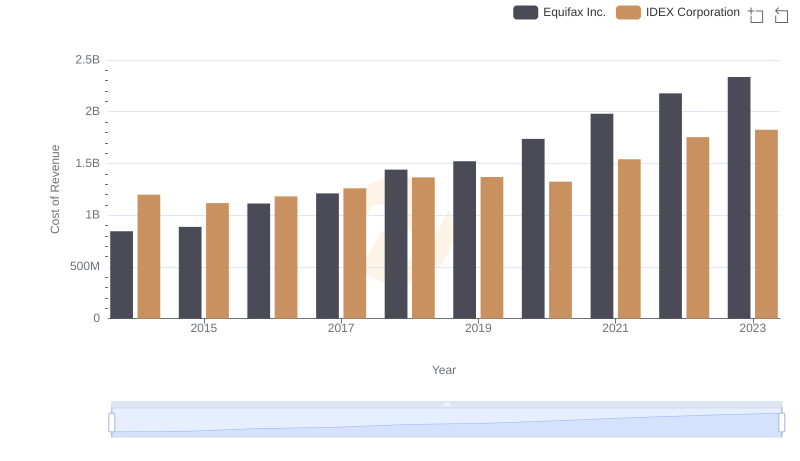

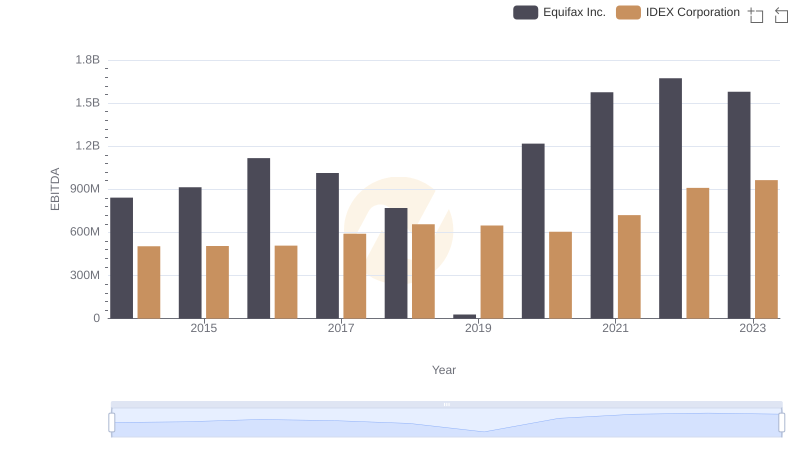

| __timestamp | Equifax Inc. | IDEX Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1591700000 | 949315000 |

| Thursday, January 1, 2015 | 1776200000 | 904315000 |

| Friday, January 1, 2016 | 2031500000 | 930767000 |

| Sunday, January 1, 2017 | 2151500000 | 1026678000 |

| Monday, January 1, 2018 | 1971700000 | 1117895000 |

| Tuesday, January 1, 2019 | 1985900000 | 1125034000 |

| Wednesday, January 1, 2020 | 2390100000 | 1027424000 |

| Friday, January 1, 2021 | 2943000000 | 1224500000 |

| Saturday, January 1, 2022 | 2945000000 | 1426900000 |

| Sunday, January 1, 2023 | 2930100000 | 1448500000 |

| Monday, January 1, 2024 | 5681100000 | 1454800000 |

Igniting the spark of knowledge

In the ever-evolving landscape of financial performance, Equifax Inc. and IDEX Corporation have shown intriguing trends in their gross profit over the past decade. From 2014 to 2023, Equifax Inc. has consistently outperformed IDEX Corporation, with a notable peak in 2021 and 2022, where its gross profit surged by approximately 85% compared to 2014. Meanwhile, IDEX Corporation has demonstrated steady growth, achieving a 53% increase in gross profit over the same period.

These trends highlight the dynamic nature of the financial sector and the strategic maneuvers by these corporations to maintain competitive advantage.

Cost Insights: Breaking Down Equifax Inc. and IDEX Corporation's Expenses

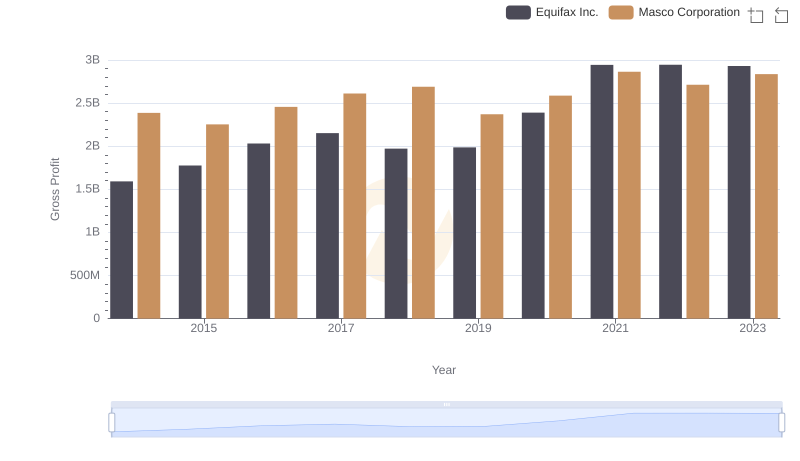

Key Insights on Gross Profit: Equifax Inc. vs Masco Corporation

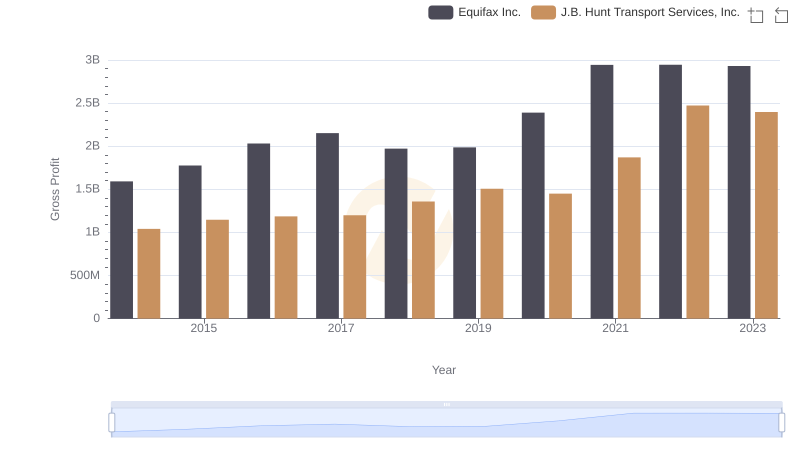

Gross Profit Analysis: Comparing Equifax Inc. and J.B. Hunt Transport Services, Inc.

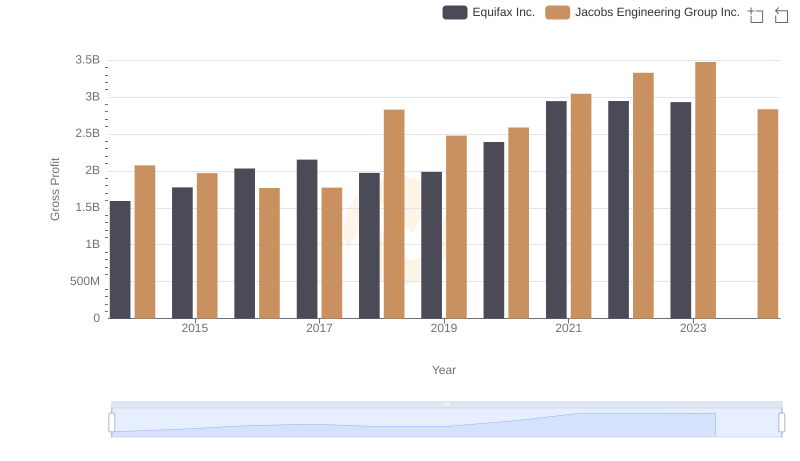

Key Insights on Gross Profit: Equifax Inc. vs Jacobs Engineering Group Inc.

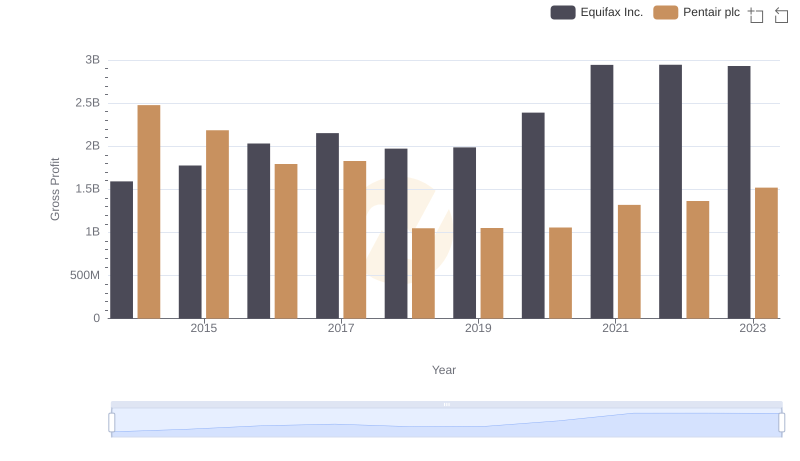

Key Insights on Gross Profit: Equifax Inc. vs Pentair plc

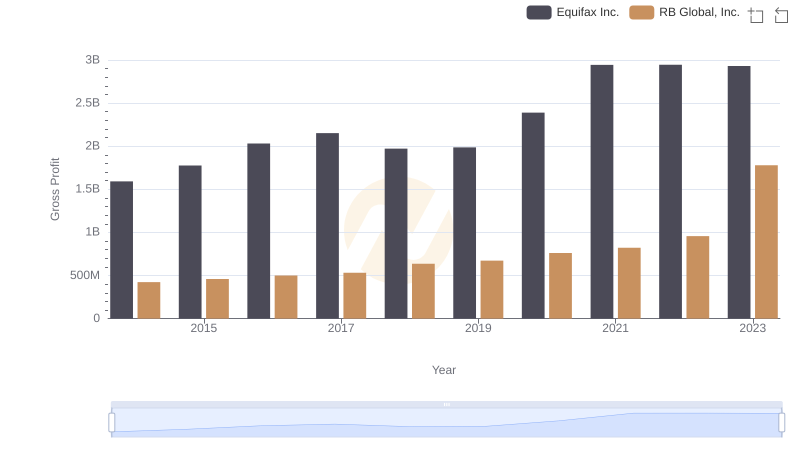

Gross Profit Comparison: Equifax Inc. and RB Global, Inc. Trends

Equifax Inc. and IDEX Corporation: A Detailed Examination of EBITDA Performance