| __timestamp | Automatic Data Processing, Inc. | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2616900000 | 842400000 |

| Thursday, January 1, 2015 | 2355100000 | 914600000 |

| Friday, January 1, 2016 | 2579500000 | 1116900000 |

| Sunday, January 1, 2017 | 2927200000 | 1013900000 |

| Monday, January 1, 2018 | 2762900000 | 770200000 |

| Tuesday, January 1, 2019 | 3544500000 | 29000000 |

| Wednesday, January 1, 2020 | 3769700000 | 1217800000 |

| Friday, January 1, 2021 | 3931600000 | 1575200000 |

| Saturday, January 1, 2022 | 4405500000 | 1672800000 |

| Sunday, January 1, 2023 | 5244600000 | 1579100000 |

| Monday, January 1, 2024 | 5800000000 | 1251200000 |

Unveiling the hidden dimensions of data

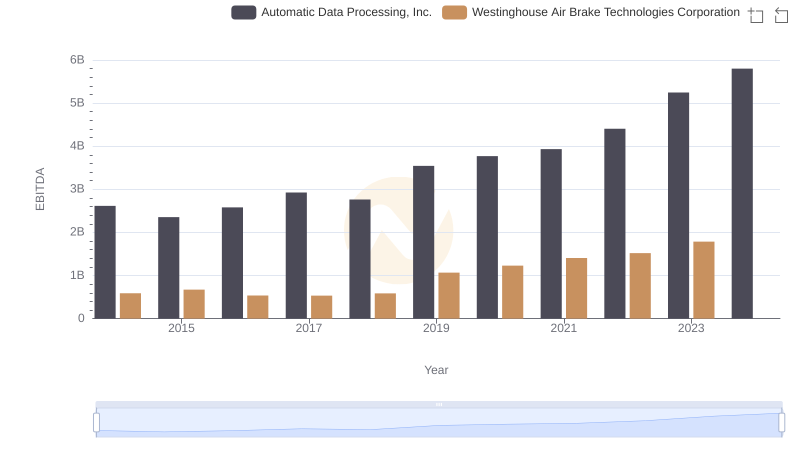

In the ever-evolving landscape of financial services, Automatic Data Processing, Inc. (ADP) and Equifax Inc. have showcased contrasting EBITDA trajectories over the past decade. From 2014 to 2023, ADP's EBITDA surged by approximately 122%, reflecting its robust growth strategy and market adaptability. In contrast, Equifax experienced a more modest increase of around 87%, with notable fluctuations, including a dip in 2019.

This analysis underscores the dynamic nature of the financial services sector, where strategic agility and market responsiveness are paramount for sustained growth.

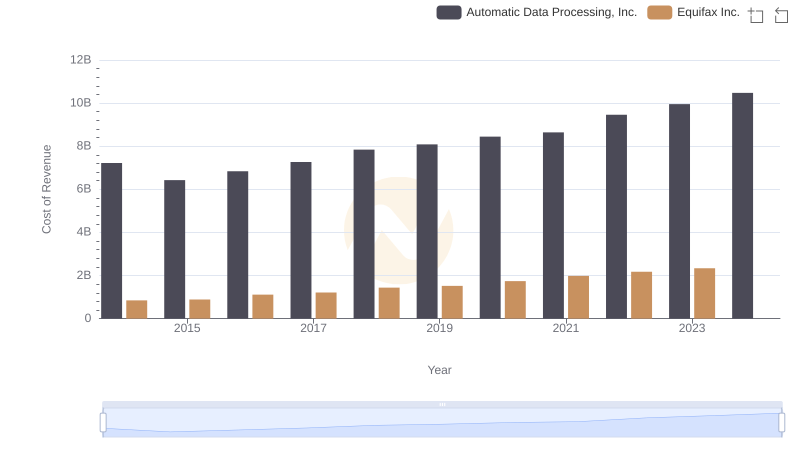

Cost of Revenue: Key Insights for Automatic Data Processing, Inc. and Equifax Inc.

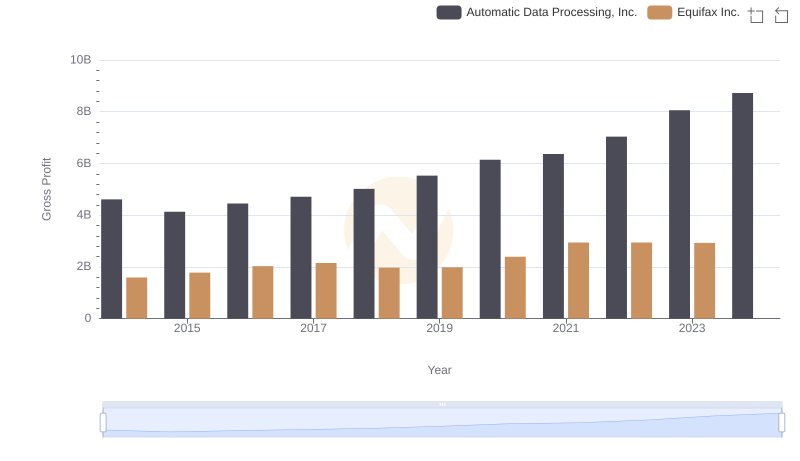

Gross Profit Trends Compared: Automatic Data Processing, Inc. vs Equifax Inc.

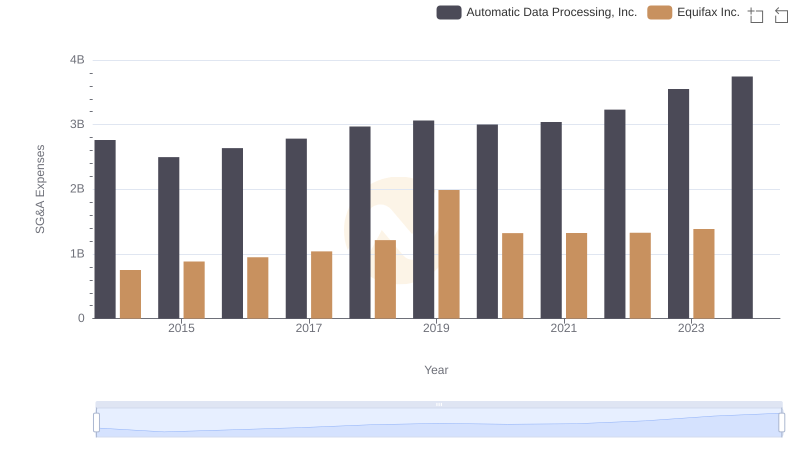

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Equifax Inc.

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Westinghouse Air Brake Technologies Corporation

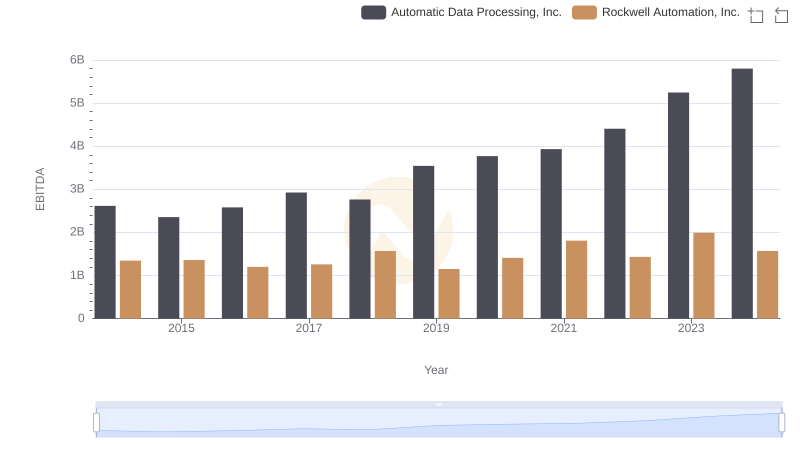

Automatic Data Processing, Inc. and Rockwell Automation, Inc.: A Detailed Examination of EBITDA Performance

Automatic Data Processing, Inc. vs HEICO Corporation: In-Depth EBITDA Performance Comparison

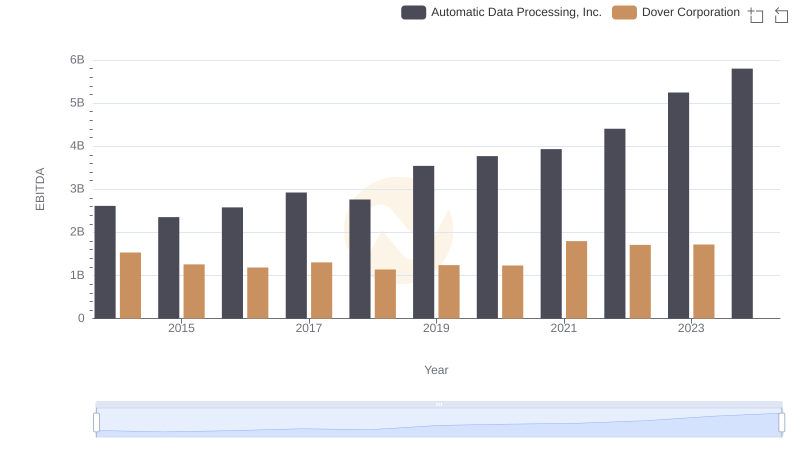

Automatic Data Processing, Inc. and Dover Corporation: A Detailed Examination of EBITDA Performance