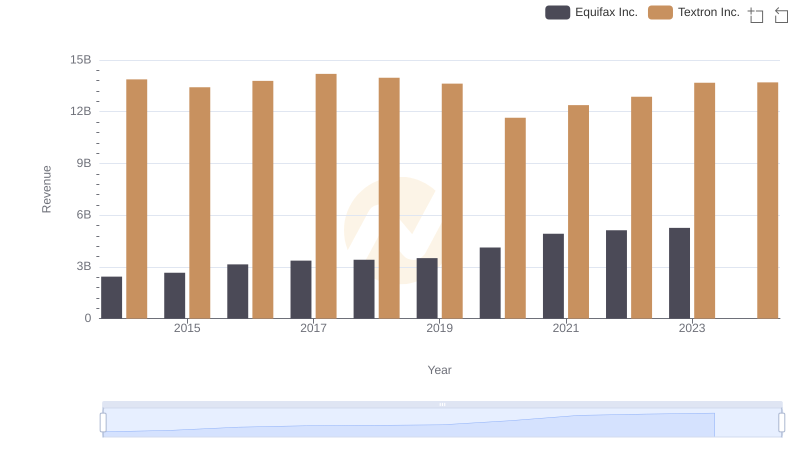

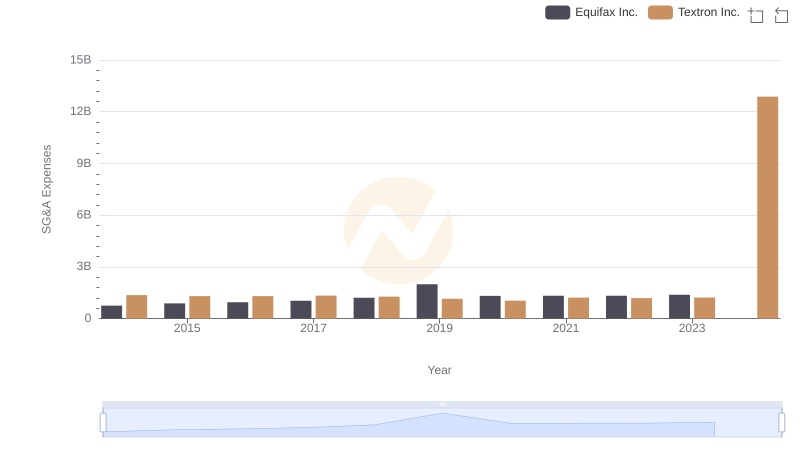

| __timestamp | Equifax Inc. | Textron Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1591700000 | 2457000000 |

| Thursday, January 1, 2015 | 1776200000 | 2444000000 |

| Friday, January 1, 2016 | 2031500000 | 2477000000 |

| Sunday, January 1, 2017 | 2151500000 | 2403000000 |

| Monday, January 1, 2018 | 1971700000 | 2378000000 |

| Tuesday, January 1, 2019 | 1985900000 | 2224000000 |

| Wednesday, January 1, 2020 | 2390100000 | 1557000000 |

| Friday, January 1, 2021 | 2943000000 | 2085000000 |

| Saturday, January 1, 2022 | 2945000000 | 2069000000 |

| Sunday, January 1, 2023 | 2930100000 | 2278000000 |

| Monday, January 1, 2024 | 5681100000 | 2502000000 |

Unleashing the power of data

In the ever-evolving landscape of American business, understanding the financial health of industry giants is crucial. This analysis delves into the gross profit trends of Equifax Inc. and Textron Inc. from 2014 to 2023. Over this decade, Equifax's gross profit exhibited a steady upward trajectory, peaking in 2022 with a remarkable 85% increase from its 2014 figures. Textron, on the other hand, experienced more volatility, with a significant dip in 2020, followed by a robust recovery, culminating in a staggering 500% surge by 2024. Notably, Equifax's consistent growth underscores its resilience, while Textron's dramatic rise in 2024 highlights its strategic adaptability. However, the absence of Equifax's data for 2024 leaves room for speculation about its future performance. This comparative insight offers a window into the strategic maneuvers and market dynamics shaping these corporate titans.

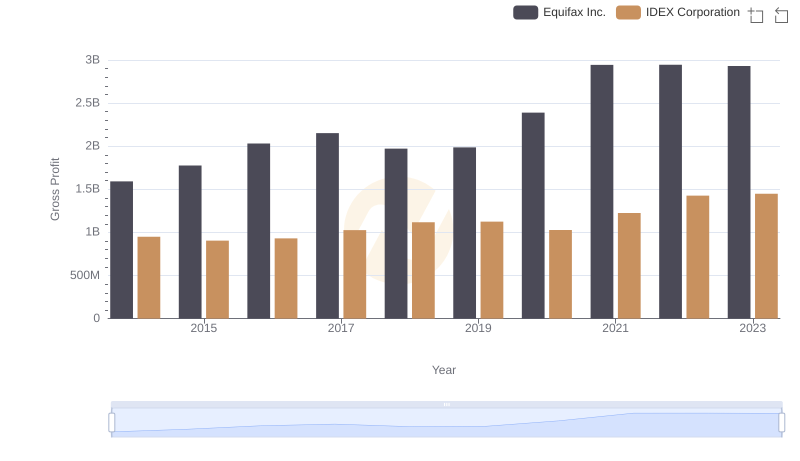

Gross Profit Trends Compared: Equifax Inc. vs IDEX Corporation

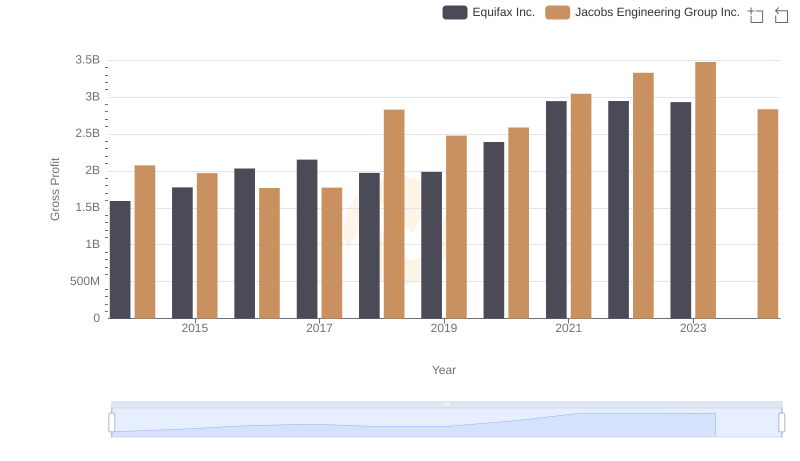

Key Insights on Gross Profit: Equifax Inc. vs Jacobs Engineering Group Inc.

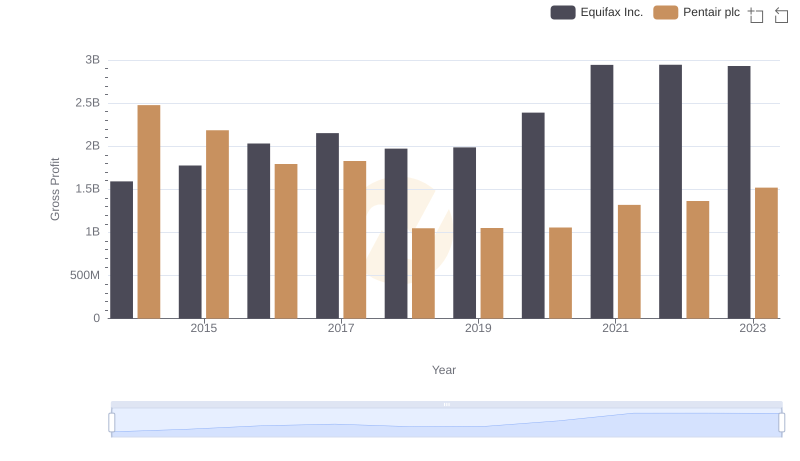

Key Insights on Gross Profit: Equifax Inc. vs Pentair plc

Comparing Revenue Performance: Equifax Inc. or Textron Inc.?

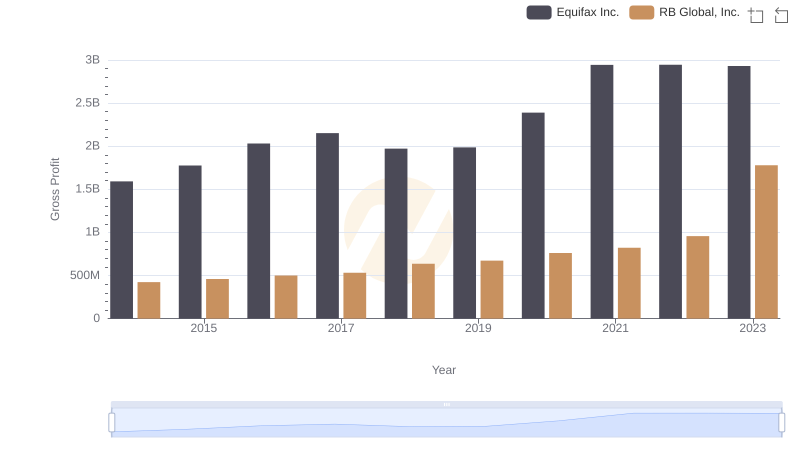

Gross Profit Comparison: Equifax Inc. and RB Global, Inc. Trends

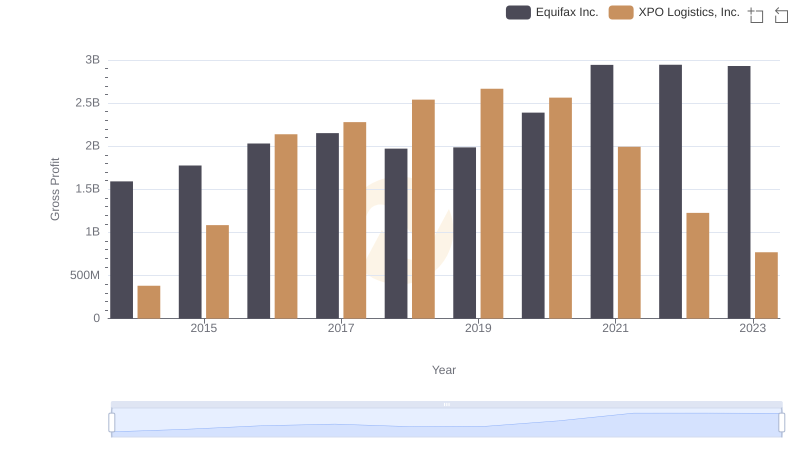

Equifax Inc. vs XPO Logistics, Inc.: A Gross Profit Performance Breakdown

Equifax Inc. vs Textron Inc.: SG&A Expense Trends

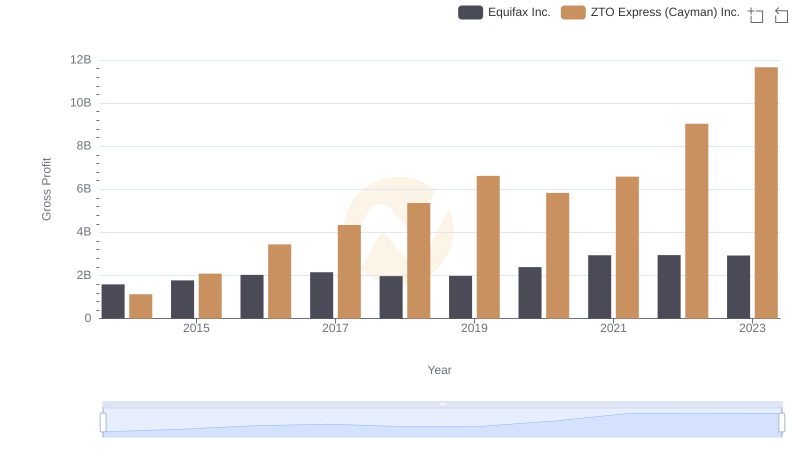

Who Generates Higher Gross Profit? Equifax Inc. or ZTO Express (Cayman) Inc.