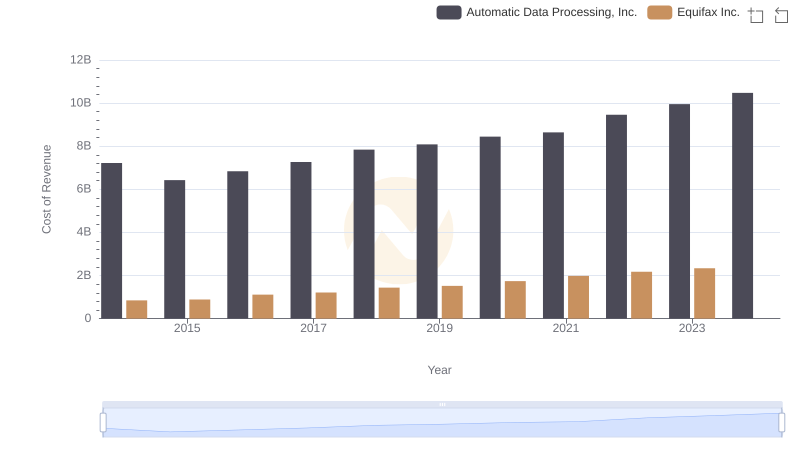

| __timestamp | Automatic Data Processing, Inc. | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4611400000 | 1591700000 |

| Thursday, January 1, 2015 | 4133200000 | 1776200000 |

| Friday, January 1, 2016 | 4450200000 | 2031500000 |

| Sunday, January 1, 2017 | 4712600000 | 2151500000 |

| Monday, January 1, 2018 | 5016700000 | 1971700000 |

| Tuesday, January 1, 2019 | 5526700000 | 1985900000 |

| Wednesday, January 1, 2020 | 6144700000 | 2390100000 |

| Friday, January 1, 2021 | 6365100000 | 2943000000 |

| Saturday, January 1, 2022 | 7036400000 | 2945000000 |

| Sunday, January 1, 2023 | 8058800000 | 2930100000 |

| Monday, January 1, 2024 | 8725900000 | 5681100000 |

Unlocking the unknown

In the ever-evolving landscape of financial services, Automatic Data Processing, Inc. (ADP) and Equifax Inc. have showcased intriguing trends in their gross profits over the past decade. From 2014 to 2023, ADP's gross profit surged by approximately 89%, reflecting its robust growth and strategic market positioning. In contrast, Equifax's gross profit increased by around 84% during the same period, highlighting its resilience amidst market challenges.

ADP's gross profit journey began at $4.6 billion in 2014, climbing steadily to an impressive $8.1 billion by 2023. This growth trajectory underscores ADP's ability to adapt and thrive in a competitive environment. Meanwhile, Equifax's gross profit rose from $1.6 billion in 2014 to $2.9 billion in 2023, despite facing data breaches and regulatory hurdles.

While ADP's data for 2024 is available, Equifax's figures remain elusive, leaving room for speculation on its future performance. This comparison offers a fascinating glimpse into the financial dynamics of two industry titans, each navigating their unique paths to success.

Cost of Revenue: Key Insights for Automatic Data Processing, Inc. and Equifax Inc.

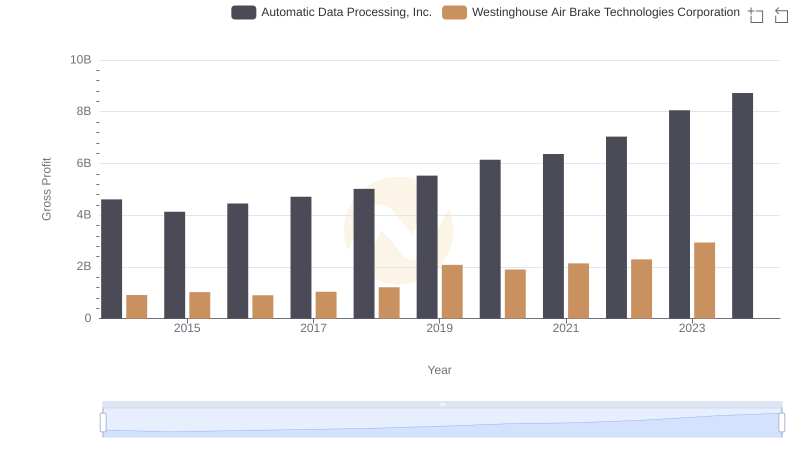

Gross Profit Comparison: Automatic Data Processing, Inc. and Westinghouse Air Brake Technologies Corporation Trends

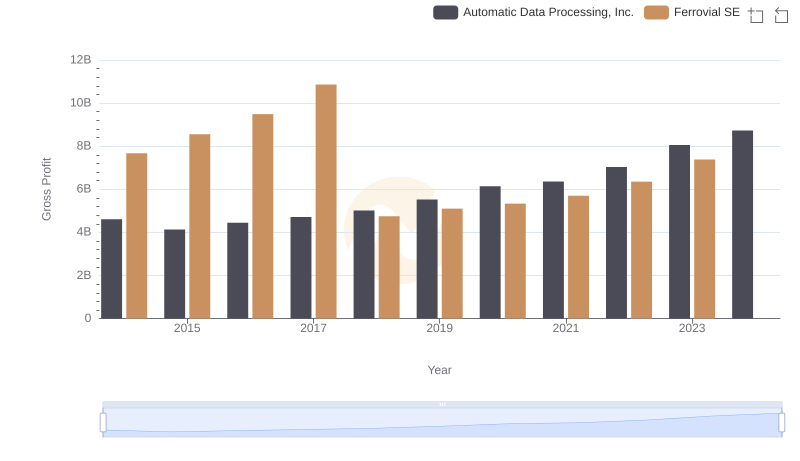

Gross Profit Comparison: Automatic Data Processing, Inc. and Ferrovial SE Trends

Gross Profit Comparison: Automatic Data Processing, Inc. and Dover Corporation Trends

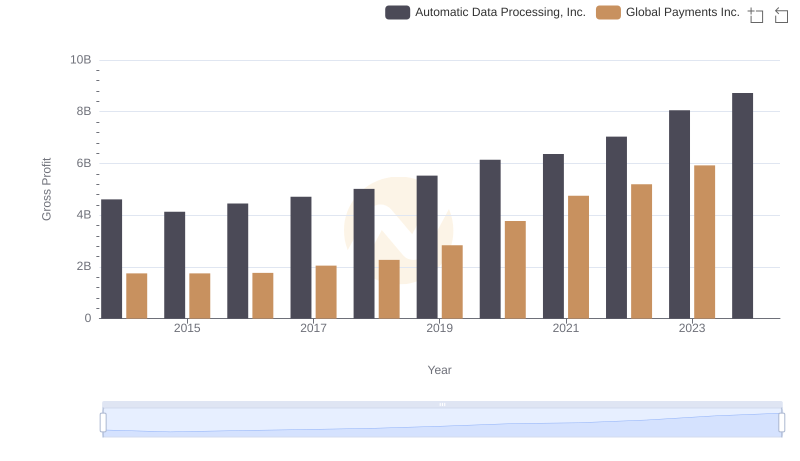

Automatic Data Processing, Inc. and Global Payments Inc.: A Detailed Gross Profit Analysis

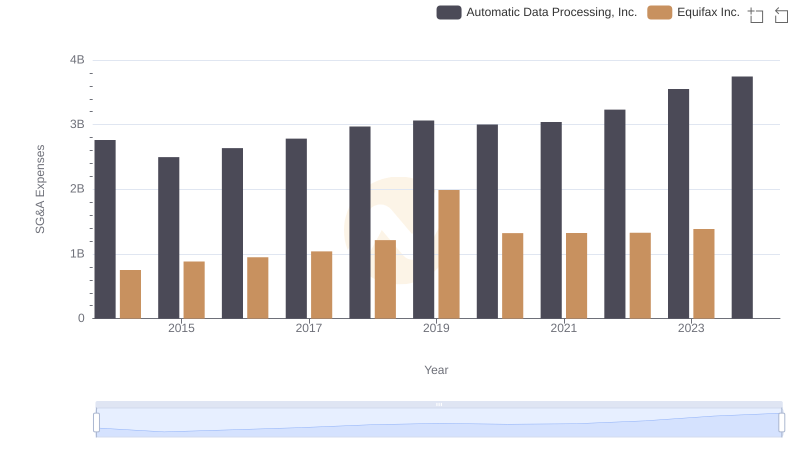

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Equifax Inc.

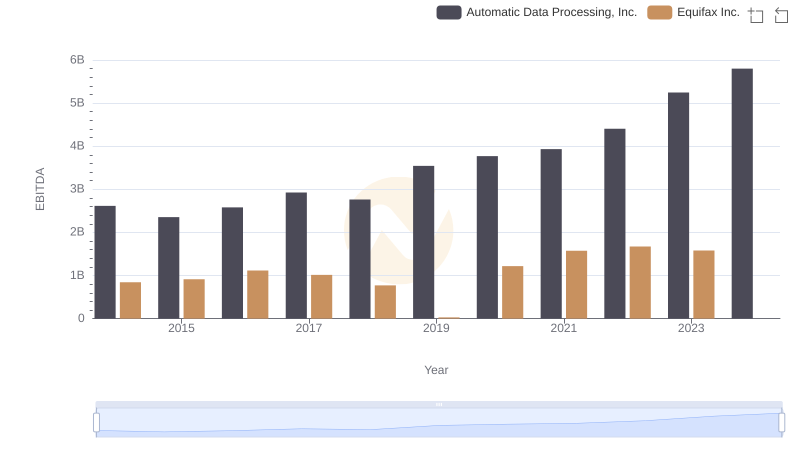

EBITDA Performance Review: Automatic Data Processing, Inc. vs Equifax Inc.