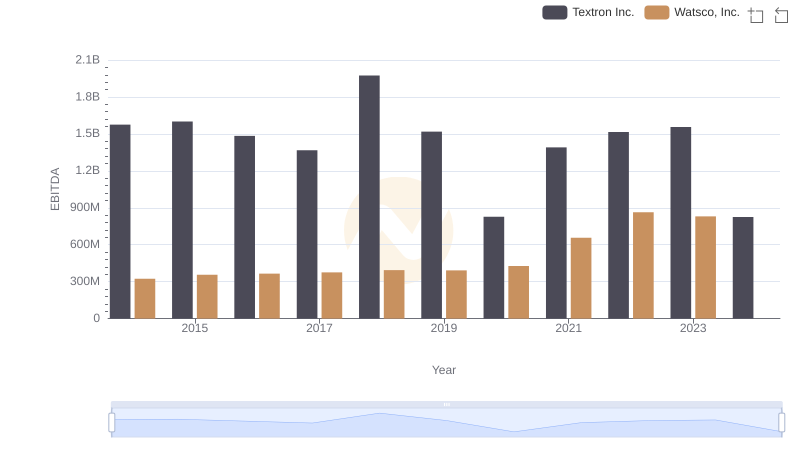

A Side-by-Side Analysis of EBITDA: Watsco, Inc. and Textron Inc.

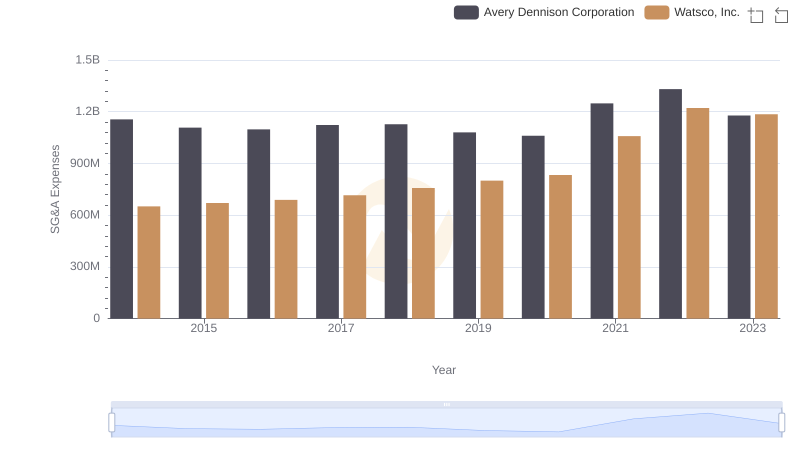

Watsco, Inc. and Avery Dennison Corporation: SG&A Spending Patterns Compared

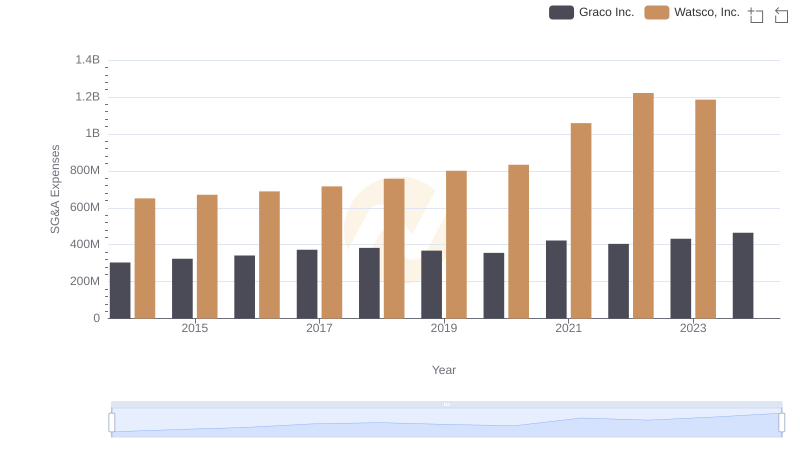

Watsco, Inc. or Graco Inc.: Who Manages SG&A Costs Better?