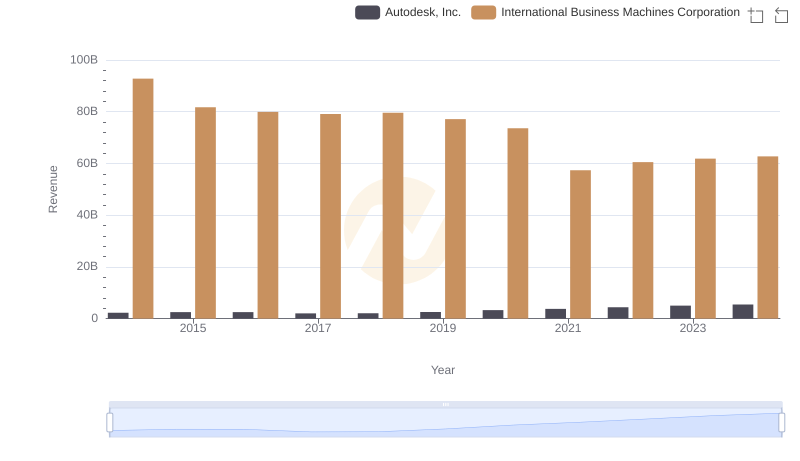

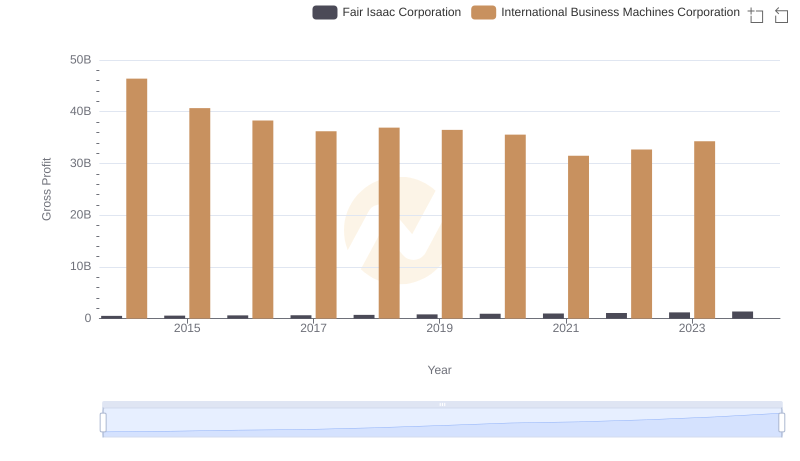

| __timestamp | Autodesk, Inc. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1999600000 | 46407000000 |

| Thursday, January 1, 2015 | 2170100000 | 40684000000 |

| Friday, January 1, 2016 | 2133400000 | 38516000000 |

| Sunday, January 1, 2017 | 1689100000 | 36943000000 |

| Monday, January 1, 2018 | 1753200000 | 36936000000 |

| Tuesday, January 1, 2019 | 2283900000 | 31533000000 |

| Wednesday, January 1, 2020 | 2949400000 | 30865000000 |

| Friday, January 1, 2021 | 3453300000 | 31486000000 |

| Saturday, January 1, 2022 | 3967900000 | 32687000000 |

| Sunday, January 1, 2023 | 4525000000 | 34300000000 |

| Monday, January 1, 2024 | 4977000000 | 35551000000 |

Cracking the code

In the ever-evolving landscape of technology, the financial performance of industry giants like International Business Machines Corporation (IBM) and Autodesk, Inc. offers a fascinating glimpse into their strategic maneuvers. Over the past decade, from 2014 to 2024, IBM's gross profit has seen a decline of approximately 23%, from a peak of $46 billion in 2014 to around $35.5 billion in 2024. This trend reflects IBM's ongoing transformation and adaptation to new market demands.

Conversely, Autodesk has experienced a remarkable growth trajectory, with its gross profit more than doubling from $2 billion in 2014 to nearly $5 billion in 2024. This 146% increase underscores Autodesk's successful pivot towards subscription-based models and cloud solutions. As these two titans continue to navigate the digital age, their financial journeys provide valuable insights into the broader tech industry's shifts and trends.

Breaking Down Revenue Trends: International Business Machines Corporation vs Autodesk, Inc.

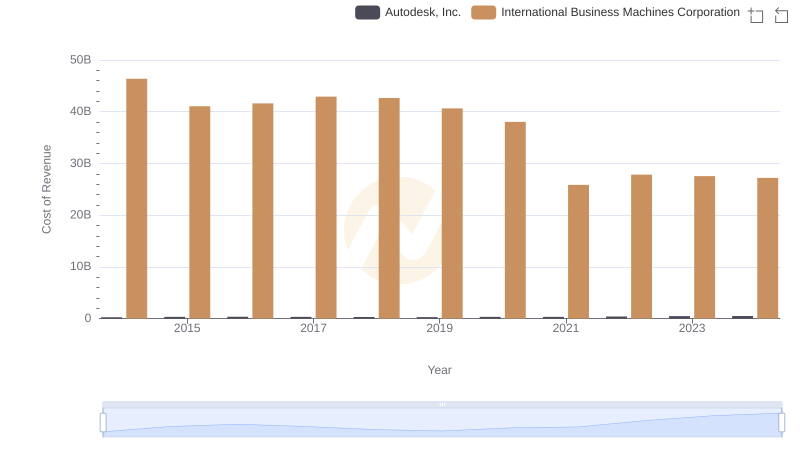

Cost of Revenue Trends: International Business Machines Corporation vs Autodesk, Inc.

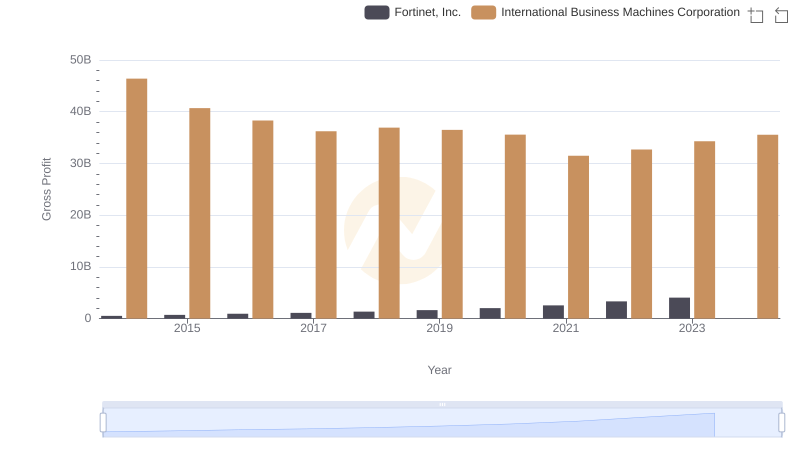

Who Generates Higher Gross Profit? International Business Machines Corporation or Fortinet, Inc.

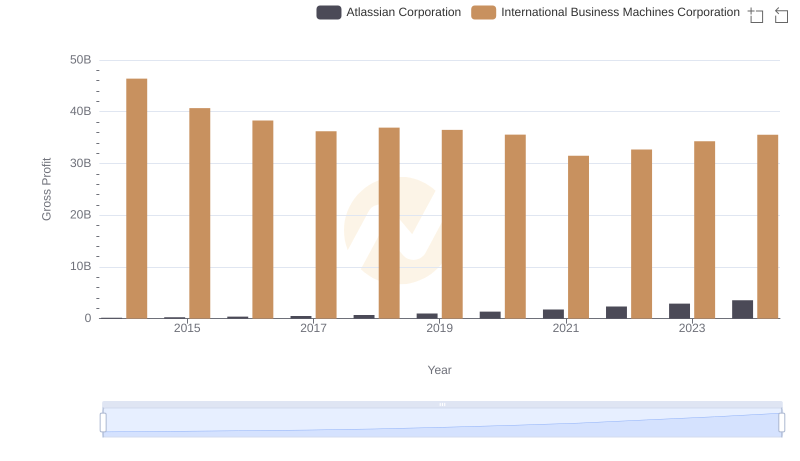

Gross Profit Comparison: International Business Machines Corporation and Atlassian Corporation Trends

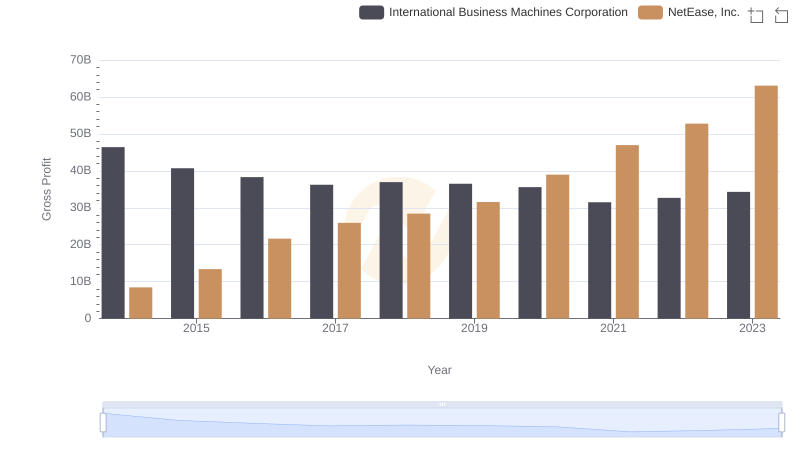

Gross Profit Analysis: Comparing International Business Machines Corporation and NetEase, Inc.

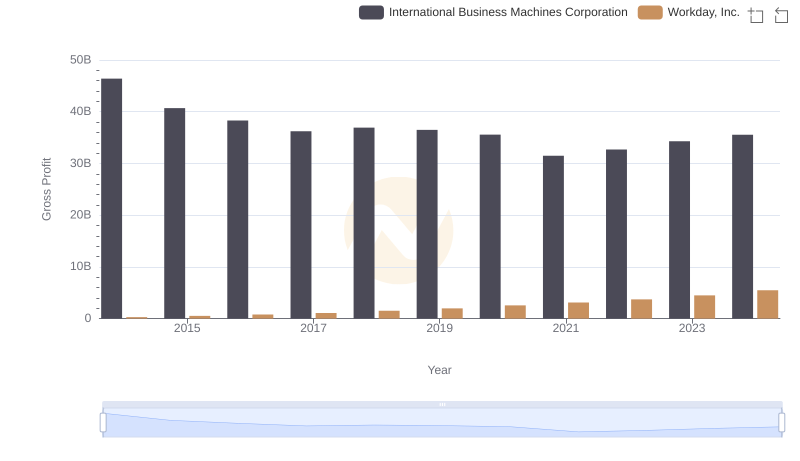

Key Insights on Gross Profit: International Business Machines Corporation vs Workday, Inc.

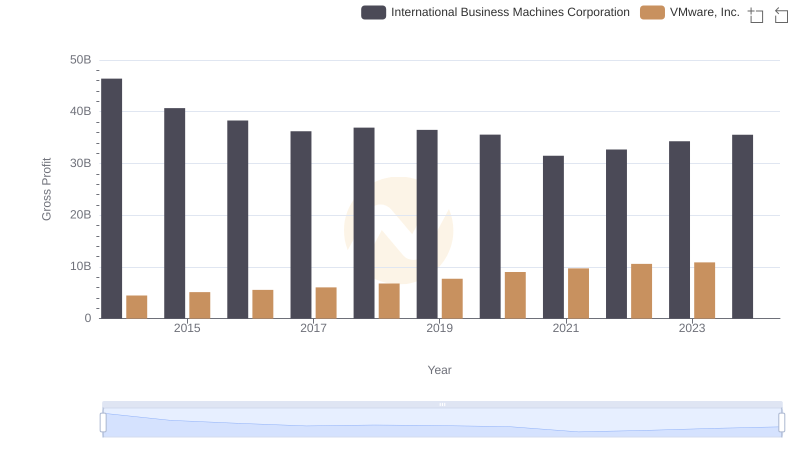

Gross Profit Analysis: Comparing International Business Machines Corporation and VMware, Inc.

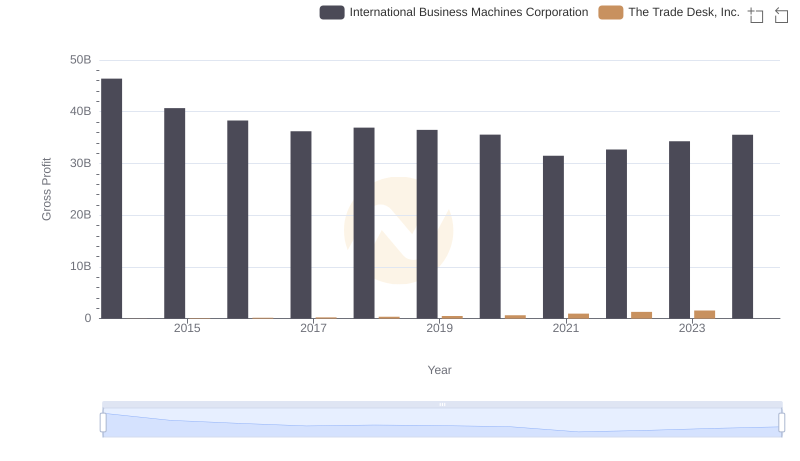

Key Insights on Gross Profit: International Business Machines Corporation vs The Trade Desk, Inc.

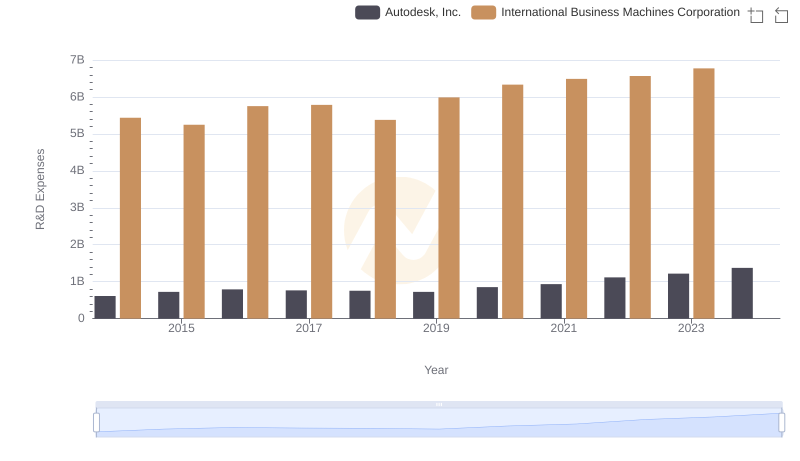

International Business Machines Corporation or Autodesk, Inc.: Who Invests More in Innovation?

Gross Profit Comparison: International Business Machines Corporation and NXP Semiconductors N.V. Trends

Who Generates Higher Gross Profit? International Business Machines Corporation or Fair Isaac Corporation

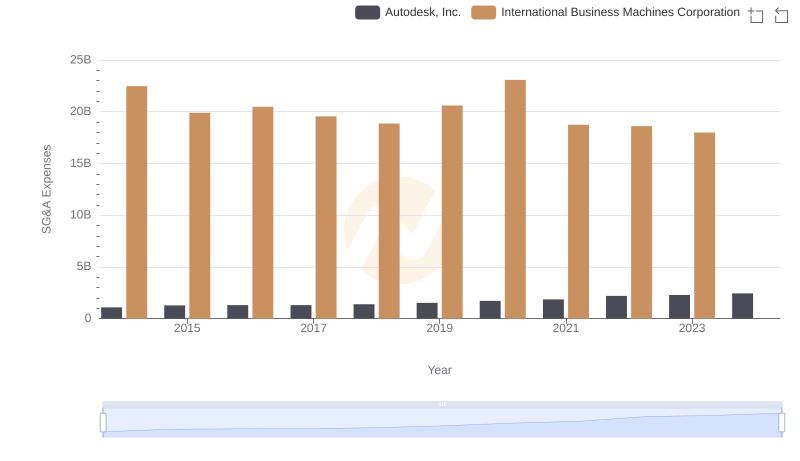

International Business Machines Corporation vs Autodesk, Inc.: SG&A Expense Trends