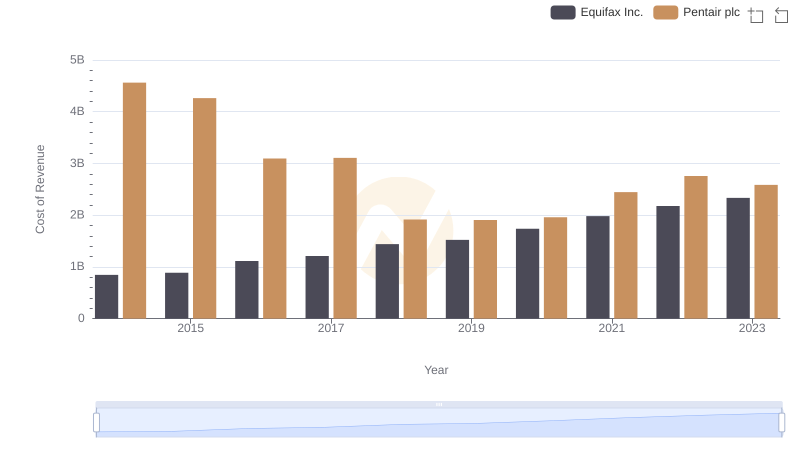

| __timestamp | Equifax Inc. | Pentair plc |

|---|---|---|

| Wednesday, January 1, 2014 | 1591700000 | 2476000000 |

| Thursday, January 1, 2015 | 1776200000 | 2185800000 |

| Friday, January 1, 2016 | 2031500000 | 1794100000 |

| Sunday, January 1, 2017 | 2151500000 | 1829100000 |

| Monday, January 1, 2018 | 1971700000 | 1047700000 |

| Tuesday, January 1, 2019 | 1985900000 | 1051500000 |

| Wednesday, January 1, 2020 | 2390100000 | 1057600000 |

| Friday, January 1, 2021 | 2943000000 | 1319200000 |

| Saturday, January 1, 2022 | 2945000000 | 1364600000 |

| Sunday, January 1, 2023 | 2930100000 | 1519200000 |

| Monday, January 1, 2024 | 5681100000 | 1598800000 |

Unleashing insights

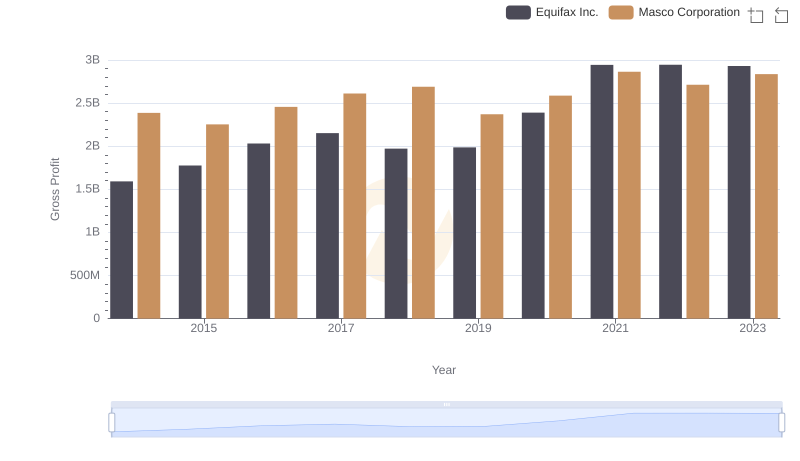

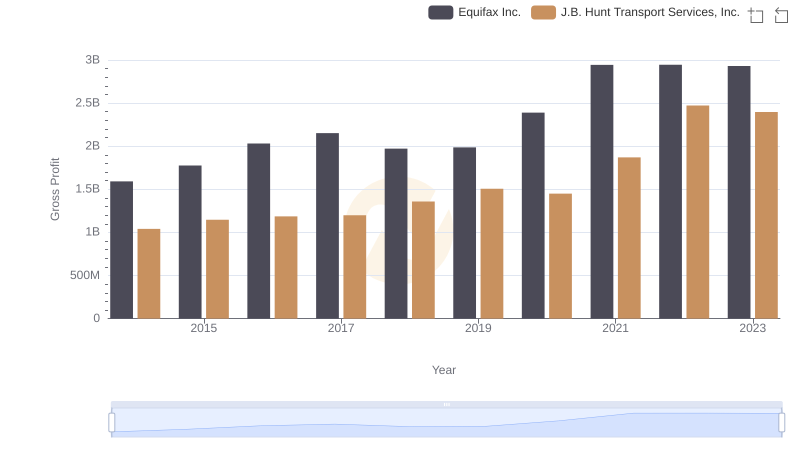

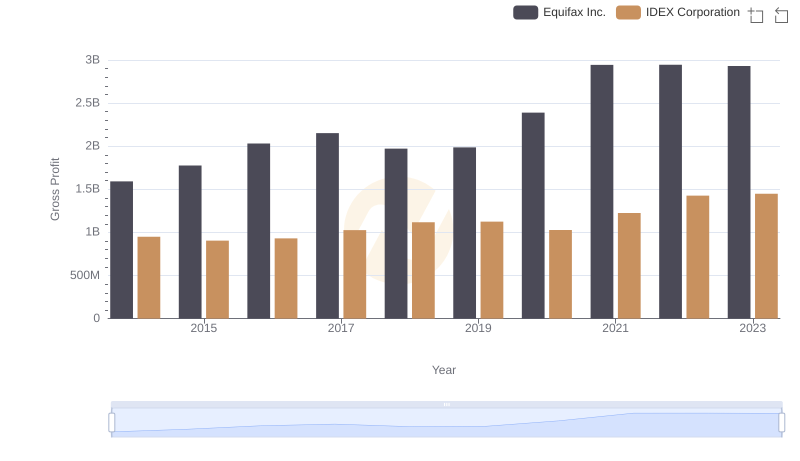

In the ever-evolving landscape of financial performance, Equifax Inc. and Pentair plc have showcased intriguing trends over the past decade. From 2014 to 2023, Equifax's gross profit surged by approximately 84%, peaking in 2022 with a remarkable $2.95 billion. This growth reflects a robust business strategy and adaptability in a competitive market. In contrast, Pentair plc experienced a 39% decline in gross profit from 2014 to 2018, hitting a low of $1.05 billion. However, a steady recovery followed, culminating in a 45% increase by 2023. This rebound highlights Pentair's resilience and strategic pivots in response to market challenges. As we delve into these financial narratives, the contrasting trajectories of these companies offer valuable insights into their operational efficiencies and market positioning. Explore the chart to uncover the detailed journey of these industry giants.

Analyzing Cost of Revenue: Equifax Inc. and Pentair plc

Key Insights on Gross Profit: Equifax Inc. vs Masco Corporation

Gross Profit Analysis: Comparing Equifax Inc. and J.B. Hunt Transport Services, Inc.

Gross Profit Trends Compared: Equifax Inc. vs IDEX Corporation

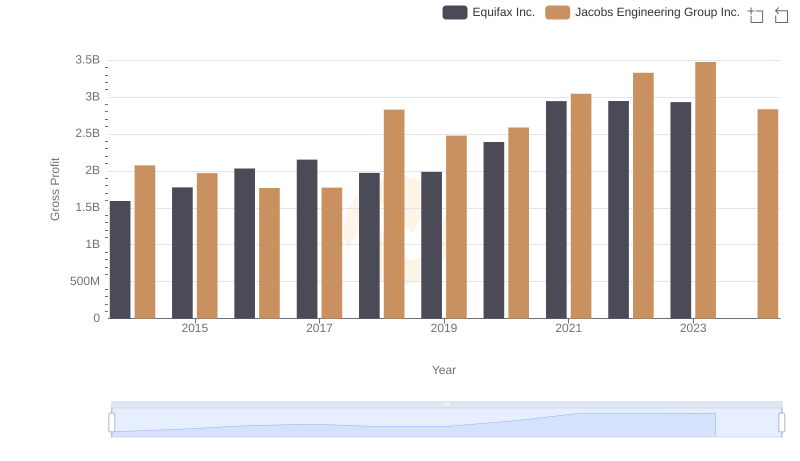

Key Insights on Gross Profit: Equifax Inc. vs Jacobs Engineering Group Inc.

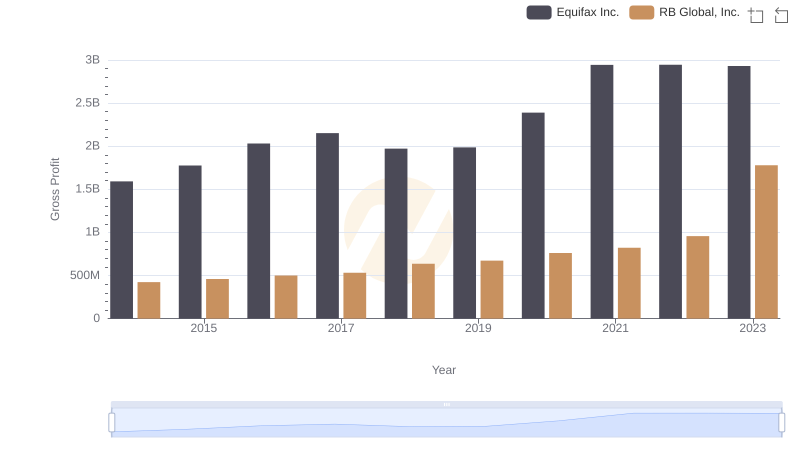

Gross Profit Comparison: Equifax Inc. and RB Global, Inc. Trends