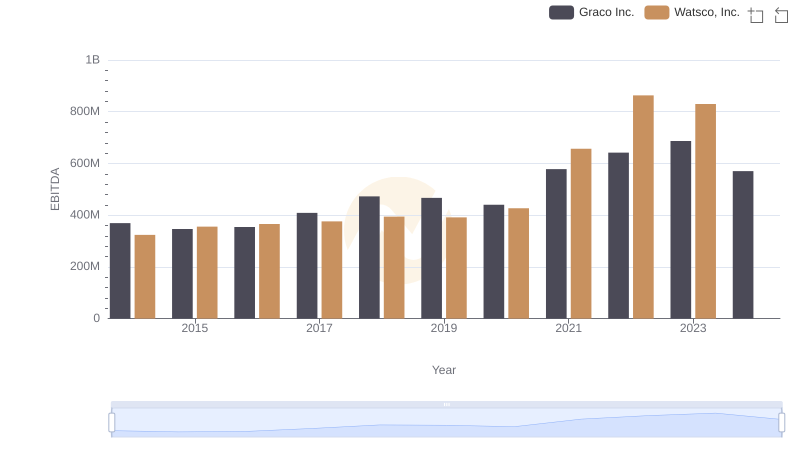

| __timestamp | Graco Inc. | Watsco, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 303565000 | 650655000 |

| Thursday, January 1, 2015 | 324016000 | 670609000 |

| Friday, January 1, 2016 | 341734000 | 688952000 |

| Sunday, January 1, 2017 | 372496000 | 715671000 |

| Monday, January 1, 2018 | 382988000 | 757452000 |

| Tuesday, January 1, 2019 | 367743000 | 800328000 |

| Wednesday, January 1, 2020 | 355796000 | 833051000 |

| Friday, January 1, 2021 | 422975000 | 1058316000 |

| Saturday, January 1, 2022 | 404731000 | 1221382000 |

| Sunday, January 1, 2023 | 432156000 | 1185626000 |

| Monday, January 1, 2024 | 465133000 | 1262938000 |

In pursuit of knowledge

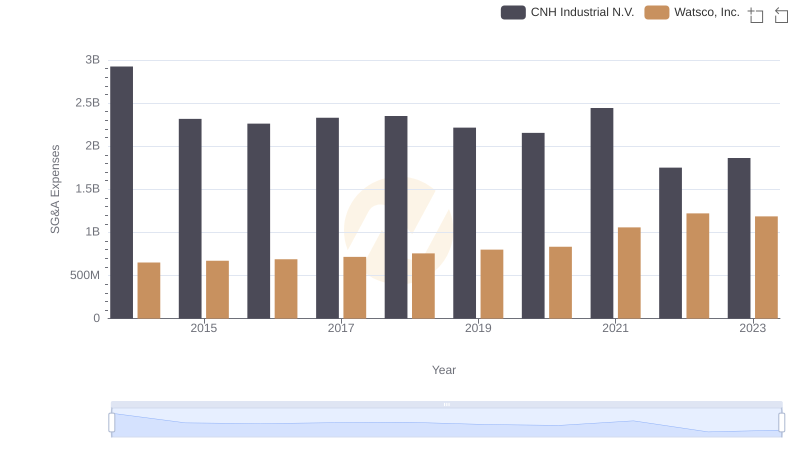

In the competitive landscape of industrial manufacturing, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Watsco, Inc. and Graco Inc. have demonstrated contrasting approaches to handling these costs. From 2014 to 2023, Graco Inc. has shown a steady increase in SG&A expenses, rising approximately 53% over the period. In contrast, Watsco, Inc. experienced a more dramatic increase of around 82% in the same timeframe. Notably, in 2021, Watsco's SG&A expenses surged by 27% compared to the previous year, reflecting strategic investments or operational shifts. However, the data for 2024 is incomplete, leaving room for speculation on future trends. This analysis provides a window into how these industry giants navigate financial management, offering insights into their strategic priorities and operational efficiencies.

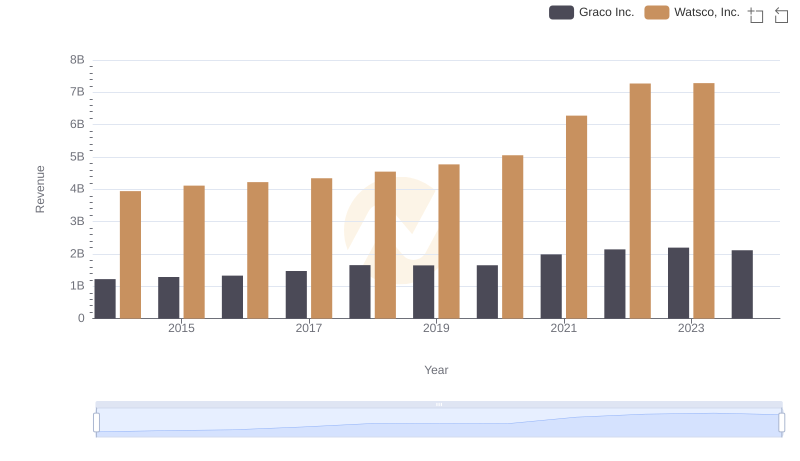

Watsco, Inc. or Graco Inc.: Who Leads in Yearly Revenue?

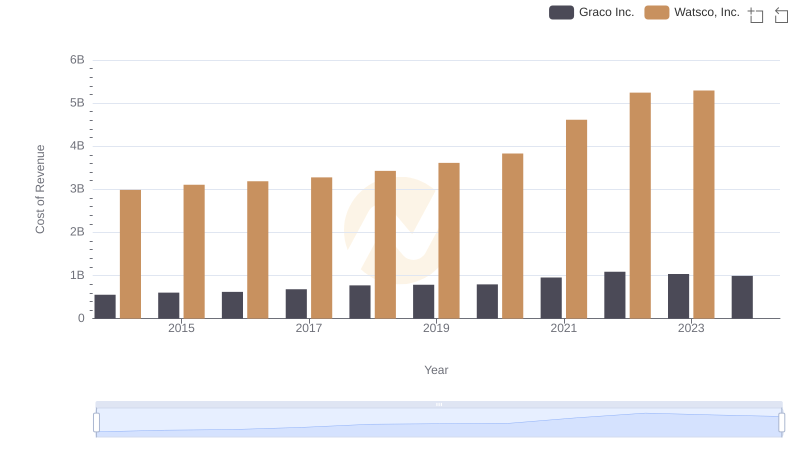

Analyzing Cost of Revenue: Watsco, Inc. and Graco Inc.

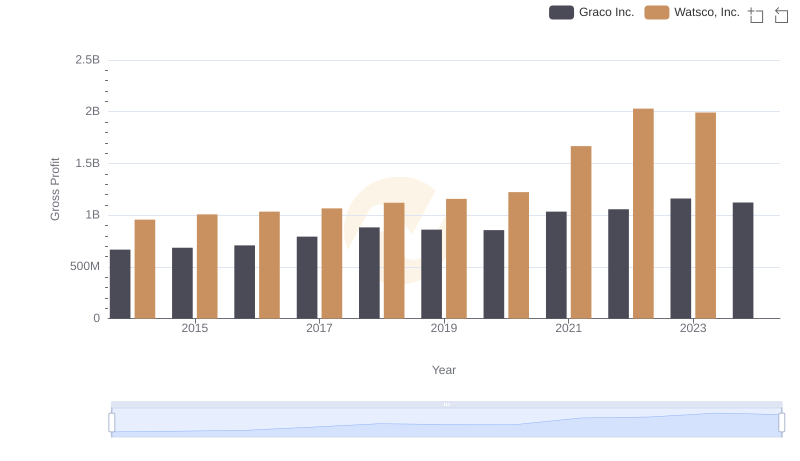

Who Generates Higher Gross Profit? Watsco, Inc. or Graco Inc.

Selling, General, and Administrative Costs: Watsco, Inc. vs CNH Industrial N.V.

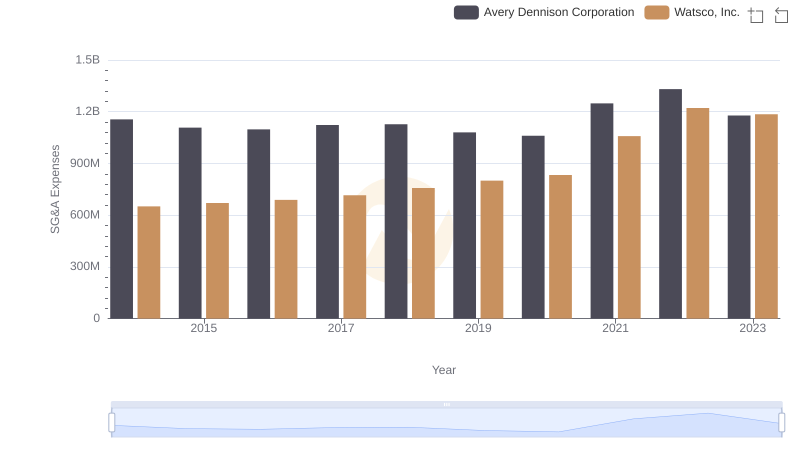

Watsco, Inc. and Avery Dennison Corporation: SG&A Spending Patterns Compared

Who Optimizes SG&A Costs Better? Watsco, Inc. or U-Haul Holding Company

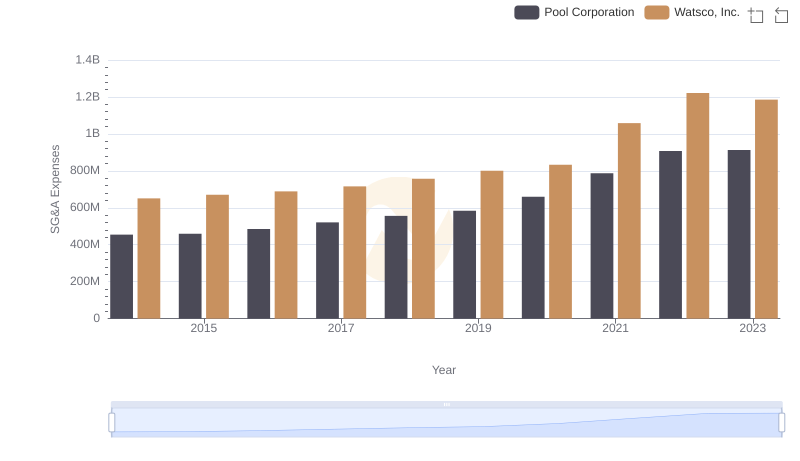

Breaking Down SG&A Expenses: Watsco, Inc. vs Pool Corporation

Watsco, Inc. vs Graco Inc.: In-Depth EBITDA Performance Comparison

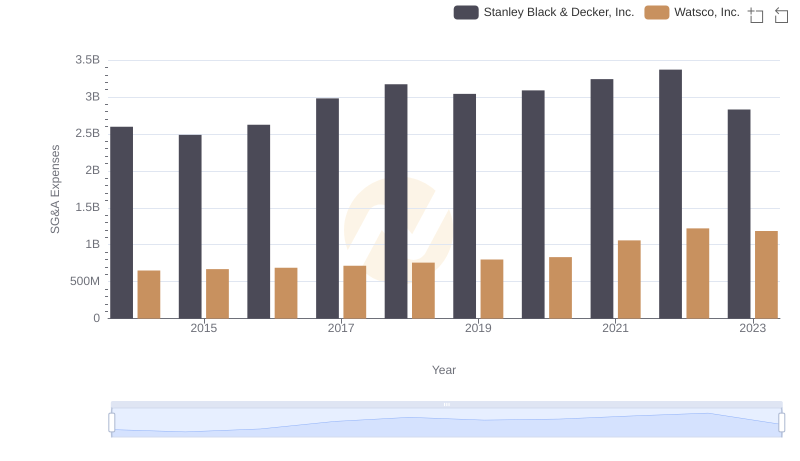

Cost Management Insights: SG&A Expenses for Watsco, Inc. and Stanley Black & Decker, Inc.