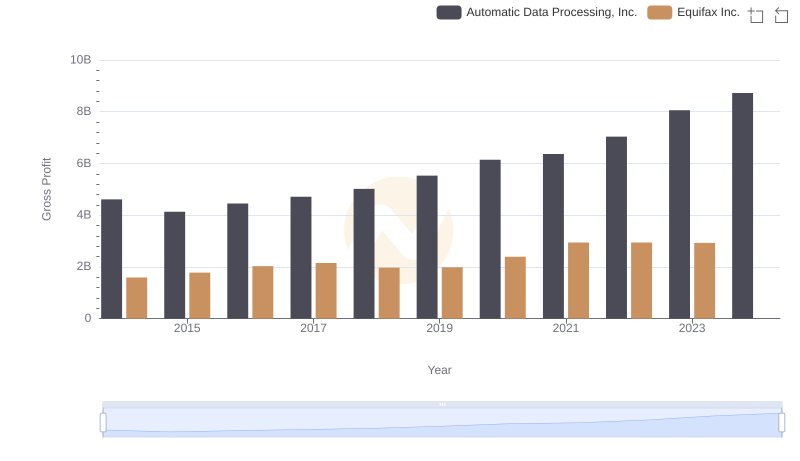

| __timestamp | Automatic Data Processing, Inc. | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 7221400000 | 844700000 |

| Thursday, January 1, 2015 | 6427600000 | 887400000 |

| Friday, January 1, 2016 | 6840300000 | 1113400000 |

| Sunday, January 1, 2017 | 7269800000 | 1210700000 |

| Monday, January 1, 2018 | 7842600000 | 1440400000 |

| Tuesday, January 1, 2019 | 8086600000 | 1521700000 |

| Wednesday, January 1, 2020 | 8445100000 | 1737400000 |

| Friday, January 1, 2021 | 8640300000 | 1980900000 |

| Saturday, January 1, 2022 | 9461900000 | 2177200000 |

| Sunday, January 1, 2023 | 9953400000 | 2335100000 |

| Monday, January 1, 2024 | 10476700000 | 0 |

In pursuit of knowledge

In the ever-evolving landscape of financial services, understanding cost structures is crucial. Automatic Data Processing, Inc. (ADP) and Equifax Inc. have shown distinct trajectories in their cost of revenue from 2014 to 2023. ADP's cost of revenue has surged by approximately 45%, reflecting its strategic investments and operational scaling. In contrast, Equifax Inc. has experienced a more modest increase of around 176%, indicating a steady expansion in its service offerings.

ADP's cost of revenue peaked in 2023, reaching over $10 billion, while Equifax's costs rose to $2.3 billion in the same year. Notably, data for 2024 is incomplete, highlighting the dynamic nature of financial reporting. These trends underscore the importance of cost management in maintaining competitive advantage and profitability in the financial sector.

Comparing Cost of Revenue Efficiency: Automatic Data Processing, Inc. vs Rockwell Automation, Inc.

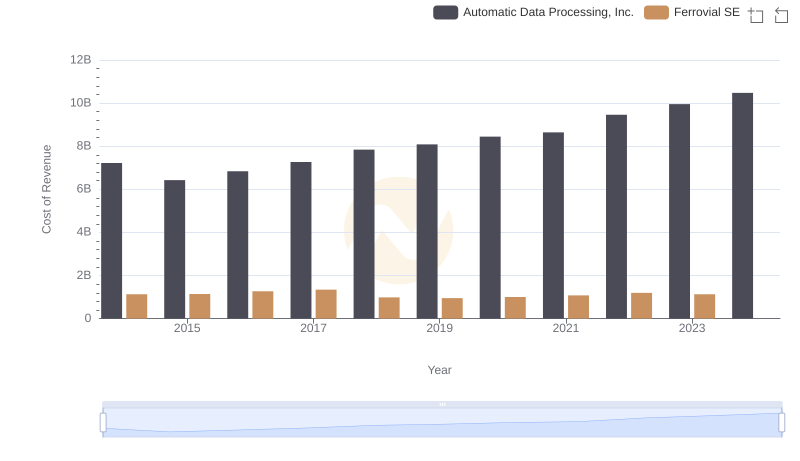

Cost of Revenue Comparison: Automatic Data Processing, Inc. vs Ferrovial SE

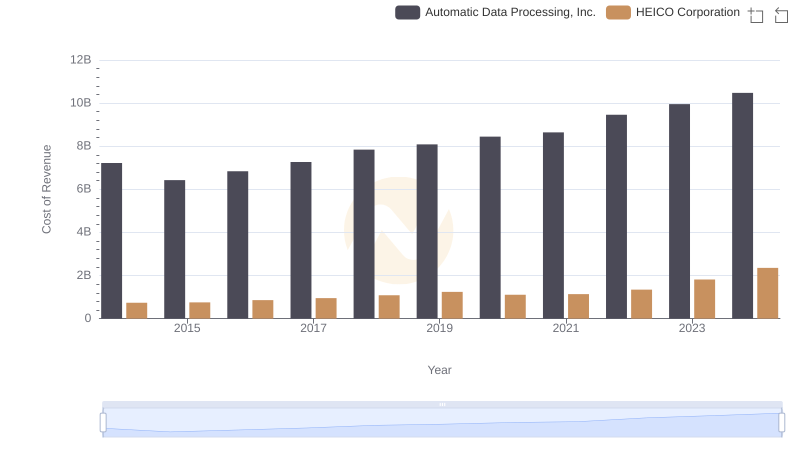

Analyzing Cost of Revenue: Automatic Data Processing, Inc. and HEICO Corporation

Gross Profit Trends Compared: Automatic Data Processing, Inc. vs Equifax Inc.

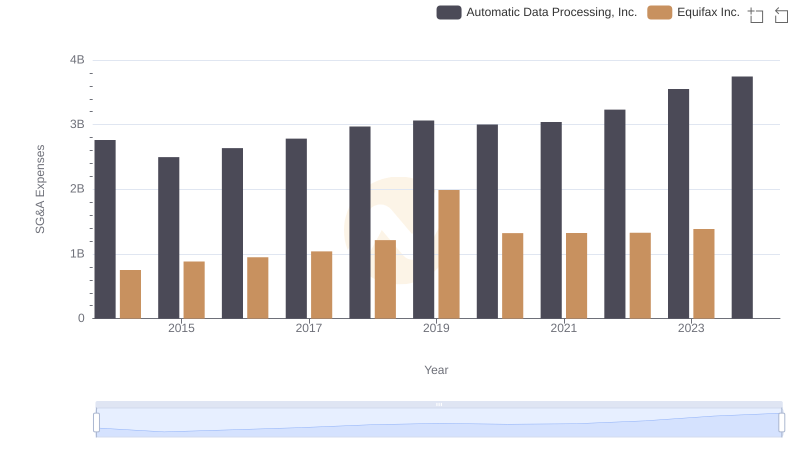

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Equifax Inc.

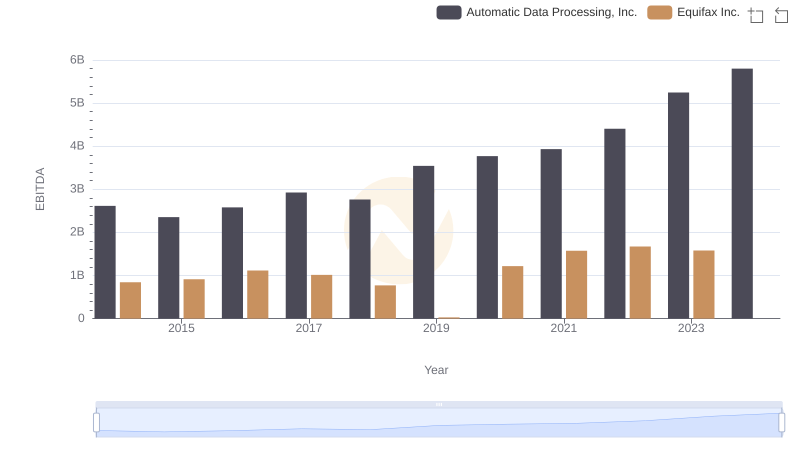

EBITDA Performance Review: Automatic Data Processing, Inc. vs Equifax Inc.