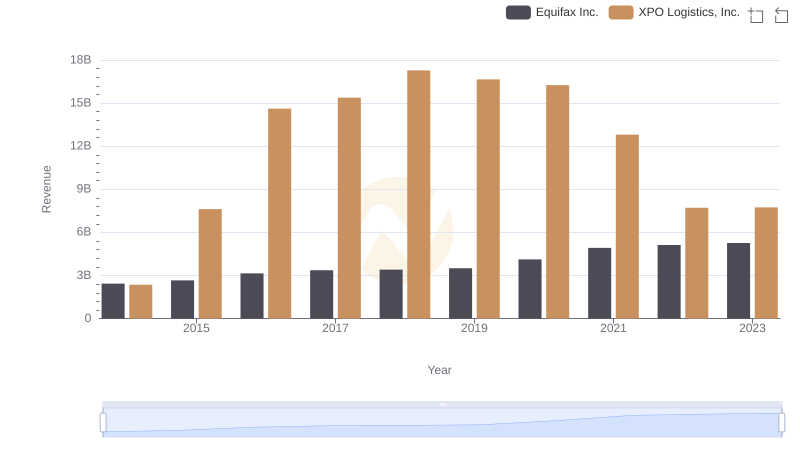

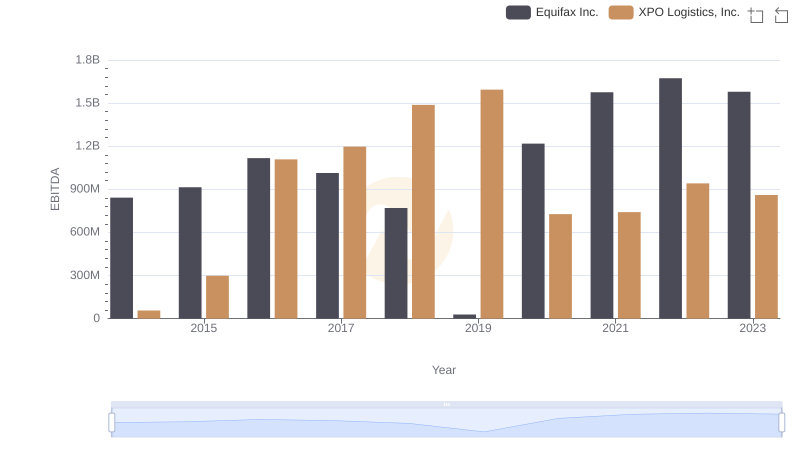

| __timestamp | Equifax Inc. | XPO Logistics, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1591700000 | 381600000 |

| Thursday, January 1, 2015 | 1776200000 | 1084800000 |

| Friday, January 1, 2016 | 2031500000 | 2139300000 |

| Sunday, January 1, 2017 | 2151500000 | 2279700000 |

| Monday, January 1, 2018 | 1971700000 | 2541000000 |

| Tuesday, January 1, 2019 | 1985900000 | 2666000000 |

| Wednesday, January 1, 2020 | 2390100000 | 2563000000 |

| Friday, January 1, 2021 | 2943000000 | 1994000000 |

| Saturday, January 1, 2022 | 2945000000 | 1227000000 |

| Sunday, January 1, 2023 | 2930100000 | 770000000 |

| Monday, January 1, 2024 | 5681100000 | 915000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of financial performance, Equifax Inc. and XPO Logistics, Inc. have showcased intriguing trends over the past decade. From 2014 to 2023, Equifax's gross profit surged by approximately 84%, peaking in 2022 with a remarkable $2.95 billion. In contrast, XPO Logistics experienced a more volatile journey, with its gross profit reaching a zenith in 2019 before declining by nearly 71% by 2023. This divergence highlights the resilience of Equifax amidst economic fluctuations, while XPO Logistics faced challenges in maintaining its upward trajectory. The data underscores the importance of strategic adaptability in the financial sector, as companies navigate through market dynamics and economic uncertainties. As we delve into these insights, it becomes evident that understanding these trends is crucial for investors and stakeholders aiming to make informed decisions in the competitive world of finance.

Equifax Inc. or XPO Logistics, Inc.: Who Leads in Yearly Revenue?

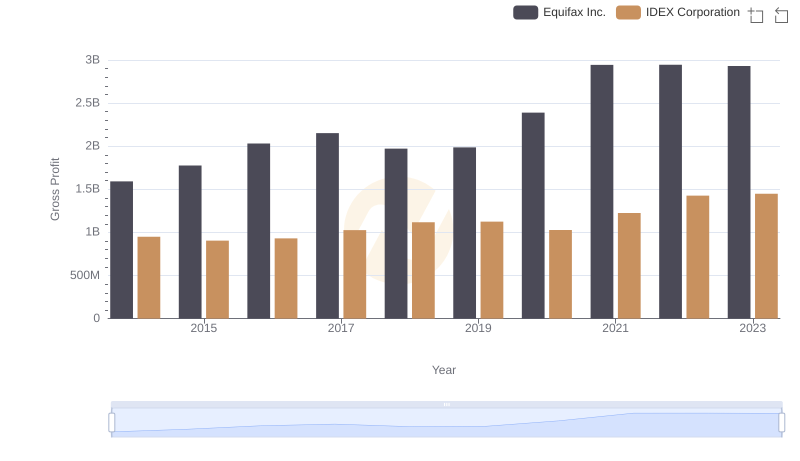

Gross Profit Trends Compared: Equifax Inc. vs IDEX Corporation

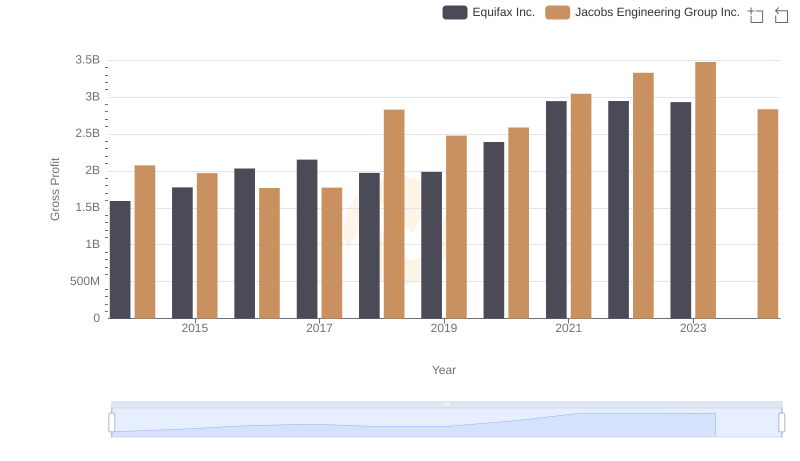

Key Insights on Gross Profit: Equifax Inc. vs Jacobs Engineering Group Inc.

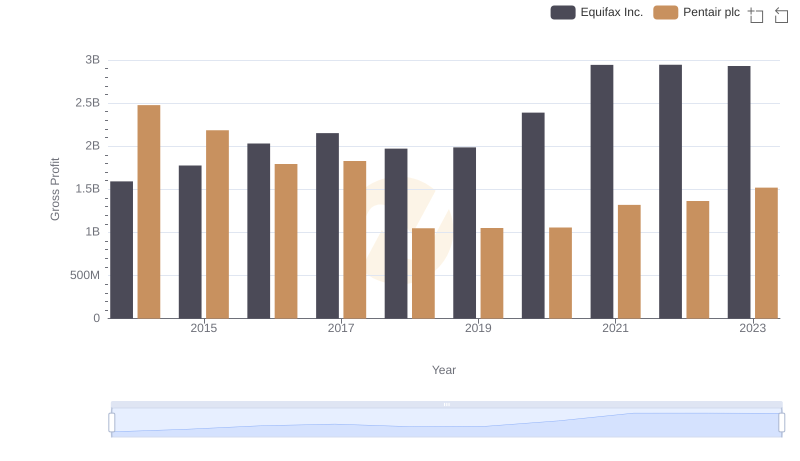

Key Insights on Gross Profit: Equifax Inc. vs Pentair plc

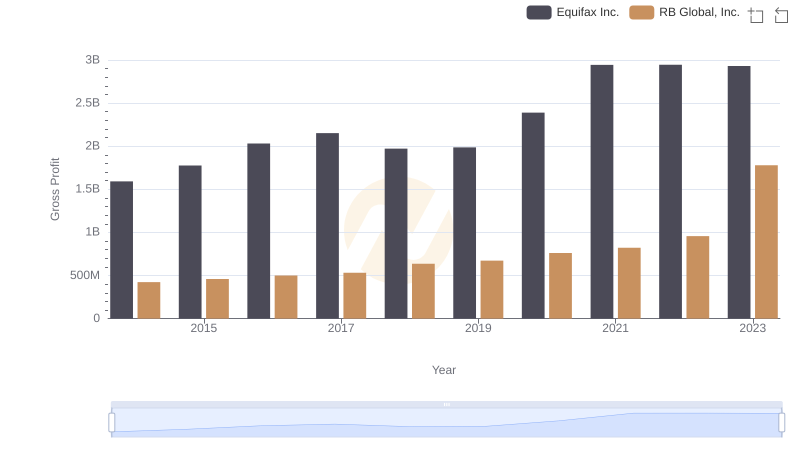

Gross Profit Comparison: Equifax Inc. and RB Global, Inc. Trends

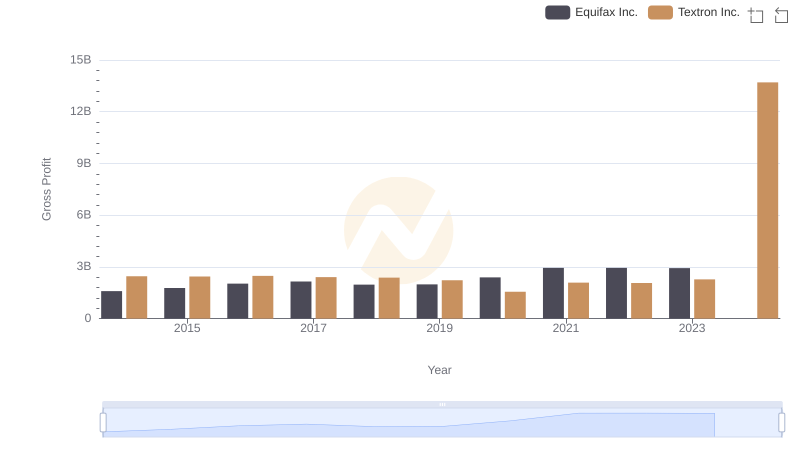

Key Insights on Gross Profit: Equifax Inc. vs Textron Inc.

Professional EBITDA Benchmarking: Equifax Inc. vs XPO Logistics, Inc.