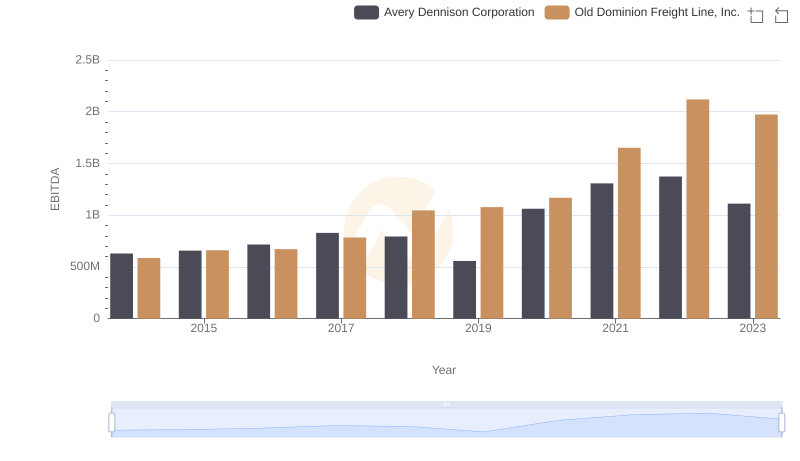

| __timestamp | AECOM | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 417662000 | 585590000 |

| Thursday, January 1, 2015 | 1020478000 | 660570000 |

| Friday, January 1, 2016 | 926466000 | 671786000 |

| Sunday, January 1, 2017 | 920292000 | 783749000 |

| Monday, January 1, 2018 | 680801000 | 1046059000 |

| Tuesday, January 1, 2019 | 573352000 | 1078007000 |

| Wednesday, January 1, 2020 | 580017000 | 1168149000 |

| Friday, January 1, 2021 | 813356000 | 1651501000 |

| Saturday, January 1, 2022 | 826856000 | 2118962000 |

| Sunday, January 1, 2023 | 543642000 | 1972689000 |

| Monday, January 1, 2024 | 1082384000 |

Data in motion

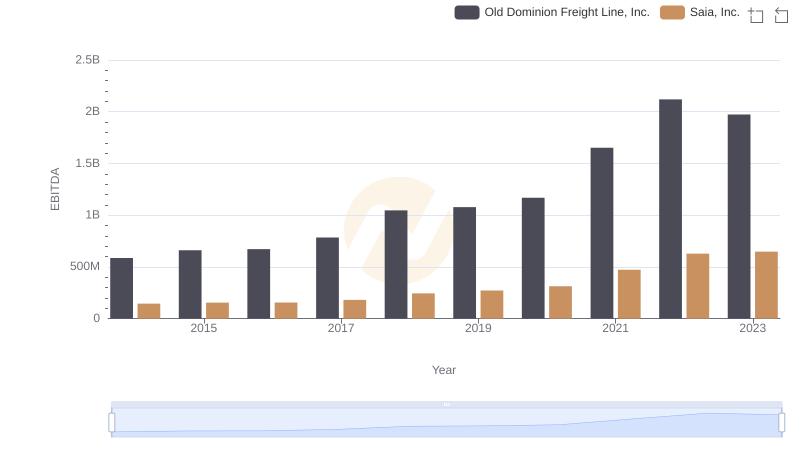

In the world of logistics and infrastructure, two giants stand out: Old Dominion Freight Line, Inc. and AECOM. Over the past decade, these companies have showcased remarkable EBITDA performance, reflecting their operational efficiency and market prowess. From 2014 to 2023, Old Dominion Freight Line, Inc. has seen a staggering growth of over 250% in EBITDA, peaking in 2022. This growth underscores their strategic expansion and robust service offerings.

Conversely, AECOM's journey has been more volatile, with a notable dip in 2019, followed by a resurgence in 2024, marking a 160% increase from its 2014 figures. This fluctuation highlights the challenges and opportunities in the infrastructure sector. As we look to the future, the missing data for 2024 for Old Dominion Freight Line, Inc. leaves us anticipating their next strategic move. Stay tuned as these industry leaders continue to shape the landscape of logistics and infrastructure.

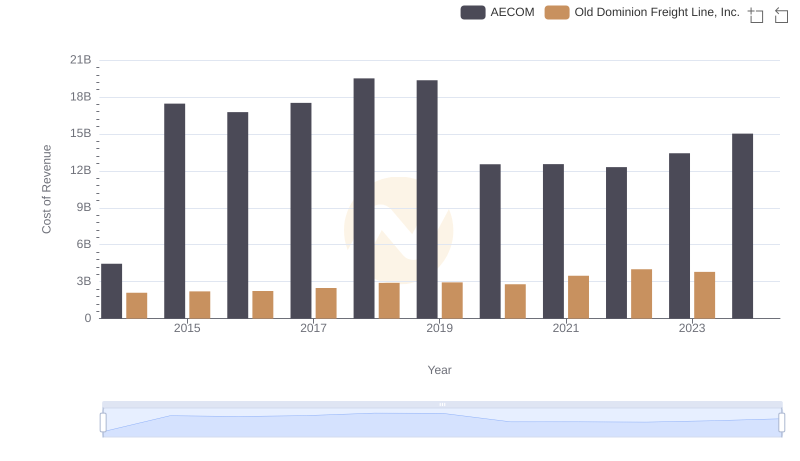

Cost of Revenue: Key Insights for Old Dominion Freight Line, Inc. and AECOM

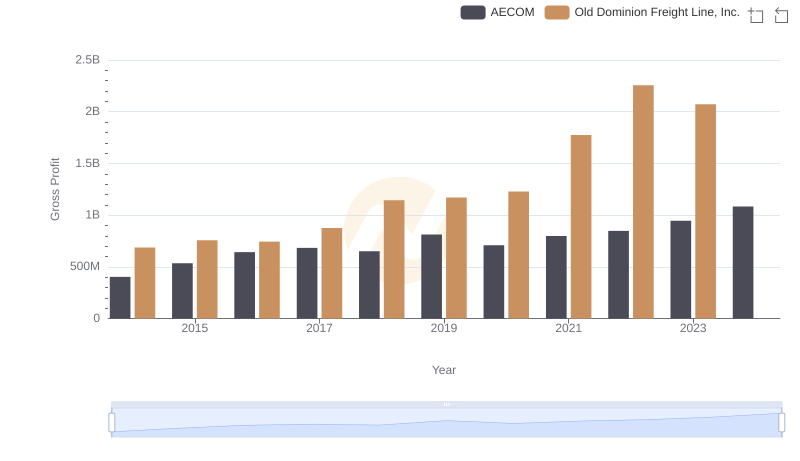

Gross Profit Analysis: Comparing Old Dominion Freight Line, Inc. and AECOM

A Professional Review of EBITDA: Old Dominion Freight Line, Inc. Compared to Avery Dennison Corporation

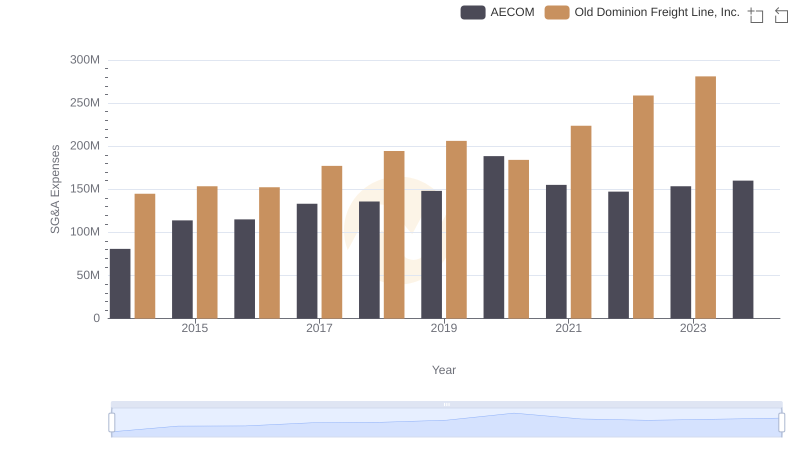

Comparing SG&A Expenses: Old Dominion Freight Line, Inc. vs AECOM Trends and Insights

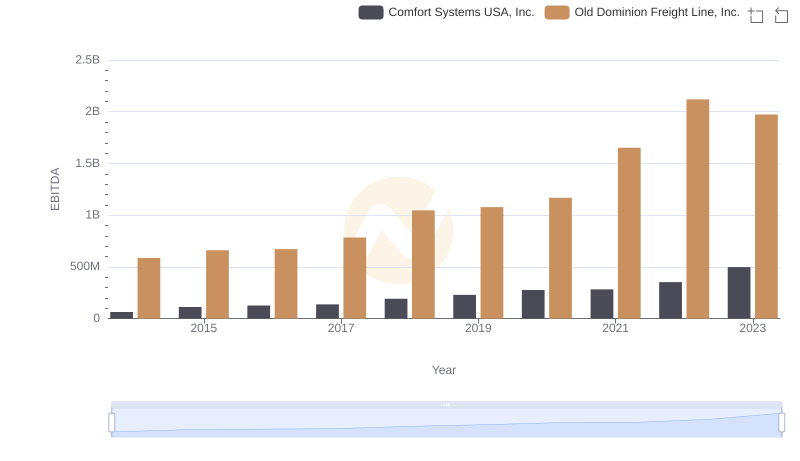

Professional EBITDA Benchmarking: Old Dominion Freight Line, Inc. vs Comfort Systems USA, Inc.

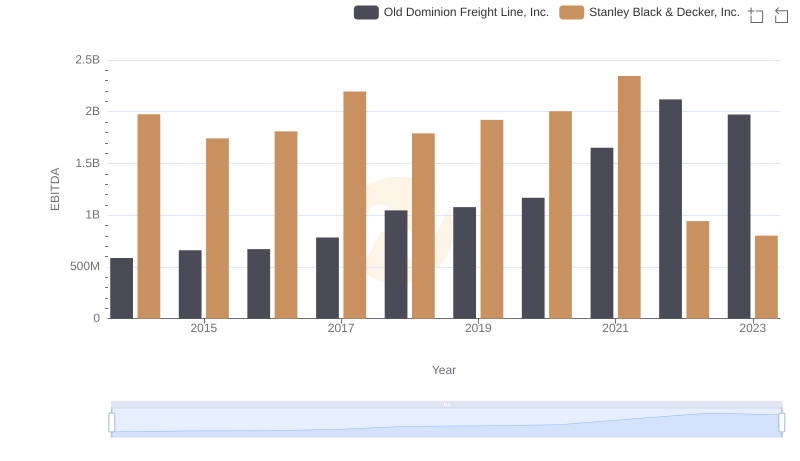

A Professional Review of EBITDA: Old Dominion Freight Line, Inc. Compared to Stanley Black & Decker, Inc.

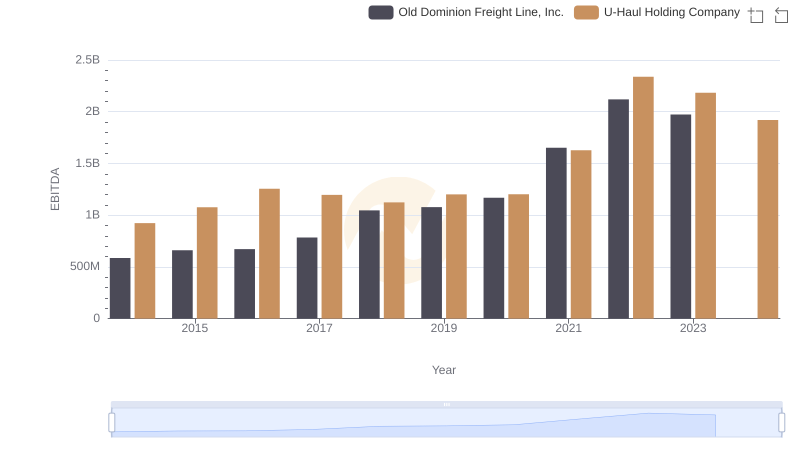

A Side-by-Side Analysis of EBITDA: Old Dominion Freight Line, Inc. and U-Haul Holding Company

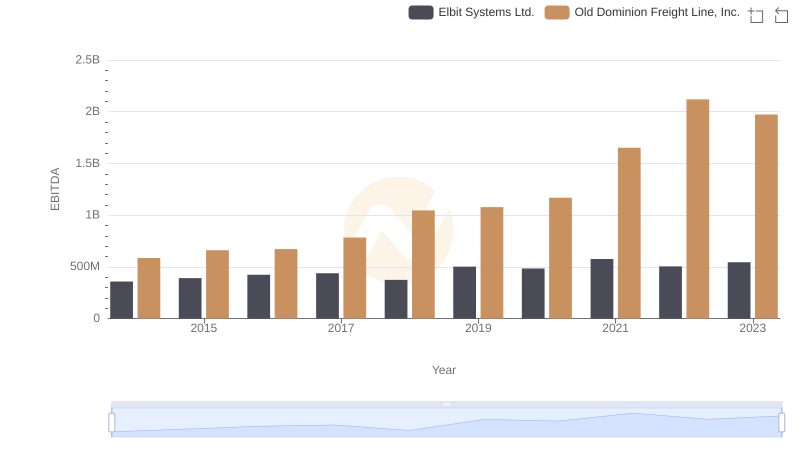

Comparative EBITDA Analysis: Old Dominion Freight Line, Inc. vs Elbit Systems Ltd.

Comprehensive EBITDA Comparison: Old Dominion Freight Line, Inc. vs Saia, Inc.